STOXX has introduced the STOXX® Europe Total Market Defense Capped index, which tracks armament producers at a time of heightened geopolitical tension and a historic upgrade of the continent’s military capabilities.

The new index selects European companies[1] from ICB’s Aerospace and Defense Sector that have revenues from specific defense activities, seeking a focused strategy on the military re-equipment theme. The launch also comes amid surging interest from investors in European equities.[2]

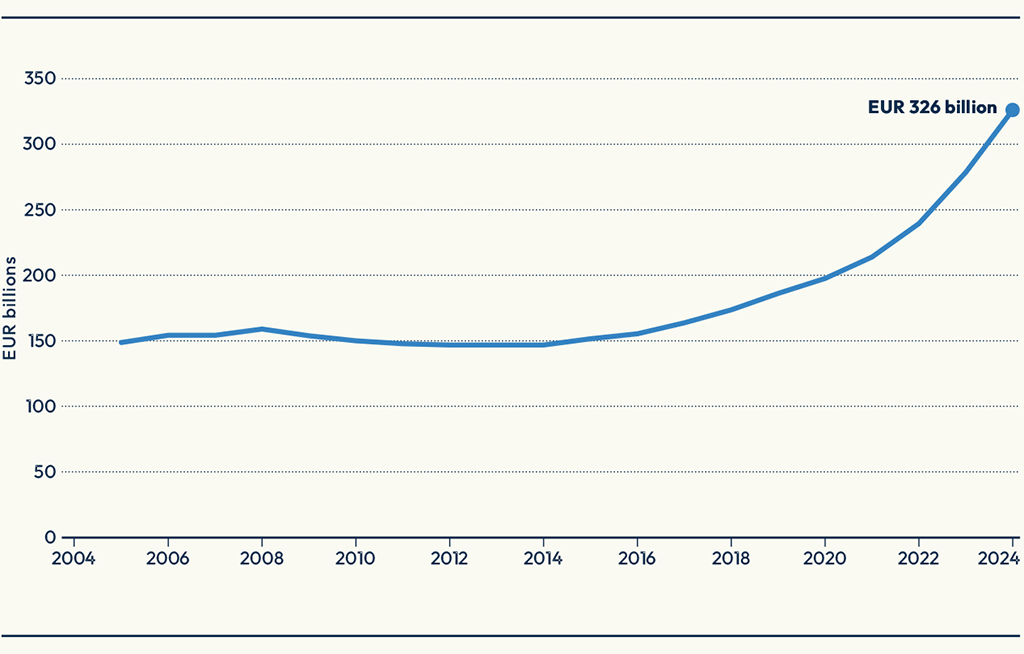

Shares in European military suppliers have rallied since Russia’s invasion of Ukraine in 2022, and gains have accelerated this year as US President Donald Trump said Europe needs to forgo the American defense support that has been a mainstay since 1945. This calls for an unprecedented ramp-up in production of equipment from missiles to artillery, drones and electronic warfare. The Bruegel think tank has estimated that Europe needs an additional EUR 250 billion a year just “to deter Russian aggression.”[3]

Germany on March 21 approved a multi-billion plan to invest in defense, breaking with decades of restrained armed forces.[4] Poland has asked NATO countries to increase defense spending from 2% to at least 3% of GDP.[5] The European Commission in March called for “decisive action” as it presented a package to help European Union nations spend over EUR 800 billion in defense and in military research from European providers.

