Global demand for technology innovation, and the consequent ascent of technology stocks, have changed the profile of the EURO STOXX 50®, once dominated by telecommunications, energy and utility companies.

Investors seeking exposure to technology have driven the industry’s shares higher and have found good reasons to do so: profits at ASML Holding NV and SAP SE, now respectively the largest and third-biggest constituents in the European index, are crashing analysts’ estimates. The two companies alone are responsible for around a quarter of the index’s gains since the start of 2023, and for two-thirds of its returns in 2024.

The new index titans look different from the more defensive and domestic-focused companies that held the biggest sway in the Eurozone blue-chip benchmark when it was launched 26 years ago today. In a recent Bloomberg News article, Michael Msika wrote that the new-found weight of technology stocks in the EURO STOXX 50 is likely to influence the index’s performance.

“Europe may lack a ‘Magnificent Seven’[1] tech cohort of its own, but a pared-down version of that phenomenon has emerged,” writes Msika. “Tech is gaining importance among investors, and the sector has yet to breach its record high from 2000, leaving plenty of room for further gains.”

The EURO STOXX 50 is at the center of an ever-growing investment ecosystem that includes ETFs, structured products and listed derivatives:

- USD 31.3 billion in AuM in EMEA-domiciled ETFs.

- 246 million EURO STOXX 50 futures and 253 million EURO STOXX 50 options traded in 2023 on Eurex.

New to Eurex: Mid-curve options on EURO STOXX 50 index dividend futures.

Performance

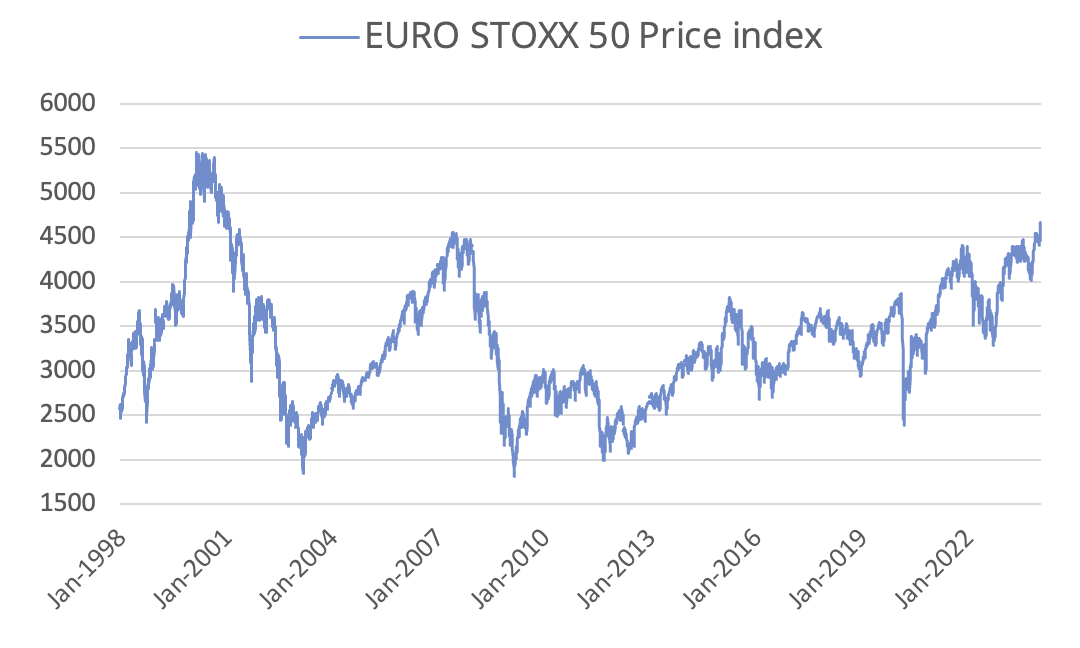

The Eurozone’s blue-chip benchmark gained 19.2% in 2023 and 23.2% when including dividends. The index has got off to a good start this year, gaining 2.8% and 3%, respectively, in January. That said, the index remains 15% short of its record on a price level, reached in 2000.

Figure 1: EURO STOXX 50 performance

Chip machines

ASML on January 24 reported that profits jumped 8.2% in the last three months of 2023 from the previous quarter, beating analysts’ predictions.[2] Shares in the Dutch company whose lithography machines are used to make chips rose 7.9% on the results, and are now up 60% since the start of 2023.

The same day, SAP shares jumped 8.3% to a record after the German maker of enterprise application software released earnings that beat expectations and said it plans to restructure 8,000 jobs as it shift resources to Artificial Intelligence technology.[3] SAP has climbed almost 70% since the start of 2023.

