Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

Blog posts

Latest blog posts

The German blue-chip benchmark was introduced in July 1988. Its impressive 1,575% rally since then is a reflection of the global economy’s transformative growth and the corporate successes at home.

Index | Listed Derivatives

Video: Upcoming elections and market volatility. What is the VSTOXX index telling us?

Asset TV caught up with Hamish Seegopaul, Global Head of Index Product Innovation at STOXX; and Zubin Ramdarshan, Head of Equity & Index Product Design at Eurex, to understand just how VSTOXX and its derivatives work. They were joined by Yangyang Hou, Executive Director for Global Quantitative and Derivatives Strategy at JP Morgan, who explained how investors and traders are using VSTOXX futures and options in a market with plenty of sources of potential risk.

Index | ESG & Sustainability

ISS STOXX indices use comprehensive framework to help investors address biodiversity challenges

The fight to preserve our nature’s systems is intensifying, presenting both additional risks and opportunities for investors. The ISS STOXX Biodiversity indices offer a multi-step framework to address biodiversity challenges while employing state-of-the-art datasets.

Index | New index launches

New STOXX Optimal 100 indices offer optimized replication strategies on benchmark portfolios

The STOXX Optimal 100 indices mirror their parent indices with a smaller constituency. In controlling tracking error and active exposures through an optimization process, the new indices offer a tool for efficient hedging of benchmark portfolios.

Weekly expirations allow market participants to finetune hedging and accurately implement strategies around specific events such as economic data releases. The new options further expand a comprehensive derivatives ecosystem around the STOXX Europe 600.

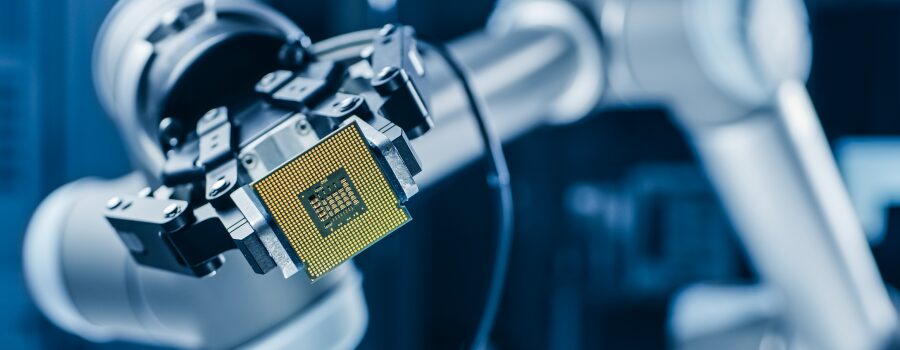

Nvidia’s formidable stock performance has lifted the company atop many indices. Thematic strategies can offer a more nuanced, and larger, exposure to the chipmaker’s shares.

As the index turns 25 on June 21, we take a look at what makes up the world of smaller-capitalization German stocks.

The DVP index tracks the gross cash dividends paid out in a year by constituents of the Eurozone’s sustainability benchmark. Dividend futures on the standard EURO STOXX 50 benchmark are a popular contract on Eurex both for hedging and directional strategies.

Buoyant markets and the ongoing shift to index investments put European ETFs on track for a tenth straight year of net inflows. Funds tracking the EURO STOXX 50 attracted USD 2bn in the first five months of 2024.

The STOXX Europe 600 turned 26 this month, a lifetime during which the index has become a trusted barometer for the region’s equities. Used widely for the benchmarking of funds, the index is also the center of a growing ecosystem of investment products.

Index | Listed Derivatives

Q&A on daily options at Eurex: expanding the trading opportunities around STOXX and DAX benchmarks

Daily expiration options on the EURO STOXX 50 and DAX indices have attracted significant flows since launch last year on Eurex as instruments to gain market exposure around specific, short-term macroeconomic and political events. We ask experts at Optiver, Eurex and STOXX what these types of options bring to the market.

Changes were announced as part of the June regular review of the DAX 50 ESG, DAX 50 ESG+, DAX 30 ESG, DAX ESG Target, DAX ESG Screened, MDAX ESG+, MDAX ESG Screened and DAX indices.