Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

Thought leadership

Most Recent Thought leadership

Volatility is playing an increasingly important role in markets and portfolios. We sat down with two experts to ask them how investors use listed derivatives such as VSTOXX and VIX futures and options to trade market swings.

STOXX has published its most complete study to date of VSTOXX, the flagship gauge of equity market volatility in the Eurozone. Explore the methodology behind the index, the concept of volatility, and available trading strategies — from theory to use cases.

Arun Singhal, global head of product management at STOXX, speaks to ETF Stream Editor Theo Andrew about why flows are returning to European equities, and the role indices play.

Index | Listed Derivatives

New ESMA fund names rules: Q&A with Eurex and STOXX on changes to ESG index derivatives

The STOXX® Europe 600 SRI index is aligned with the new ESMA guidelines on fund names. Investors, meanwhile, will have a say whether other derivatives’ underlying methodologies will change. We asked experts from Eurex and STOXX what this means for the segment.

Index | Listed Derivatives

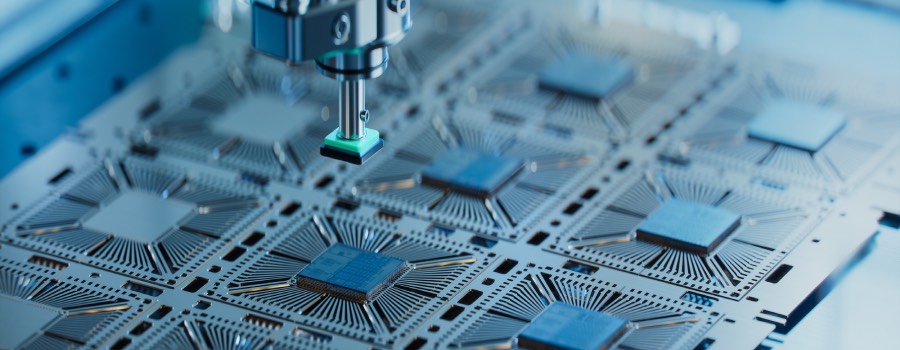

Q&A: New Eurex futures on STOXX Semiconductor 30 index as investment vehicle into dynamic sector

Eurex’s Mezhgan Qabool explains how demand to invest in chipmakers drove the launch of the STOXX Semiconductor 30 index futures in March, and what the new product offers for portfolios.

A portfolio’s decarbonization becomes more difficult once an emissions reduction of 60% is achieved, as high-emissions sectors become depleted. Thereafter, the portfolio construction approach — whether exclusion or optimization — will make a difference to the resulting tracking error and size of the portfolio.

Index | Listed Derivatives

Q&A on daily options at Eurex: expanding the trading opportunities around STOXX and DAX benchmarks

Daily expiration options on the EURO STOXX 50 and DAX indices have attracted significant flows since launch last year on Eurex as instruments to gain market exposure around specific, short-term macroeconomic and political events. We ask experts at Optiver, Eurex and STOXX what these types of options bring to the market.

Index | Events, Conferences & Webinars

Europe’s ‘Magnificent’ equities in focus at ETF Ecosystem Unwrapped event

STOXX was present at the annual gathering organized by ETF Stream, leading a workshop where a high number of participants discussed valuations and flows into European equities.

ETF flows can provide key information about the revealed preferences of investors. A STOXX paper analyzes fund purchases to determine the long-term choices across style, industry and regional exposures.

Index | Events, Conferences & Webinars

IPE Webinar: Digital Assets – Exploring a new paradigm in investing

The digital assets market is growing strongly, yet it still lacks the maturity of traditional markets. A blue-chip index can bring transparency, help standardize prices and enable institutional-level investment products, a panel of experts argued during the webinar.

A new report delves into the STOXX Digital Asset Blue Chip Index’s construction process to unpick the metrics used to select constituents that, much like in the equities world, stand for high quality and financial strength.

Index | Events, Conferences & Webinars

Futurization and the role of indices in a growing derivatives market

A panel at the recent Eurex Derivatives Forum in Frankfurt discussed the growing market for listed derivatives and why indices are key in the transition from OTC to exchange trading. Futurization is linked to the customization of strategies, and experts said they see both growing.