In May, the European Securities and Markets Authority (ESMA) released its final guidelines for the use of ESG and Sustainability terms on fund names. STOXX analyzed the new rules and how they may affect the current fund landscape in Europe in a report published in June.

The new naming rules – designed to mitigate the risk of greenwashing – concern the use of specific words in fund names such as “ESG,” “sustainable” or “impact.” Indices and products such as futures may be indirectly impacted because they are used as benchmarks, or for management purposes, in funds.

Figure 1: ESMA naming guidelines

ESMA published the guidelines’ translations in all official EU languages on August 21, meaning the rules will start applying for new funds in three months from that date. Managers of existing funds will get an additional six months for compliance.

Some indices are already aligned with the ESMA guidelines. One example is the STOXX® Europe 600 SRI index, which underlies the SPDR® STOXX Europe 600 SRI UCITS ETF as well as futures listed on Eurex in January this year.

We caught up with Antonio Celeste, Head of Sustainability Index Product Management at STOXX, and Christine Heyde, Equity & Index Product Design at Eurex, to discuss what the ESMA guidelines mean for the market and for listed products such as the STOXX Europe 600 SRI futures.

Antonio, what do the recently published ESMA fund naming guidelines mean for the suite of indices available in the market?

Antonio: “The new naming rules seek to protect investors and offer greater clarity, and are therefore a welcome development. However, the guidelines also increase the complexity of a fund’s or index’s design, which now must satisfy the new rules and maintain the original investment philosophy. It is not an easy task. One of the main challenges is that funds with ‘ESG’ or ‘SRI’ acronyms in their name will have to apply the Paris-aligned Benchmarks (PABs) set of exclusions, which essentially means they can no longer invest in oil and gas.

STOXX as an index provider does not need to comply with the ESMA rules. However, we are looking to support our clients by offering ESMA-compliant indices.”

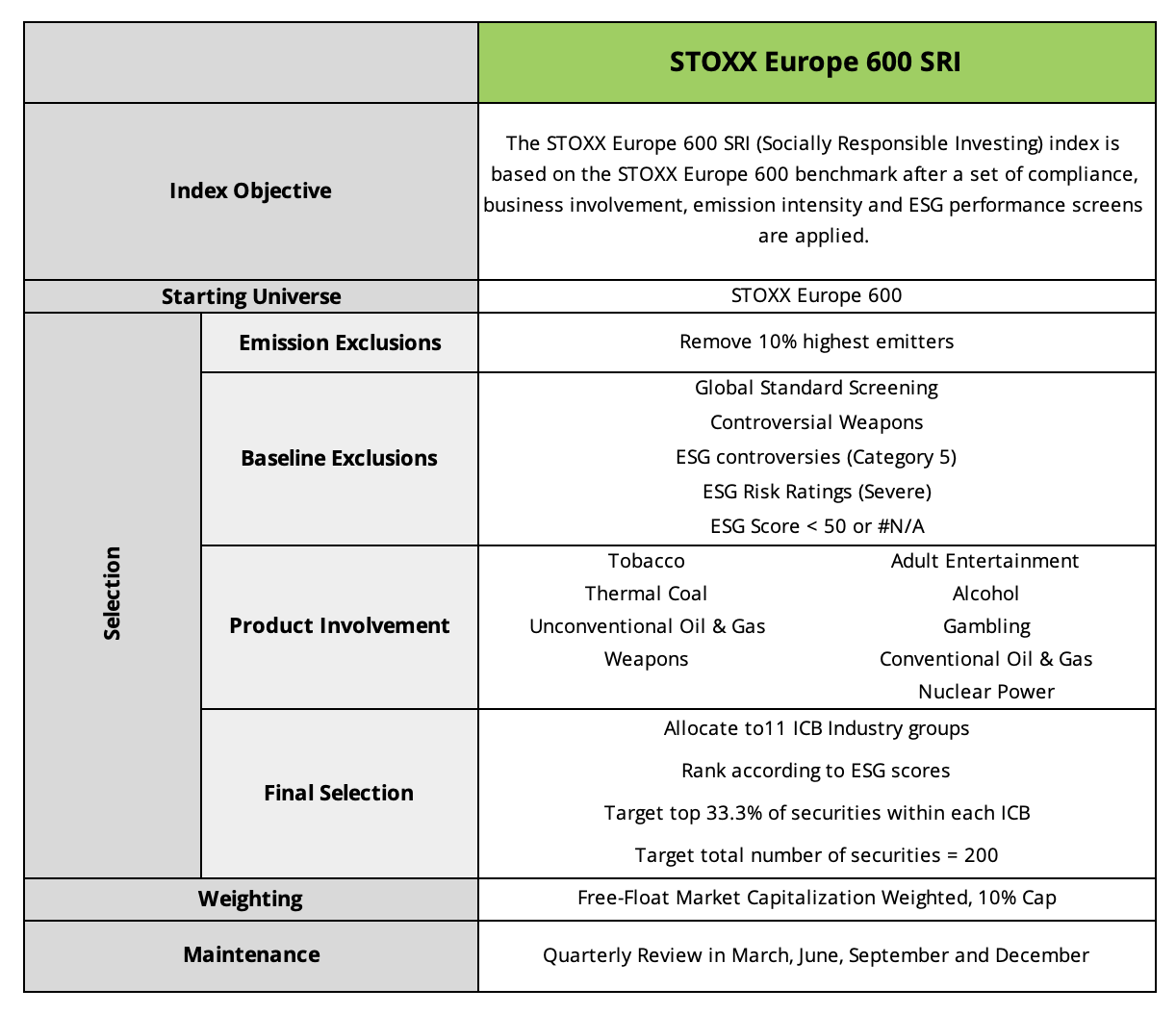

There are, already, investment products using underlying indices that comply with the ESMA fund naming guidelines. Among them are an ETF and futures on the STOXX Europe 600 SRI index. Can you explain to us the goals of the index’s underlying methodology?