Figure 1: Total defense expenditure by EU members

The index

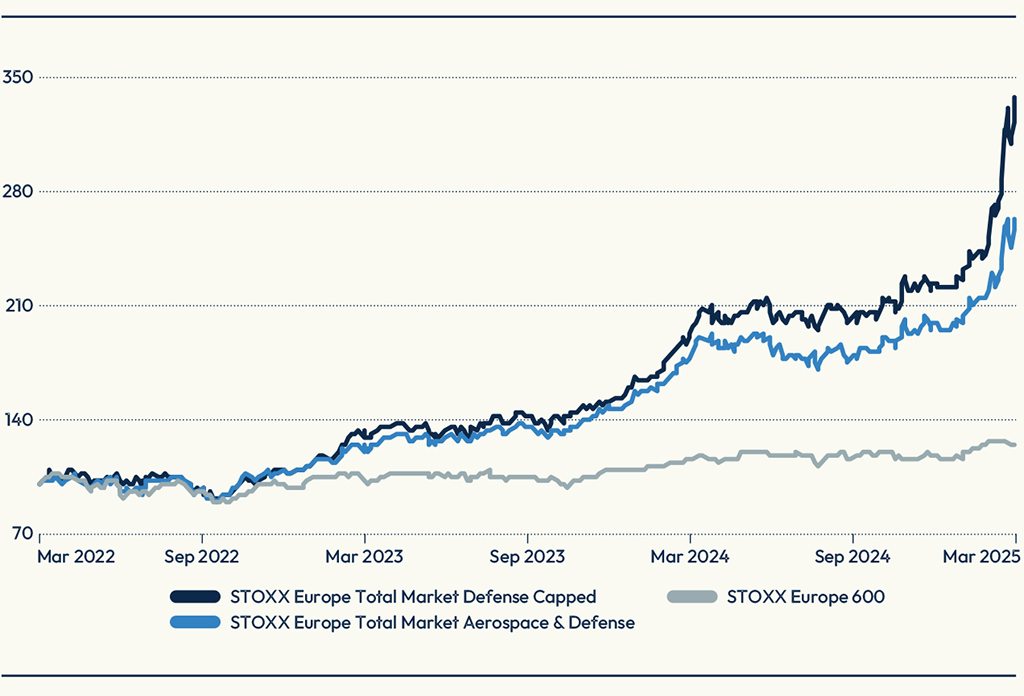

In backtested data, the STOXX Europe Total Market Defense Capped index has risen 239%[6] in the last three years, and 52% so far in 2025 (Figure 2). That compares with gains of 165% and 35%, respectively, for the STOXX® Europe Total Market Aerospace & Defense index, which also includes the segments of design, development, production and maintenance of commercial aircraft. The STOXX® Europe 600 benchmark, by comparison, has risen 25% and 8% over the respective periods.

Figure 2: Index performance

“In view of the unfortunate geopolitical situation, European governments are stepping up to the difficult challenge of keeping the region secure and conflict-free,” said Ladi Williams, Head of Thematics and Strategy Index Product Management at STOXX. “The STOXX Europe Total Market Defense Capped index offers a systematic strategy to track those companies that may benefit from a massive re-deployment of investments into defense. That means having a targeted approach towards defined defense business lines and not dilute that exposure with broader aerospace activities.”

