By Steven Edwards, Product Research and Development, STOXX.

In 2021, the launch of the Glasgow Financial Alliance for Net Zero (GFANZ) at COP 26, alongside record inflows into ESG funds, underscored the increasing importance of sustainability, social responsibility and sound governance in capital allocation.

Since then, the Russian invasion of Ukraine in early 2022 caused energy prices to surge, resulting in solid outperformance of oil and gas stocks. This raised questions about whether ESG strategies, particularly those that exclude fossil fuel companies, can outperform over the long term.

These questions are pertinent following the release of the European Securities and Markets Authority’s (ESMA) guidelines for the use of ESG and Sustainability terms on fund names. In part, the ESMA guidelines describe limits on how funds branded as “ESG” or “Sustainable” can invest in oil and gas companies to mitigate the risk of greenwashing.

In this article, we address these questions by examining the performance of an ESG-focused portfolio, the ESMA-aligned STOXX® Global 1800 SRI, compared to a basket of fossil fuel companies over the last decade. Our analysis shows that while fossil fuel companies may outperform during certain periods, the SRI Index delivers more consistent, long-term returns. Furthermore, the SRI Index surpasses the returns of an ex-fossil fuel version of the STOXX® Global 1800 benchmark, demonstrating the strength of broader ESG approaches.

Empirical design

To assess the long-term viability of the SRI approach, we compare the returns of three free-float market cap-weighted portfolios from March 24, 2014, to October 8, 2024, against the STOXX Global 1800 benchmark:

- Global Fossil Fuel Basket: STOXX Global 1800 companies categorized within the Industry Classification Benchmark’s (ICB) Oil, Gas and Coal Sector.

- STOXX Global 1800 SRI: Index derived from the STOXX Global 1800, with a set of emissions intensity, international norms compliance, product involvement and ESG performance screens applied.

- STOXX Global 1800 ex Fossil Fuels[1]: Companies in the STOXX Global 1800 which do not belong to the ICB’s Oil, Gas and Coal Sector.

Analyzing returns

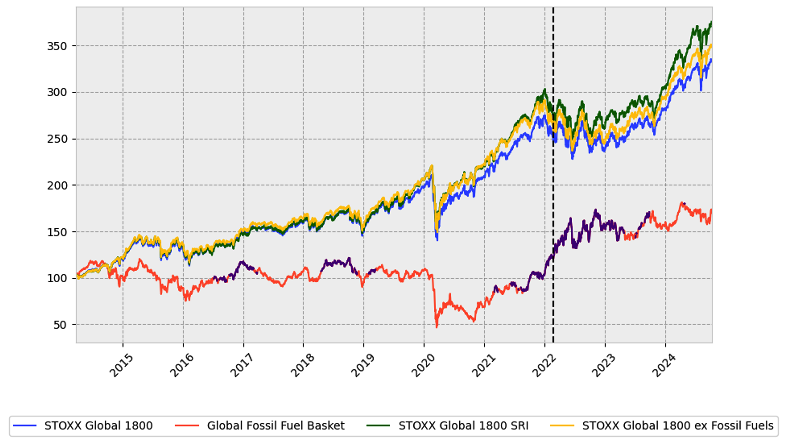

Figure 1 shows, in orange, the performance of the Global Fossil Fuel Basket in the past decade. Periods of outperformance relative to the benchmark are highlighted in purple. The broad market started a post-pandemic rebound in the final months of 2020, and fossil fuel companies began outperforming[2] the market in late 2021, driven by rising energy demand.

