STOXX has introduced the STOXX® Digital Asset Blue Chip index, which aims to track high-quality assets that represent the crypto universe today.

The launch, in partnership with Bitcoin Suisse, a leading Swiss crypto-financial services provider, marks STOXX’s entry into the digital assets space.

A blue-chip focus means the new index does not just select the largest crypto assets by market capitalization, as is customary with other indices, but instead considers crypto-native metrics including the scope of adoption, the size of the developer community, the fees paid by users and the age of the protocol.

More investment institutions are turning to digital assets for strategic objectives such as portfolio diversification, and as enhanced, institutional-grade infrastructure and clearer regulation make market fundamentals more attractive to a larger breed of investors. After a bout of market volatility in 2022, asset prices have recovered in 2023, and the crypto market is now valued at USD 1.45 trillion[1].

In a survey of over 250 investment institutions conducted by Ernst & Young, 60% of respondents indicated they allocate more than 1% of their portfolio to digital assets and/or related products.[2] Over two-thirds of respondents (69%) said they plan to increase the holdings in the next two to three years.

Just below half of professional investors polled in another survey this year, conducted by Trackinsight[3], said they would consider investing in single- and multi-cryptocurrency ETPs. A smaller 37% indicated they would be willing to invest directly in cryptocurrencies.

“As the current era of reliably negative equity/bond correlations is ending, investors will need to further diversify for efficient portfolio construction,” said Axel Lomholt, General Manager at STOXX. “That’s why we are moving into an investment segment that’s increasingly gaining a foothold in portfolios. With Bitcoin Suisse, we are doing so with a strong and established partner, and with an index methodology designed to meet the robustness needs of today’s investors.”

“With the launch of this unique blue-chip crypto index together with STOXX, we are taking the next step in the development of our digital assets offering,” added Dr. Dirk Klee, Chief Executive Officer at Bitcoin Suisse. “We are recognizing the need for institutional investors to move into crypto currency diversification in their portfolios and are proud to partner up with STOXX to drive innovation further in the crypto and traditional space.”

Best-in-sector selection methodology

The list of eligible digital assets for the STOXX Digital Asset Blue Chip index is derived from all assets classified under the Bitcoin Suisse Global Crypto Taxonomy (GCT). Basic screening criteria trims the universe, with assets in the following five sectors then available for selection: Cryptocurrencies, General Purpose Smart Contract Platforms, Decentralized Finance (DeFi), Utility and Culture.[4] Assets are selected in several steps that compare use-case peers within respective sectors. The steps are as follows:

- Determine assets’ ranking in their sector in each criterion: Age[5], Total Value Secured[6], Developer Community[7], Active Addresses[8] and Economic Activity[9].

- Assets which rank in the top half of their sector are assigned a score of 1 for the criterion in question. The rest are assigned a score of 0.

- The scores are aggregated to create a composite score per asset.

- Assets with a composite score of 4 or more are selected into the index.

