Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

Blog posts

Latest blog posts

As part of the expanding STOXX thematic offering, we are excited to introduce a new index tracking four technologies transforming business globally.

PE’s latest Top 400 Asset Managers survey of the largest institutional money managers sheds light on the increasing popularity of index-based strategies: passively managed assets grew almost twice as fast as actively managed ones between 2013 and 2018.

Strong balance sheets, established businesses, higher return-on-equity and superior profitability.

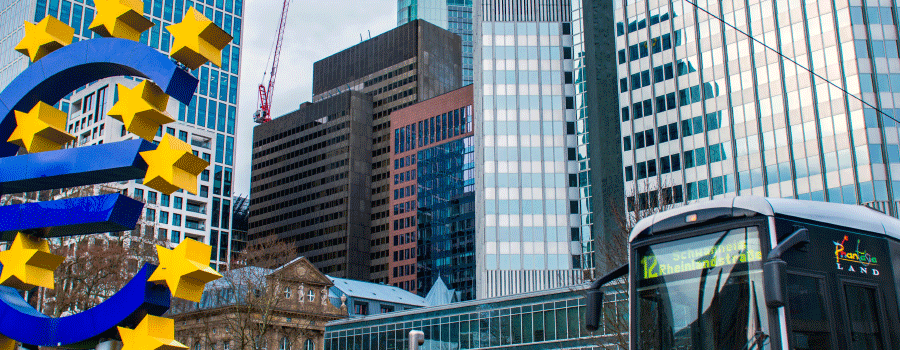

The European Central Bank (ECB) recently conducted a market consultation to assess three candidate euro overnight rates as alternatives to the current benchmark EONIA, the long-established risk-free rate (RFR) for pan-European lending.

Equity markets struggled in June, led by Europe and emerging economies, as US barriers on imports raised concerns that a trade war is unfolding.

It’s the uncontested benchmark for German stocks, but its 30th anniversary finds DAX covering a much wider scope.

The secured interbank lending market may play a role in the search for a reliable indicator of the cost of funding in Europe.

STOXX Ltd. has introduced the STOXX® Emerging Markets 800 LO Minimum Variance Index (STOXX EM 800 LO MinVar), expanding its suite of rules-based minimum variance strategies to the universe of developing nations.

Statistical analysis and probability theory have long focused on the problem of trying to detect turning points in financial markets.

Global stocks posted a gain in May, even as emerging markets were engulfed in volatility and political developments in Italy triggered losses in Europe in the second part of the month.

Use of exchange-traded funds (ETFs) among European institutional investors continues to grow, driven by both tactical and strategic functions and by the access to new markets, according to an annual survey from Greenwich Associates.

As of Sept. 24, Deutsche Boerse AG is changing the composition of the DAX indices for German small- and mid-sized companies and technology shares to better reflect the size and sector representation of those markets and bring rules in line with international standards.