Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

Index

Most Recent Index

Index | New product launches

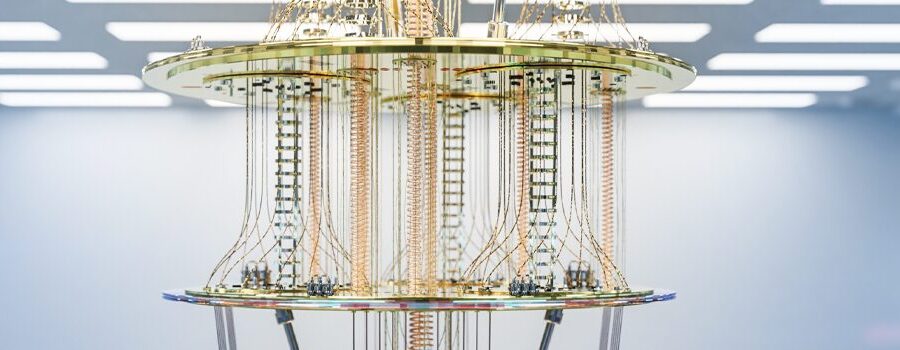

New iShares UCITS ETF tracking STOXX index targets quantum computing leaders

The underlying STOXX Global Quantum Computing index selects companies through a unique systematic process of scanning candidates’ patents, annual reports and corporate websites.

Changes are part of the December regular review of the DAX 50 ESG, DAX 50 ESG+, DAX 30 ESG, DAX ESG Target, DAX ESG Screened, MDAX ESG+, MDAX ESG Screened and DAX indices.

Index | Events, Conferences & Webinars

What’s next for VSTOXX? Eurex-hosted panel explores the next evolution in volatility indices

Tom Shuttlewood, Head of Strategy and Digital Asset Indices within Product Development at STOXX, spoke during the Eurex Focus Day on Volatility about possible avenues to expand the current offering of the STOXX volatility indices.

From the effect of compounding to volatility decay and little interest, there are frequent misconceptions about trading leveraged ETPs. Oktay Kavrak, Head of Communications & Strategy at Leverage Shares, addresses five of them to set the record straight.

Prices for the metal have climbed 24% this year amid ongoing structural demand and mining disruptions. The STOXX® Global Copper Miners index has performed more than twice as well — jumping 55% in 2025. We look at what’s inside the index.

Index | Portfolio Risk Management

When do returns come from? An analysis of the ‘overnight effect’ in equities trading

A trading analysis of the past 12 years shows a large portion of the daily returns in the EURO STOXX 50 index occurs between a session close and the immediate open the following day. But does it pay off to trade this nighttime boost? Hamish Seegopaul, Global Head of Index Product Innovation at STOXX, takes a look.

Germany’s DAX is outperforming pan-European indices and its ETFs are luring record flows in 2025. Veronika Kylburg, Head of Global Benchmarks DAX at STOXX, discusses with the ETF publication what some of the drivers are behind this performance and explores the benchmark’s methodology changes since 2018.

Index | Index spotlight

Gold, silver mining shares poised for biggest annual surge amid metals rally

The STOXX Global Junior Gold Miners and STOXX Global Silver Mining indices have each risen 126% in 2025 amid record prices for the underlying precious metals.

Index | Events, Conferences & Webinars

Decoding Europe’s equity comeback: Market drivers and index innovation

In a recent webinar, Lukas Ahnert, Senior Product Specialist at Xtrackers by DWS, and Arun Singhal, Head of Product Management and Client Success at STOXX, discussed the drivers behind Europe’s stock rally and the latest investment strategies designed in collaboration by both firms.

Index | New product launches

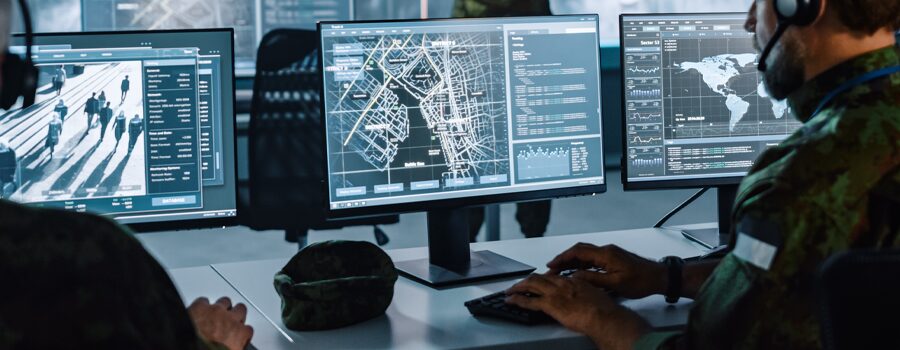

New ETF from Xtrackers by DWS tracks STOXX Europe Total Market Defence Space and Cybersecurity Innovation index

The underlying index combines revenues- and patent-based stock selection methodologies, capturing companies across the spectrum and life cycle of the targeted themes.

Index | New index launches

Xtrackers by DWS ETF switches to new STOXX Europe Total Market Leaders index

The asset manager has updated the objective of an existing ETF to track an index focused on European companies with significant share in their respective market segments, competitive business advantage and superior profitability.

Changes are part of the September regular review of the DAX 50 ESG, DAX 50 ESG+, DAX 30 ESG, DAX ESG Target, DAX ESG Screened, MDAX ESG+, MDAX ESG Screened and DAX indices.