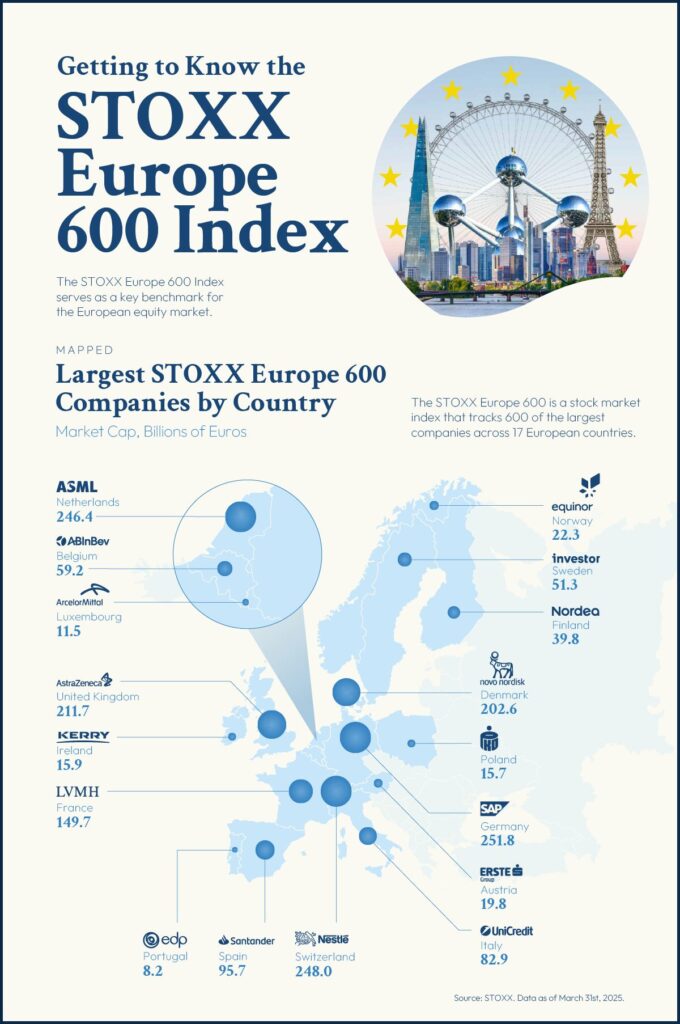

The STOXX® Europe 600 is a broad measure of the European equity market. With a fixed number of 600 components, the index provides extensive and diversified coverage across 17 countries and 11 industries within Europe’s developed economies, representing nearly 90% of the underlying investable market.

There is a wide and very liquid ecosystem built around the benchmark and its popular size, sector and ESG sub-indices, consisting of ETFs, exchange-traded derivatives and structured products.

Key benefits

Details

Symbol

SXXGR

Calculation

Realtime

Dissemination Period

09:00-18:00 CET

ISIN

CH0102635015

Bloomberg

SXXGR Index

Last Value

359.5

-1.93 (-0.53%)

As of CET

Week to Week Change

-0.02%

52 Week Change

15.70%

Year to Date Change

16.95%

Daily Low

359.39

Daily High

363.52

52 Week Low

285.02 — 9 Apr 2025

52 Week High

362.64 — 12 Nov 2025

Top 10 Components

| ASML HLDG | NL |

| ROCHE HLDG P | CH |

| ASTRAZENECA | GB |

| HSBC | GB |

| NOVARTIS | CH |

| SAP | DE |

| NESTLE | CH |

| SHELL | GB |

| SIEMENS | DE |

| LVMH MOET HENNESSY | FR |

Zoom

Low

High