Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

Blog posts

Latest blog posts

Index | New product launches

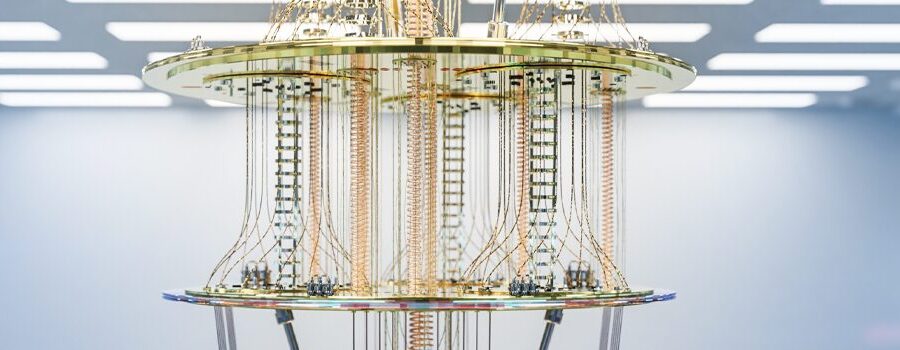

New iShares UCITS ETF tracking STOXX index targets quantum computing leaders

The underlying STOXX Global Quantum Computing index selects companies through a unique systematic process of scanning candidates’ patents, annual reports and corporate websites.

Changes are part of the December regular review of the DAX 50 ESG, DAX 50 ESG+, DAX 30 ESG, DAX ESG Target, DAX ESG Screened, MDAX ESG+, MDAX ESG Screened and DAX indices.

The new ETF is a first for the issuer and the only one in the market offering an equal-weight approach to the flagship Eurozone benchmark. Investors have this year been turning increasingly to equal-weight strategies to avoid single-stock concentration risks and rising valuations.

The recognition comes in a year marked by multi-year-high inflows into European equity ETFs and a series of innovative launches from STOXX.

The new ETF reflects a hypothetical portfolio invested in the German benchmark that simultaneously sells a DAX at-the-money call option, generating additional income at the cost of capping stock gains.

In this interview, Priya Panse, Lead Strategist for BlackRock’s US Factor ETFs business, Arun Singhal, Head of Product Management and Client Success at STOXX, and Brian Spinelli, CIO of Halbert Hargrove, discuss the main attributes and advantages of the multifactor ETF strategies.

Index | Events, Conferences & Webinars

What’s next for VSTOXX? Eurex-hosted panel explores the next evolution in volatility indices

Tom Shuttlewood, Head of Strategy and Digital Asset Indices within Product Development at STOXX, spoke during the Eurex Focus Day on Volatility about possible avenues to expand the current offering of the STOXX volatility indices.

From the effect of compounding to volatility decay and little interest, there are frequent misconceptions about trading leveraged ETPs. Oktay Kavrak, Head of Communications & Strategy at Leverage Shares, addresses five of them to set the record straight.

Prices for the metal have climbed 24% this year amid ongoing structural demand and mining disruptions. The STOXX® Global Copper Miners index has performed more than twice as well — jumping 55% in 2025. We look at what’s inside the index.

Index | Portfolio Risk Management

When do returns come from? An analysis of the ‘overnight effect’ in equities trading

A trading analysis of the past 12 years shows a large portion of the daily returns in the EURO STOXX 50 index occurs between a session close and the immediate open the following day. But does it pay off to trade this nighttime boost? Hamish Seegopaul, Global Head of Index Product Innovation at STOXX, takes a look.

Germany’s DAX is outperforming pan-European indices and its ETFs are luring record flows in 2025. Veronika Kylburg, Head of Global Benchmarks DAX at STOXX, discusses with the ETF publication what some of the drivers are behind this performance and explores the benchmark’s methodology changes since 2018.

Events, Conferences & Webinars

Europe defense, AI take center stage at Deutsche Börse’s ETF Forum event amid stocks rally

European defense and AI stocks were the focus of discussion during a breakout session at this year’s gathering in Frankfurt. ETF experts from Amundi and BlackRock weighed in on the drivers and outlook for two of the market’s strongest investment themes this year.