Copper prices reached a record high on October 29, and analysts are boosting their 2026 price forecasts for the red metal amid a tight market.

The 3-month copper contract on the London Metal Exchange (LME) reached an all-time-high of USD 11,183 per metric ton on October 29, 2025, and has risen 24% year-to-date[1]. According to the median forecast of 30 analysts in a Reuters poll, copper is expected to average USD 10,500 per ton in 2026, up 7.2% from the projection in the previous survey, conducted in July.[2]

Figure 1: LME copper price

Why are copper prices rising?

With its applications in electrification and industry, copper is widely regarded as a barometer of global growth. Demand has been supported by structural economic expansion as well as emerging drivers, including the rollout of renewable energy, AI data centers and increased defense spending. Supply, meanwhile, has been hindered by mining disruptions and limited global output.

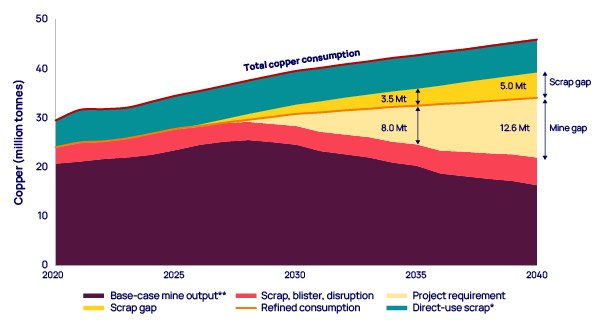

According to Wood Mackenzie, total copper demand is expected to surge 24% to 42.7 million tones per annum (Mtpa) by 2035. Supply will fall well short amid dwindling output, the research firm has predicted, creating a widening deficit through 2040 (Figure 2).

Figure 2: Mounting copper shortfall signals long-term risk

“While global appetite for copper may be voracious, there are serious questions over whether the mining industry can deliver the supply needed to meet the expected surge in demand,” wrote an analyst team at Wood Mackenzie.[3] “Western mining companies have been more fixated on capital discipline and achieving scale by engaging in mergers and acquisitions than on investing organically in the new copper mines needed. Copper prices are already lofty and could go higher still if investment in mine supply continues to lag.”

