Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

News & Research

Most Recent News & Research

Index | New product launches

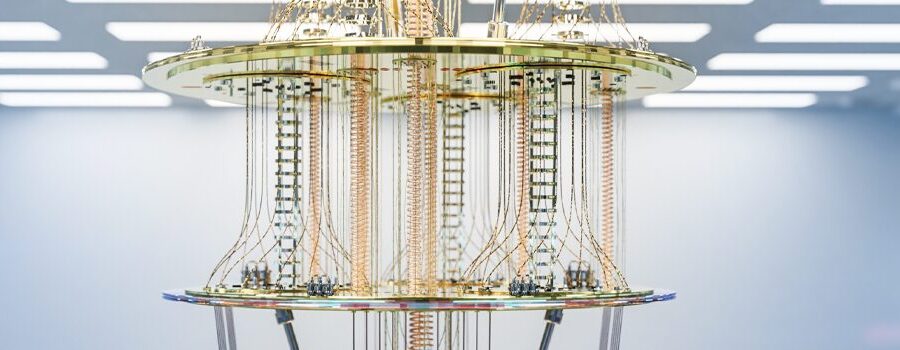

New iShares UCITS ETF tracking STOXX index targets quantum computing leaders

The underlying STOXX Global Quantum Computing index selects companies through a unique systematic process of scanning candidates’ patents, annual reports and corporate websites.

Index | Events, Conferences & Webinars

Decoding Europe’s equity comeback: Market drivers and index innovation

In a recent webinar, Lukas Ahnert, Senior Product Specialist at Xtrackers by DWS, and Arun Singhal, Head of Product Management and Client Success at STOXX, discussed the drivers behind Europe’s stock rally and the latest investment strategies designed in collaboration by both firms.

Index | New product launches

New ETF from Xtrackers by DWS tracks STOXX Europe Total Market Defence Space and Cybersecurity Innovation index

The underlying index combines revenues- and patent-based stock selection methodologies, capturing companies across the spectrum and life cycle of the targeted themes.

Index | Thematic Investing

European defense stocks: A look at purity through military revenues’ exposure

Amid strong demand for European defense stocks this year, seeking ‘pure’ exposure to the theme through military equipment revenues has enabled investors to outperform.

Index | Thematic Investing

Thematic indices: Capturing trends from AI to defense to transition metals

Seismic shifts in the environment, technology and socio-demographics — known as megatrends — as well as geopolitical drivers are transforming our world and creating investable themes such as artificial intelligence, defense, digital assets and energy transition metals. Thematic indices offer investors a chance to target the beneficiaries of these trends.

Index | Thematic Investing

Q&A with EconSight and STOXX: Navigating the patents landscape in emerging AI technologies

AI is a vast and complex theme that covers multiple conceptual areas and technologies. How do patents help identify the AI innovators that are selected into STOXX thematic indices? We asked EconSight’s Kai Gramke and STOXX’s Ladi Williams.

Index | Thematic Investing

Video: How to target Europe’s booming defense stocks with thematic indices

Ladi Williams, Head of Thematics and Strategy Index Product Management at STOXX, explains how the index provider has catered to the specific needs and objectives of ETF managers in devising a series of indices targeting the defense sector.

Ladi Williams, Head of Thematics and Alternative Strategies at STOXX, explains in an article on ETF Stream how we have catered to the specific needs and objectives of ETF managers in devising a series of indices targeting the defense sector.

Index | Thematic Investing

Q&A with BlackRock’s Moufti: AI as driver for ‘picks and shovels’ and copper

The world is in immediate need of vast amounts of data centers, chips and energy. Omar Moufti, Thematics & Sectors Product Strategist at BlackRock’s iShares, explains how to harness the upside from the infrastructure supporting the AI revolution.

The new iShares fund offers precise exposure to European companies expected to benefit from the region’s historic ramp-up in military investments. The launch marks another collaboration in thematic ETFs between BlackRock and STOXX.

Index | Thematic Investing

Amundi ETF, Eurex launch products tracking STOXX Europe Total Market Defense Capped index

The index selects European companies from ICB’s Aerospace and Defense Sector that have revenues from specific defense activities, seeking a focused strategy on the military re-equipment theme.

Index | Thematic Investing

Video: Beyond the buzz: How to design indices that truly capture AI’s evolution

STOXX currently offers five indices targeting specific segments within the Artificial Intelligence theme. Ladi Williams, Head of Thematics & Strategy, Index Product Management at STOXX, discusses in an interview with Asset TV the construction of indices covering such a vast and complex theme.