Derivatives trading on EURO STOXX® Sector Indices has reached a record high at a time when shifts in macroeconomic conditions are set to influence the performance of the key banking industry.

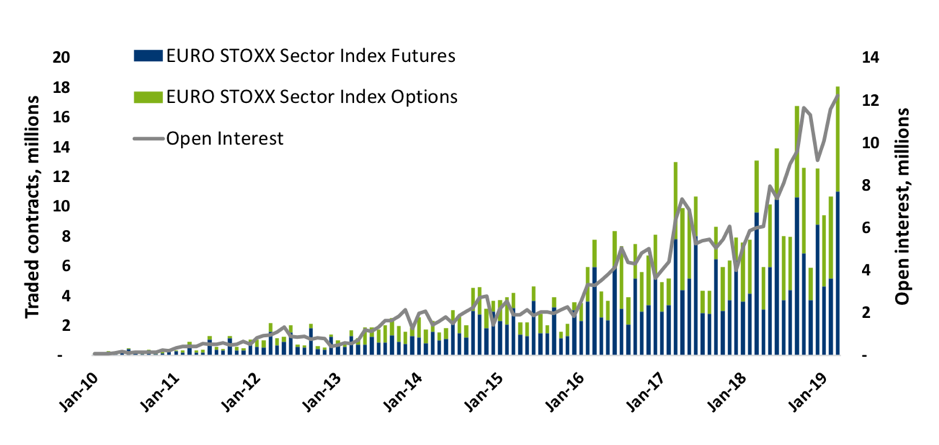

More than 18 million futures and options contracts on EURO STOXX Sector Indices exchanged hands on Eurex in March, the most ever, beating out the previous record from September 2018 by 8%. Open interest in the futures and options reached 12.2 million contracts last month, also the highest since the first listing of STOXX sector index derivatives took place in 2001.

Turnover is by far led by trading in EURO STOXX® Banks Index derivatives. More than 10.7 million futures and over 7 million options on the index traded last month, more than any other month in both instances. Open interest stood at 1.6 million futures and a record 10.4 million options contracts.

Chart 1 – Volume and open interest in EURO STOXX Sector Index futures and options

The role of banks

As Chart 1 shows, activity around EURO STOXX Sector Index derivatives has thrived in recent years.

Futures and options on sector indices have attracted interest as a simple way to target the specific idiosyncrasies of industries with important weight in the region. Banks, in particular, have exercised outsized leverage on the broader market. For many investors, the outlook for the region’s equity benchmarks has been tied not only to economic growth, but also to the health of financial earnings and lenders’ balance sheets.