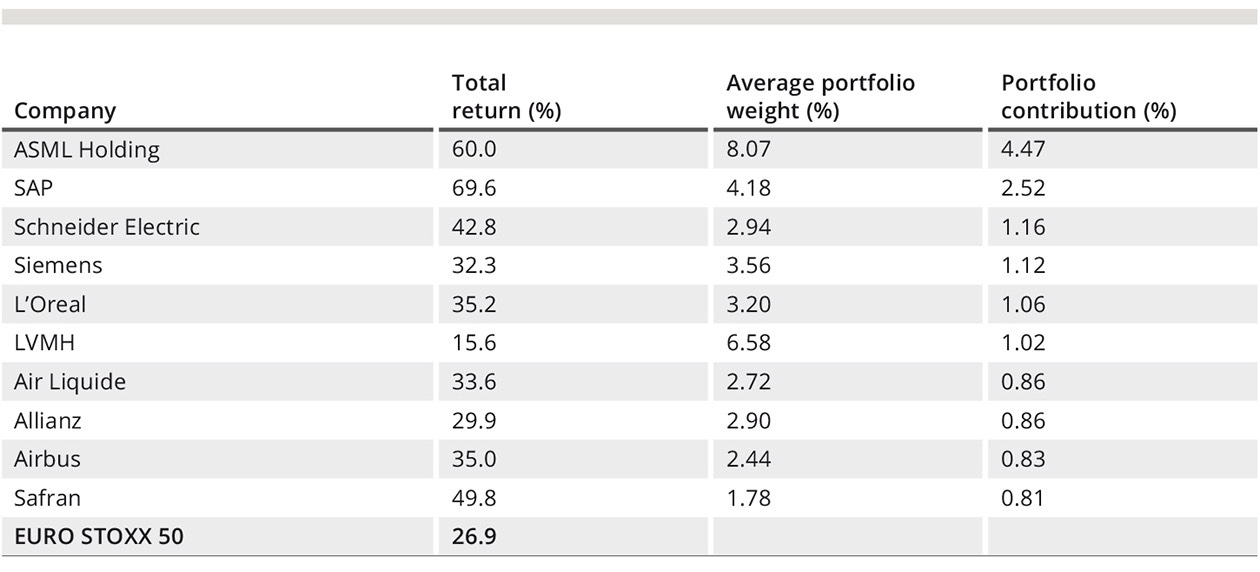

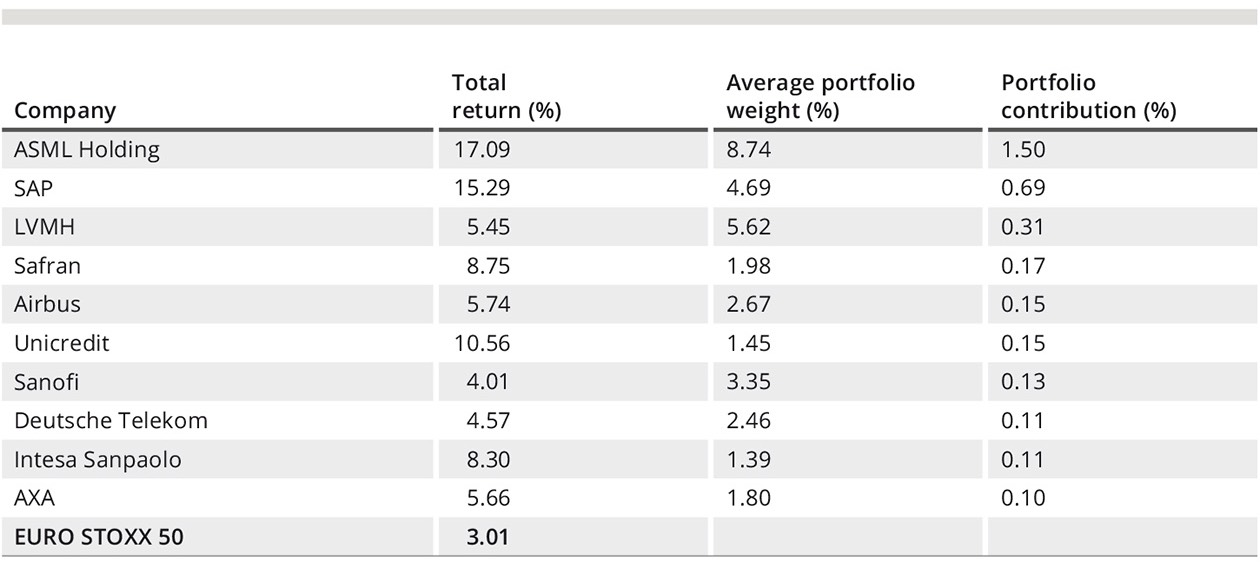

SAP and ASML have accounted for 7 percentage points, or just over a quarter, of the EURO STOXX 50’s 27% return since the start of 2023 (Figure 2). This year, their contribution has increased, accounting for two-thirds of the portfolio’s 3% advance through January (Figure 3).

