Growing interest in cryptocurrencies from allocators is coinciding with the introduction of institutional-grade products to invest in digital assets, allowing investors to tap a market they seek for its potential returns and diversification.

A webinar organized by IPE was the stage to discuss the new paradigm in the way investors look at digital assets. It was also an opportunity to explore the recently launched STOXX® Digital Asset Blue Chip index, which offers exposure to high-quality assets that represent the crypto universe today.

“We are entering the era of digital assets maturity,” Loris Voneschen, Head of Index Business at Bitcoin Suisse, said during the broadcast. “The space is migrating towards more tangible use cases and less fixation on price volatility and speculation.” The amount of assets available and heightened interest from investors and institutions in the last couple of months “underly the importance of being able to navigate the digital assets space with know-how and experience,” he said.

New rules and inflows

The approval of the first spot bitcoin exchange-traded funds (ETFs) in the US this year has triggered a dash to invest in cryptocurrencies through regulated and transparent vehicles. The ten US spot bitcoin ETFs launched in January 2024 have attracted record inflows and have amassed total assets of nearly USD 50 billion.[1] With more clarity in the regulatory landscape, many institutional investors are starting to include cryptocurrencies within their multi-asset funds.

Johanna Belitz, Head of Nordics at Valour, which has recently introduced an exchange-traded product (ETP) listed on the Frankfurt Stock Exchange (FSE) tracking the STOXX Digital Asset Blue Chip index and using Bitcoin Suisse as crypto data provider, said the digital assets market is currently undergoing a “demand shock.” She estimated during the panel that demand for bitcoin is running at about ten times the amount that is actually being mined.

Amid such uptake, a blue-chip index can bring transparency, help standardize prices and enable institutional-level investment products in a quickly evolving and emerging market that was until recently little regulated, said Ladi Williams, Head of Thematic and Strategy Index Product Management at STOXX. There are over 2 million digital assets trading in more than 700 venues, according to CoinMarketCap.

“An index is an important tool that allows us to measure, understand and participate in a particular asset class or segment,” said Ladi. “In order to do that, an index has to have certain characteristics: it has to be representative of the asset class or segment, it needs to be rules-based and transparent, and if the intention is for it to underlie an investment product, it has to be investable.”