Figure 1: Portfolios’ performance

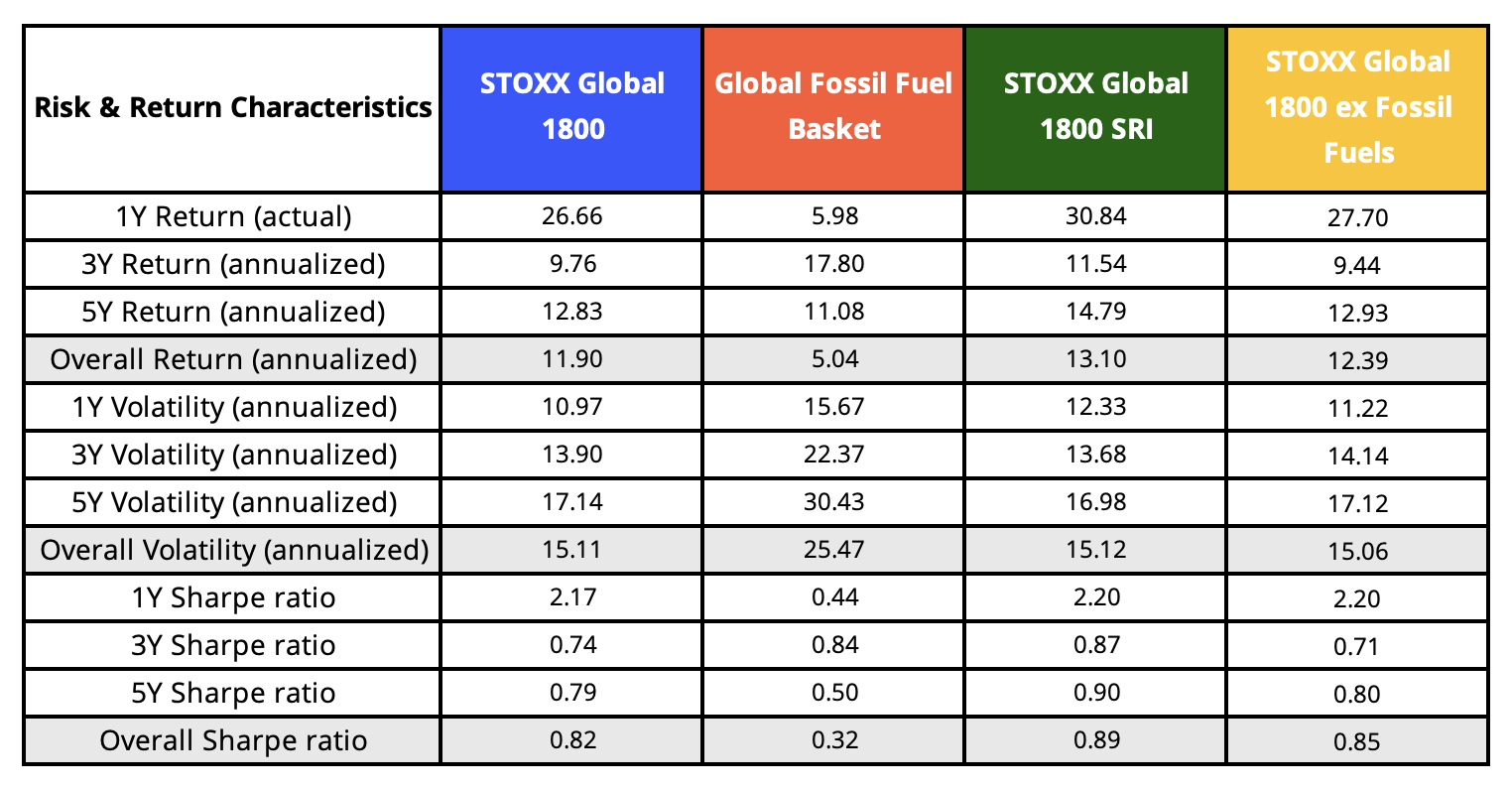

The trend continued following the Russian invasion of Ukraine in February 2022 (marked with a dotted line in Figure 1), as fossil fuel companies reported record profits due to elevated energy prices. This is reflected in the 17.80% 3-year annualized return of the Global Fossil Fuel Basket, compared to that of 9.76% in the STOXX Global 1800, 11.54% in the STOXX Global 1800 SRI and 9.44% in the STOXX Global 1800 ex Fossil Fuels (Table 1). However, it’s worth noting that this outperformance came with high volatility, making returns less competitive on a risk-adjusted basis. Over the last three years, the Global Fossil Fuel Basket had a Sharpe ratio of 0.84, lower than the STOXX Global 1800 SRI’s 0.87.

Table 1: Risk and returns

In the past year, however, the Global Fossil Fuel Basket delivered a return of 5.98%, significantly underperforming the returns of the benchmark (26.66%), the SRI index (30.84%) and the ex Fossil Fuels custom index (27.70%). The stabilization of supply chains, policy measures prioritizing energy security and slowing demand for fossil fuels contributed to this decline in performance.

Taking a broader view, over the 10+ year analysis period, the STOXX Global 1800 SRI Index outperformed the three other portfolios with an annualized return of 13.10%, compared with 11.90% for the STOXX Global 1800, 12.39% for the STOXX Global 1800 ex Fossil Fuels and only 5.04% for the Global Fossil Fuel Basket. Furthermore, the annualized volatility of the Global Fossil Fuel Basket over the same period was notably higher, at 25.47%, compared to ~15% for the other indices.

