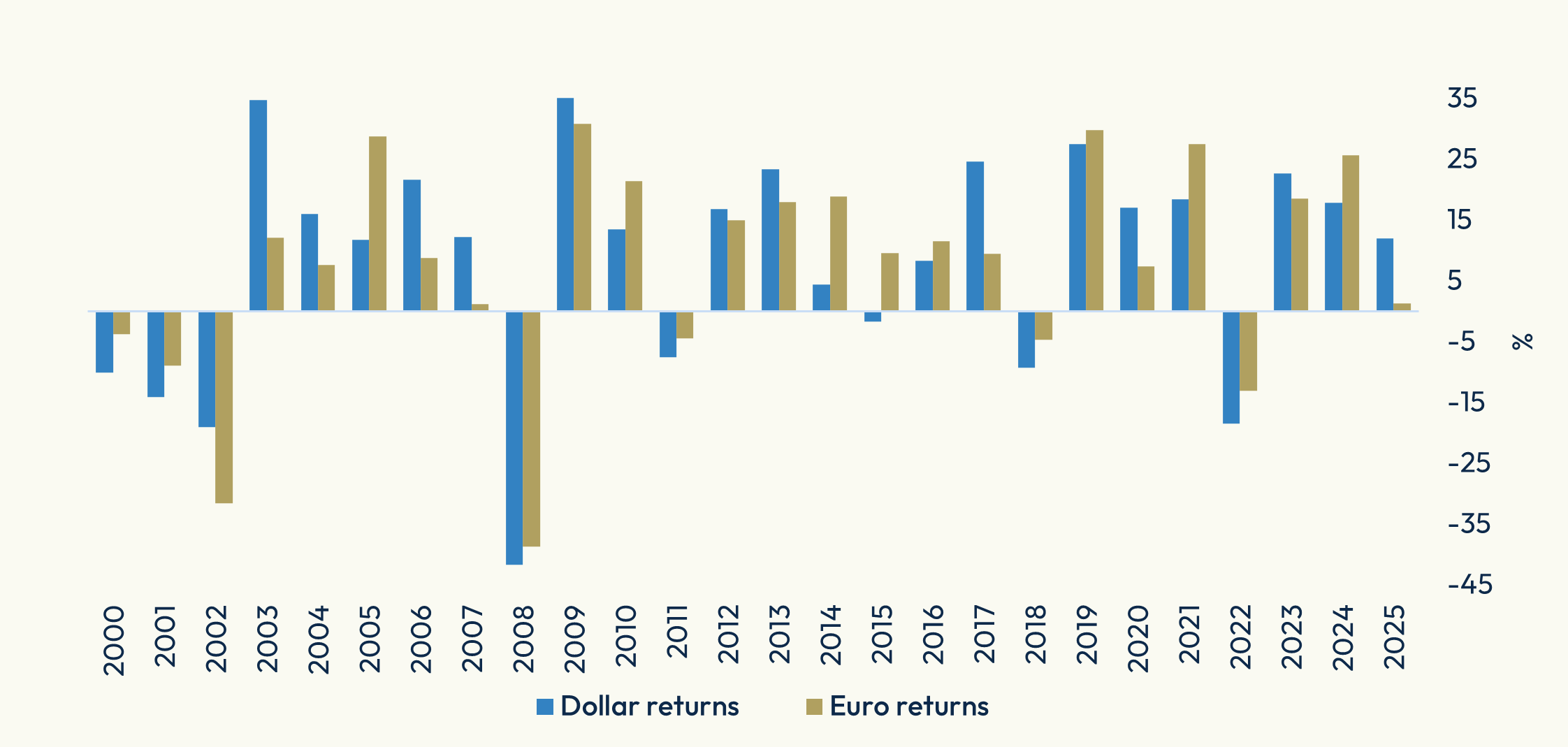

Stocks rose for a fourth consecutive month in July amid optimism that the worst of new trade tariffs will be avoided and as companies reported better-than-expected quarterly earnings.

