US stocks rose in June as investors weighed the prospects for interest-rate cuts amid slowing inflation. European shares fell as results from the European Parliamentary elections increased political risk.

The STOXX® World AC index rose 2.3% last month when measured in US dollars and including dividends[1], taking its 2024 gain to 11.6%. The STOXX® Global 1800 index added 1.9% in the month.

The Eurozone’s EURO STOXX 50® dropped 1.7% in euros, while the pan-European STOXX® Europe 600 fell 1.1%[2] from a record. The STOXX® North America 600 rose 3.4% in dollars and the STOXX® USA 500 increased 3.7%. The STOXX® Asia/Pacific 600 shed 0.8% in dollars. The STOXX® Developed World rose 2.1% and the STOXX® Emerging Markets gained 4.2%.

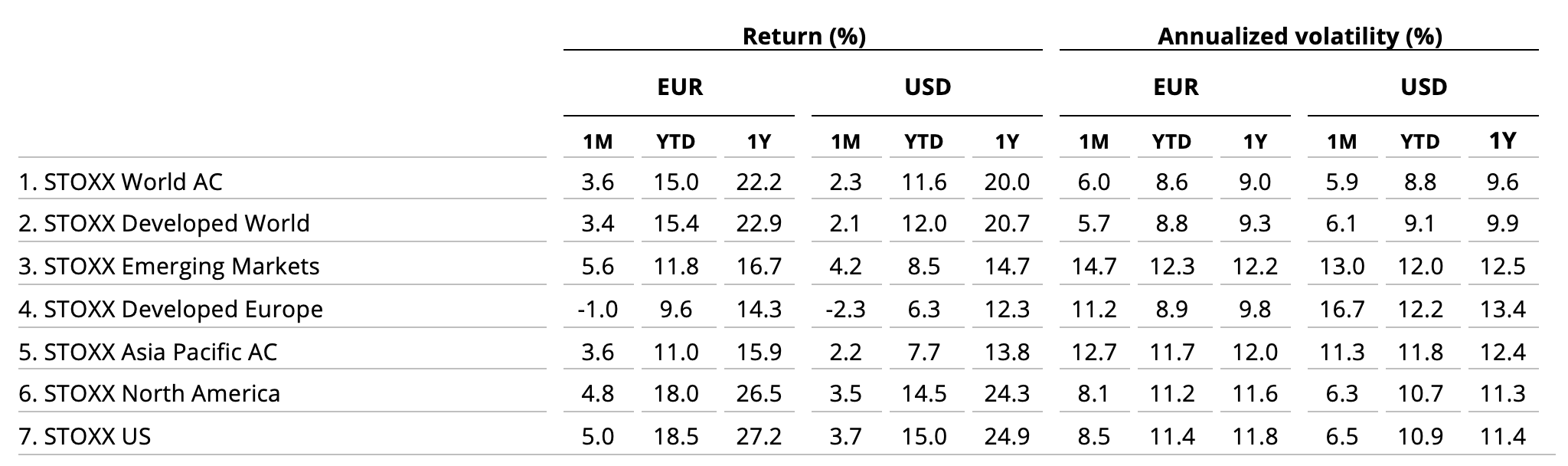

Figure 1: STOXX Equity World indices’ June risk and return

