Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

News & Research

Most Recent News & Research

Today UniCredit Bank AG, via its subsidiary Structured Invest SA, introduced two exchange-traded funds (ETFs) based on the Eurozone’s first set of indices combining a factor strategy with environmental, social and governance (ESG) criteria on European equities.

Thematic investing has been one of the most talked-about topics in the asset management industry over recent years, led largely by innovation in index-based products.

Willem Keogh, Head of ESG, Thematic and Factor Solutions at STOXX Ltd., discusses the future of index-based ESG strategies.

In the asset management world, the terms ‘value’ and ‘growth’ have long been used to describe two distinct investment styles, and many managers categorize themselves and their products along these two labels.

STOXX Ltd. has licensed the EURO iSTOXX® 50 Low Carbon NR Decrement 3.75% Index to Banca IMI, Intesa Sanpaolo Group, as an underlying for structured products.

The rapid growth in environmental, social and governance (ESG) investment strategies has been underpinned by the thriving availability of corporate sustainability metrics.

Global stocks recovered in June from their May slump, as investors looked for a favorable resolution to trade disputes and leading central banks indicated their readiness to ease monetary policy should the economic situation demand it.

Global stocks recovered in June from their May slump, as investors looked for a favorable resolution to trade disputes and leading central banks indicated their readiness to ease monetary policy should the economic situation demand it.

Institutional and retail client demand is making environmental, social and governance (ESG) strategies a common feature and requirement in the structured-products business, according to a panel of industry professionals at the Innovate2Invest conference.

Index | ESG & Sustainability

STOXX Wins Multi-Billion Landmark Deal With Four German Pension Funds For Sustainable, Climate-Friendly Global Index Solutions

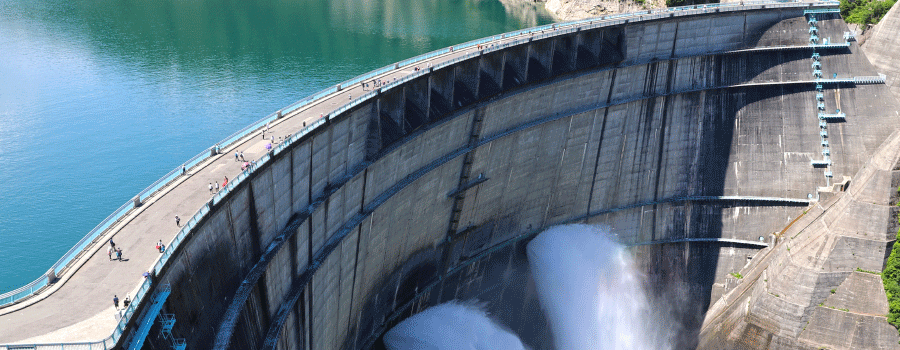

STOXX Ltd. has won a request for proposal to license four low-carbon sustainability indices to the pension funds of four states in Germany.

Last August, Credit Suisse Asset Management (Switzerland) Ltd. launched the first index fund tracking the EURO STOXX® Multi Premia Index, a multi-factor strategy based on cutting-edge research.

After rising in tandem with other investment styles for most of 2019, value stocks — those trading at below-average valuations — have since May slipped back to the bottom, adding to their multi-year lagging record.