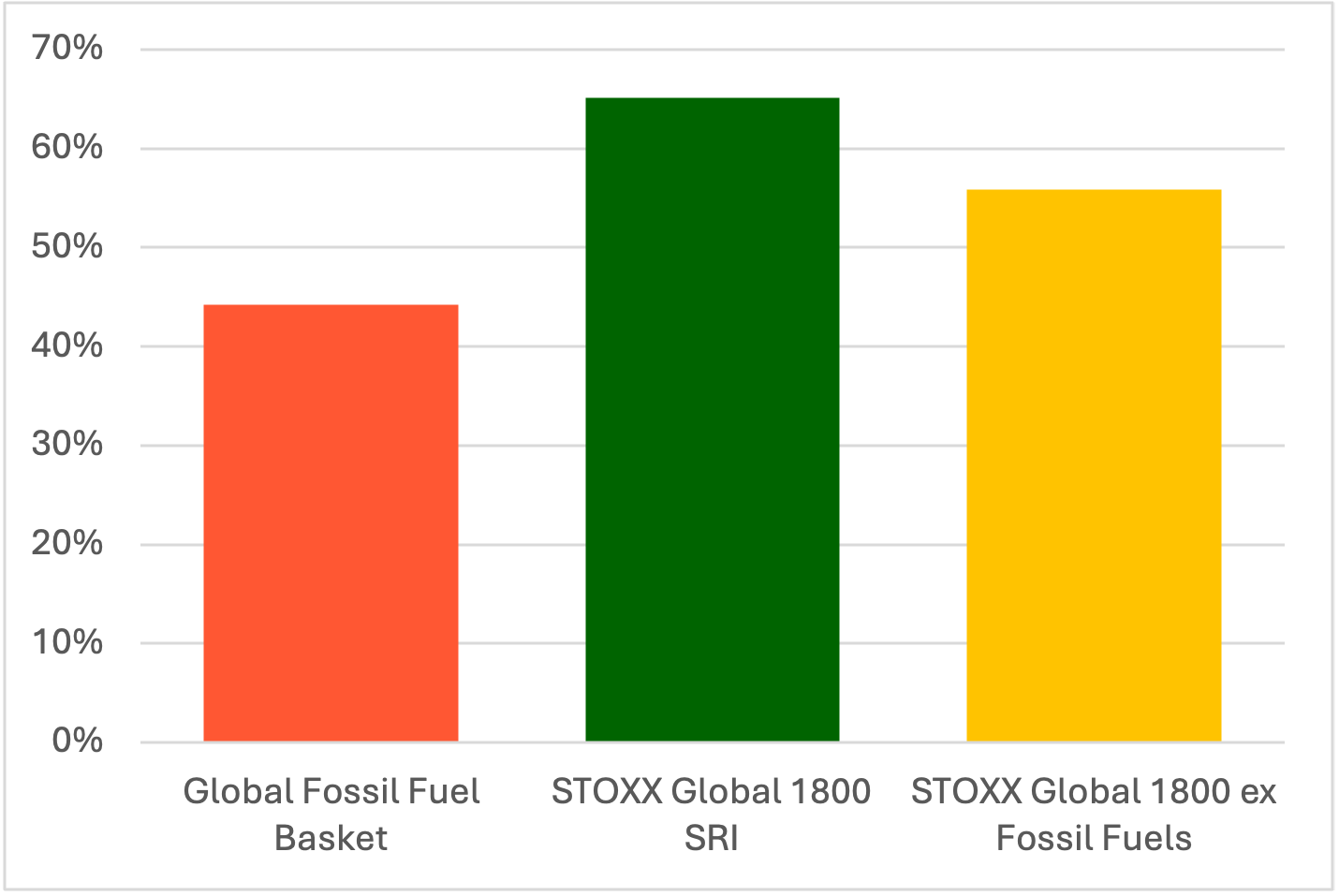

With respect to consistency of outperformance, we find that the Global Fossil Fuel Basket outperformed the benchmark in only 19 of 43 quarters over the period, or 44.2% of the time, as shown in Figure 2. By contrast, the SRI Index beat the benchmark in 28 of 43 quarters, or 65.1% of the period. Though it outperformed the benchmark in 55.8% of quarters, the ex Fossil Fuels Index did not achieve the same consistency as the SRI Index.

Figure 2: Proportion of quarters outperforming the STOXX Global 1800

Regional variations

It is important to note that the effects of the Ukraine war vary across regions. In Europe, where reliance on Russian gas is significantly higher, fossil fuel companies saw outsized gains relative to other markets. In contrast, the U.S. experienced less of an industry surge owing to its more domestically managed energy production. In APAC, the dynamics differed again, as some economies benefited from cheaper energy imports while others faced higher costs.

Conclusion

Fossil fuel companies have seen bursts of strong performance. However, these periods are often brief and volatile. For example, recent spikes in European gas and LNG prices driven by Middle Eastern tensions and concerns over pipeline security highlight the sensitivity of fossil fuel assets to geopolitical events rather than to lasting demand trends. In contrast, ESG strategies, such as those embodied by the STOXX Global 1800 SRI Index, have been able to outperform the benchmark over the past decade.

Empirical evidence suggests that fossil fuel exclusions can deliver both financial and sustainability benefits over the long term, particularly when integrated into a broader set of ESG criteria. Companies that prioritize environmental responsibility, social well-being and sound governance may be better equipped to adapt to regulatory changes, climate risks and evolving consumer preferences. These factors support the potential for ESG strategies to deliver stable, long-term growth.

Importantly, there is room for fossil fuels in the ESG discussion. Engaging with these energy companies to support their transition to sustainable practices is a vital aspect of ESG investing, as it can drive significant reductions in carbon emissions and foster the industry’s shift toward renewable energy sources.

[1] Note that this is not a readily available index but was instead constructed for the purposes of this analysis.

[2] Additional shading on the Global Fossil Fuel basket indicates periods in which the rolling annual returns outperform the benchmark.