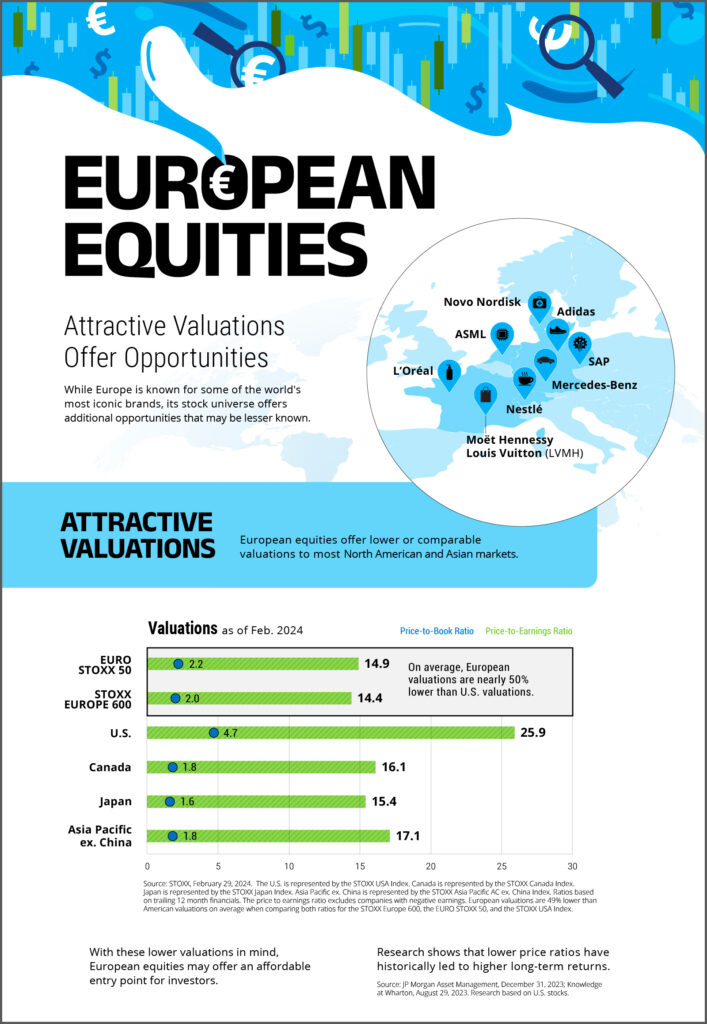

The EURO STOXX 50 tracks the Eurozone’s supersector leaders, resulting in a diversified and liquid portfolio. The index’s weighting is based on free-float market capitalization, with a maximum weight of 10 percent per constituent.

The blue-chip benchmark underlies more than 25 billion euros in ETF assets, while futures and options on the index are the most actively traded equity index derivatives on Eurex.1 More than 160,000 structured products are linked to the EURO STOXX 50.2

Loading…

Details

Symbol

SX5E

Calculation

Realtime

Dissemination Period

09:00-18:00 CET

ISIN

EU0009658145

Bloomberg

SX5E Index

Last Value

5,352.64

-28.44 (-0.53%)

As of CET

Week to Week Change

-1.31%

52 Week Change

5.30%

Year to Date Change

8.84%

Daily Low

5334.78

Daily High

5374.8

52 Week Low

4571.6 — 5 Aug 2024

52 Week High

5540.6899 — 3 Mar 2025

Top 10 Components

| ASML HLDG | NL |

| SAP | DE |

| SIEMENS | DE |

| LVMH MOET HENNESSY | FR |

| ALLIANZ | DE |

| TOTALENERGIES | FR |

| SCHNEIDER ELECTRIC | FR |

| SANOFI | FR |

| DEUTSCHE TELEKOM | DE |

| AIR LIQUIDE | FR |

Zoom

5334.92

Low

5374.03

High

Featured indices

EURO STOXX 50® ESG - EUR (Price Return)

€226.93

-1.48

1Y Return

7.68%

1Y Volatility

0.15%

EURO STOXX 50® Volatility (VSTOXX®) - EUR (Price Return)

€20.207

+0.6

1Y Return

51.04%

1Y Volatility

1.1%

STOXX® Europe 600 - EUR (Price Return)

€544.61

-1.7

1Y Return

6.23%

1Y Volatility

0.11%

DAX - EUR (Total Return)

€22,546.73

-132.01

1Y Return

21.92%

1Y Volatility

0.15%

STOXX® World AC All Cap - EUR (Price Return)

€6,319.73

+1.34

1Y Return

6.91%

1Y Volatility

0.12%

No Results Found

Try a different search term or browse all our indices

1 Data as of December 2023.

2 Source: Structured Retail Products.