This year, STOXX is celebrating the 15th anniversary of its Thematic indices suite, which has grown alongside investors’ continued push to tap into long-term megatrends shaping the modern world.

The anniversary comes as nearly EUR 62 billion flowed into thematic-focused ETFs worldwide in 2025, more than eleven times the amount a year earlier.1 Thematic investing has established itself within asset allocation as a compelling long-term equity proposition.

STOXX Thematics history

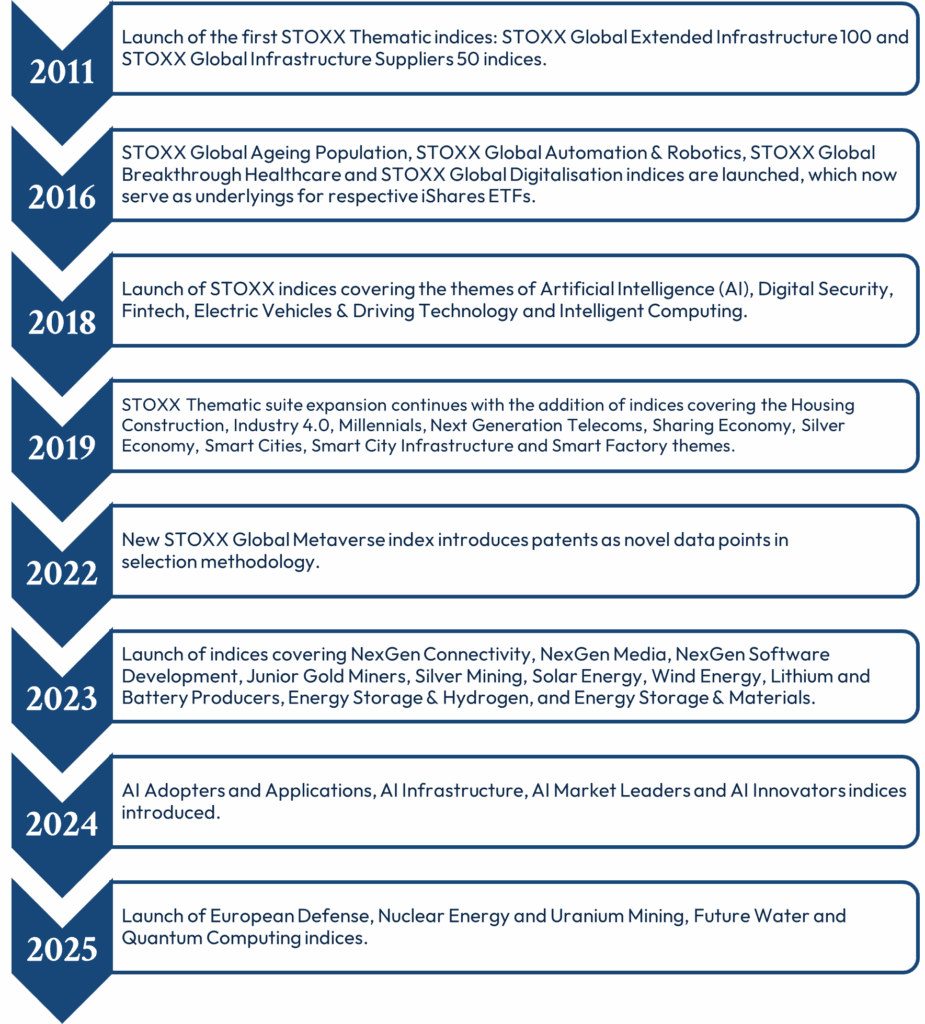

STOXX introduced its first thematic index in May 2011, launching a suite that now comprises more than 70 indices.2 These target the beneficiaries of transformative forces shaping societies, businesses and the economy, creating historical opportunities for investors. The indices are grouped into three broad megatrends: the environment, future technology and socio-demographics.

STOXX Thematics suite timeline

Revenue- and patents-based selection approaches

Today, STOXX’s Thematic indices mostly employ two distinct methodologies for stock selection: those based on companies’ revenues and those tracking intellectual property (patents).

The revenue-based thematic indices use the FactSet Revere Business Industry Classification System (RBICS) dataset, whose highly granular and accurate sector and industry classification allows a detailed breakdown of companies’ revenue sources, helping to identify and select businesses with substantial exposure to specific themes.

Patent-based thematic investing, on the other hand, is a forward-looking strategy that focuses on identifying companies at the forefront of innovation. By analyzing patent activity in collaboration with EconSight, it is possible to gain early insights into emerging technologies and disruptive trends, and identify those companies likely to play a key role in them in years to come.

Thematic investing in 2026

Far from slowing, advancing technologies and disruptive forces continue to accelerate amid innovation and societal change. The result is a new wave of investable themes that are capturing investors’ attention for their potential to deliver superior or differentiated risk-return outcomes. Among the themes to have emerged most recently are AI, European defense and quantum computing.

A closer look at selected themes

With billions forecast to be spent on computing infrastructure, training and applications, AI appears as a generational game-changer for the economy. AI, however, is a vast and complex topic that covers multiple conceptual areas and technologies. The STOXX AI thematic suite aims to help investors navigate this space, accessing different aspects and development stages of its sub-themes and segments.

Available indices

European defense has emerged as a strong theme for investors as the continent undertakes a historic upgrade of its military capabilities. NATO countries are boosting defense spending, and the European Commission has announced plans to help European Union nations spend over EUR 800 billion in defense and in military research from regional providers.

Available indices

Quantum computing is an emerging field of computer science that applies the principles of quantum mechanics to solve problems too complex for classical computers. By tackling problems in ways that were previously impossible, experts say quantum computing can optimize algorithms and AI systems to accelerate processes such as the design and improvement of materials, drugs and financial models. This has triggered increased demand for ultra-fast information processing technologies capable of running advanced industry applications and AI models.

Available indices

Source: STOXX.

Collaborative approach

STOXX has become Europe’s pre-eminent index provider for thematic strategies, driven by its deep expertise, extensive customization capabilities, robust data availability and collaborative approach to index design with clients. This partnership spans the entire process — from concept ideation to index construction and product launch — delivering fast solutions tailored to our clients’ needs.

More info:

- Thematic indices overview

- Capitalizing on early lifecycle innovation through thematic investing

- Thematic indices: Capturing trends from AI to defense to transition metals

1 Source: STOXX. Data through December 2025.

2 This figure was updated in February 2026 to reflect indices launched following the publication of the original article.