A quality focus

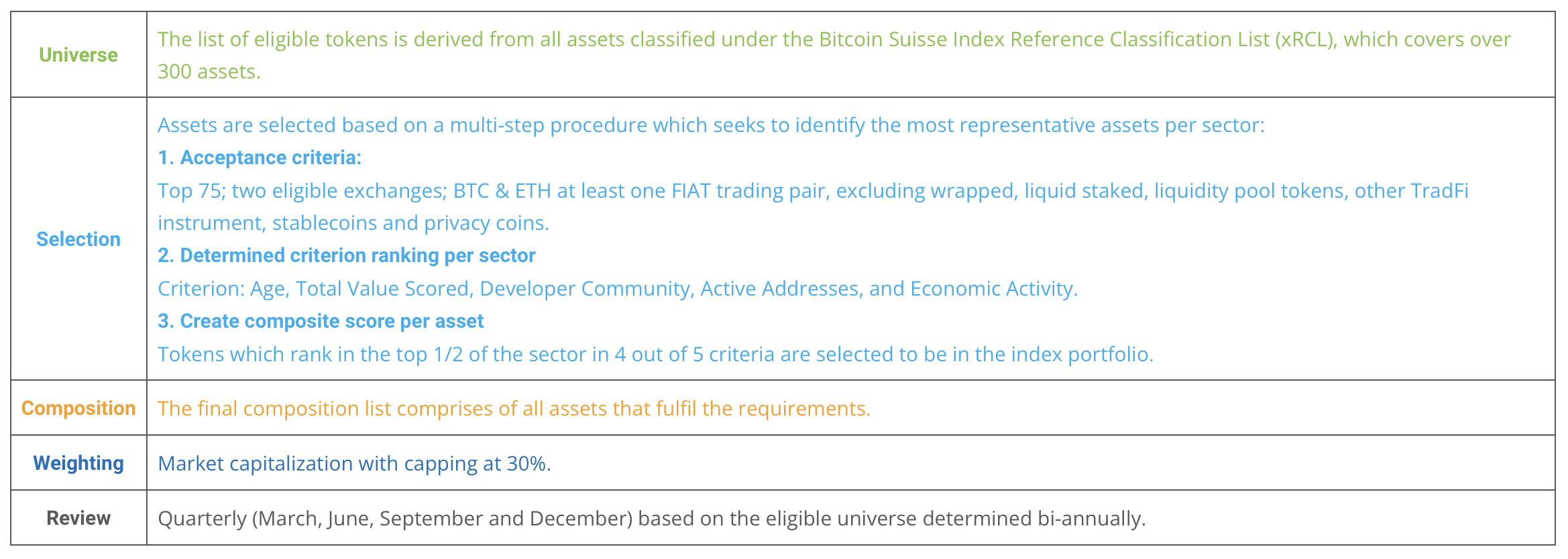

The STOXX Digital Asset Blue Chip index was designed with a focus on quality, rather than market capitalization as it is customary with other indices. The index considers crypto-native metrics including age, total value scored, developer community, active addresses and economic activity.

