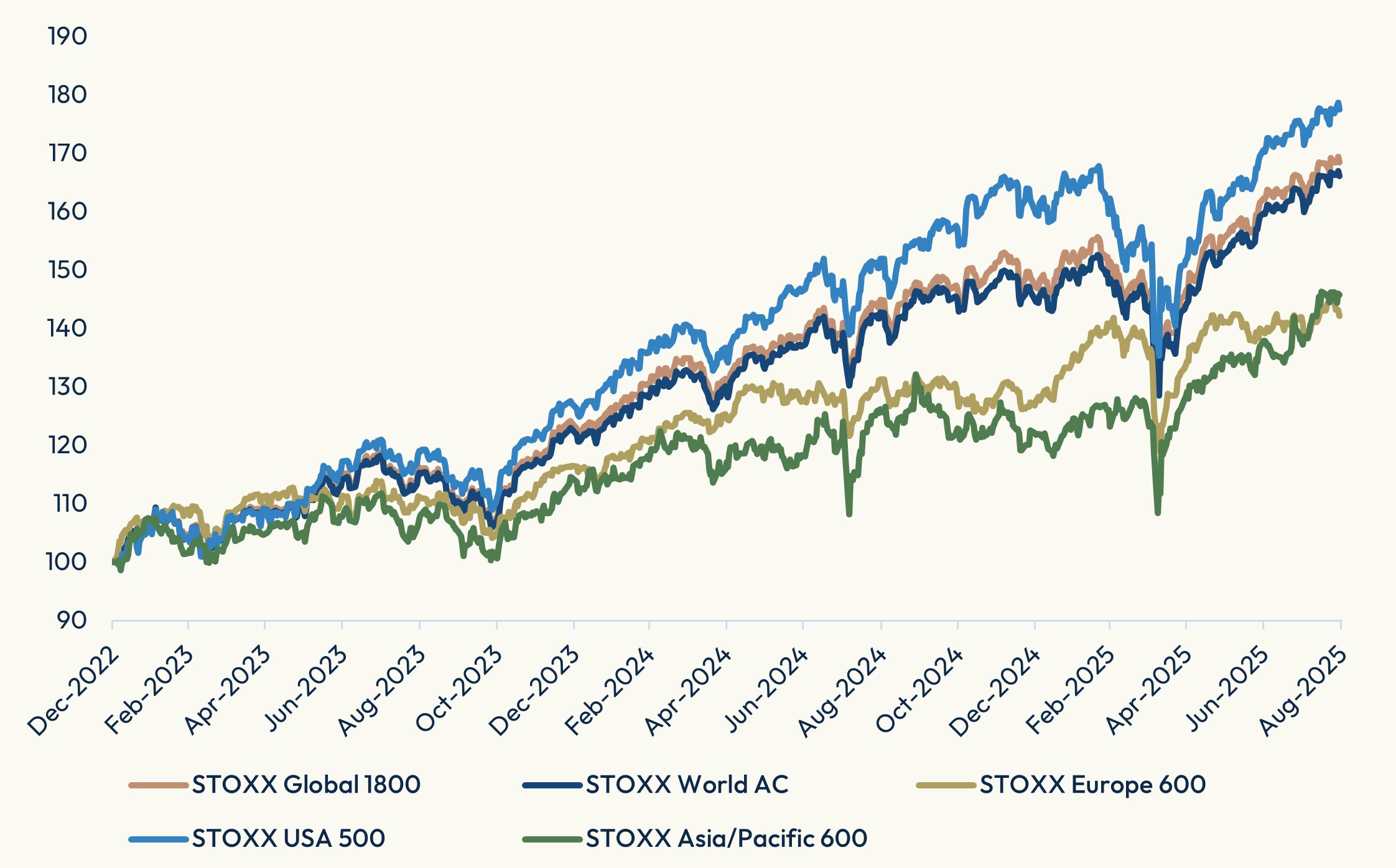

Stocks gained for a fifth consecutive month in August amid expectations the Federal Reserve is poised to cut interest rates as early as this month.

The STOXX® World AC added 2.6% last month to a new record when measured in US dollars and including dividends, taking its 2025 advance to 14.8%. The benchmark climbed only 0.3% in euros in the month as the greenback fell 2.3% against the common currency. The STOXX® Global 1800 index rose 2.6%.

The Eurozone’s EURO STOXX 50® rose 0.6% in euros[1] while the pan-European STOXX® Europe 600 advanced 1%, but both fell short of their record highs. Germany’s DAX® fell 0.7% from an all-time high and the MDAX®, which gauges the performance of German mid-caps, decreased 2.3%.

