DWS’ Xtrackers has launched the Xtrackers Europe Defence Technologies UCITS ETF, which tracks the STOXX® Europe Total Market Defence Space and Cybersecurity Innovation index, amid growing demand for European defense and security stocks.

The index, part of STOXX’s Thematics series, is designed to capture the performance of companies with existing revenues and patent exposure to the three thematic segments — defense, space and cybersecurity — hence covering established suppliers of traditional military equipment and of more advanced defense systems, as well as those likely to play relevant roles in those fields in the future. The fund has been listed on the London and Frankfurt stock exchanges.

Shares in European defense stocks have rallied since Russia’s invasion of Ukraine in 2022, and gains have accelerated this year as US President Donald Trump said Europe needs to forgo the American defense support that has been a pillar since 1945. This calls for an unprecedented ramp-up in production of equipment from missiles to artillery, drones and electronic warfare. The Bruegel think tank has estimated that Europe needs an additional EUR 250 billion a year just “to deter Russian aggression.”[1]

“Our new ETF offers an opportunity to invest in companies that can benefit from the growing momentum of the European defense sector,” said Michael Mohr, Global Head of Xtrackers Product, “applying a diversified approach that also includes providers of space technology and cybersecurity, which are essential for modern defense systems.”

Coverage scope

The STOXX Europe Total Market Defence Space and Cybersecurity Innovation index selects companies from specific ICB[2] sectors that have either high revenues from sectors associated with the targeted themes, or relevant patent exposure to related technologies as measured by EconSight[3]. This combination of selection metrics allows for the capture of companies across the spectrum and life cycle of the targeted theme.

Registered patents, which can be processed in a systematic manner, represent one of the best tools at hand to identify companies that have the potential to be leading commercial actors in their field in coming years. Specialized actors and innovators are pivotal in the advancement and evolution of the defense, space and cybersecurity sectors at a time when the European Union (EU) is directing investments towards the modernization of the region’s security capabilities.