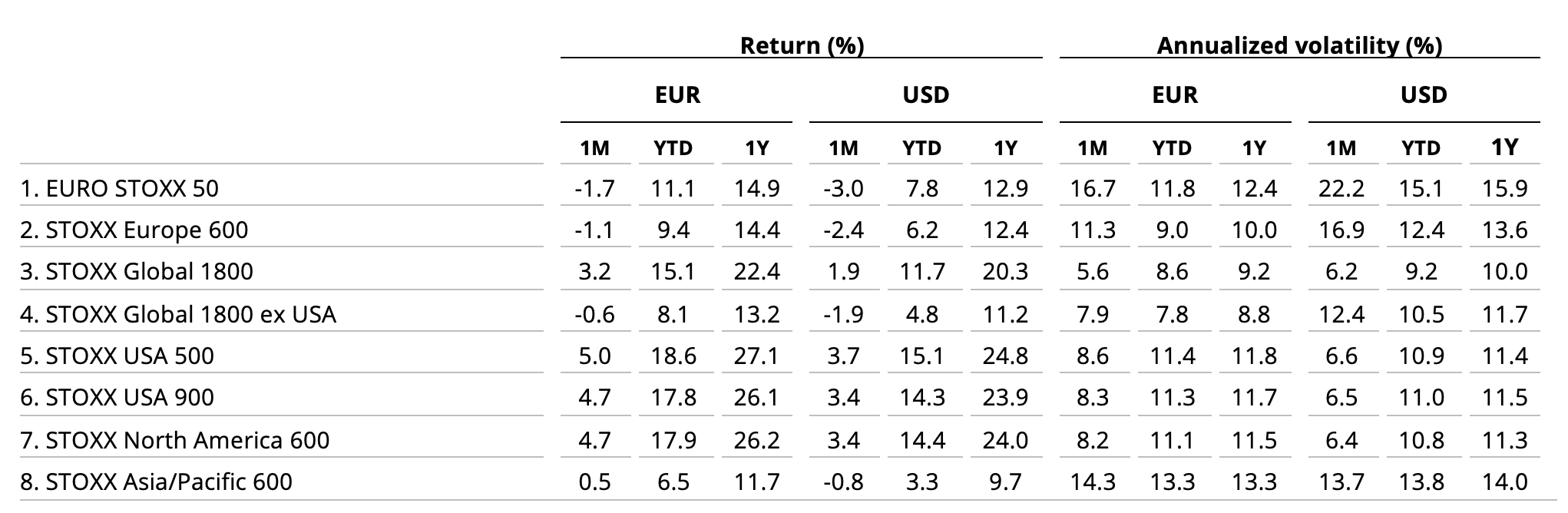

Figure 2: STOXX Equity World indices’ June risk and return

Germany’s DAX® decreased 1.4% in the month. MDAX®, which gauges the performance of German mid-caps, slumped 5.8%.

| For a complete review of all indices’ performance last month, visit our June index newsletter. |

Inflation, elections

U.S. consumer prices were unchanged in May, the lowest reading since July 2022, bolstering expectations that the Federal Reserve will cut interest rates this year. At the end of June, the US personal consumption expenditures price index (PCE) came at an annual 2.6%, compared with 2.8% in April.

In Europe, far-right parties made gains in the European Union Parliamentary elections in early June, defeating ruling governments in Germany and France. French President Emmanuel Macron called snap elections at home following the defeat.