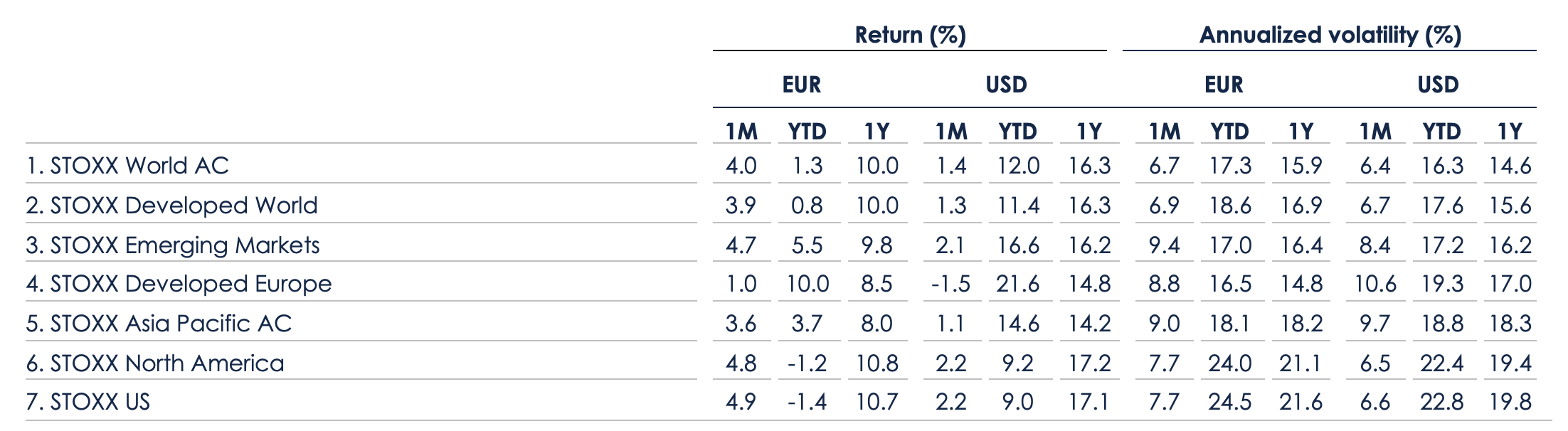

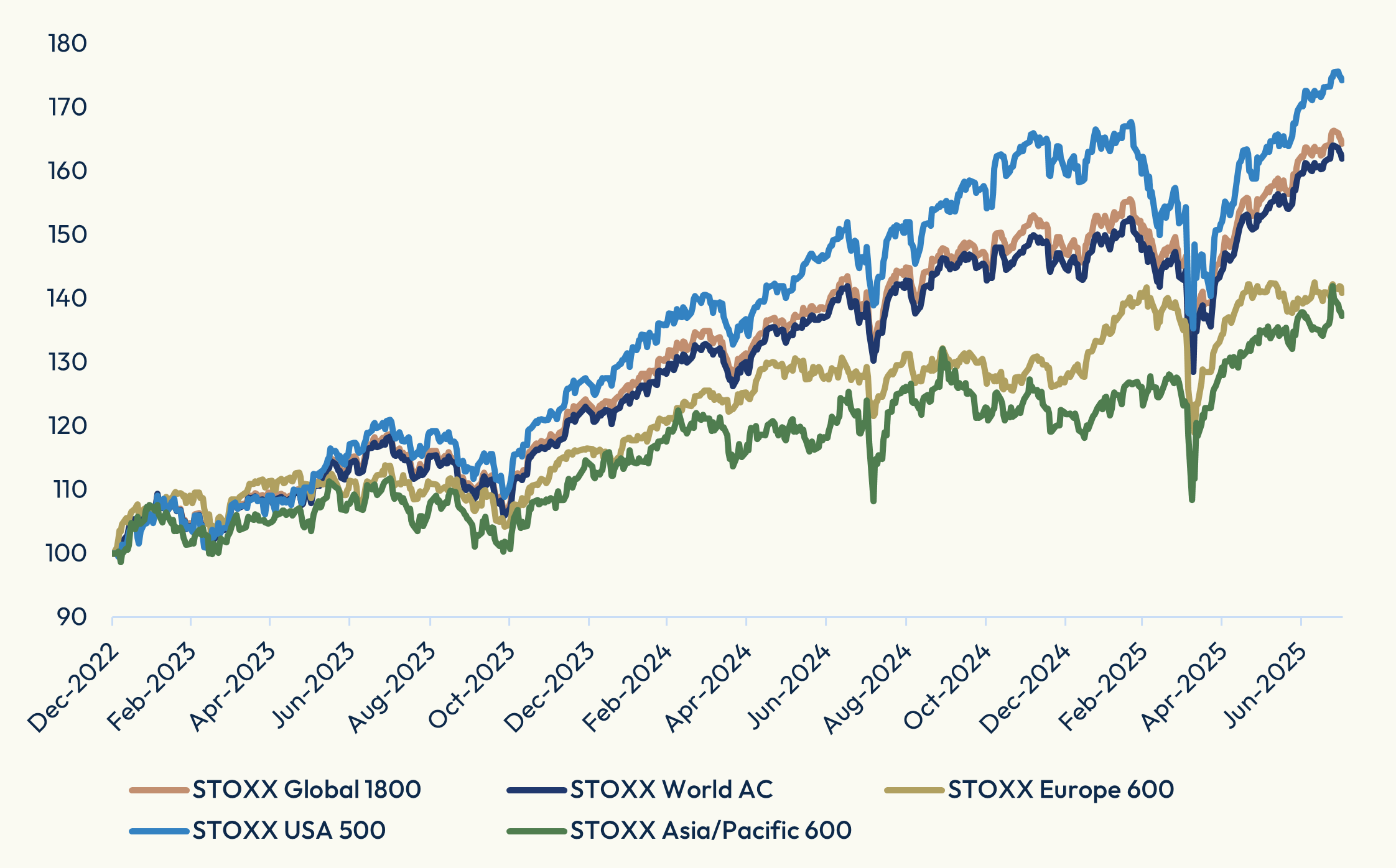

The STOXX® World AC added 1.4% last month when measured in US dollars and including dividends, taking its 2025 advance to 12%. The benchmark climbed 4% in euros in July as the greenback strengthened 2.6% against the common currency. The STOXX® Global 1800 index rose 1.2% in dollars.