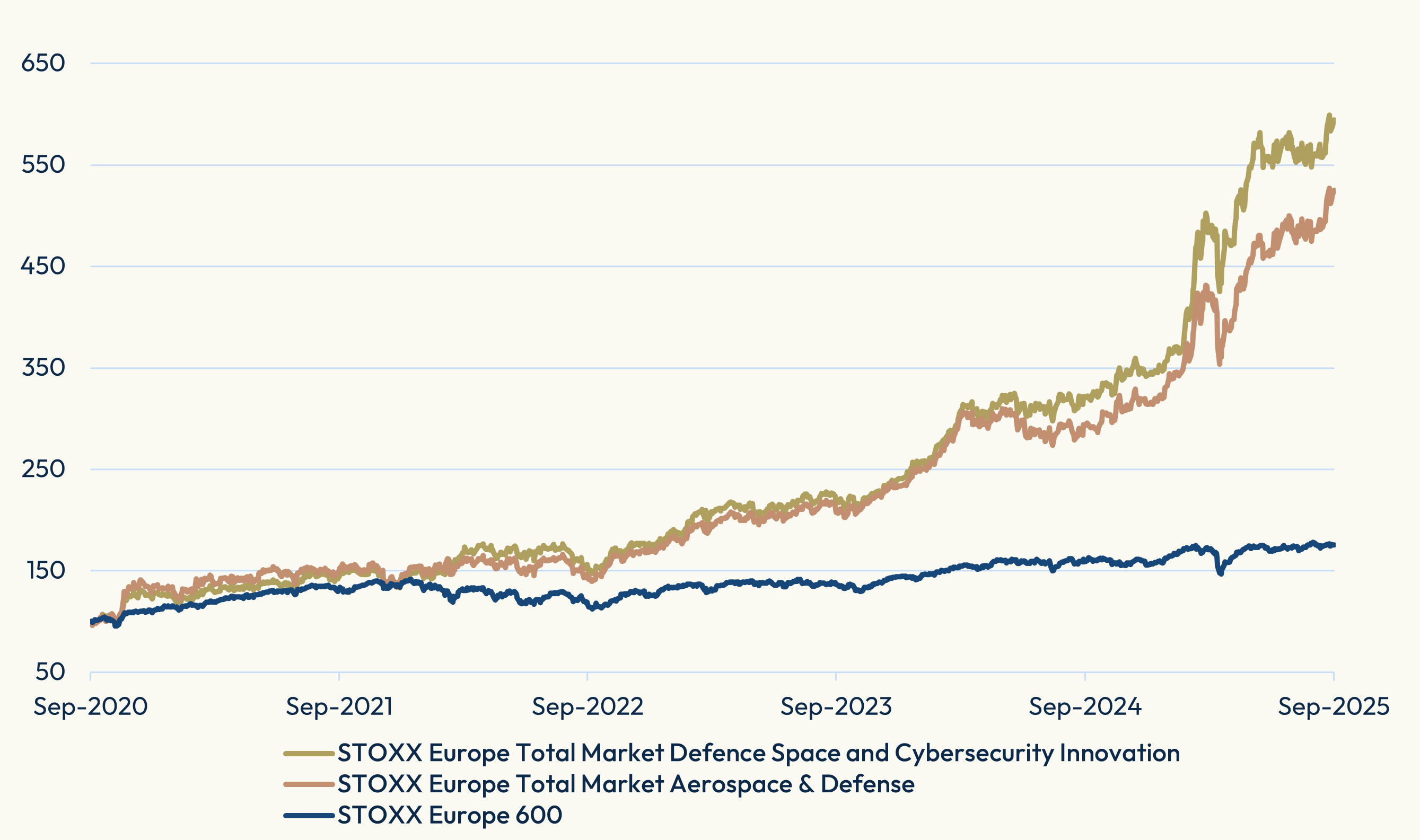

Performance

The STOXX Europe Total Market Defence Space and Cybersecurity Innovation index has gained 72% in 2025[4], adding to an average annual increase of 29% in the past four years. Those returns outperform both the STOXX® Europe Total Market Aerospace & Defense sector index and the benchmark STOXX® Europe 600 index.

Figure 1: 5-year index performance

Methodology

From the starting universe of the STOXX® Europe Total Market index, all securities are screened for ICB Industry[5] and minimum liquidity. Remaining companies are further filtered for both their revenue and patent exposure to the themes to determine the eligible pool of securities.

