Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

Blog posts

Latest blog posts

In modifying how DAX composition changes are fixed and publicized every quarter, Qontigo is providing index trackers more visibility and a more stable base upon which to trade the changes and replicate the index.

Index | ESG & Sustainability

Q&A with WTW’s David Nelson: Managing a portfolio’s climate transition risk with a forward-looking focus

“Counting molecules of carbon is the essential first step to tackling climate change, but it’s only the start,” says the director at WTW’s Climate and Resilience Hub. He explains why investors should focus on a company’s current climate-transition risk by understanding what the impact will be on its future cash flows.

Index | Thematic Investing

BlackRock’s iShares launches tech-focused thematic ETF of ETFs powered by STOXX indices

The Australia-listed iShares Future Tech Innovators ETF seeks exposure to companies driving the technological innovation that’s disrupting our modern world, by investing in six thematic ETFs. Target investments include the themes of automation & robotics, breakthrough healthcare and digitalization.

This year has seen a steep slowdown in net purchases of global ESG funds, but inflows remain positive. Broader funds, meanwhile, registered USD 139 billion in net outflows in the first six months of 2022, according to Morningstar data.

Investors can access three different German benchmarks that follow an ESG strategy designed to meet specific needs and responsible objectives, and that have the same rules and transparency characteristics as the blue-chip DAX index.

The STOXX Global 1800 index gained 7.9% in dollars last month, its best monthly showing since November 2020. The index is still down 14.4% in 2022.

Futures and options enable investors to take directional views and hedge portfolios as markets pull back and price swings increase this year.

This year’s market volatility and macro shocks have raised a challenge to the thematic investing boom, but also offer a chance to reappraise the benefits of the investment approach. Overall, the funds continue to attract net inflows as investors seek alternatives to traditional sector-based portfolios in their search for long-term outperformance.

A new white paper from Qontigo analyzes the components of a multi-factor alpha forecast in a universe of US stocks. The alpha has enhanced market returns over the last 20 years, with 2021 showing the best annual results.

The ROOF methodology can capture the ‘sentiment’ of a portfolio relative to its benchmark. We run ROOF scores to determine the risk appetite of investors holding four portfolios aligned with respective Sustainable Development Goals.

Index | Benchmarks

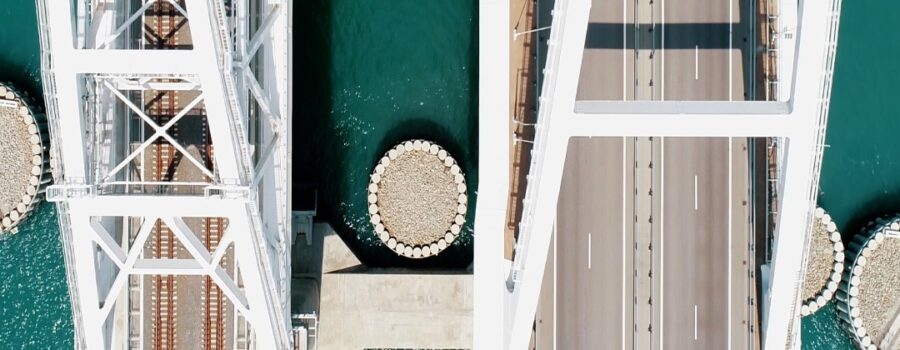

DAX indices to change rules around corporate actions, keep single-stock capping at 10%

Changes follow a market consultation with stakeholders and were devised to bring the German equity benchmarks in line with international standards.

The global benchmark plunged 8.7% in dollars last month, wrapping up its worst month and quarter since the COVID-19 pandemic hit in the first quarter of 2020. The index is down 21% so far in 2022.