Stocks rally

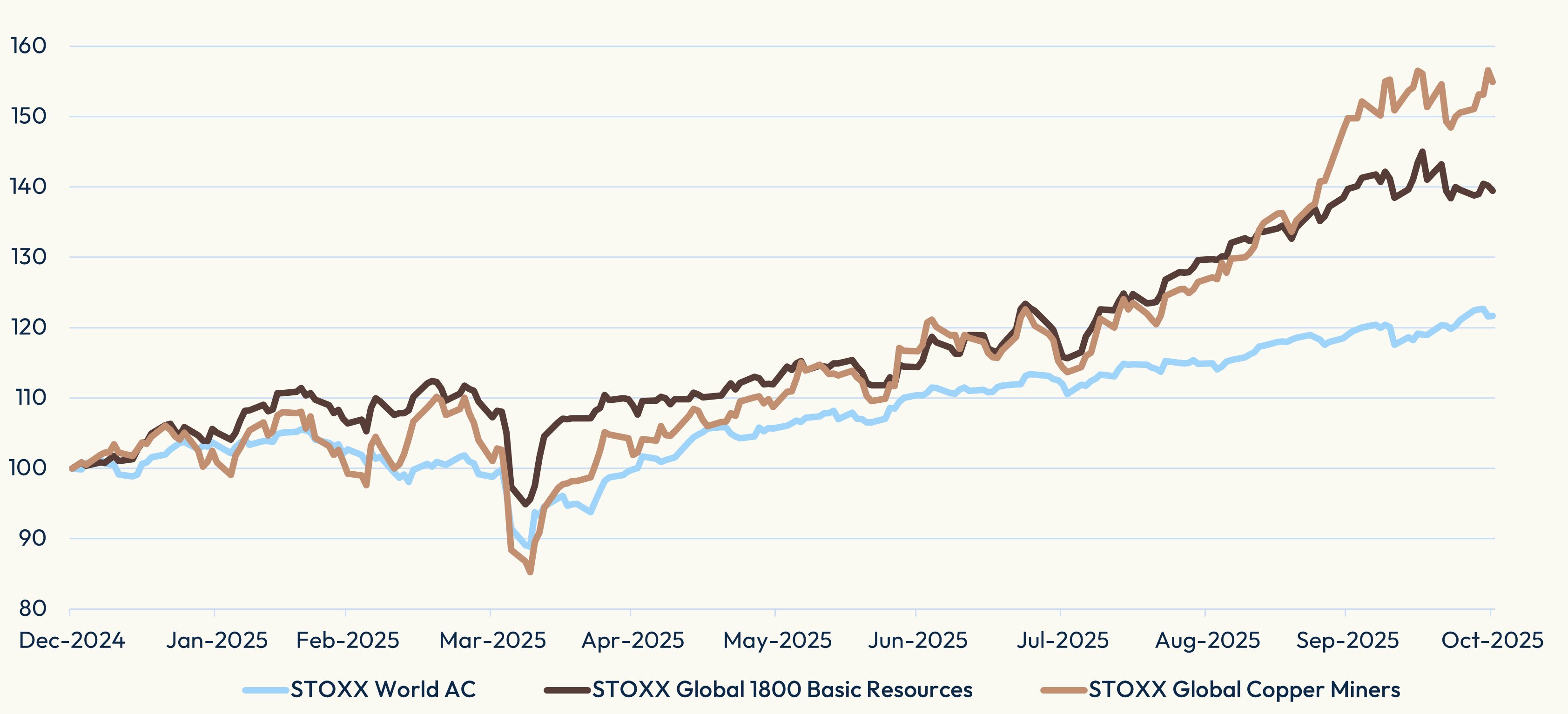

This market backdrop has raised earnings expectations for the mining industry. The STOXX® Global Copper Miners index has risen 55% in 2025, recently surpassing the STOXX® Global 1800 Basic Resources sector benchmark — composed of diversified mining conglomerates — in its year-to-date return (Figure 3). That would mark the best annual performance in data going back to 2018. The index tracks companies with the largest revenues from, and market share in, copper mining.

