As interest in Europe’s defense stocks grows, the question of how best to capture exposure to the targeted theme while preserving its purity has become a topic of discussion.

Company revenues are a common and reliable metric in thematic stock selection processes, providing a factual and accurate indication of a business’s core focus. Many of STOXX Thematic indices rely on this indicator, including the STOXX® Europe Targeted Defence, which underlies since June an ETF from BlackRock’s iShares.

That index’s starting universe is the STOXX® Europe AC All Cap index. After excluding candidates for Global Norms and Controversial Weapons screens, the index uses ISS Sustainability’s Military Equipment and Services revenue data to identify those companies with a significant share of sales derived from military equipment (both combat and non-combat). This is a key filter as defense products can be sourced by companies in different industries (i.e., aerospace, technology or telecommunications).

Business stream coverage

The ISS revenue data covers products designed or modified on the basis of military specifications.[1] The screen does not cover dual-use equipment or products that were not designed or modified on the basis of military specifications.

The scope of covered military equipment is based on international arms export control standards. Corporate involvement is differentiated by equipment type, based on its lethality.

Combat equipment includes lethal items such as tanks, combat aircraft, missiles and combat ammunition. It also covers certain sub-systems and components directly tied to the lethality of weapons, such as fire control, arming, deployment and detonation systems.

Non-combat equipment, meanwhile, includes non-lethal systems and their specifically designed components, such as unarmed vehicles, naval surveillance vessels and training aircraft, as well as ammunition for non-combat purposes (e.g., training). Also included are protective and training equipment, encrypted communication systems and radars.

Composition process

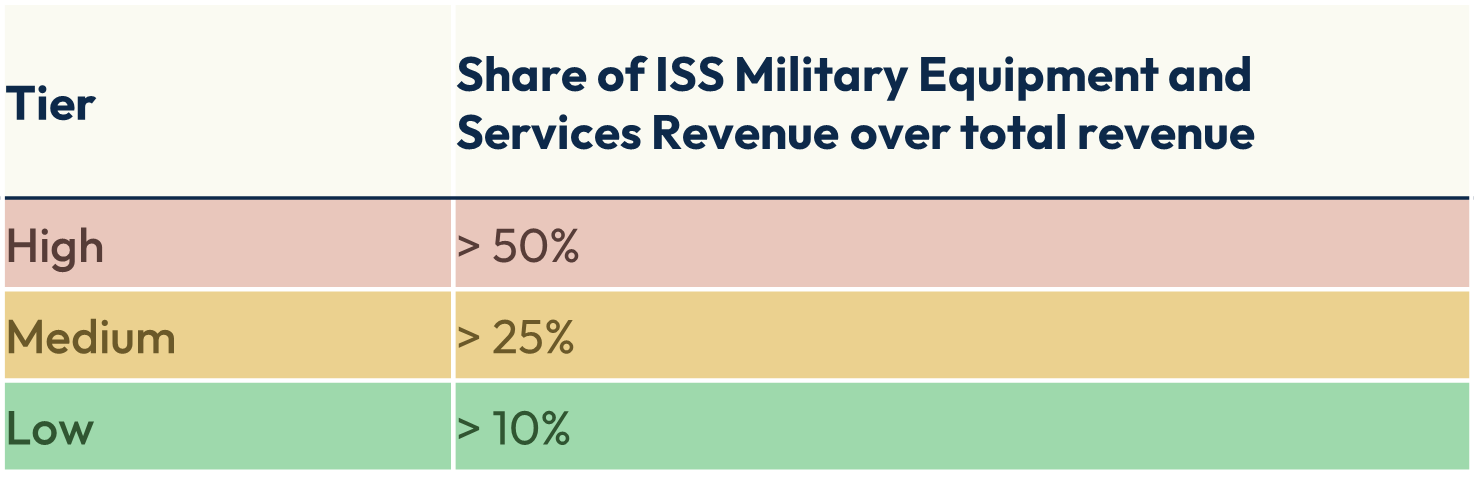

Following the exclusionary screens, remaining securities in the selection list for the STOXX Europe Targeted Defence index are sorted into three revenue tiers.