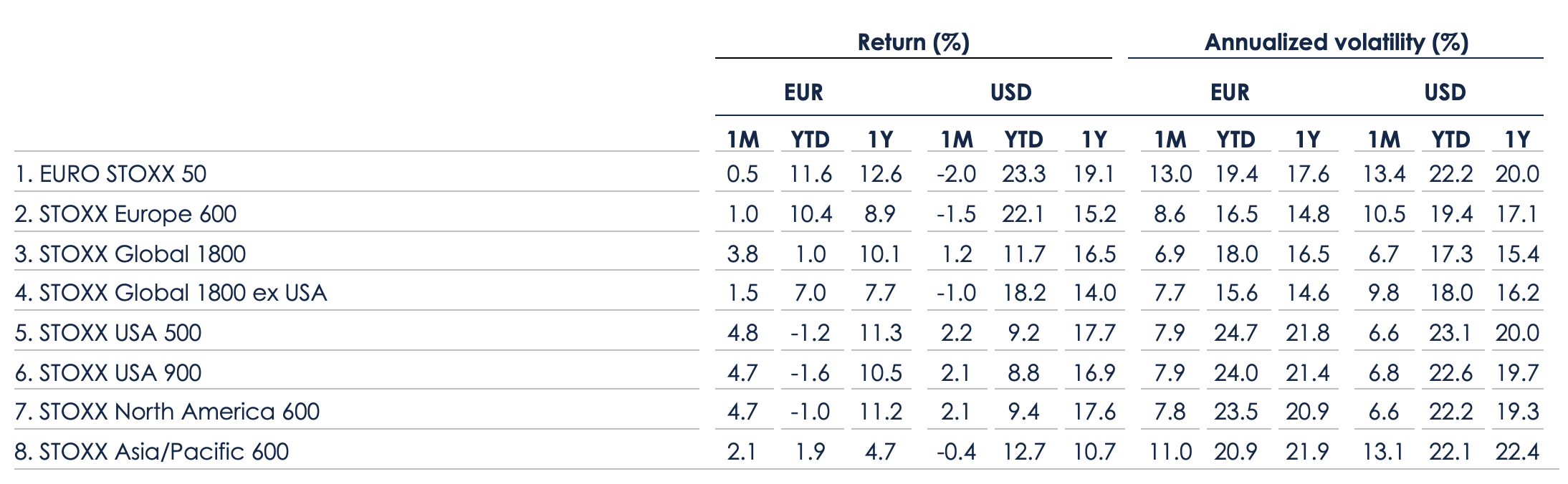

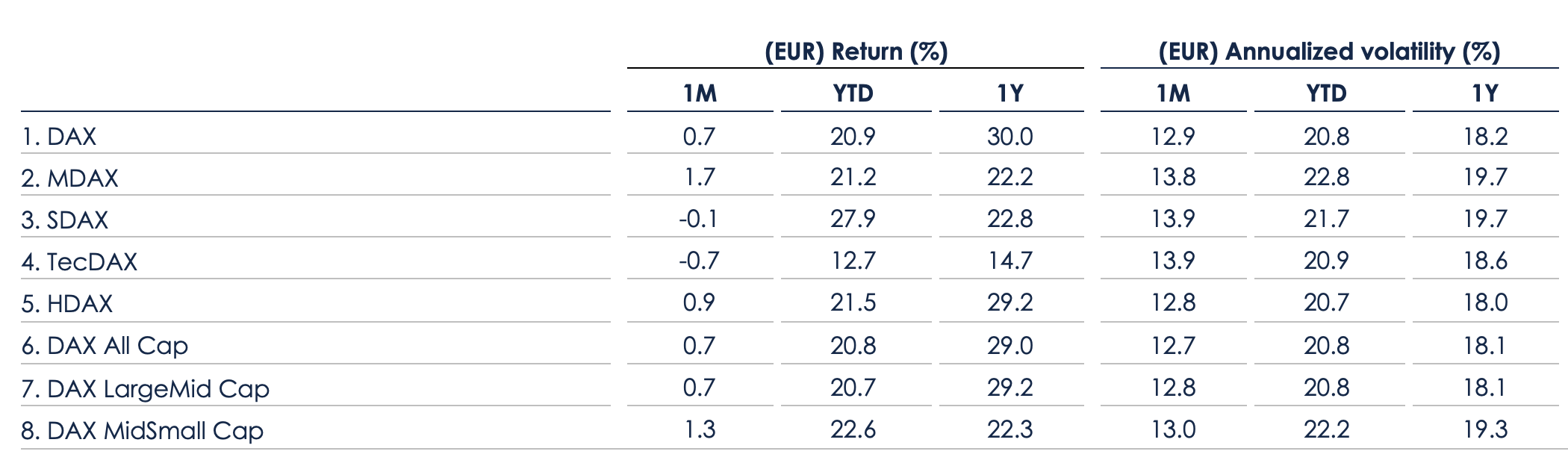

The Eurozone’s EURO STOXX 50® rose 0.5% in euros in the month[1], while the pan-European STOXX® Europe 600 advanced 1%. Germany’s DAX® climbed 0.7% to a record and the MDAX®, which gauges the performance of German mid-caps, increased 1.7%.

The STOXX® USA 500 rose 2.2% to extend its record. The STOXX® Asia/Pacific 600 added 2.2%. The STOXX® Developed World climbed 1.3% and the STOXX® Emerging Markets gained 2.1%.

Figure 1: STOXX Equity World indices’ July risk and return

Figure 2: STOXX Benchmark indices’ July risk and return

Figure 3: DAX indices’ July risk and return

| For a complete review of all indices’ performance last month, visit our July index newsletter. |

Trade, earnings

US President Donald Trump agreed during the month import tariff hikes with trading partners including the European Union and Japan that were lower than he had previously threatened.

Meanwhile, 80% of US companies that reported quarterly earnings through July 25 beat estimates, a higher percentage than the 10-year average, according to FactSet.[2] Among companies that reported better-than-expected profits during July are Apple, Meta and Microsoft.

A soft US jobs report during the month’s last session weighed only slightly on sentiment, with the STOXX USA 500 falling 0.3% on the day.

Figure 4: Total annual % returns for STOXX World AC index

Figure 5: Select STOXX benchmarks’ returns since 2023

Volatility eases slightly

The VSTOXX® (Eurozone equity volatility), which tracks the prices of EURO STOXX 50 options traded on Eurex, slipped to 17.5 in July from 17.7 in June. A higher VSTOXX reading suggests investors are paying up for puts that offer insurance against stock price drops. The VDAX®, which measures volatility in German equities, dropped to 17.9 from 18.4 a month earlier.