Figure 2: Stock contribution, January 2023 – January 2024

Figure 3: Stock contribution, January 2024

Shifting industry composition

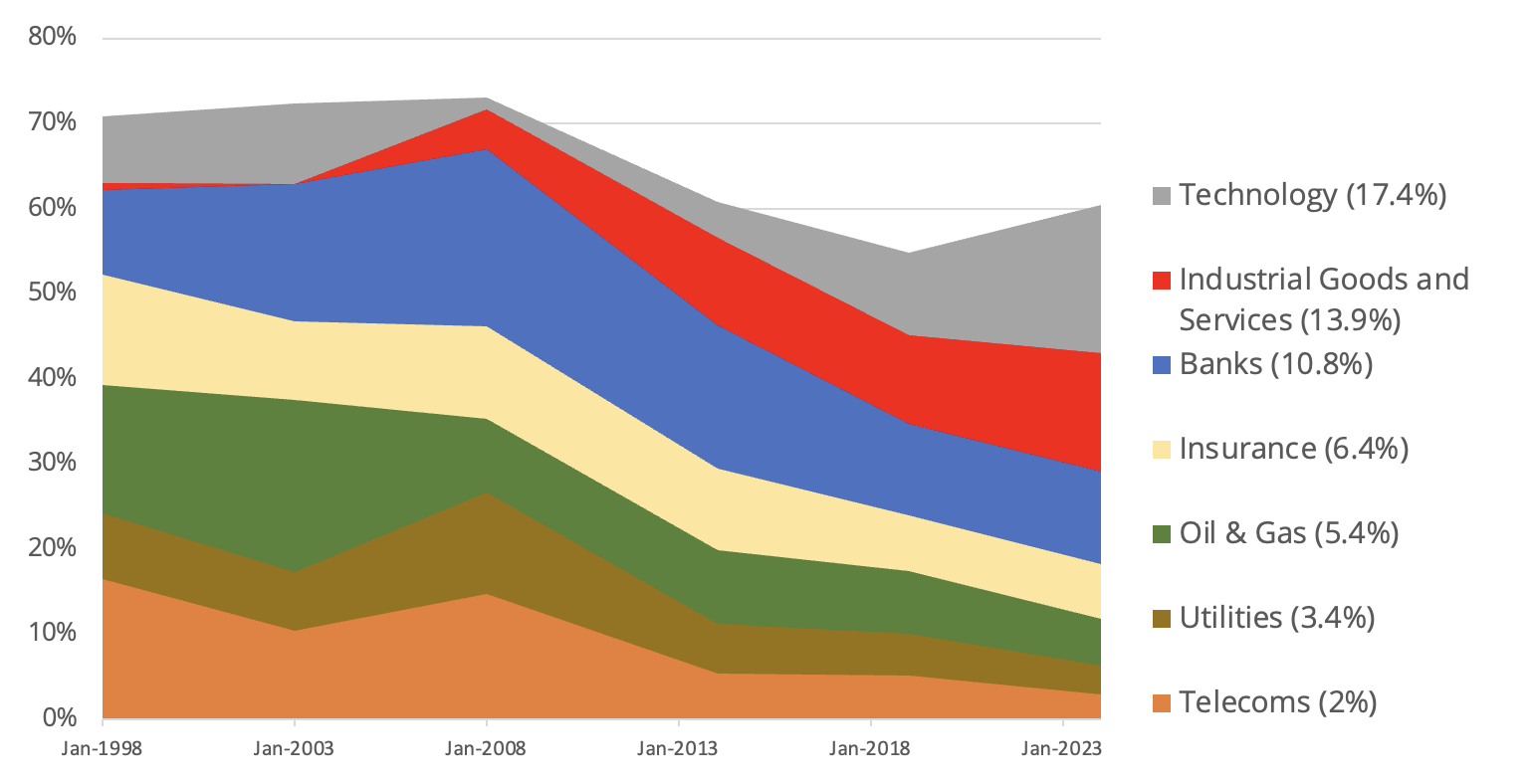

The increasing sway of the Technology sector in the Eurozone market started years ago, and is part of a shifting sector composition in the index and broader economy. Figure 4 shows the evolution, in roughly five-year intervals, of a selection of ICB Supersectors as represented in the EURO STOXX 50 since 1998. The trends are a proxy for the fortunes of each industry, although there have also been company reclassifications and changes to industry definitions over the period.