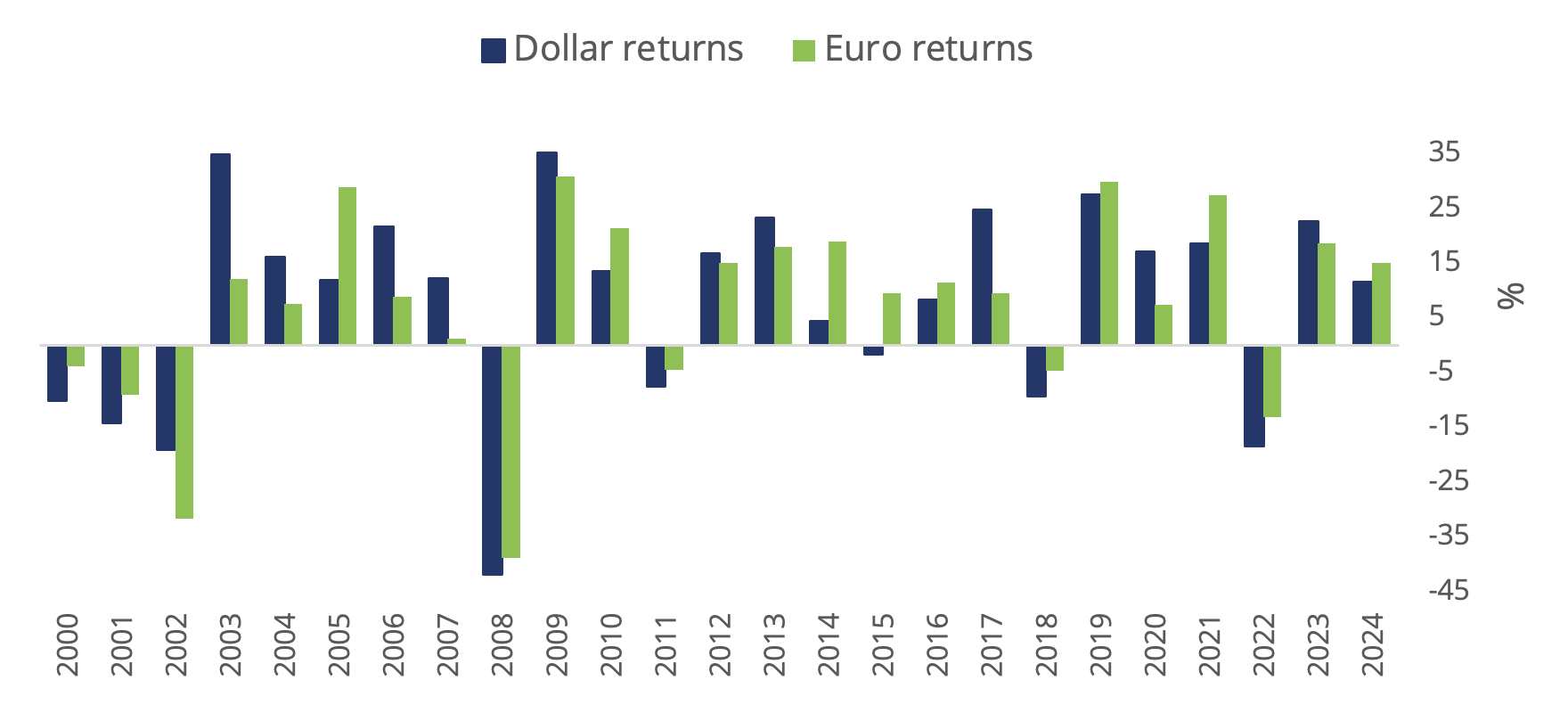

Figure 3: Total annual % returns for STOXX World AC index

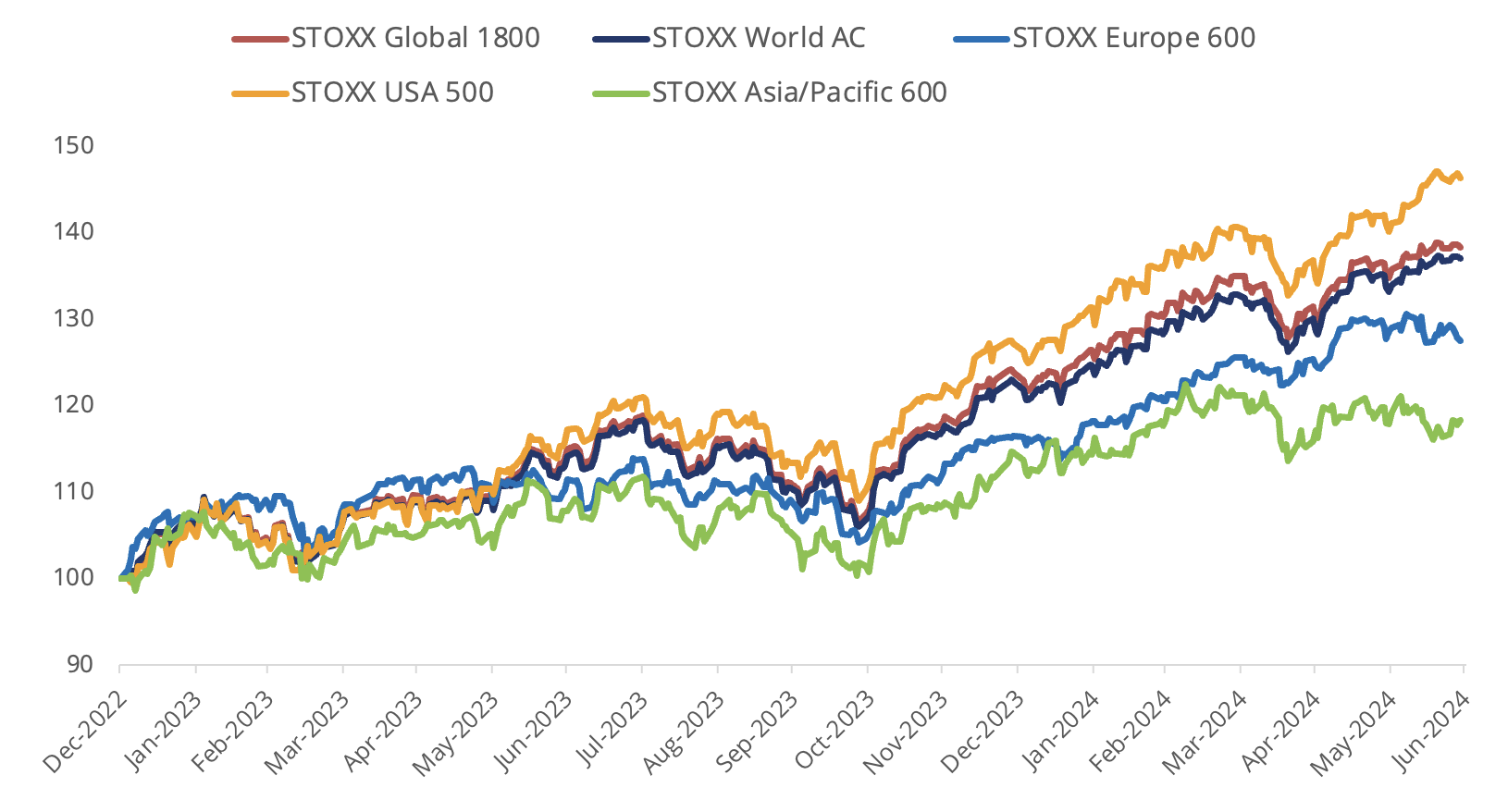

Figure 4: Select STOXX benchmarks’ returns since 2023

Volatility rises

The EURO STOXX 50® Volatility (VSTOXX®), which tracks EURO STOXX 50 options prices, rose to 18.3 at the end of last month from 14.1 in May. A higher VSTOXX reading suggests investors are paying up for puts that offer insurance against stock price drops. The VDAX-New®, which measures volatility in German equities, climbed to 15.8 from 13.8 in May.

