Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

Index

Most Recent Index

In May, STOXX introduced a fully-fledged ESG-X Index family comprised of versions of established benchmarks that exclude companies based on standard environmental, social and governance (ESG) principles.

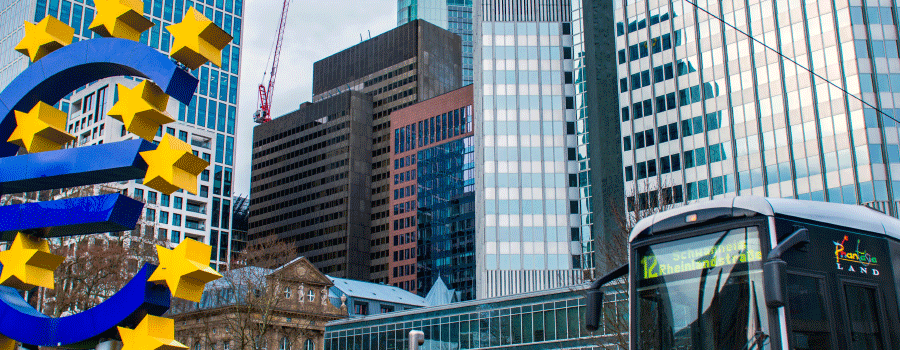

The prospect of further monetary stimulus has raised questions about the performance of Eurozone banks just as the sector has once again fallen to near record low levels.

With the acquisition of Axel Springer SE by Traviata II S.à.r.l., the free float falls to 5 per cent. According to the Guide to the DAX Equity Indices the shares of Axel Springer SE will be deleted from the MDAX index.

As more data on environmental, social and governance (ESG) factors becomes available and widely adopted, so does the debate grow about the efficiency and materiality of this information, and how best to use it while investing.

Index | Index / ETFs

STOXX Named Administrator Under EU Benchmarks Regulation STOXX Named Administrator Under EU Benchmarks Regulation

OXX Ltd. on Jul. 31 was recognized as index administrator under the European Union’s Benchmarks Regulation (BMR), a rules framework devised to ensure the accuracy and integrity of indices in the region.

STOXX has licensed the EURO iSTOXX® 50 Low Carbon NR Decrement 3.75% Index to Banca IMI to underly the first1 structured products distributed in Italy tracking a low-carbon strategy.

The countdown to Britain’s yet-unmanaged departure from the European Union is causing anxiety across the country – with the stock market appearing as one noticeable exception.

Due to the acquisition of Axel Springer SE (DE0005501357) by Traviata II S.à.r.l. the free float of Axel Springer changed by more than 10 percentage points.

STOXX Ltd., the operator of Deutsche Boerse Group’s index business and a global provider of innovative and tradable index concepts, has launched an ESG version of its flagship index EURO STOXX 50®.

UBS Asset Management has teamed-up with index provider STOXX and Sustainalytics to launch the world’s first environmental, social and governance (ESG) Euro Stoxx 50 ETF.

STOXX is introducing a second generation of environmental, social and governance (ESG) benchmarks with a version of the flagship EURO STOXX 50® Index.

Global stocks extended gains during July as investors anticipated an interest-rate cut in the US that came on the last day of the month and the European Central Bank indicated that it is ready to increase monetary stimulus.