Antonio: “In analyzing compliance with the ESMA guidelines, existing sustainability indices can be divided into three categories: indices that had a light approach and will require profound changes to align with the rules; indices with a rather advanced approach that will need minor adjustments; and finally, indices that had a very advanced approach and are immediately compatible with the ESMA guidelines.

The STOXX Europe 600 SRI index falls into this third category. The index applies a broad spectrum of filters — including product involvement and carbon emissions — that covers all of the PAB screens. The remaining securities are ranked in descending order of their ESG scores within each of the 11 ICB Industries, and the top-ranking companies in each Industry are selected until the number of stocks reaches a third of that in the starting benchmark.”

Figure 2: STOXX Europe 600 SRI methodology

Christine, what did the introduction of the STOXX Europe 600 SRI futures mean for Eurex’s sustainability offering? How has trading evolved since launch in January?

Christine: “The introduction of the STOXX Europe 600 SRI futures significantly enhanced Eurex’s sustainability offering and has allowed investors with responsible investment policies to manage their portfolios more efficiently. It also provides greater liquidity and helps lower trading costs.

Eurex’s move to introduce these futures is in line with the growing demand for sustainable investment tools, which enable investors to integrate sustainability considerations in a transparent manner.

Trading volume has grown since launch in January 2024, driven by client business and facilitated by banks and on-screen market makers.”

What does the SRI strategy say about current market demand and exclusions in responsible portfolios?

Christine: “Having been a key player in the global derivatives market for over 25 years, we foresaw that the rising interest in sustainability-aware investing would drive the need for more sustainable versions of traditional benchmark derivatives.

In early 2019, we introduced futures tracking the STOXX® Europe 600 ESG-X. This was a promising start, but we recognized the necessity to continuously develop and offer new, enhanced solutions as demand grew.

Since then, we have been doing just that. Our offerings have expanded to include a variety of equity index products incorporating different ESG integration methodologies such as best-in-class, ESG tilts, and positive and negative screening.

Eurex’s offering around the STOXX and DAX ESG index family consists of 12 equity index futures and options with a total value of open interest of 3.2 billion euros.[1]

Over time, the index methodologies underlying our flagship ESG index options and futures have been updated. For example, there was the lowering of the threshold for thermal coal investments, and the addition of exclusions for ESG laggards.”

Antonio: “A key takeaway from the ESMA guidelines is the ascendancy of oil and gas stocks exclusions. In banning those stocks from funds carrying ‘sustainable,’ ‘environmental,’ ‘ESG’ and ‘SRI’ in their names, the agency is expanding an exclusion that was particularly contentious in the run-up to the PABs and the Climate Transition Benchmarks (CTBs), to the majority of the ESG and Sustainability market.”

How do you see asset managers and issuers moving to comply with the ESMA guidelines?

Antonio: “Investors will have to meet new requirements at a time when they already face the challenge of navigating European Union-wide and national-level rules, some of which may potentially clash with ESMA’s directive.

In short, we believe issuers will follow two alternatives:

- A product that requires minor adjustments will likely modify its methodology to align with the ESMA guidelines, as the impact on the initial investment philosophy will be moderate.

- In the case of a product significantly distant from the ESMA guidelines, there will be difficult decisions between modifying the product’s name or changing its methodology. The first choice entails a significant bureaucratic burden, while the second will have a substantial impact on the risk/return profile.

As always, we will be working with our index clients and partners to find the best solution in each case.”

Indices are not required to align with the ESMA guidelines, yet the funds replicating them are. Does STOXX intend to modify its range of ESG & sustainability indices?

Antonio: “STOXX has launched two separate market consultations to gather input from relevant stakeholders and interested third parties on whether the methodologies of the rest of STOXX and DAX ESG & Sustainability indices should be modified along ESMA’s guidelines.

We strongly believe that clear rules to define investment strategies ultimately benefit investors, reduce greenwashing risk and foster market confidence.”

Christine, what’s going to happen to ESG index derivatives if clients demand ESMA-aligned contracts?

Christine: “Regarding the ESMA alignment of our products, as an exchange, we adhere to the index provider’s official announcements while maintaining an ongoing dialogue with our members and product users. Index providers must remain adaptable and responsive to user feedback, especially in the ESG sector, where standardization is relatively low and many customized approaches exist.”

Finally, Antonio, the STOXX Europe 600 SRI has outperformed its benchmark in recent years. What explains this outperformance?

Antonio: “We have analyzed the returns of the SRI index over the 2017-2024 period, during which it returned 61 basis points more than the benchmark.[2] The outperformance can be largely explained by a higher exposure to the Pharmaceuticals, Biotechnology & Life Sciences, and Semiconductors & Semiconductor Equipment Industries. Those active positions more than compensated the negative contribution from the large underweights in Materials and Energy.

At the constituent level, Novo Nordisk, ASML Holding and Nestle were the top three contributors to returns, with a combined active contribution of 1.66%. These stocks form part of the group that has been labelled the ‘GRANOLAS,’ which are European companies with large overseas revenues, solid balance sheets and steady earnings growth.”

[1] Data as of August 27, 2024.

[2] Data from March 31, 2017 to July 31, 2024.