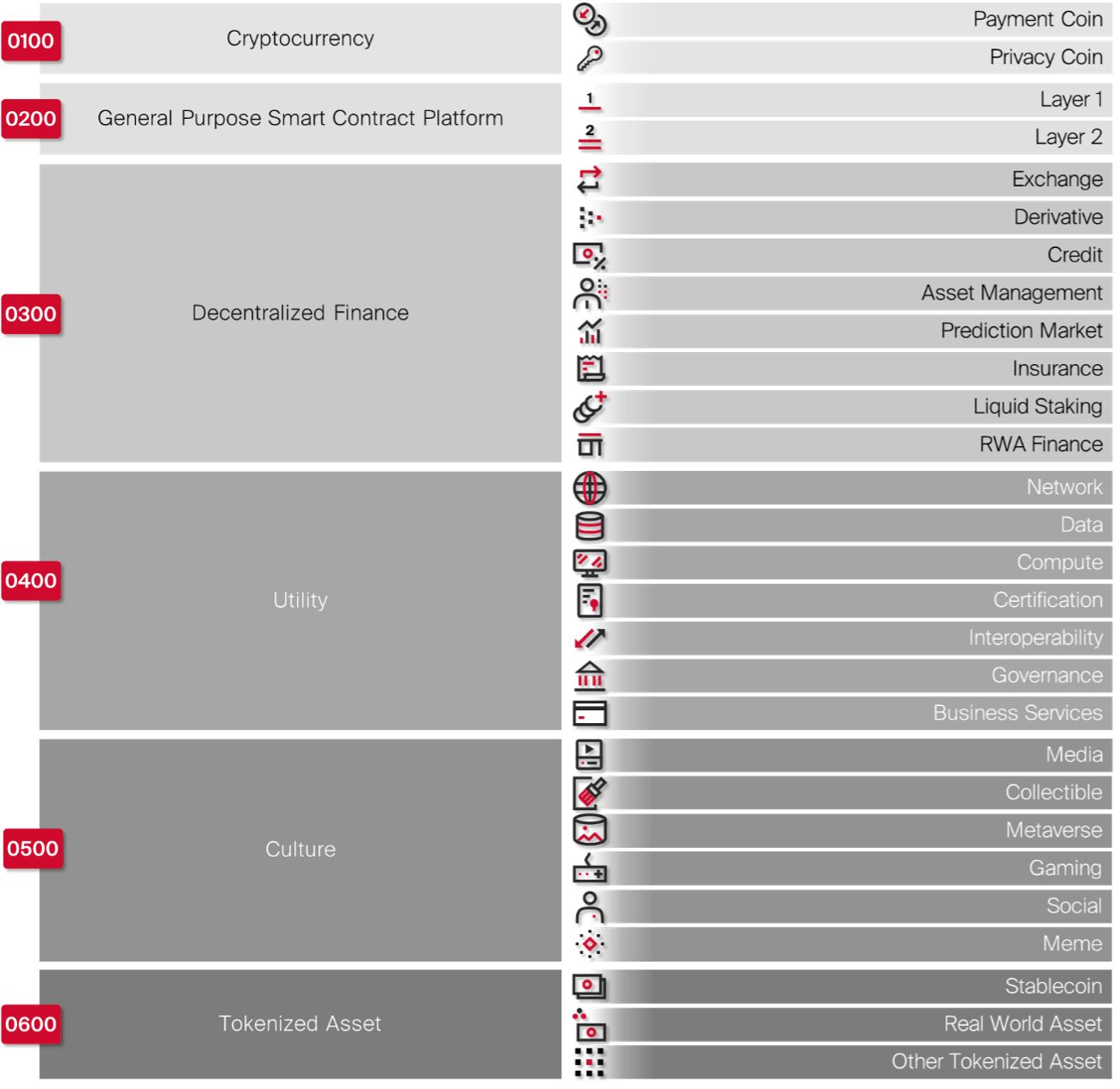

The list of eligible assets for the index is derived from the Bitcoin Suisse Index Reference Classification List (xRCL). Basic screening criteria trims the universe, with assets in the following five sectors from the Bitcoin Suisse Global Crypto Taxonomy (GCT) (Figure 1) then available for selection: Cryptocurrencies, General Purpose Smart Contract Platforms, Decentralized Finance (DeFi), Utility and Culture.

Figure 1: Bitcoin Suisse Global Crypto Taxonomy

“The primary objective of the Bitcoin Suisse Global Crypto Taxonomy is to make the space more accessible for investors and the larger expert audience by offering a systematic structuring of the crypto industry,” explained Loris at Bitcoin Suisse.

Index constituents are selected in a screening process that considers the five crypto-native metrics mentioned earlier to rank assets in relation to their peer group. Those metrics give an idea of the quality, adoption, utility and financial strength of digital assets, in the same way metrics such as revenue and market capitalization define blue chips in the equities space.

Each digital asset gets an aggregated score based on those metrics, and those with the highest scores by sector make it into the index. This selection strategy draws parallels to the constitution of the flagship EURO STOXX 50®, which is also comprised of Supersector leaders.

The index is finally weighted by market capitalization with a maximum cap of 30% at each quarterly review. This offers investors a true representation of the underlying market as well as exposure to smaller assets, but seeks to limit concentration in a few, dominant ones.