Index selection process

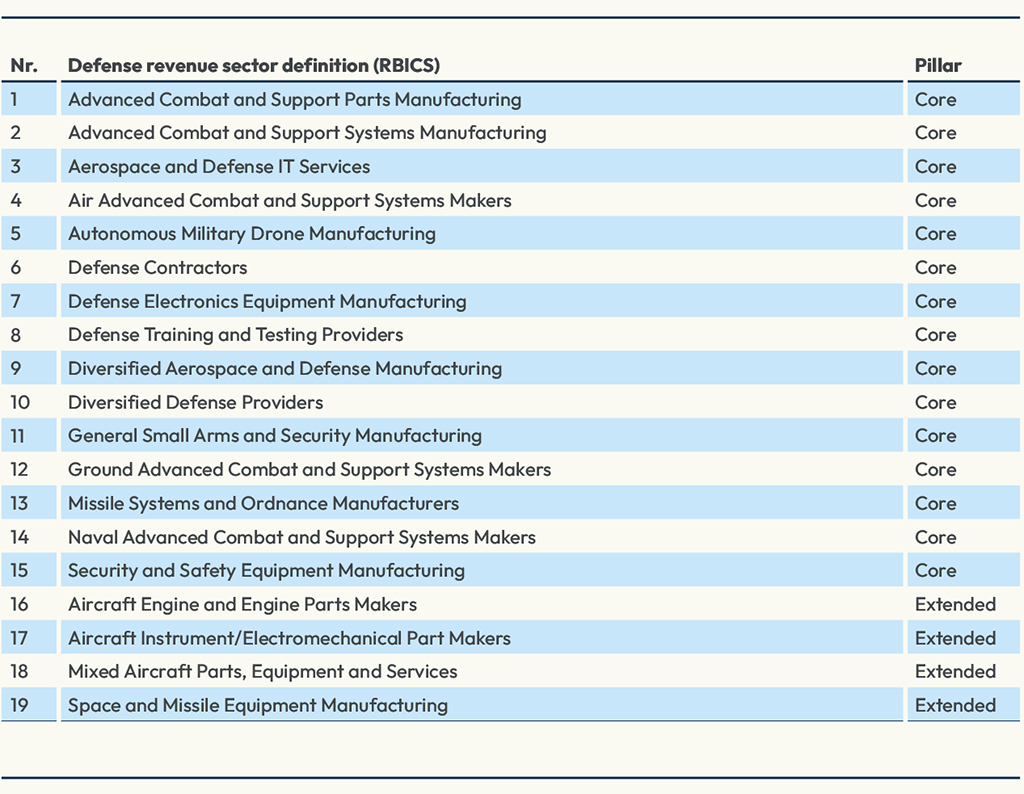

Eligible companies that are part of ICB’s Defense Subsector are included in the index. Stocks in ICB’s Aerospace Subsector are also considered provided they raise revenue from core and extended defense and military business lines as detailed below.

Figure 3: Business lines included in selection process

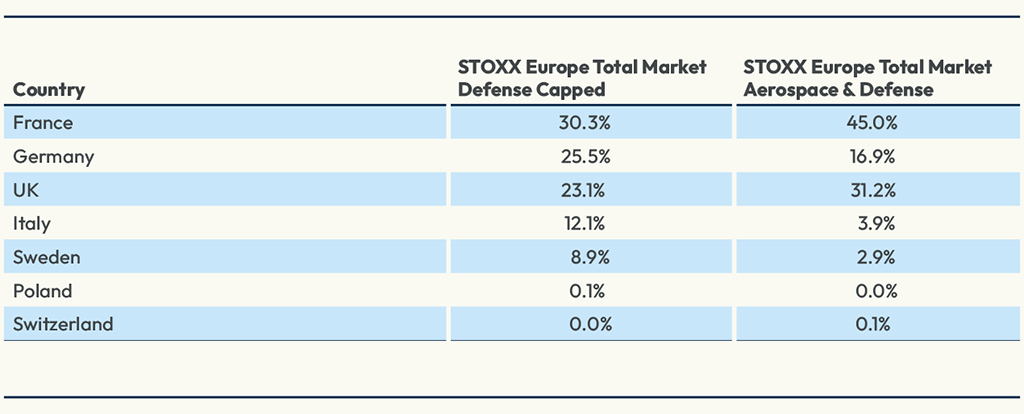

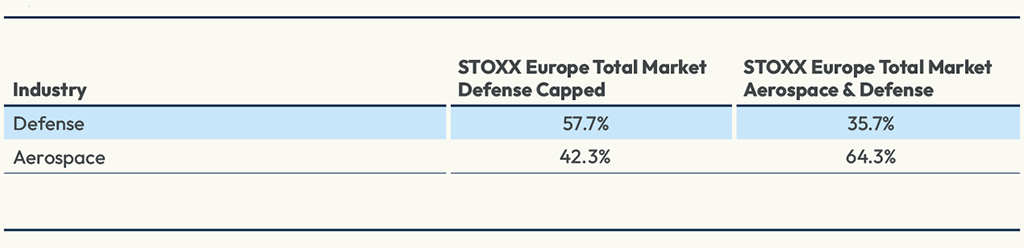

Figures 3 and 4 show that the selection methodology results in a more diversified portfolio in terms of country exposure than a sectorial Aerospace & Defense index, and a more tilted allocation towards defense industry companies.

Figure 4: Country exposure

Figure 5: Subsector allocation

Customization

The STOXX Europe Total Market Defense Capped index carves deeper than the six levels in FactSet’s RBICS taxonomy structure by analyzing the financial reports of companies that have revenue exposure to the extended sectors and selecting specific business lines that match the targeted theme. The index also applies a cap of 10% on single stocks’ exposure to avoid over-concentration in individual companies.

All in all, the strategy showcases the customization possibilities that are available in index construction, where different thematic and sector selection approaches can be utilized to meet investor demand. This is an area where STOXX’s offering continues to grow as we collaborate with clients on innovative solutions.

[1] The starting universe is the STOXX® Europe Total Market index.

[2] EUR 22 billion were invested in EMEA-focused ETFs in the first two months of 2025, according to STOXX data, nearly three-quarters of the entire net flows for all of 2024.

[3] Bruegel, ‘Defending Europe without the US: first estimates of what is needed,’ February 21, 2025.

[4] Euronews, ‘Germany’s upper house clears historic defence spending bill,’ March 21, 2025.

[5] Euronews, ‘Polish president asks NATO leaders to increase military spending,’ 12 March 2025.

[6] Price version through March 14, 2025.