Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

News & Research

Most Recent News & Research

New ESMA rules establish which funds can carry terms such as ‘ESG’ or ‘SRI’ in their names. While the guidelines are designed for funds, they are likely to impact the names and methodologies of underlying indices too.

Index | Portfolio Risk Management

August market turmoil highlights benefit of dynamic volatility allocation

The EURO STOXX 50 Volatility-Balanced index, which combines an investment in stocks with a dynamic allocation to volatility futures, jumped 8% on August 5 amid a broad equities sell-off. The volatility strategy has returned an average of 3.2 percentage points a year above its benchmark since 2006 as tail-risk protection paid off.

A well-researched multifactor strategy can help investors avoid the inherent pitfalls of style-premia harvesting and cyclical headwinds, while increasing opportunities for incremental returns. We analyze the performance of the STOXX Equity Factor indices that have underlied iShares ETFs since June 2022.

The global benchmark rose 1.7% in July, with all the advance coming in the month’s first half. Weaker output and inflation data in the US boosted forecasts that the Fed may start easing monetary policy as early as September.

Stocks rose in July amid expectations that the Federal Reserve is getting close to its first interest-rate cut since 2020. The STOXX World AC index rose 1.7% last month when measured in US dollars and including dividends, taking its 2024 gain to 13.4%. The STOXX Global 1800 index added 1.9% in the month.

Driven by strong domestic growth, the STOXX India All Cap has extended its bullish run this year, climbing 84% since the start of 2021. By comparison, the STOXX Emerging Markets All Cap index has fallen 2.1% over the same period.

Index | Listed Derivatives

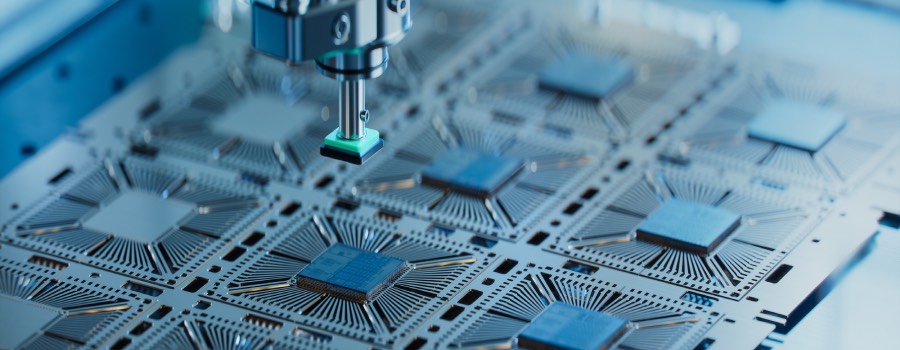

Q&A: New Eurex futures on STOXX Semiconductor 30 index as investment vehicle into dynamic sector

Eurex’s Mezhgan Qabool explains how demand to invest in chipmakers drove the launch of the STOXX Semiconductor 30 index futures in March, and what the new product offers for portfolios.

A portfolio’s decarbonization becomes more difficult once an emissions reduction of 60% is achieved, as high-emissions sectors become depleted. Thereafter, the portfolio construction approach — whether exclusion or optimization — will make a difference to the resulting tracking error and size of the portfolio.

STOXX Ltd. has announced an unscheduled component change in the SDAX index. SYNLAB AG will leave the SDAX because it does not meet the requirement “existing listing on the Regulated Market of the Frankfurt Stock Exchange (FSE)” any more (rulebook, section 5.4.2 Breaches of basic criteria).

Eight STOXX Thematic indices underlying ETFs in Europe had their annual rebalancing in June, with six of them seeing updates to the business sectors associated with the targeted theme. The ‘purity’ ratio, or theme-related revenue, remains above 80%.

The global benchmark rose 2.3% last month for a 2024 advance of 11.6%. It was the index’s seventh monthly advance in eight months as investors expect US interest rates to start dropping this year, aiding the global economy.

US stocks rose in June as investors weighed the prospects for interest-rate cuts amid slowing inflation. European shares fell as results from the European Parliamentary elections increased political risk.