Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

Blog posts

Latest blog posts

Equal-weight index strategies have gained in popularity and capital flows in recent years as a way for investors to diversify risk at the stock level.

CDP’s Europe report for 2018 provides an invaluable window into the state of climate-related risks and considerations among Europe’s largest companies, and signals that environmental issues have taken precedence within corporate boards.

Thematic investing continues to attract strong capital flows as investors target disruptive megatrends with above-average growth outlooks.

Eurex on Feb. 18 listed the first three futures on European benchmarks for responsible-investment criteria, climate impact and low-carbon focus.

The growth of responsible investing has been one of the most defining trends of recent years in the asset-management industry. Investing along responsible lines is now a major consideration, if not the standard position, for most large asset owners and money managers.

Eurex will on Feb. 18 list the first three futures on European benchmarks for responsible-investment criteria, climate impact and low-carbon focus.

On occasion of the listing of the first three futures on leading European benchmarks of responsible-investment criteria, climate impact and low-carbon focus.

STOXX has received two new awards for its products and work with the structured-products industry. Structured Retail Products (SRP) awarded STOXX the mention of ‘Best Index Provider’ at this year’s SRP Europe Conference.

A new and intriguing offshoot of the active vs passive debate is emerging. As factor index investing continues to expand the choices available to investors, is it still a truly passive strategy, or is it active?

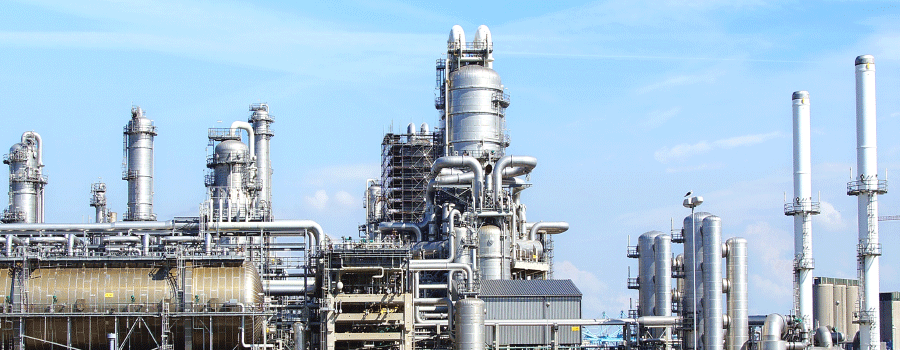

A new STOXX index tracks the Eurozone’s environmental pioneers with an equal-weight approach, combining the benefits of climate sustainability and a diversified portfolio.

December’s severe losses were followed by an equally sharp rebound in January of the new year, as investors returned to battered markets encouraged by positive macroeconomic news flow.

STOXX has launched the Eurozone’s first set of indices combining a factor strategy with responsible-investing screens that meet the standard sustainable policies of investors.