Figure 3: 2025 returns

Index methodology

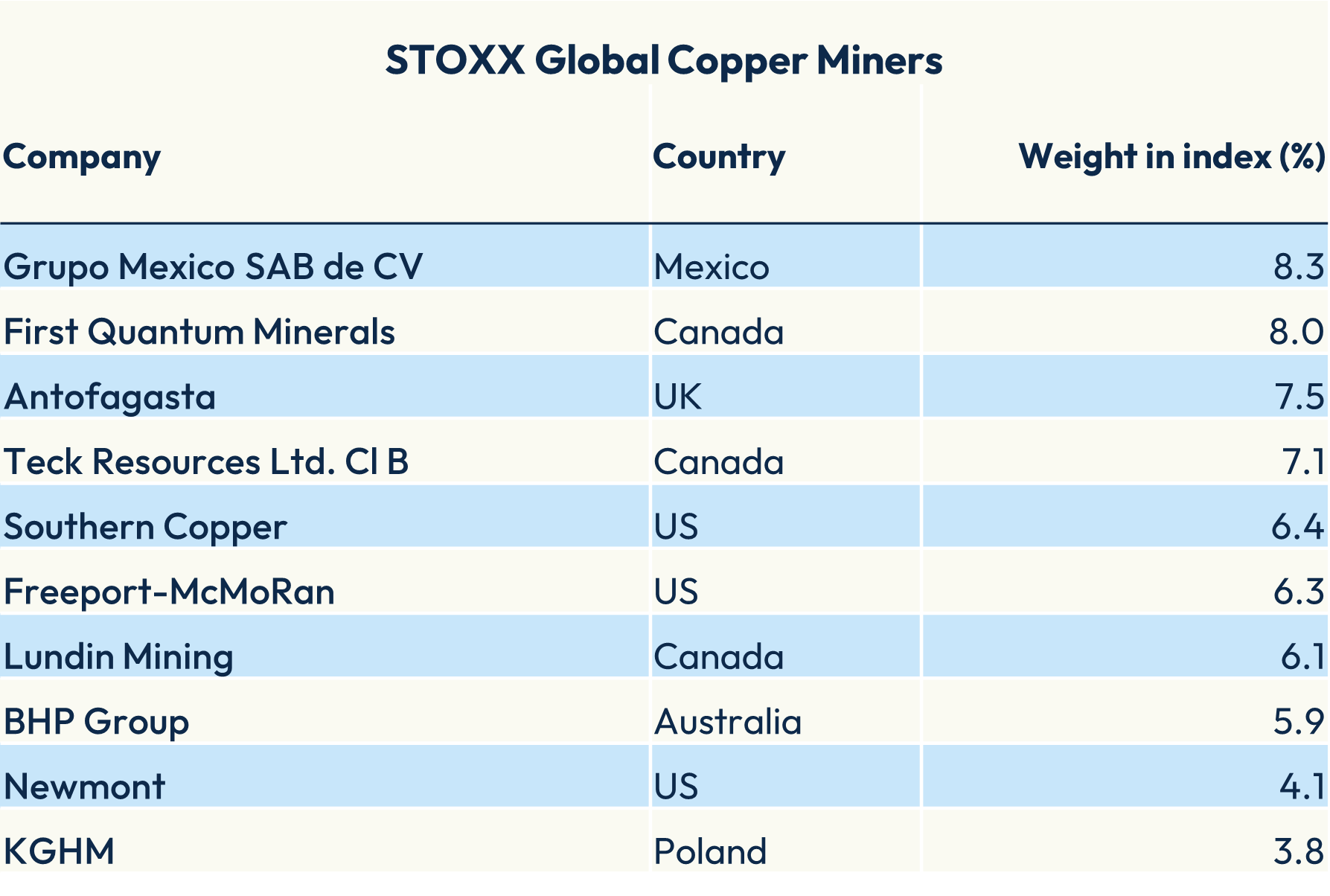

Index constituents are selected based on their classification under RBICS Level 6 Focus of Copper Ore Mining, RBICS Level 6 subindustry of Copper Ore Mining and their market share within Copper Ore Mining.

Figure 4 shows the top 10 companies by weight in the index, out of a total of 43 components.

Figure 4: STOXX Global Copper Miners index – Top 10 holdings

Copper miners ETF

The STOXX Global Copper Miners index underlies the iShares Copper Miners UCITS ETF from BlackRock, which was launched in June 2023 and is closing in on USD 200 million under management. In an interview in June this year, Omar Moufti, Thematics & Sectors Product Strategist at BlackRock’s iShares unit, argued that copper is an essential metal at the center of a generational overhaul of the world’s power infrastructure.

To be sure, copper is not alone in this year’s metals rally. Silver, gold and lithium have also experienced price surges, each driven by distinct, idiosyncratic factors. The STOXX Thematic indices offer diversified exposure to miners of these metals, with indices tracking companies that produce the four commodities leading gains in 2025.

Key role

Copper is demonstrating its role as a proxy for global growth and, importantly, is increasingly recognized as a geopolitically critical asset due to its importance in climate transition, emerging technologies and energy security. For equity investors, focusing on shares of specialized miners may offer an efficient way to capture the upside in a world reliant on essential metals.

[1] Data through October 31, 2025.

[2] Reuters, “Copper to hold gains in 2026 as mine disruptions fuel deficit,” October 27, 2025.

[3] Source: Wood Mackenzie, ‘High-wire act – Is soaring copper demand an obstacle to future growth?’ October 2025.