Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

News & Research

Most Recent News & Research

Weekly expirations allow market participants to finetune hedging and accurately implement strategies around specific events such as economic data releases. The new options further expand a comprehensive derivatives ecosystem around the STOXX Europe 600.

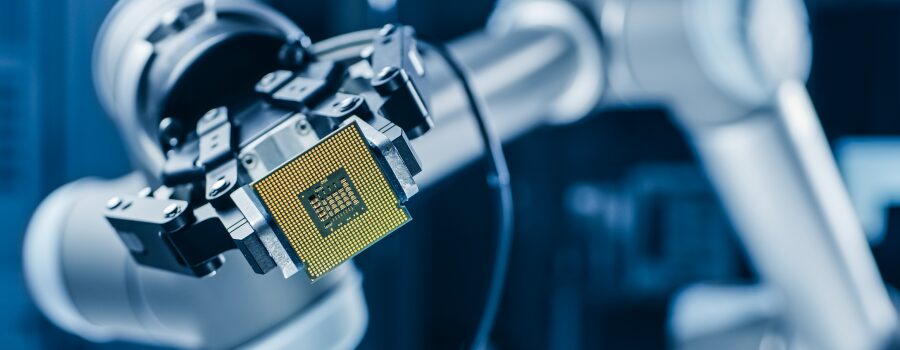

Nvidia’s formidable stock performance has lifted the company atop many indices. Thematic strategies can offer a more nuanced, and larger, exposure to the chipmaker’s shares.

As the index turns 25 on June 21, we take a look at what makes up the world of smaller-capitalization German stocks.

The DVP index tracks the gross cash dividends paid out in a year by constituents of the Eurozone’s sustainability benchmark. Dividend futures on the standard EURO STOXX 50 benchmark are a popular contract on Eurex both for hedging and directional strategies.

STOXX Ltd. has announced unscheduled component changes in the MDAX and TecDAX indices.

Buoyant markets and the ongoing shift to index investments put European ETFs on track for a tenth straight year of net inflows. Funds tracking the EURO STOXX 50 attracted USD 2bn in the first five months of 2024.

The STOXX Europe 600 turned 26 this month, a lifetime during which the index has become a trusted barometer for the region’s equities. Used widely for the benchmarking of funds, the index is also the center of a growing ecosystem of investment products.

STOXX Ltd. has announced an unscheduled component change in the SDAX index.

Index | Listed Derivatives

Q&A on daily options at Eurex: expanding the trading opportunities around STOXX and DAX benchmarks

Daily expiration options on the EURO STOXX 50 and DAX indices have attracted significant flows since launch last year on Eurex as instruments to gain market exposure around specific, short-term macroeconomic and political events. We ask experts at Optiver, Eurex and STOXX what these types of options bring to the market.

Changes were announced as part of the June regular review of the DAX 50 ESG, DAX 50 ESG+, DAX 30 ESG, DAX ESG Target, DAX ESG Screened, MDAX ESG+, MDAX ESG Screened and DAX indices.

Index | Benchmarks

STOXX Global 1800 resumes gains in May as investors gauge inflation data, earnings

The global benchmark rose 4.5% last month for a 2024 advance of 9.6%. Economic reports during the month showed mixed inflation data while bellwether companies delivered better-than-expected earnings statements.