Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

New index launches

Most Recent New index launches

New product launches

Eurex, STOXX expand Equity and Basket Total Return Futures collaboration with new ETRFs on US stocks

Equity Total Return Futures (ETRFs) on 73 US stocks including NVIDIA and Apple were listed on February 23, expanding a successful offering in these types of exchange-traded derivatives. TRFs have seen strong demand from market participants as a way to efficiently gain exposure to price-plus-dividend returns of shares and indices.

The Deka STOXX Future Water ESG UCITS ETF was launched today and tracks the STOXX Future Water ESG index. The strategy allows investors to participate in opportunities linked to this scarce natural resource and the forward-looking investment theme it underpins.

The 25-year-old iShares STOXX Europe 50 UCITS ETF (DE) will be renamed to reflect its new index, which offers exposure to a smaller number of mega-caps in the broad European region.

Index | New product launches

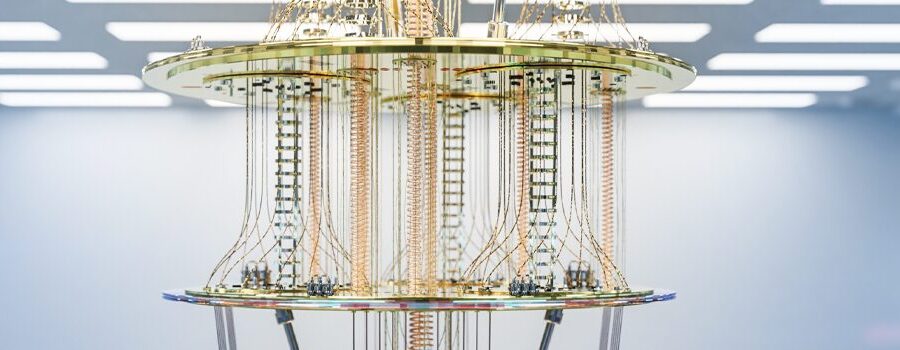

New iShares UCITS ETF tracking STOXX index targets quantum computing leaders

The underlying STOXX Global Quantum Computing index selects companies through a unique systematic process of scanning candidates’ patents, annual reports and corporate websites.

Index | Events, Conferences & Webinars

Decoding Europe’s equity comeback: Market drivers and index innovation

In a recent webinar, Lukas Ahnert, Senior Product Specialist at Xtrackers by DWS, and Arun Singhal, Head of Product Management and Client Success at STOXX, discussed the drivers behind Europe’s stock rally and the latest investment strategies designed in collaboration by both firms.

Index | New index launches

Xtrackers by DWS ETF switches to new STOXX Europe Total Market Leaders index

The asset manager has updated the objective of an existing ETF to track an index focused on European companies with significant share in their respective market segments, competitive business advantage and superior profitability.

Ladi Williams, Head of Thematics and Alternative Strategies at STOXX, explains in an article on ETF Stream how we have catered to the specific needs and objectives of ETF managers in devising a series of indices targeting the defense sector.

STOXX Ltd. today announced its collaboration with Intercontinental Exchange (NYSE: ICE), a leading global provider of technology and data, to support a suite of fixed income climate indices launched on June 2.

The new indices expand STOXX’s presence in the fixed income segment and strengthen its collaboration with ICE, which already provides pricing and reference data for calculation and reporting of STOXX’s eb.rexx bond indices.

The new benchmarks offer investors the chance to combine different size segments of the German equity market in one index strategy.

The STOXX Europe Total Market Defense Capped index tracks companies with revenues from specific defense activities. The launch comes at a time of heightened geopolitical tension and a historic reconsideration of the continent’s military capabilities.

Index | New index launches

New ISS STOXX net zero indices adopt innovative, forward-looking approach to carbon transition

The next-generation net zero indices focus on a real-world view of the global low-carbon transition, and offer investors the tools and advanced data to steer capital towards companies driving the decarbonization journey.