Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

News & Research

Most Recent News & Research

Eight STOXX Thematic indices underlying ETFs in Europe had their annual rebalancing in June, with six of them seeing updates to the business sectors associated with the targeted theme. The ‘purity’ ratio, or theme-related revenue, remains above 80%.

Index | ESG & Sustainability

ISS STOXX indices use comprehensive framework to help investors address biodiversity challenges

The fight to preserve our nature’s systems is intensifying, presenting both additional risks and opportunities for investors. The ISS STOXX Biodiversity indices offer a multi-step framework to address biodiversity challenges while employing state-of-the-art datasets.

Index | New index launches

New STOXX Optimal 100 indices offer optimized replication strategies on benchmark portfolios

The STOXX Optimal 100 indices mirror their parent indices with a smaller constituency. In controlling tracking error and active exposures through an optimization process, the new indices offer a tool for efficient hedging of benchmark portfolios.

Nvidia’s formidable stock performance has lifted the company atop many indices. Thematic strategies can offer a more nuanced, and larger, exposure to the chipmaker’s shares.

As the index turns 25 on June 21, we take a look at what makes up the world of smaller-capitalization German stocks.

Buoyant markets and the ongoing shift to index investments put European ETFs on track for a tenth straight year of net inflows. Funds tracking the EURO STOXX 50 attracted USD 2bn in the first five months of 2024.

The STOXX Europe 600 turned 26 this month, a lifetime during which the index has become a trusted barometer for the region’s equities. Used widely for the benchmarking of funds, the index is also the center of a growing ecosystem of investment products.

ETF flows can provide key information about the revealed preferences of investors. A STOXX paper analyzes fund purchases to determine the long-term choices across style, industry and regional exposures.

STOXX’s European benchmarks offer transparent and liquid exposure to the region, and are at the center of a wide ecosystem of derived investment strategies and products. Those characteristics have made the indices the top choice for issuers of investable products.

As it turns 13, the STOXX Thematics index suite continues to grow, offering investors exposure to structural megratrends changing our modern world. We look at the historical performance of the indices and zoom in on 2023 – a year dominated by technology themes.

The sector composition of the Eurozone blue-chip benchmark looks very different from its inception 26 years ago. Most recently, two technology stocks – ASML and SAP – have had the biggest influence on the index’s direction, and may be re-positioning it in the eyes of investors.

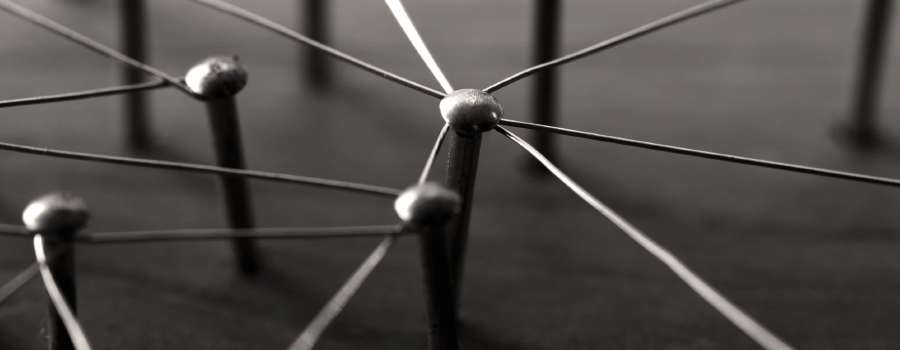

What is the value of diversification? We can visualize it using a simple three-asset portfolio, observing how the risk-adjusted performance changes when varying the correlation. Correlation measures the degree to which two variables move in relation to each other, and serves as a guide as to how well assets can diversify each other.