Stocks extended gains in March as countries pushed ahead with their COVID-19 vaccine rollouts, the US passed a new stimulus package and major central banks indicated they are likely to keep interest rates low even as the economy rebounds.

The STOXX® Global 1800 Index gained 3.3% when measured in dollars and including dividends.1 It added 6.7% in euros as the greenback strengthened 3.2% during the month against the common currency.

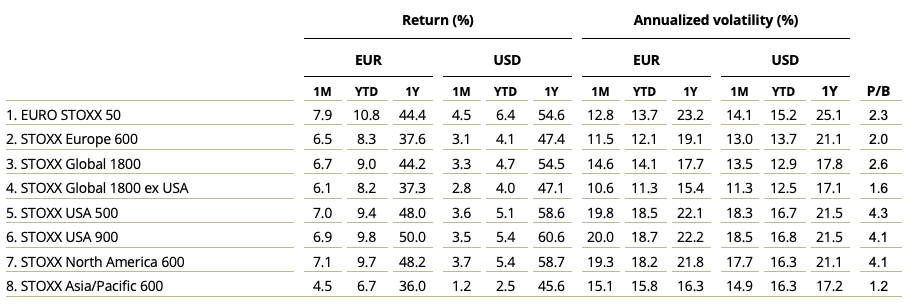

The Eurozone’s EURO STOXX 50® Index jumped 7.9% in euros and reached its highest level since January 2008 when excluding dividends. The pan-European STOXX® Europe 600 Index increased 6.5% and ended 1 percentage point shy of a record on a price basis. The STOXX® North America 600 Index climbed 3.7% in dollars and the STOXX® USA 500 Index rose 3.6%. The STOXX® Asia/Pacific 600 Index increased 1.2% in dollars.

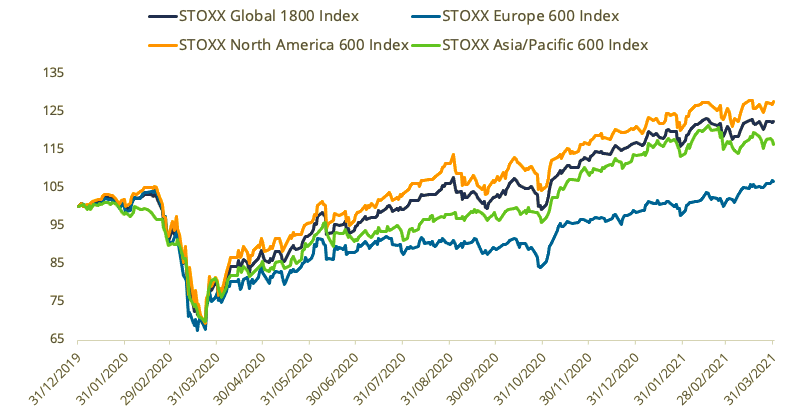

The STOXX Global 1800 rose 16.9% last year, its second straight year of double-digit percentage gains, as investors raised expectations that policy support and vaccines will help economies overcome the pandemic-induced slump.

Exhibit 1 – Returns since Jan. 1, 2020

Exhibit 2 – Benchmark indices’ March risk and return characteristics

For a complete review of all indices’ performance last month, view the March Index Newsletter report.

Volatility decreases

The EURO STOXX 50® Volatility (VSTOXX®) Index, which tracks EURO STOXX 50 options prices, fell to 18 from 26.9 in February. A higher reading suggests investors are paying up for puts that offer insurance against stock price drops.

Gains for most developed markets

All but four of 25 developed markets tracked by STOXX advanced during March when measured in dollars. The STOXX® Luxembourg Total Market Index led gains, rising 17.2%. The STOXX® Developed Markets 2400 Index climbed 3.2% in dollars and 6.6% in euro terms.

Fourteen of the 21 national developing markets tracked by STOXX also posted a gain for the month. The STOXX® Mexico Total Market Index was the best performer, adding 8.2%. The STOXX® Turkey Total Market Index paced losses, declining 13.7%. The Turkish lira slumped after the country’s central bank governor was removed. The STOXX® Emerging Markets 1500 Index rose 1.5% in dollars and 4.8% in euros.

Utilities supersector swings to gains

Nineteen of 20 Supersectors gained in the month, with the exception being the STOXX® Global 1800 Media Index (-3.4%). The STOXX® Global 1800 Utilities Index swung from worst in February to best in March after an 8.3% jump.