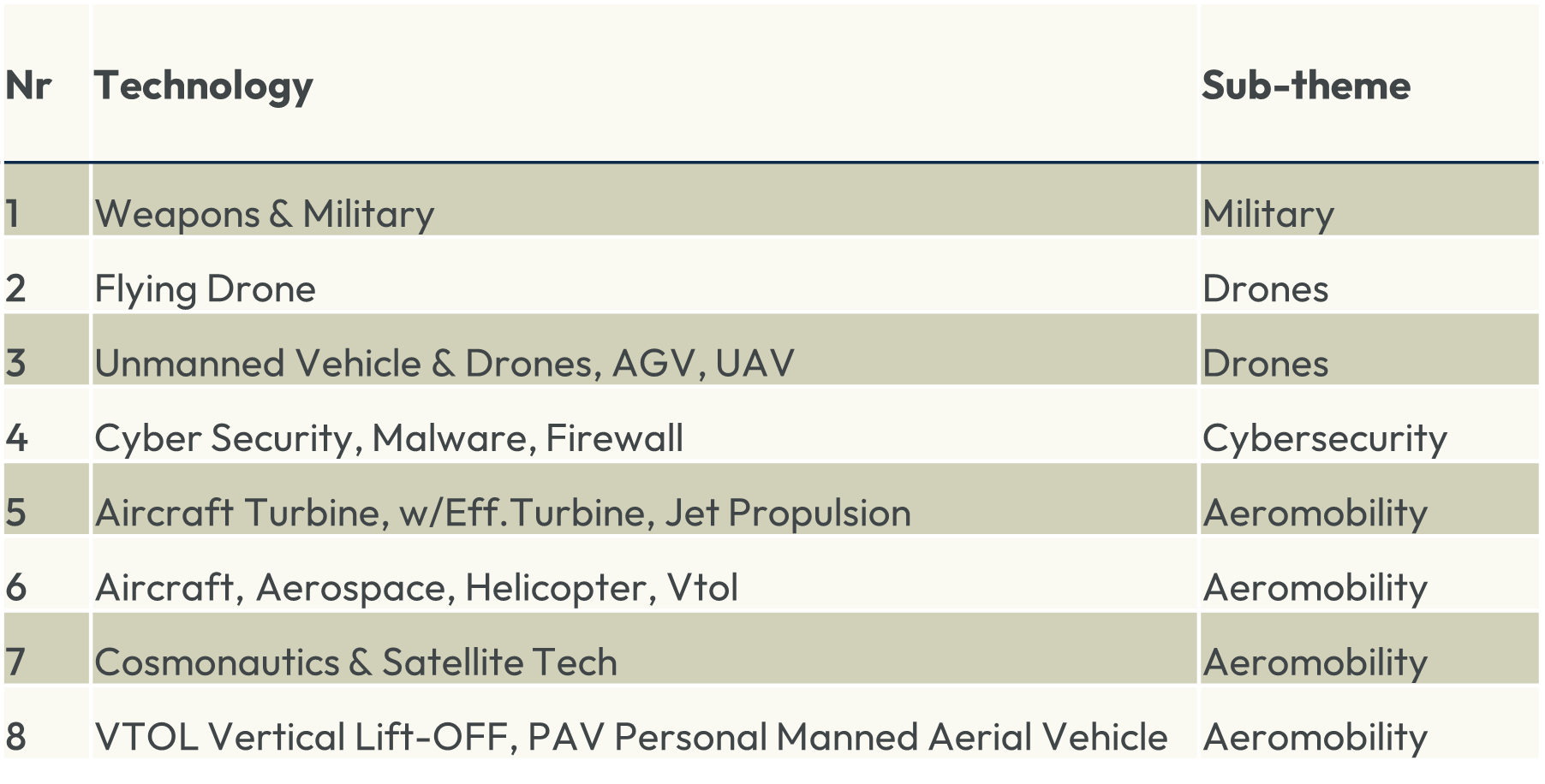

To be included in the index, a company must generate at least 25% of its revenue in aggregate from 41 FactSet Revere (RBICS) sectors associated with the themes. For the patent-based selection, companies in the top 10% ranked by high-quality patents in targeted technology sub-themes (Figure 2), or that have patent specialization of 10% or more within the respective sub-theme, can be selected.

All securities that pass either the revenue or patent selection criteria are eligible for the index.

Figure 2: Innovation selection – technologies targeted by index’s patent exposure