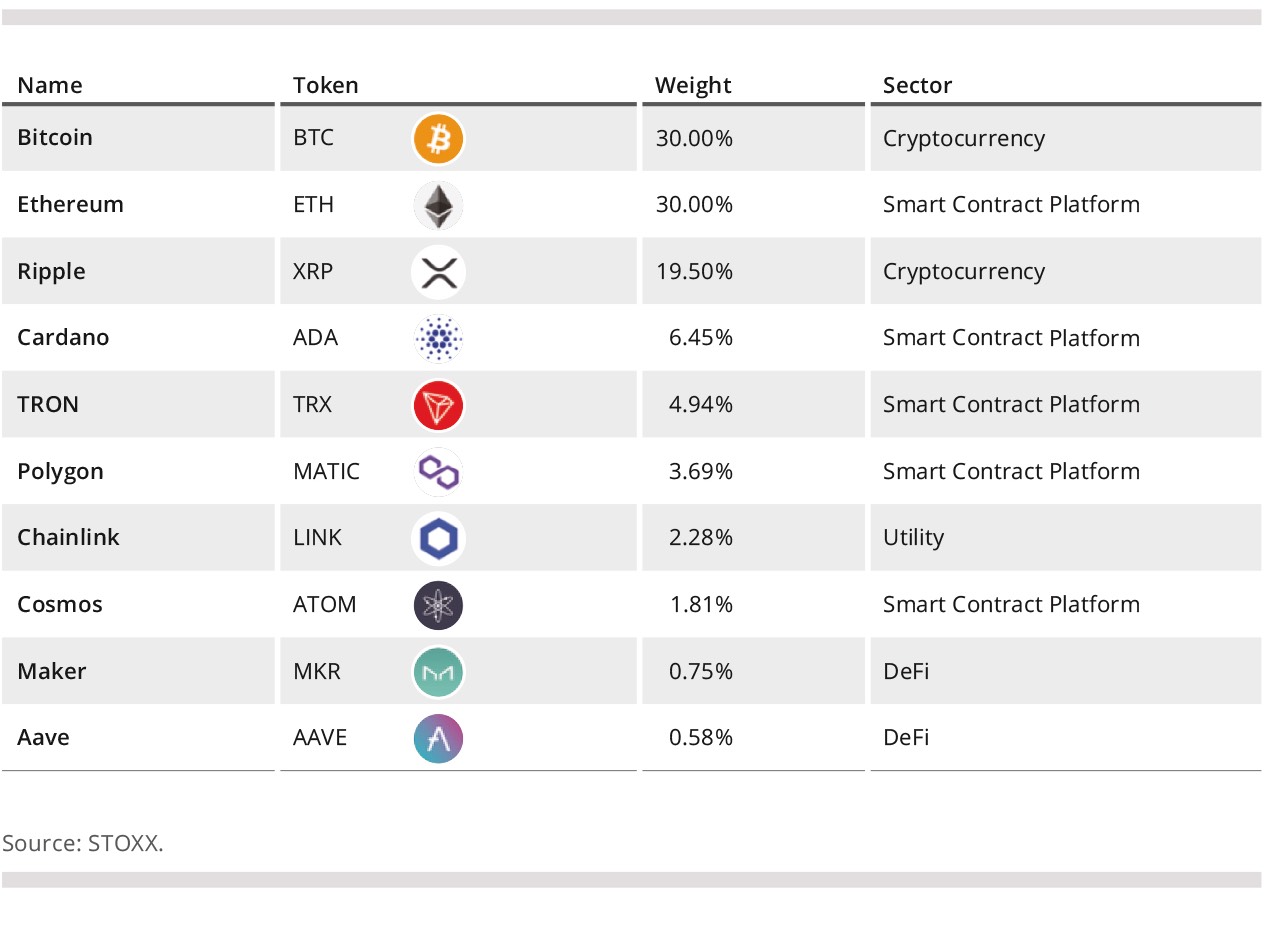

Components’ weightings are based on market capitalization with capping at 30%.

A second index, the STOXX® Digital Asset Blue Chip X, was launched in parallel. The index excludes assets not traded on Xetra®.

A robust pricing methodology

Bitcoin Suisse will provide reference and pricing data for the index. The company has deep capabilities in research, trading, staking, custody and investment management in digital assets.

The limited number of regulated exchanges has led to less reliable pricing for digital assets compared to other markets. To address this issue, Bitcoin Suisse implements thorough exchange vetting, which includes due diligence, exchange scoring, comparing trading volumes and time-decay analysis. These measures are employed to select two principal exchanges for each asset at any given time.[10]

Averaging the most recent traded asset prices across these two sources ensures the most reliable, up-to-date and representative price. This pricing mechanism, together with a fully rules-based methodology, makes the index transparent and representative of the underlying market.

Table 1: Index holdings

A benchmark for digital assets

The STOXX Digital Asset Blue Chip index is intended to be a barometer for large, well-established and high-quality digital assets, and become a benchmark for the space. The gauge serves as an important tool for investors and the broader market to understand, measure and participate in the evolving crypto landscape. An index contributes to the development of a more mature and transparent market, and this launch comes at a time when interest in digital assets is growing strongly.

[1] https://coinmarketcap.com/

[2] Ernst & Young, “Staying the course: institutional investor outlook on digital assets,” May 10, 2023.

[3] Trackinsight, “Global ETF Survey 2023.”

[4] The Cryptocurrency sector contains blockchains with the primary purpose of being a form of cryptographically secured digital money. The General Purpose Smart Contract Platform sector contains blockchains that offer functionality ‘beyond money’, usually in the form of decentralized applications consisting of smart contracts that utilize the native coin of the blockchain. The DeFi sector contains smart-contract-based protocols that may operate on their own or another blockchain and are powered by a native token. The Utility sector contains blockchains and protocols that enable access to, or represent, a resource. The resource does not have to be digital. The Culture sector contains blockchains or protocols that represent cultural works of art – as opposed to utility. A sixth sector in the taxonomy, Tokenized Assets, is currently not covered in the index methodology. This sector contains blockchains and protocols to manage tokenized versions of asset classes or instruments of traditional finance.

[5] The age of a crypto asset helps gauge the ongoing concern and commitment to the project and adoption by the market.

[6] The total value secured by a protocol is defined as the total economic value, expressed as the aggregate USD value of the entirety of all crypto assets, that are being secured by the underlying crypto-economic security mechanism.

[7] The size of the developer community on a protocol measures the activity.

[8] Active addresses is used to measure adoption.

[9] To measure the ongoing concern of a protocol, the fees collected by the project from its users is akin to the revenue of a traditional enterprise.

[10] Assets must have an active market on a minimum of two exchanges.