Figure 2: STOXX Digital Asset Blue Chip index methodology summary

Top holdings

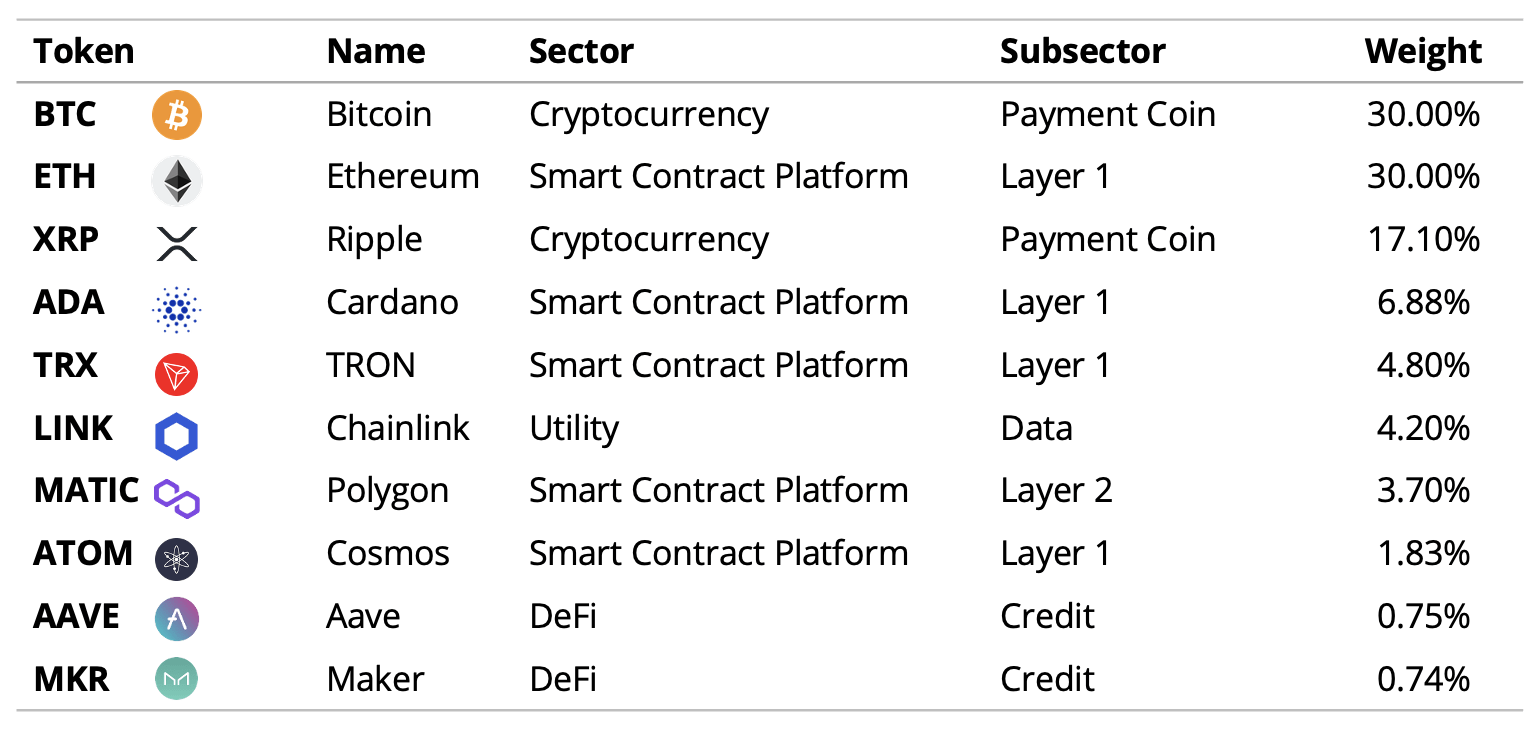

The discussion turned towards the holdings in the STOXX Digital Asset Blue Chip index. The selection and weighting methodology seeks to capture the full opportunity set for investors in such a broad market, explained Ladi at STOXX.

“A key characteristic of an index is its representativeness of the market,” Ladi said. “Bitcoin and Ethereum represent 70% of the market. These tokens’ weights (in the index) represent what you actually see in the market. In terms of having other assets as well, we have to be mindful of the fact that if you were to overweight those, they might not have the capacity to support the institutional inflows.”

Figure 3: STOXX Digital Asset Blue Chip index holdings

“There is both a diversification aspect as well as an attempt to capture bigger movements which you might not find in the top three digital assets, but lower down,” Johanna at Valour said about the index. “This is a very interesting aspect of basket or index products.”

Exchange vetting and pricing

Pricing reliability is a big consideration for an asset class such as cryptocurrencies, which do not trade on exchanges that are as mature as traditional ones.

“It was important to make sure that the exchanges we are using for pricing have a level of scrutiny that is acceptable for our index,” said Ladi at STOXX. “That is where we lean heavily on Bitcoin Suisse’s expertise in order to come up with a pricing methodology that would reflect prices that investors are actually able to transact on.”

Loris at Bitcoin Suisse explained that assets in the STOXX index are priced in a process that includes thorough exchange vetting. The data provider ranks crypto exchanges according to their scores based on security, legal, compliance and regulation, and financial criteria. The two highest-ranked venues measured by exchange score, adjusted for volumes and a decay-time factor, will provide the average price for the asset. Additionally, on a day-to-day basis, Bitcoin Suisse monitors the exchanges which are part of the eligible exchange universe.

Averaging the most recent traded asset prices across two sources ensures the most reliable, up-to-date and representative price.

High returns, diversification

Towards the end, the panelists were asked about the outlook for cryptocurrencies, a hot topic given that bitcoin prices have jumped more than 70% so far in 2024.[2] Johanna at Valour took the baton.

“We see very strong demand,” she said. “Also, we have the bitcoin halving coming up. Supply of new coins will be cut in half. It is a bigger risk to stand outside of the digital assets market than to take a position.”

The webinar provided a great chance to understand the evolving state of play in the digital assets space and how investors can access the market through a systematic, index-based strategy that can help them navigate through the unknowns and challenges.

[1] Wall Street Journal, “Bitcoin Funds Pull In Money at Record Pace,” March 5, 2024.

[2] Intraday prices through March 13, 2024.