ETF Ecosystem Unwrapped, one of the industry’s key annual gatherings, took place on May 22-23 in London and saw a record-breaking turnout.

STOXX was present at the event in a workshop session led by Nico Langedijk, Head of EMEA ETF and Index Investments. Speaking to a packed room, Nico discussed about the current state of play for European equities, a topic of interest judging by the number of attendees and questions from the audience.

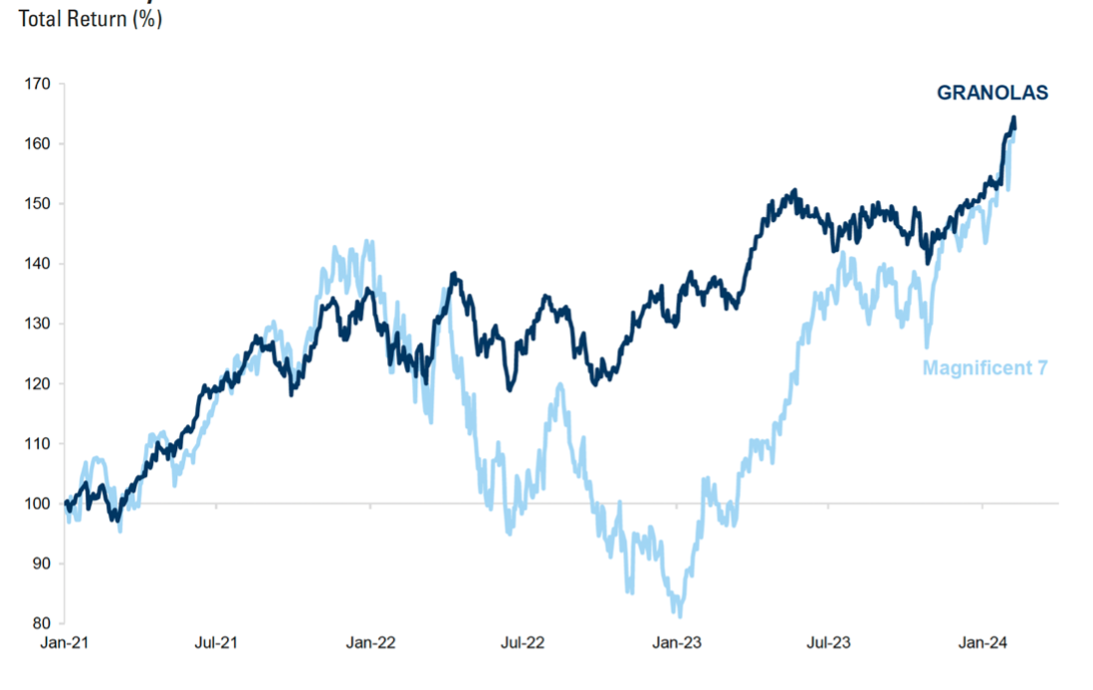

One of Nico’s focus during the session was comparing several standout European companies, known as the ‘GRANOLAS,’ against the ‘Magnificent Seven’ in the US.

The GRANOLAS moniker was coined by Goldman Sachs in 2020 and is an acronym for a group of 11 companies[1] that stand out for strong earnings growth, low volatility, high and stable profit margins, and solid balance sheets. These stocks have been star performers and have driven 60% of the gains in the STOXX® Europe 600 in the past year.[2] They’ve also outperformed their regional benchmark by 10% or more annually since 2017, according to Goldman Sachs research.

In the past three years, the GRANOLAS’ returns have matched those of the Magnificent Seven, a group of equally high-flying stocks that includes Nvidia and Meta (Figure 1).[3] Moreover, they have even outperformed the US basket when adjusted for risk. As a group, the GRANOLAS derive under a fifth of revenues in Europe.[4]

Figure 1: GRANOLAS vs. Magnificent Seven

Global footprint, European valuations

As Nico explained, a lot of investor interest in the GRANOLAS, and in European equities more broadly, lies in their relatively low valuations.

The GRANOLAS, for example, trade at 20 times trailing earnings. That compares to a ratio of 30 for the Magnificent Seven. As of May, the STOXX Europe 600 traded at a cheaper valuation than any equivalent benchmark elsewhere in the world (Figure 2).

Figure 2: Cheap for no reason?

“Like the Magnificent Seven, GRANOLAS are international companies with huge overseas earnings, but are still valued as European stocks,” Nico said. “That discount may present something of a sweet spot for investors.”