The STOXX® USA 500 rose 1.8% to extend its record. The STOXX® Asia/Pacific 600 jumped 6.2%. The STOXX® Developed World climbed 2.7% and the STOXX® Emerging Markets gained 1.3%.

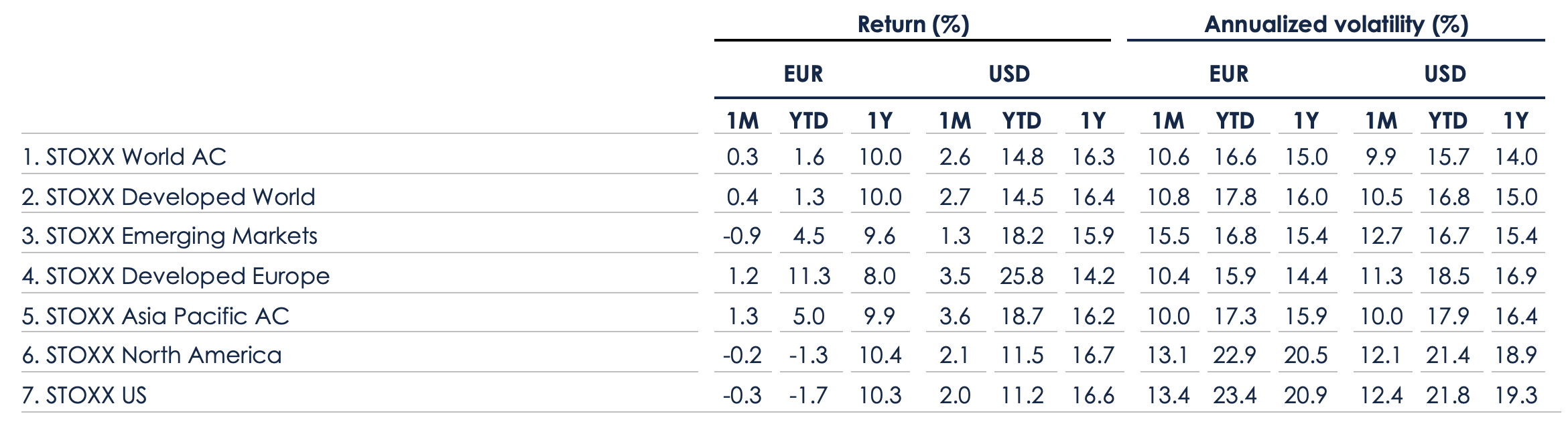

Figure 1: STOXX Equity World indices’ August risk and return

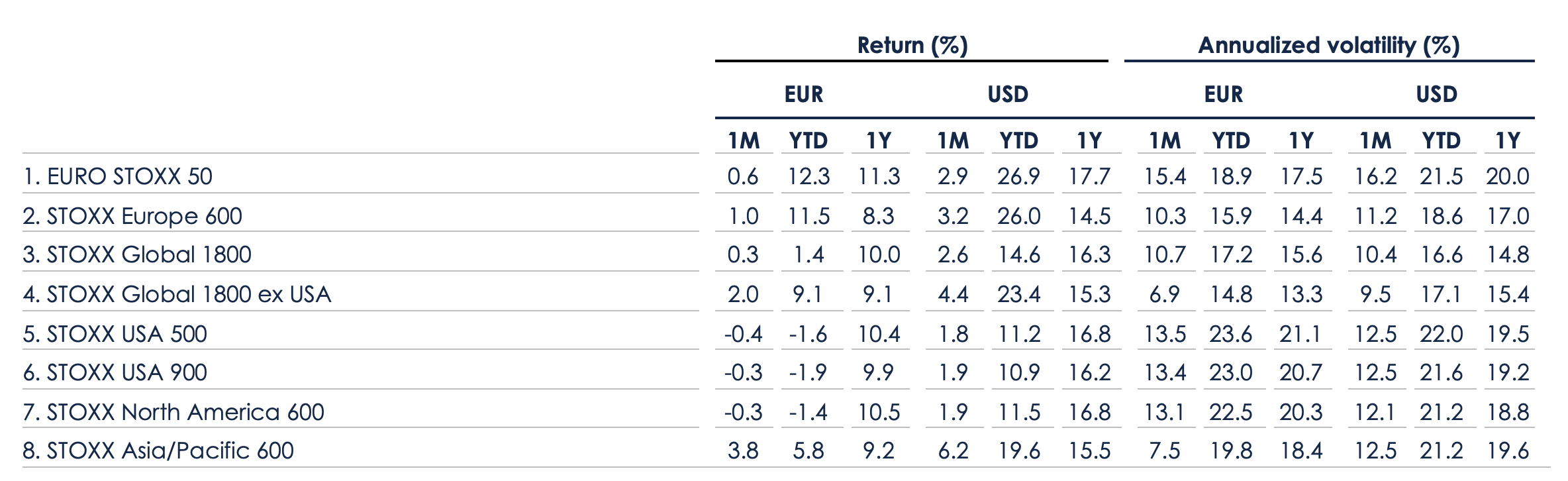

Figure 2: STOXX Benchmark indices’ August risk and return

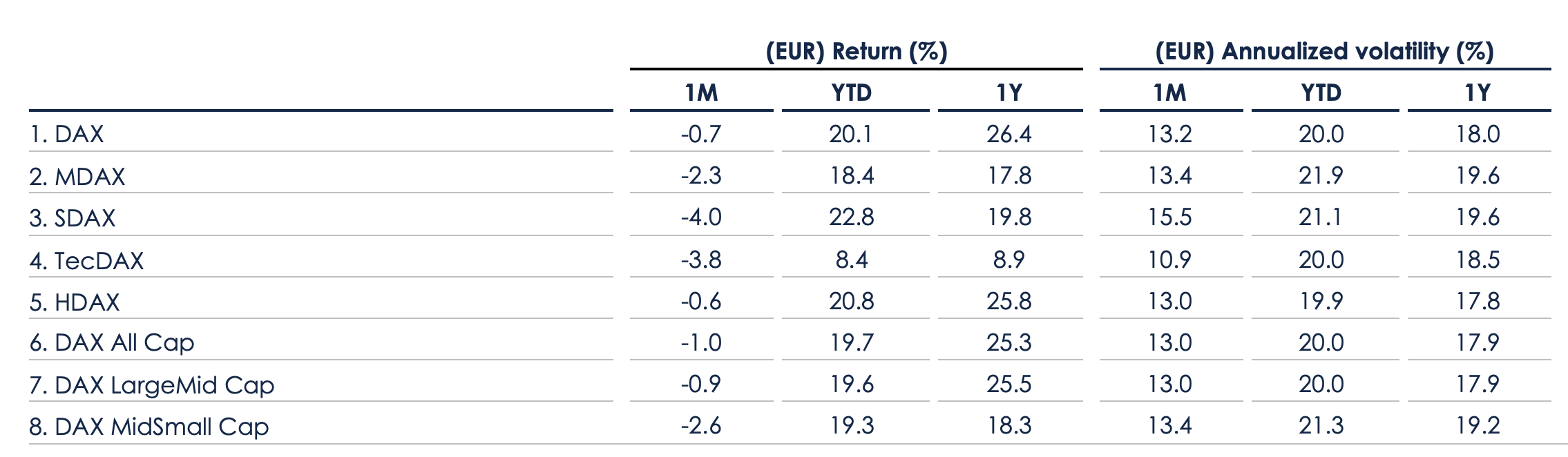

Figure 3: DAX indices’ August risk and return

| For a complete review of all indices’ performance last month, visit our August index newsletter. |

‘Adjust stance’

Speaking at the Fed’s annual conference in Jackson Hole, Wyoming, on Aug. 22, Chair Jerome Powell said the bank may need to “adjust its policy stance” amid downside risks to employment. Optimism that the Fed may cut rates for the first time since December outweighed concerns about incoming global trade tariffs.

In Europe, French Prime Minister François Bayrou called a vote of confidence in parliament for Sept. 8 as the government tries to cut costs. The likelihood that he may fail to win support from a fragmented congress, leading to a government collapse, sent the yield on 10-year French government bonds higher. The STOXX® France Total Market index dropped 1.1% in August.