Figure 1: Military revenue tiers

Companies in the high, medium and low revenue tiers will comprise the index.

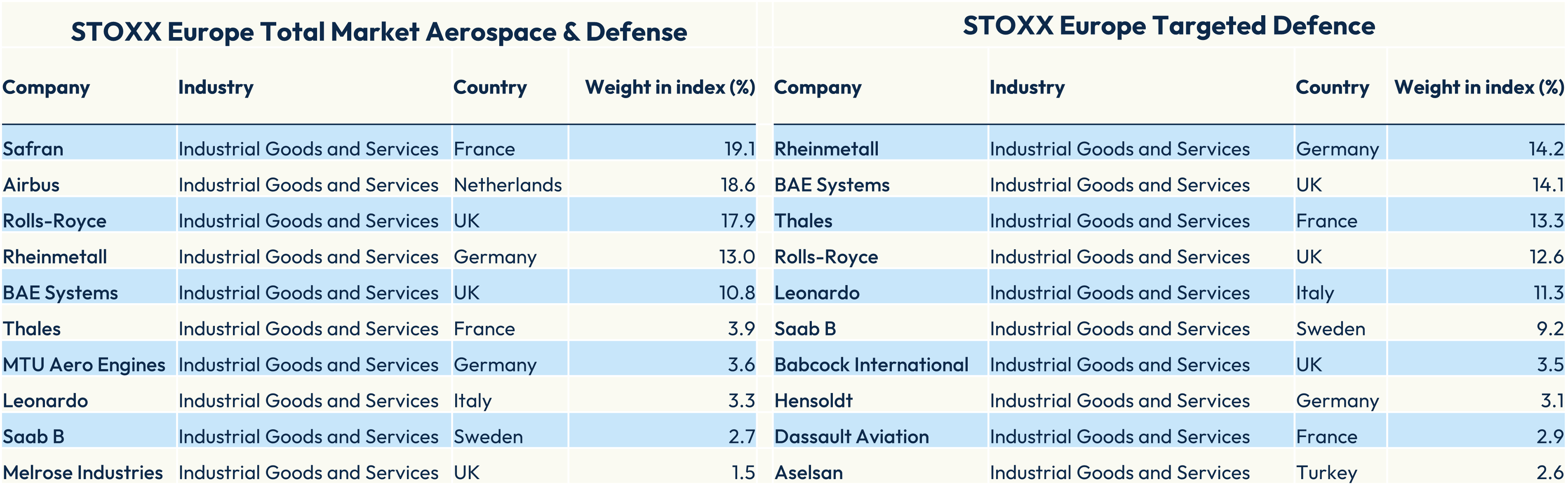

This selection method results in a markedly different portfolio for the STOXX® Europe Targeted Defence than for a sector benchmark such as the STOXX® Europe Total Market Aerospace & Defense, which is based on the Industry Classification Benchmark (ICB) (Figure 2).