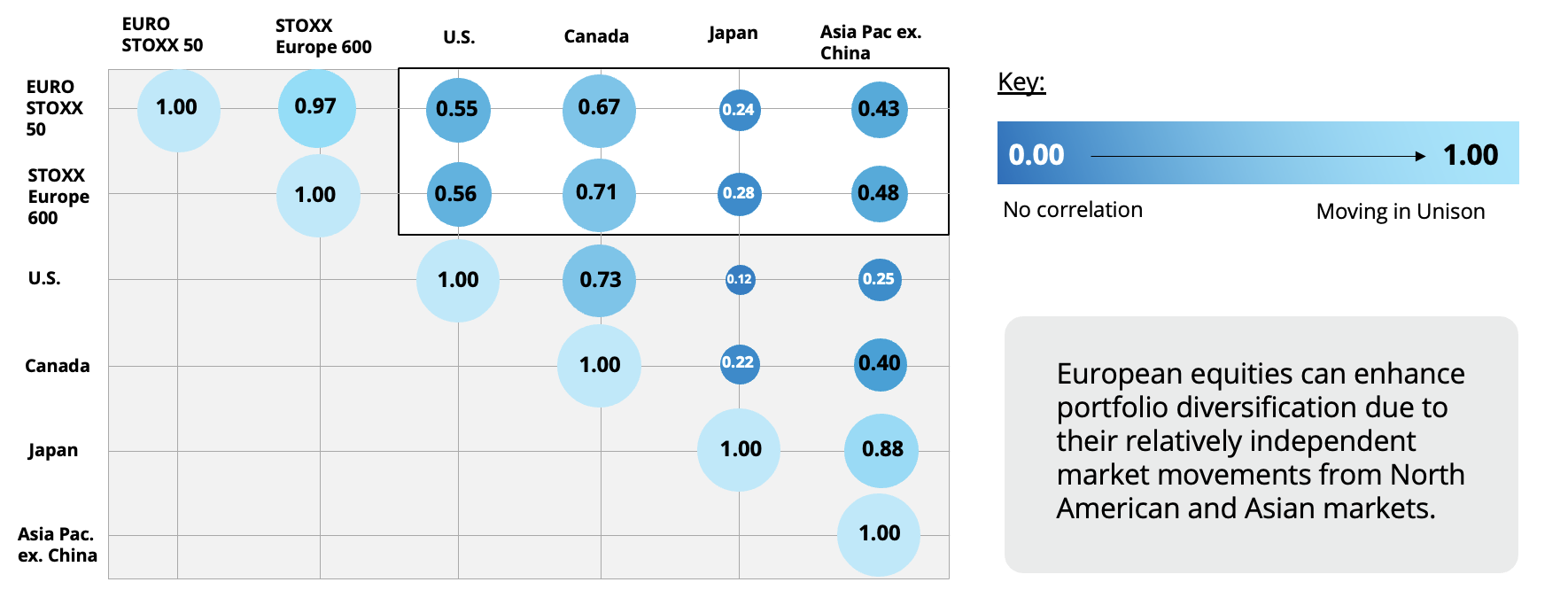

Regional correlations

Nico also highlighted research from STOXX that shows European stocks provide de-correlation in global portfolios (Figure 3). For example, the STOXX Europe 600’s correlation to US stocks is only 0.56. A ratio of 1 denotes exact lockstep.

Figure 3: 10-year regional correlations in daily returns

Fund flows revert to positive

As part of the presentation, Nico also touched upon European equities’ fund flows this year. More than USD 8 billion were poured into European equities ETFs in the first five months of 2024,[5] with STOXX-benchmarked funds attracting the most inflows.

“Investors are returning to European stocks in a bid to find the best of both worlds: strong earnings and low valuations,” Nico argued, linking again those requirements to the GRANOLAS.

The flows picture also has a positive tilt, with most of the investments coming in recent months and reverting outflows from early this year. The trend coincides with rising investor expectations that interest rates may start to drop in the Eurozone earlier than in the US.

Index recognition

ETF Stream, which organizes ETF Ecosystem Unwrapped, is a leading publication of ETF news in Europe. The media outlet in April recognized the iShares STOXX Europe Small 200 UCITS ETF (EXSE), which replicates the STOXX® Europe Small 200 index, as the “ETF of the month” in its ETF Insider magazine.

Overall, ETF Ecosystem Unwrapped was an insightful stage to hear from the ETF industry’s most innovative and forward-thinking experts, and the high number of participants is testament to the event’s interest. We look forward to next year’s iteration and views.

[1] GSK, Roche, ASML Holding, Nestle, Novartis, Novo Nordisk, L’Oreal, LVMH, AstraZeneca, SAP and Sanofi.

[2] Source: STOXX. Price data in USD from February 9, 2023 to February 9, 2024.

[3] Amazon, Apple, Alphabet, Meta, Microsoft, Nvidia and Tesla.

[4] Source: Goldman Sachs.

[5] Data from ETF Book. Includes only ETFs based in Europe.