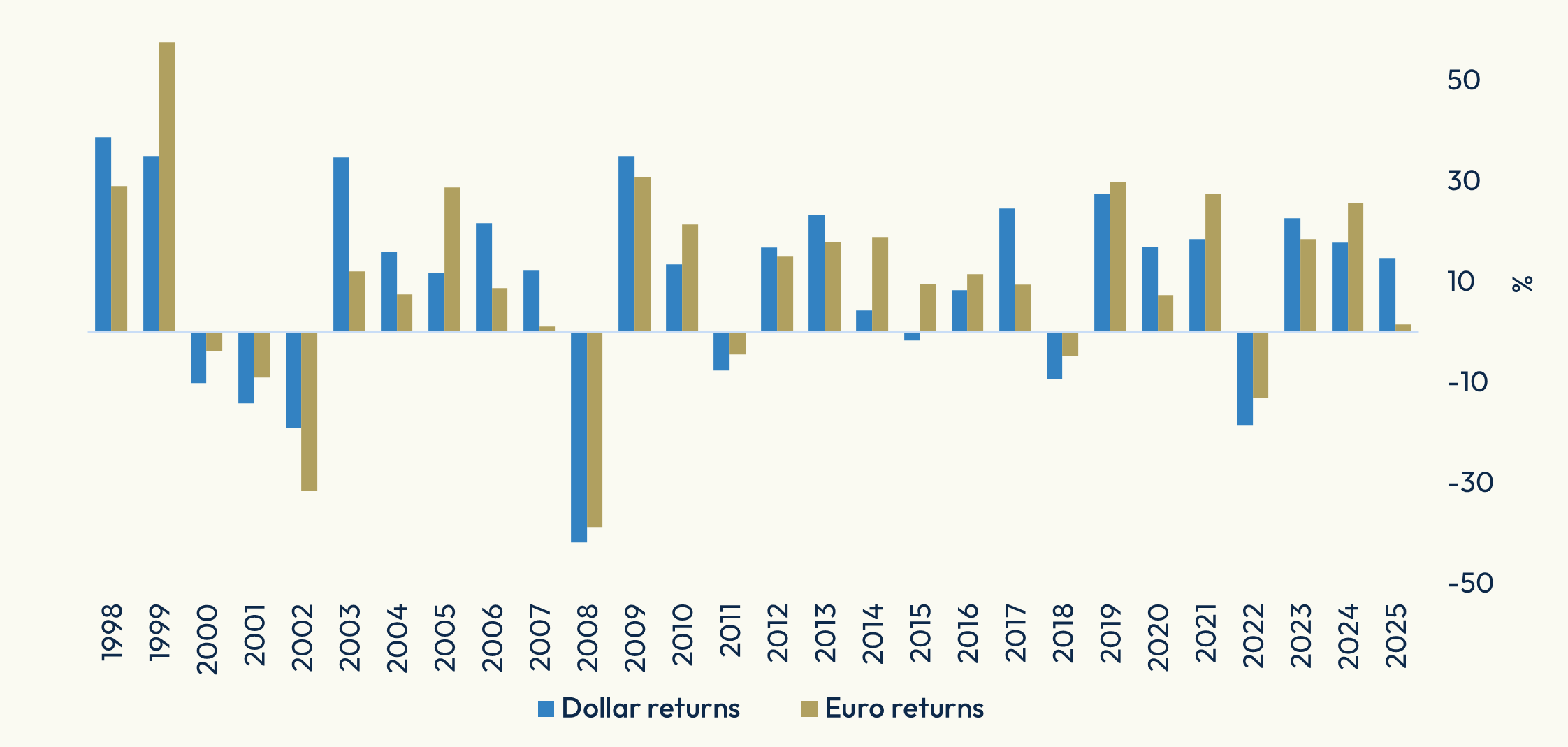

Figure 4: Total annual % returns for STOXX World AC index

Figure 5: Select STOXX benchmarks’ returns since 2023

Eurozone volatility is little changed

The VSTOXX® (Eurozone equity volatility), which tracks the prices of EURO STOXX 50 options traded on Eurex, ended August at 17.6, from 17.5 in July. A higher VSTOXX reading suggests investors are paying up for puts that offer insurance against stock price drops. The VDAX®, which measures volatility in German equities, dropped to 16.8 from 17.9 a month earlier.

