Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

Blog posts

Latest blog posts

Thematic strategies aim to offer differentiated and often superior returns to those of traditional broad-market benchmarks. As STOXX celebrates the 15th anniversary of its Thematic indices suite, we take a look at how the indices have performed in recent years.

This year, STOXX is celebrating the 15th anniversary of its Thematic indices suite, which has grown alongside investors’ continued push to tap into long-term megatrends shaping the modern world.

Assets under management in STOXX-linked ETFs grew 51% in 2025 to EUR 189 billion, following EUR 35.1 billion in net investments. The growth was largely driven by renewed interest in European equities, a segment where STOXX and DAX ETFs captured 44.6% of net new flows.

Devised in 2020, the European Union’s Climate Transition Benchmarks (CTBs) and Paris-aligned Benchmarks (PABs) were designed to support climate goals that have continued to evolve since then. In response, the indices’ methodologies have recently been updated to reflect shifting priorities and real-world developments.

Introduced in 1996, the MDAX tracks Germany’s listed mid-cap companies, widely regarded as the backbone of the national economy. The index has become a popular barometer for investors, both in terms of the breadth of investable products linked to it and the returns it has delivered over the past three decades.

Index | ESG & Sustainability

BlackRock’s Thurner on why iShares EURO STOXX 50 ESG ETF is attractive proposition for both retail and institutional investors

In its third year of existence, the iShares EURO STOXX 50 ESG ETF offers exposure to a core Eurozone benchmark minus controversial business activities. Sophie Thurner, ETF Product Strategist at BlackRock, explains how the ESG ETF fits in investors’ portfolios and how its underlying index has adapted to evolving regulation.

Index | Benchmarks

European bank stocks have record year, lifting sector STOXX ETF assets above EUR 13bn

The EURO STOXX® Banks and STOXX® Europe 600 Banks indices climbed 80.3% and 67% respectively in 2025, the best performance among 20 ICB Supersectors and best year since 1987. In spite of strong gains in recent years, the banking sector remains significantly below the levels reached just before the global financial crisis.

The Deka STOXX Future Water ESG UCITS ETF was launched today and tracks the STOXX Future Water ESG index. The strategy allows investors to participate in opportunities linked to this scarce natural resource and the forward-looking investment theme it underpins.

The 25-year-old iShares STOXX Europe 50 UCITS ETF (DE) will be renamed to reflect its new index, which offers exposure to a smaller number of mega-caps in the broad European region.

Index | Factor Investing

Q&A with BlackRock: fourth year of multifactor collaboration with STOXX amid evolving factor investing landscape

The iShares Core Multifactor ETF suite was introduced in June 2022. We spoke with Priya Panse, CFA, lead strategist for BlackRock’s US Factor ETFs, to discuss what defines a modern, risk-controlled multifactor strategy.

The launches follow on from the roll-out three years ago of ETFs tracking yen-hedged versions of the two European flagship benchmarks, and come amid rising interest in European equities.

Index | New product launches

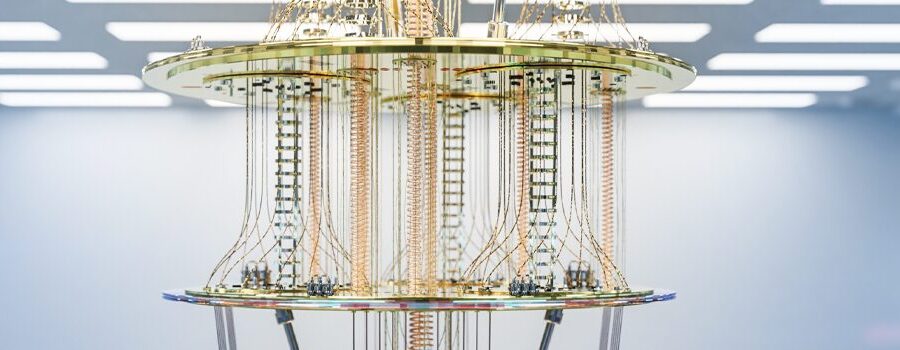

New iShares UCITS ETF tracking STOXX index targets quantum computing leaders

The underlying STOXX Global Quantum Computing index selects companies through a unique systematic process of scanning candidates’ patents, annual reports and corporate websites.