Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

News & Research

Most Recent News & Research

Index | Portfolio Risk Management

When do returns come from? An analysis of the ‘overnight effect’ in equities trading

A trading analysis of the past 12 years shows a large portion of the daily returns in the EURO STOXX 50 index occurs between a session close and the immediate open the following day. But does it pay off to trade this nighttime boost? Hamish Seegopaul, Global Head of Index Product Innovation at STOXX, takes a look.

Germany’s DAX is outperforming pan-European indices and its ETFs are luring record flows in 2025. Veronika Kylburg, Head of Global Benchmarks DAX at STOXX, discusses with the ETF publication what some of the drivers are behind this performance and explores the benchmark’s methodology changes since 2018.

This report, in partnership with ETF Stream, explores the macro and policy forces driving this momentum, the evolution of the DAX index family and how index innovation is helping investors express nuanced views across Germany’s growth story.

Events, Conferences & Webinars

Europe defense, AI take center stage at Deutsche Börse’s ETF Forum event amid stocks rally

European defense and AI stocks were the focus of discussion during a breakout session at this year’s gathering in Frankfurt. ETF experts from Amundi and BlackRock weighed in on the drivers and outlook for two of the market’s strongest investment themes this year.

STOXX Ltd. today announced an unscheduled adjustment to the MDAX. Following the spin-off of TKMS AG & Co. KGaA from thyssenkrupp AG, an adjustment of the index is required.

Index | Index spotlight

Gold, silver mining shares poised for biggest annual surge amid metals rally

The STOXX Global Junior Gold Miners and STOXX Global Silver Mining indices have each risen 126% in 2025 amid record prices for the underlying precious metals.

STOXX Ltd. today announced the following unscheduled change to the SDAX index. Ceconomy St will leave the SDAX due to a breach of basic criteria as defined in chapter 5.4.2 of the DAX Equity Index Methodology Guide.

Index | Events, Conferences & Webinars

Decoding Europe’s equity comeback: Market drivers and index innovation

In a recent webinar, Lukas Ahnert, Senior Product Specialist at Xtrackers by DWS, and Arun Singhal, Head of Product Management and Client Success at STOXX, discussed the drivers behind Europe’s stock rally and the latest investment strategies designed in collaboration by both firms.

Stocks rose for the sixth consecutive month in September, the longest positive run in four years, on investor expectations that falling US interest rates and sustained economic growth will help corporate earnings.

Whitepapers

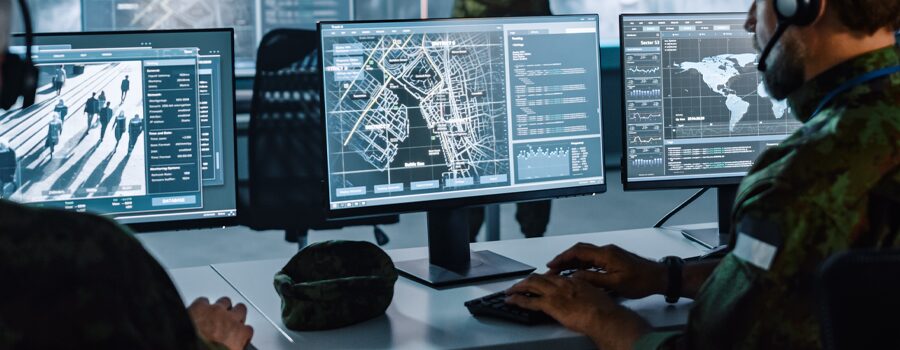

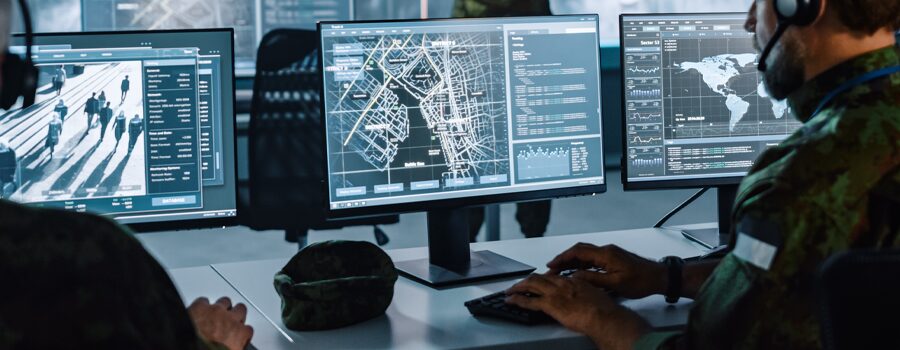

The arms portfolio: Reviewing the thematic and sustainability profiles of European defense stocks

In this Perspectives report, we weigh the military sales exposures of a European defense portfolio, and examine its alignment with current sustainability regulations.

STOXX Ltd., part of the ISS STOXX group of companies, today announced its expanding collaboration with DWS, with DWS’ launch of its Xtrackers Europe Defence Technologies UCITS ETF tracking the STOXX® Europe Total Market Defence Space and Cybersecurity Innovation index, as the continent undertakes a historic upgrade of its military capabilities.

Index | New product launches

New ETF from Xtrackers by DWS tracks STOXX Europe Total Market Defence Space and Cybersecurity Innovation index

The underlying index combines revenues- and patent-based stock selection methodologies, capturing companies across the spectrum and life cycle of the targeted themes.