Factor investing

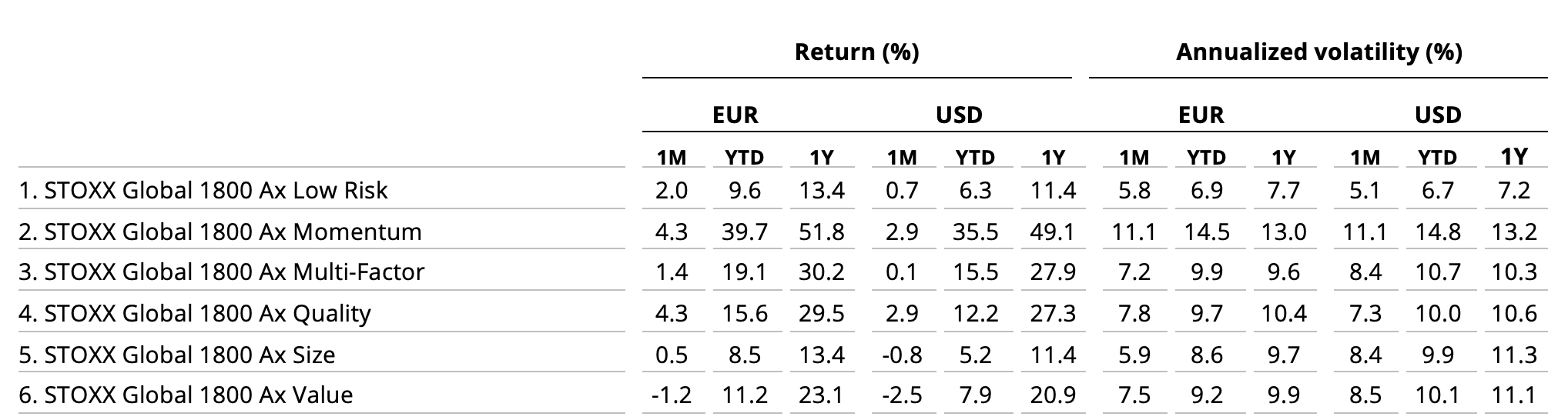

Among the STOXX Factor indices, Momentum and Quality led gains last month while Value struggled (Figure 5).

Figure 5: STOXX Factor (Global) indices’ June risk and return characteristics

Climate benchmarks

Within climate benchmarks, the STOXX® Global 1800 Paris-Aligned Benchmark (PAB) rose 2.2%, while the STOXX® Global 1800 Climate Transition Benchmark (CTB) climbed 2%. The PAB and CTB indices follow the requirements outlined by the European Commission’s climate benchmarks regulation.

Sustainability indices

The STOXX® Global 1800 ESG-X index advanced 2.4% in the month. The STOXX® ESG-X indices are versions of traditional, market-capitalization-weighted benchmarks that observe standard responsible exclusions.

Within indices that combine exclusions and best-in-class ESG integration, the EURO STOXX 50® ESG index fell 1.4%. Germany’s DAX® 50 ESG index (-1.4%)[3], which excludes companies involved in controversial activities and integrates ESG scoring into stock selection, performed in line with the benchmark DAX in the month.

The STOXX® Global 1800 SRI rose 2.4%. The STOXX SRI indices apply a rigorous set of carbon emission intensity, compliance and involvement screens, and track the best ESG performers in each industry group within a selection of STOXX benchmarks.

Finally, the DAX® ESG Screened slid 0.8% in the month. The index reflects the composition of the DAX benchmark minus companies that fail to pass norms-based and controversial weapons screenings, meet minimum ESG ratings or are involved in certain business activities considered undesirable from a responsible investing perspective.

Thematics, dividend strategies

Seventeen of 36 STOXX® Thematic indices outperformed the benchmark STOXX Global 1800 last month. The STOXX® World AC NexGen Connectivity index (+7.2%) showed the biggest gain, while the STOXX®Global Lithium Miners and Producers index (-16.8%) led losses.

Dividend strategies underperformed in June. The STOXX® Global Maximum Dividend 40 (-7.1% on a net basis) selects only the highest-dividend-yielding stocks. The STOXX® Global Select Dividend 100 (-2.3%)tracks companies with sizeable dividends but also applies a quality filter such as a history of stable payments.

Minimum variance

Minimum variance strategies in the US trailed their benchmarks, while those in Europe outperformed. The STOXX® Global 1800 Minimum Variance gained 1.3% and the STOXX® Global 1800 Minimum Variance Unconstrained was unchanged.

The STOXX Minimum Variance Indices come in two versions. A constrained version has similar exposure to its market capitalization-weighted benchmark but with lower risk. The unconstrained version, on the other hand, has more freedom to fulfill its minimum variance mandate within the same universe of stocks.

Digital assets

The STOXX® Digital Asset Blue Chip index, which aims to track high-quality assets that represent the crypto universe today, fell 9% in the month.

[1] All results are total returns before taxes unless specified.

[2] Throughout the article, all European indices are quoted in euros, while global, North America, US, Japan and Asia/Pacific indices are in US dollars.

[3] Figures in parentheses show last month’s gross returns.