Figure 2: Top 10 components

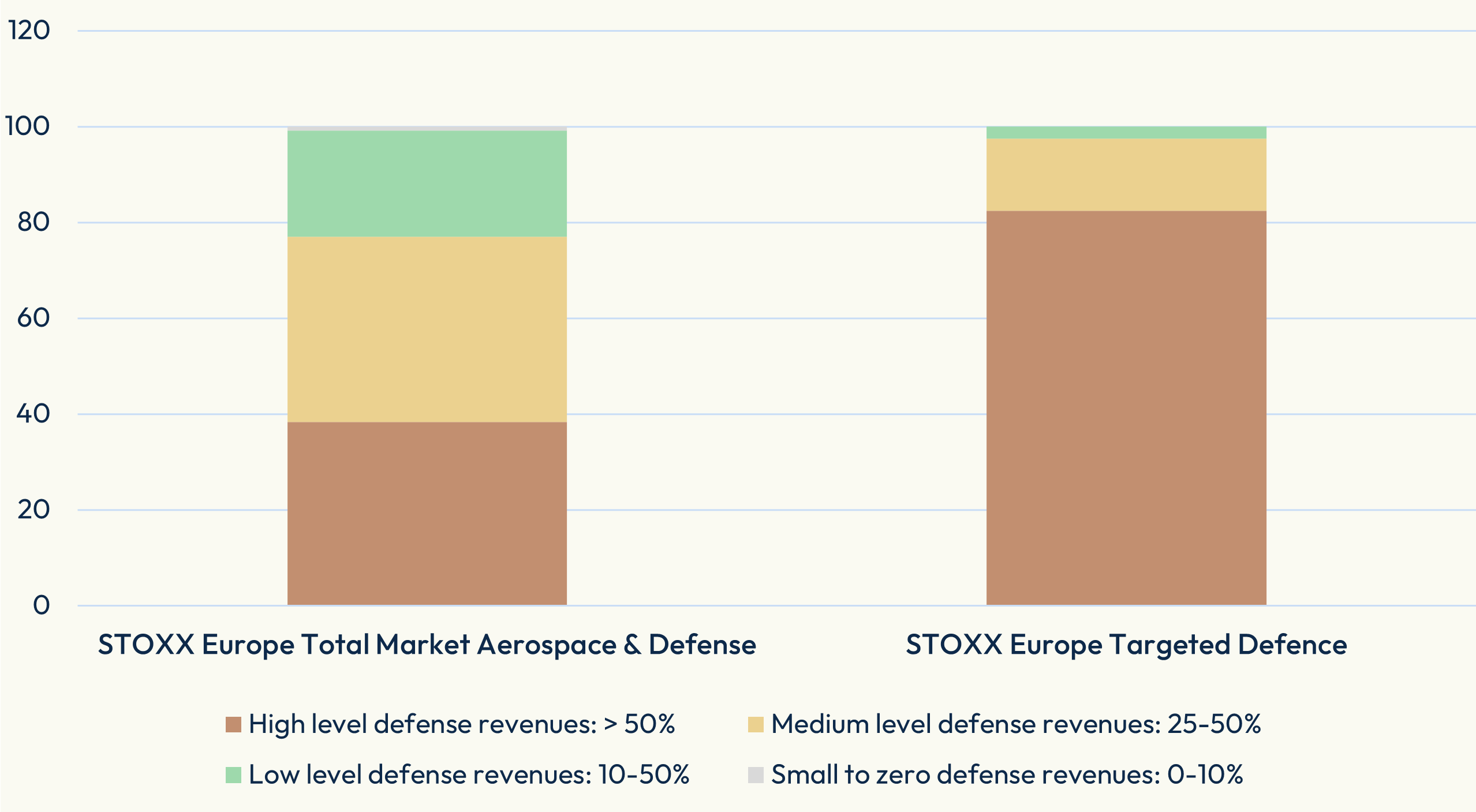

The difference in exposure to the defense theme is even more noticeable when analyzing both portfolios’ exposure to military revenues. Figure 3 shows that more than 80% of the STOXX Europe Targeted Defence is allocated to companies with a high share of military sales, as opposed to just under 40% for the sector benchmark.