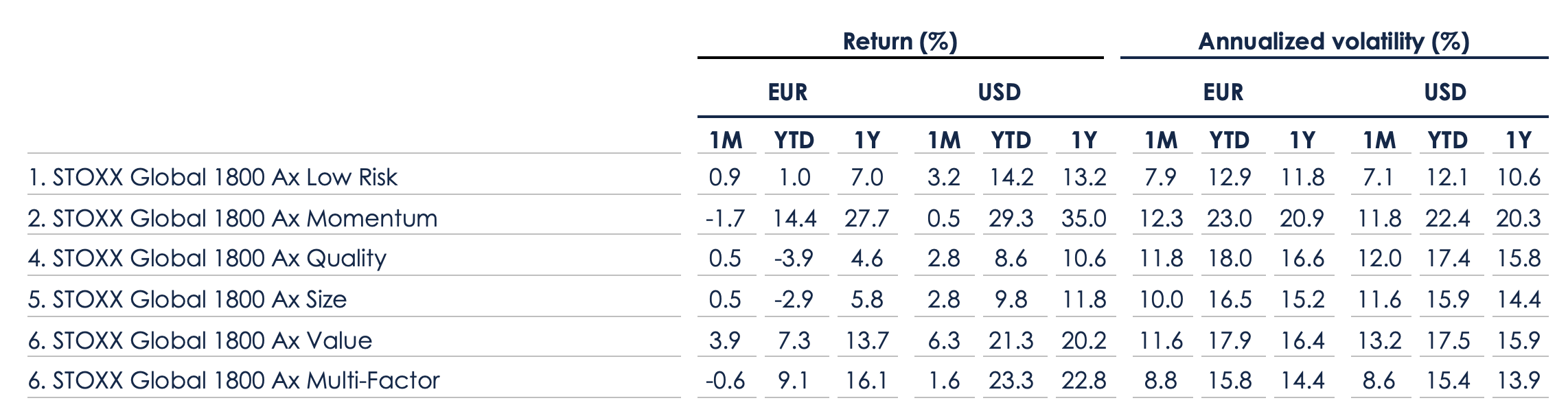

Factor investing

Among the STOXX Factor indices, the Value signal led gains for a second straight month (Figure 6).

Figure 6: STOXX Factor (Global) indices’ August risk and return characteristics

Climate benchmarks

Within climate benchmarks, the ISS STOXX® Developed World Net Zero Transition added 2.7%. The index is focused on net-zero targets and real-world transition-aligned metrics, and includes all industries featured in the parent universe.

The STOXX® Global 1800 Paris-Aligned Benchmark (PAB) rose 3.1%, while the STOXX® Global 1800 Climate Transition Benchmark (CTB) added 2.9%. The PAB and CTB indices follow the requirements outlined by the European Commission’s climate benchmarks regulation.

Sustainability indices

The STOXX® Global 1800 ESG-X index rose 2.4% in the month. The STOXX® ESG-X indices are versions of traditional, market capitalization-weighted benchmarks that observe standard responsible exclusions.

The DAX® ESG Screened fell 0.2%. The index reflects the composition of the DAX benchmark minus companies that fail to pass norms-based and controversial weapons screenings, meet minimum ESG ratings or are involved in certain business activities considered undesirable from a responsible investing perspective.

Within indices that combine exclusions and best-in-class ESG integration, the EURO STOXX 50® ESG advanced 0.4% over the month. Germany’s DAX® 50 ESG (-0.3%)[2], which excludes companies involved in controversial activities and integrates ESG scoring into stock selection, outperformed the benchmark DAX in the month.

The STOXX® Global 1800 SRI rose 3.1%. The STOXX SRI indices apply a set of carbon emission intensity, compliance and involvement screens, and track the best ESG performers in each industry group within a selection of STOXX benchmarks.

Thematics, digital assets

Twenty of 43 STOXX® Thematic indices outperformed the benchmark STOXX Global 1800 last month. The STOXX® Global Silver Mining index (+22.3%) had the best performance in the suite amid a rally in the metal. Only one index in the STOXX Thematic suite, the STOXX® USA ETF Industry (-0.8%), posted a negative return in the month.

The STOXX® Digital Asset Blue Chip index, which aims to track high-quality assets that represent the crypto universe today, gained 7% in the month.

Dividend strategies

Dividend strategies had strong performances in the month that ended. The STOXX® Global Maximum Dividend 40 (+4.6% on a net basis) selects only the highest-yielding stocks. The STOXX® Global Select Dividend 100 (+4.7%) tracks companies with sizeable dividends but also applies a quality filter such as a history of stable payments.

Minimum variance

Some minimum variance strategies outperformed in their unconstrained versions. The STOXX® Global 1800 Minimum Variance climbed 1.8% while the STOXX® Global 1800 Minimum Variance Unconstrained added 3.1%.

The STOXX Minimum Variance indices come in two versions. A constrained version has similar exposure to its market capitalization-weighted benchmark but with lower risk. The unconstrained version, on the other hand, has more freedom to fulfill its minimum variance mandate within the same universe of stocks.

[1] Throughout the article, all European indices are quoted in euros, while global, North America, US, Japan and Asia/Pacific indices are in US dollars.

[2] Figures in parentheses show last month’s gross returns.