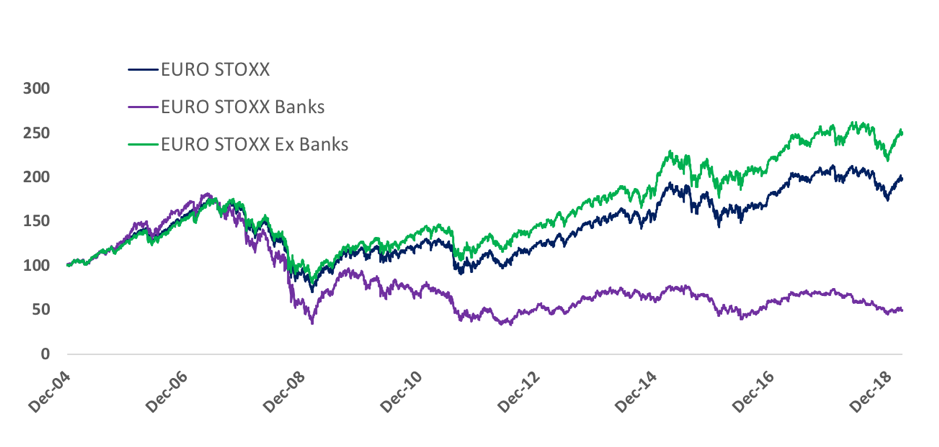

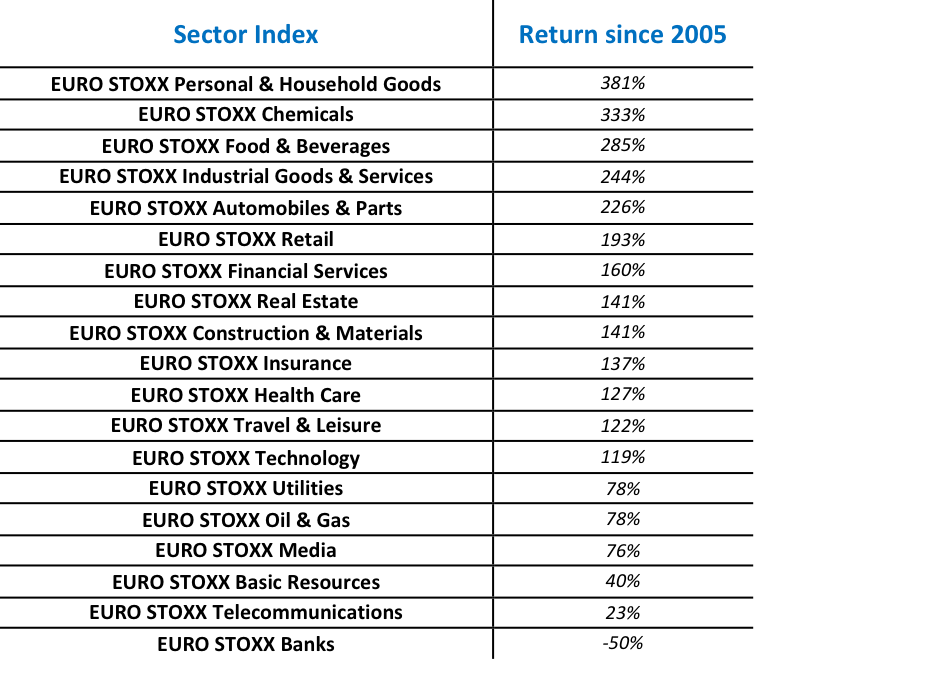

Chart 2 shows the EURO STOXX® Index, an all-size benchmark for the Eurozone, which has doubled in value since 2005.1 Next to it is the EURO STOXX Banks Index, which at a 50% retreat is the only supersector among 19 to have declined in the period (Table 1). The industry has been weighed down by concerns about bad loans and fears that low interest rates will stymie profit growth.

The EURO STOXX® Ex Banks Index, which includes all 19 Industry Classification benchmark (ICB) supersectors except banks, has advanced 151% in the period.

Chart 2 – Banks weigh on returns

Table 1 – EURO STOXX Sector Indices since 2015

Ten years ago last month, global indices reached their trough during the financial crisis. Since Mar. 9, 2009, the EURO STOXX has gained 184%. The EURO STOXX Banks Index, meanwhile, has climbed 45%.

New economic stimulus

The European Central Bank announced on Mar. 7 a new package of cheap loans for lenders, while President Mario Draghi said record-low interest rates are likely to stay unchanged for longer than originally indicated. While loose monetary policy stimulates the economy, low rates tend to hinder banks’ net interest income.

The yield on 10-year German bunds fell below zero on Mar. 22 for the first time since 2016. It was as high as 0.77% in February 2018. The EURO STOXX Banks Index fell 3.3% on Mar. 7, compared with a 0.6% retreat for the EURO STOXX Index. Between the ECB announcement and through Mar. 29, the EURO STOXX Banks Index dropped 3.8%, while the benchmark gained 0.7%.

Banks’ risk profile

Banks show the highest risk profile among the 19 EURO STOXX Sector Indices and are likely to remain key to the evolution of the Eurozone’s equity market. This position may continue to underpin demand for derivatives that track the industry.

The EURO STOXX Banks Index has a 5-year beta coefficient of 1.4 relative to the EURO STOXX Index, meaning it moves 1.4 times in the direction of the market. No other sector has posted such pronounced shifts: the average beta ratio among the remaining 18 EURO STOXX Sector Indices is 0.9.

The banks index also shows the sharpest price swings: its 5-year annualized volatility stands at 27.5%, compared with 16.9% for the benchmark and 18.9% as average for the other sectors.

Even though banks are the second-biggest supersector in the EURO STOXX Index, they have the second-highest tracking error in the past five years, only topped by basic resources. Industrial goods and services companies make up the biggest supersector in the benchmark by weight.

Pan-European sectors

Futures and options on all 19 EURO STOXX Sector Indices and 19 STOXX® Europe 600 Index supersectors are listed on Eurex.

Turnover in the latter, which cover the entire European geography, topped 2.1 million contracts last month and shows a significantly more diversified profile. While trading in EURO STOXX Sector Index futures is 98% made up by the banking sector, five supersectors account for more than two thirds of trading in STOXX Europe 600 Sector Index futures. These are the indices for banks, oil & gas, basic resources, telecommunications and automobiles & parts.

Trading in sector index derivatives is likely to continue growing in coming years as investors assess the benefits of the securities as a transparent, centrally-cleared and efficient way to hedge positions and gain rapid exposure to the peculiarities of Eurozone industries.

Featured indices

- EURO STOXX® Sector Indices

- EURO STOXX® Banks Index

- STOXX® Europe 600 Index

- STOXX® Europe 600 Sector Indices

1Net returns in euros through Mar. 29, 2019.