Figure 3: Index exposure (weight %) to ISS ESG Military Equipment Revenues

Military revenue tier performance

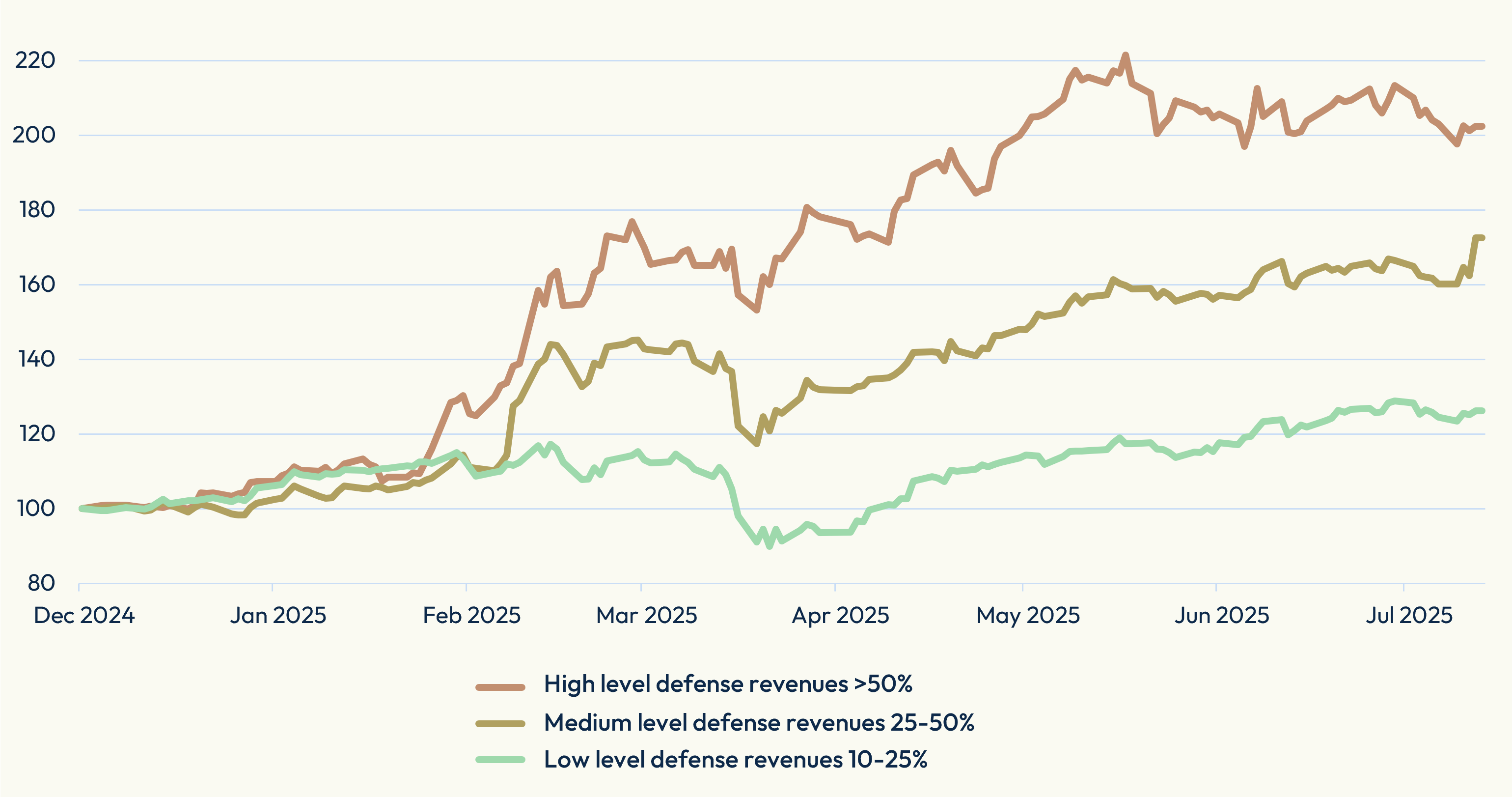

Market returns suggest investors have favored exposure to ‘pure’ defense companies. Figure 4 shows the performance of stocks in the index methodology’s three revenue tiers. Through Aug. 1, 2025, the high military revenues basket rose 102% this year, compared with 73% for the medium tier and 26% for the group of companies with low military revenues.

Figure 4: YTD Performance – based on defense revenues (High/Medium/Low)

“Military equipment revenues provide one of the most reliable signals for building a European defense portfolio, as illustrated by the performance of pure defense stocks,” said Serkan Batir, Global Head of Product Development and Benchmarks at STOXX. “Defining military equipment revenues is a process involving lots of screening and research. This includes dialogue with companies when key information is not disclosed.”

European collective defense and resilience

The STOXX Europe Targeted Defence’s starting universe is the STOXX® Europe AC (All Country) All Cap index, which covers Western and Eastern European countries, as well as Turkey — all important NATO members. This broad regional scope ensures that the STOXX Europe Targeted Defence universe reflects Europe’s geopolitical and security landscape, providing exposure to companies across the region that are critical to the continent’s collective defense and resilience.

Defense stocks have surged to the forefront of a market rally in Europe amid rising geopolitical tensions. The STOXX Europe Targeted Defence index offers investors focused and strategic exposure to those companies that are central to the modernization and strengthening of regional security.

[1] The screening covers production and distribution of military equipment as well as the provision of related services.