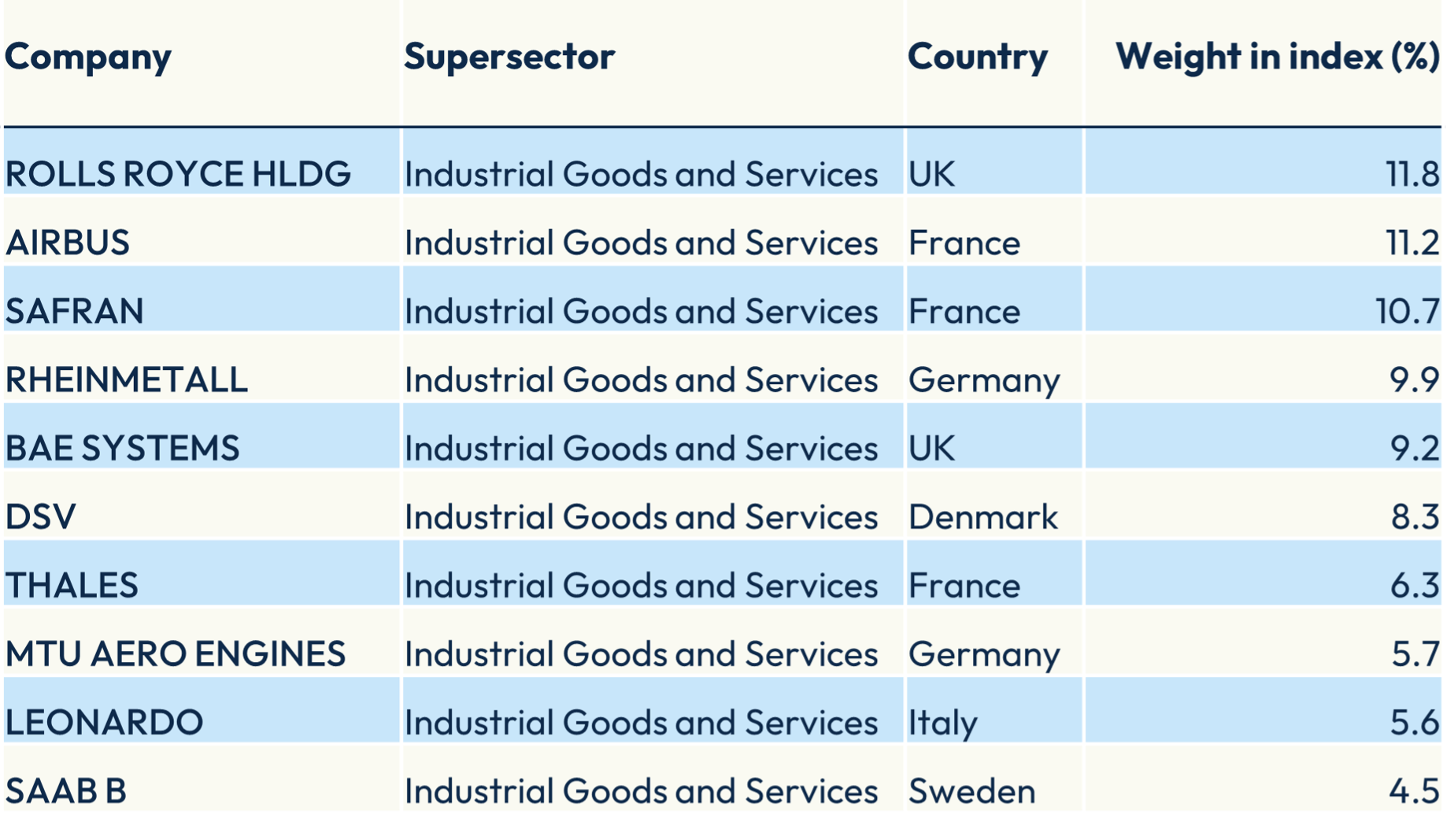

Figure 3 presents the index’s top 10 components.

Figure 3: Index top 10 components

Historic military upgrade

The European Commission in March called for “decisive action” as it presented a package to help EU nations spend over EUR 800 billion in defense and in military research from European providers. Germany, which in 2024 boosted its military expenditure by 28% to become the biggest armament spender in Western Europe for the first time since reunification in 1990, on March 21 approved a multi-billion plan to invest further in defense.[6] NATO countries have called to increase defense investment from 2% of gross domestic product to 3.5%.[7]

The new DWS Xtrackers ETF allows investors systematic and efficient exposure to those companies at the center of increased spending and efforts to strengthen Europe’s security.

[1] Bruegel, ‘Defending Europe without the US: first estimates of what is needed,’ February 21, 2025.

[2] Industry Classification Benchmark.

[3] EconSight is a technology-based analytics provider whose unique patent classification system and indicators help identify and source companies by their intellectual property.

[4] Net returns in EUR through Sept. 22, 2025.

[5] Companies whose ICB classification belongs to the Health Care, Financials, Real Estate, Consumer Discretionary and Consumer Staples Industries are excluded from the selection.

[6] SIPRI, ‘Unprecedented rise in global military expenditure as European and Middle East spending surges,’ April 28, 2025.

[7] Euractiv, ‘Rutte says NATO allies ready for big jump in defence spending commitments,’ May 15, 2025.