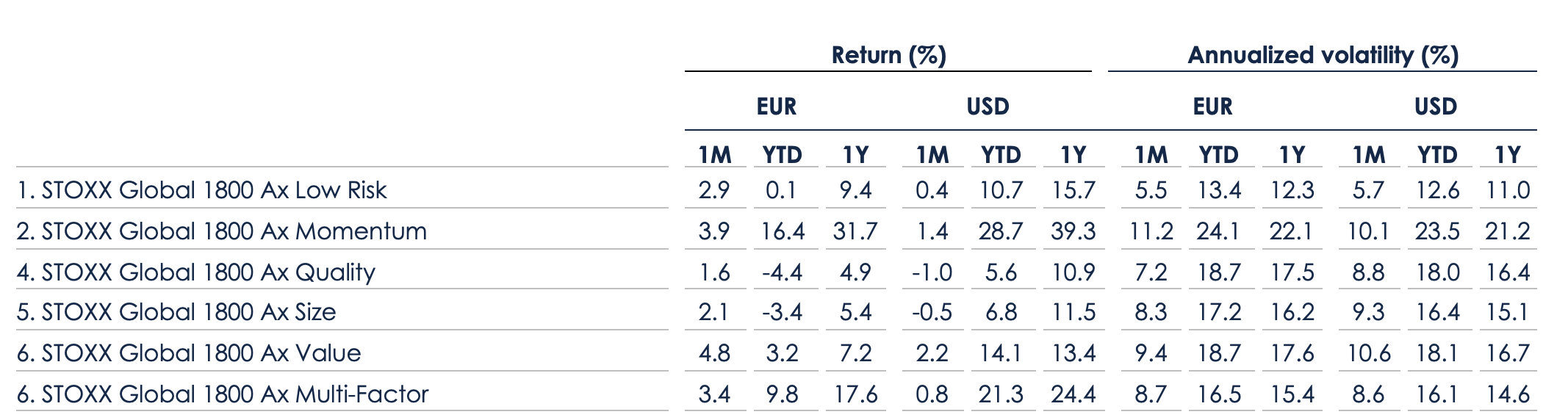

Factor investing

Among the STOXX Factor indices, the Value signal led gains last month (Figure 6).

Figure 6: STOXX Factor (Global) indices’ July risk and return characteristics

Climate benchmarks

Within climate benchmarks, the ISS STOXX® Developed World Net Zero Transition added 0.6%. The index is focused on net-zero targets and real-world transition-aligned metrics, and includes all industries featured in the parent universe.

The STOXX® Global 1800 Paris-Aligned Benchmark (PAB) fell 1.2%, while the STOXX® Global 1800 Climate Transition Benchmark (CTB) shed 1.1%. The PAB and CTB indices follow the requirements outlined by the European Commission’s climate benchmarks regulation.

Sustainability indices

The STOXX® Global 1800 ESG-X index rose 0.9% in the month. The STOXX® ESG-X indices are versions of traditional, market capitalization-weighted benchmarks that observe standard responsible exclusions.

The DAX® ESG Screened added 1.1%. The index reflects the composition of the DAX benchmark minus companies that fail to pass norms-based and controversial weapons screenings, meet minimum ESG ratings or are involved in certain business activities considered undesirable from a responsible investing perspective.

Within indices that combine exclusions and best-in-class ESG integration, the EURO STOXX 50® ESG index advanced 1% over the month. Germany’s DAX® 50 ESG index (+1.3%)[3], which excludes companies involved in controversial activities and integrates ESG scoring into stock selection, outperformed the benchmark DAX in the month.

The STOXX® Global 1800 SRI fell 0.3%. The STOXX SRI indices apply a set of carbon emission intensity, compliance and involvement screens, and track the best ESG performers in each industry group within a selection of STOXX benchmarks.

Thematics, digital assets

Only 15 of 42 STOXX® Thematic indices outperformed the benchmark STOXX Global 1800 last month. The STOXX® Global Lithium and Battery Producers index had the best performance in the suite, rising 11%.

The STOXX® Digital Asset Blue Chip index, which aims to track high-quality assets that represent the crypto universe today, jumped 26.4% in the month.

Dividend strategies

Dividend strategies had positive performances in dollars in the month that ended. The STOXX® Global Maximum Dividend 40 (+0.3% on a net basis) selects only the highest-yielding stocks. The STOXX® Global Select Dividend 100 (+1.4%) tracks companies with sizeable dividends but also applies a quality filter such as a history of stable payments.

Minimum variance

Minimum variance strategies underperformed. The STOXX® Global 1800 Minimum Variance fell 1.9% while the STOXX® Global 1800 Minimum Variance Unconstrained lost 1.3%.

The STOXX Minimum Variance Indices come in two versions. A constrained version has similar exposure to its market capitalization-weighted benchmark but with lower risk. The unconstrained version, on the other hand, has more freedom to fulfill its minimum variance mandate within the same universe of stocks.

[1] Throughout the article, all European indices are quoted in euros, while global, North America, US, Japan and Asia/Pacific indices are in US dollars.

[2] FactSet, ‘S&P 500 Earnings Season Update: July 25, 2025.’

[3 Figures in parentheses show last month’s gross returns.