Technology, in gray, is one of the biggest advancers over the period. It now accounts for 17.4% of the benchmark’s weight, the largest Supersector in the index, up from just over 1% in 2008. The Supersector accounted for nearly 8% upon inception of the index, before Philips, Nokia, Siemens and Alcatel were re-classified from Technology to other Supersectors.

Over the entire 1998-2024 period, it is Industrial Goods & Services that has registered the biggest weight increase: it’s gone from less than 1% in 1998 to 13.9% of the index today, thanks to stocks including Siemens and Schneider Electric. This sector and Technology have given the EURO STOXX 50 a more cyclical tilt.

By contrast, Oil & Gas, Insurance and the defensive Supersectors of Utilities and Telecommunications have ceded territory in the past two-and-a-half decades.

Banks accounted for over a fifth of the index in 2008, before the financial crisis triggered a sell-off in the sector.

When the EURO STOXX 50 was launched in 1998, the continent’s large phone companies accounted for a combined 16.5% of the benchmark. Energy companies were the second-largest Supersector, at 15.1%, followed by Insurers with a total weight of 13%.

Figure 4: EURO STOXX 50’s ICB composition, selected Supersectors

While the Technology Supersector has grown in Europe, it remains smaller than in the US. In the STOXX® USA 500, it accounts for 32.7% of the index.

Valuations remain competitive

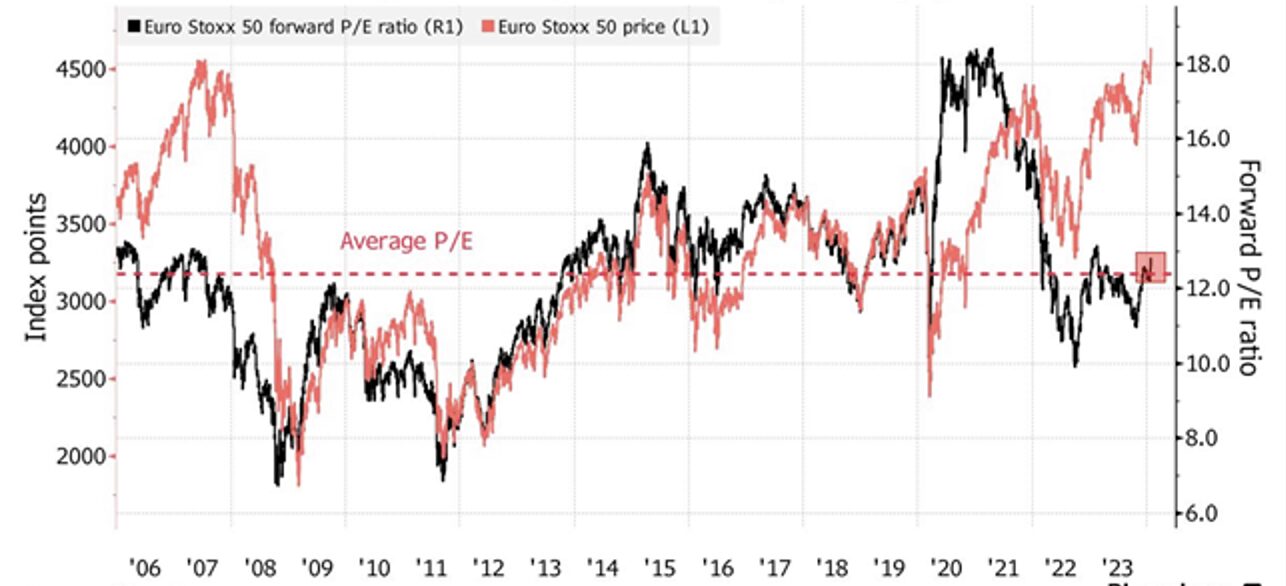

As Bloomberg’s Msika notes, profits at the EURO STOXX 50’s largest companies have risen alongside share prices, keeping the index’s relative valuation around its historical average (Figure 5).

Figure 5: EURO STOXX 50 valuation

At 12.4 times its companies’ projected earnings, the Eurozone benchmark is about a third cheaper than the STOXX® USA 500 index, which trades at 18.2 times earnings.

Technology dominance

The role of a benchmark is to be representative of its underlying market and economic reality. In that sense, the EURO STOXX 50 shows that the Eurozone has also been impacted by the technology boom this century, and investors’ rush to participate in the economic upside of the pioneering companies innovating in the industry.

[1] As Diana R. Baechle and Leon Serfaty of Axioma have written here and here, the “Magnificent Seven” stocks (Amazon, Apple, Alphabet, Meta, Microsoft, Nvidia and Tesla) have held an outstanding influence on the performance of US equity indices.

[2] Reuters, “ASML shares close at record high after earnings beat, orders pop,” January 24, 2024.

[3] Euronews, “SAP shares hit all-time high after announcing job restructuring plans,” January 24, 2024.