Value continues to rebound

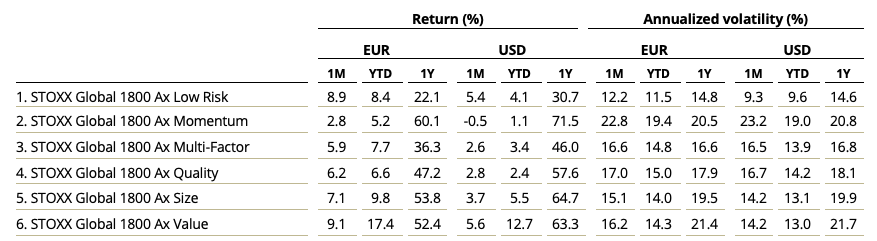

Investors continued their turn towards Value stocks, a style that was out of favor for a long time. The STOXX® Global 1800 Ax Value Index added 5.6%, taking its gain this year to 12.7%. The STOXX® Global 1800 ESG-X Ax Value Index, which applies the same factor approach but also excludes companies involved in controversial activities from a sustainability point of view, rose 4.9%.

Exhibit 3 – STOXX Factor (Global) indices’ March risk and return characteristics

On a regional basis, gains were led by the STOXX® Europe 600 Ax Value Index (+11.7%), STOXX® USA 900 Ax Value Index and STOXX® USA 900 Ax Quality Index (both +5%), and STOXX® Asia/Pacific 600 Ax Value Index (+5.5%).2

Factor Market Neutral Indices

With the exception of the Value factor, all iSTOXX® Europe Factor Market Neutral Indices had negative returns during March. The indices assume a short position in STOXX Europe 600 futures to help investors neutralize systematic risk. The iSTOXX® Europe Value Factor Market Neutral Index rose 1.1% on a net-return basis.

The iSTOXX® Europe Momentum Factor Market Neutral Index had the worst return in the suite, at -2.5%.

Sustainability indices

The STOXX® ESG-X indices showed varied performances during March when compared against their benchmarks. The indices are versions of traditional, market-capitalization-weighted benchmarks that observe standard responsible exclusions of leading asset owners. The STOXX® Global 1800 ESG-X Index added 3% in dollars, while the EURO STOXX 50® ESG-X Index jumped 8.2% in euros and the STOXX® Europe 600 ESG-X Index climbed 6.5%.

Within indices that combine exclusions and ESG integration, the EURO STOXX 50® ESG Index underperformed its benchmark by 22 basis points. The ESG index, which is derived from the iconic EURO STOXX 50 Index, beat its benchmark by more than 3 percentage points in 2020.

The DAX® 50 ESG Index, which excludes companies involved in controversial activities from a sustainability point of view and integrates ESG scoring into stock selection, rose 7.2%, compared with an 8.9% advance for the blue-chip DAX®.

Climate benchmarks

There were strong performances from STOXX’s Climate indices. All Climate Impact Ex Global Compact Controversial Weapons & Tobacco indices performed better than their benchmarks during March.

The indices include companies that are leading in terms of climate change as well as those that are managing the effect of climate-related issues. They additionally exclude companies in contravention of global norms, and those involved with coal, tobacco or controversial weapons.

The STOXX Paris-Aligned Benchmark Indices (PABs) and the STOXX Climate Transition Benchmark Indices (CTBs) outperformed during March. The indices were introduced last year and follow the requirements outlined by the European Commission’s Technical Expert Group (TEG) on climate benchmarks.

The EURO STOXX 50® Low Carbon Index, however, trailed its benchmark by 66 basis points.

Thematic indices

The STOXX® Thematic Indices were poor performers for a second month in a row, as investors rotate away from the best-performing stocks. The indices seek exposure to the economic upside of disruptive global megatrends and follow two approaches: revenue-based and artificial-intelligence-driven.

Only two of the 22 revenue-based thematic indices — the STOXX® Global Broad Infrastructure Index and STOXX® Global Housing Construction Index — outperformed the STOXX Global 1800 Index during March. The Global Broad Infrastructure Index is the index family’s worst performer in the past year.

New ESG-X Select Dividend family

Within the dividend strategies tracked by STOXX, the STOXX® Global Select 100 EUR Index had its best month since 2009 (+7.7%). The index, which blends increasing dividend yields with low volatility, was a strong underperformer last year.

The STOXX® Global Select Dividend 100 Index, which tracks companies with sizeable dividends but also applies a quality filter such as a history of stable payments, topped the benchmark STOXX Global 1800 by 30 basis points last month. The STOXX® Global ESG-X Select Dividend 100 Index, however, performed closer in line with the benchmark (+3.2%). The index belongs to the STOXX ESG-X Select Dividend family, which was introduced in February and targets the highest-yielding stocks within universes screened for responsible investment criteria.

Minimum variance

There was a mixed picture from minimum variance strategies last month. In Europe, the indices extended their underperformance to benchmarks: the STOXX® Europe 600 Minimum Variance Index added 5.9% in euros, while its unconstrained version increased 6.2%. The indices covering the US and global markets, on the other hand, performed strongly relative to their respective benchmarks.

The STOXX® Minimum Variance Indices come in two versions. A constrained version has similar exposure to its market-capitalization-weighted benchmark but with lower risk. The unconstrained version, on the other hand, has more freedom to fulfill its minimum variance mandate within the same universe of stocks.

1 All results are total returns before taxes unless specified.

2 The European index is in euros, while the others are in dollars.