Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

New product launches

Most Recent New product launches

New product launches

Eurex, STOXX expand Equity and Basket Total Return Futures collaboration with new ETRFs on US stocks

Equity Total Return Futures (ETRFs) on 73 US stocks including NVIDIA and Apple were listed on February 23, expanding a successful offering in these types of exchange-traded derivatives. TRFs have seen strong demand from market participants as a way to efficiently gain exposure to price-plus-dividend returns of shares and indices.

Index | New product launches

Xtrackers by DWS expands US-based ETF offering with European Market Leaders and defense strategies using STOXX indices

The Xtrackers Europe Market Leaders ETF and Xtrackers Europe Defense Technologies ETF track STOXX indices that have performed very strongly in recent months, and grow DWS’ lineup of European equities strategies for American investors.

New product launches

STOXX and DWS collaborate on U.S. launch of DWS Xtrackers Europe Defense Technologies ETF

STOXX Ltd. today announced its expanding collaboration with DWS, with DWS’ launch of its Xtrackers Europe Defense Technologies ETF tracking the STOXX Europe Total Market Defence Space and Cybersecurity Innovation 50-25 index.

The Deka STOXX Future Water ESG UCITS ETF was launched today and tracks the STOXX Future Water ESG index. The strategy allows investors to participate in opportunities linked to this scarce natural resource and the forward-looking investment theme it underpins.

STOXX Ltd. today announced the expansion of its collaboration with Deka Investment GmbH (“Deka”), with the launch of an ETF targeting companies leading in water management and innovation.

The 25-year-old iShares STOXX Europe 50 UCITS ETF (DE) will be renamed to reflect its new index, which offers exposure to a smaller number of mega-caps in the broad European region.

The launches follow on from the roll-out three years ago of ETFs tracking yen-hedged versions of the two European flagship benchmarks, and come amid rising interest in European equities.

New product launches

STOXX and Nomura collaborate on launch of Nomura’s currency-unhedged EURO STOXX 50 and DAX ETFs

STOXX Ltd., part of the ISS STOXX group of companies, and Nomura Asset Management Co., Ltd., Japan’s largest ETF issuer, today announced their expanding collaboration with Nomura’s launch of two ETFs respectively tracking STOXX’s flagship EURO STOXX 50® and DAX® benchmark indices in euros. The ETFs will list on the Tokyo Stock Exchange on December 17th.

Index | New product launches

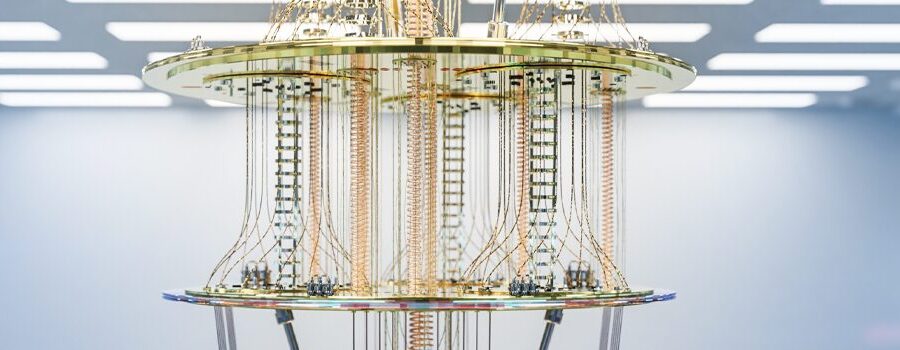

New iShares UCITS ETF tracking STOXX index targets quantum computing leaders

The underlying STOXX Global Quantum Computing index selects companies through a unique systematic process of scanning candidates’ patents, annual reports and corporate websites.

New product launches

STOXX and BlackRock collaborate on BlackRock’s launch of iShares ETF tracking STOXX Global Quantum Computing index

STOXX Ltd. today announced its expanding collaboration with BlackRock, with BlackRock’s launch of the iShares Quantum Computing UCITS ETF, which tracks the STOXX Global Quantum Computing index.

The new ETF is a first for the issuer and the only one in the market offering an equal-weight approach to the flagship Eurozone benchmark. Investors have this year been turning increasingly to equal-weight strategies to avoid single-stock concentration risks and rising valuations.

New product launches

STOXX and Invesco collaborate on Invesco’s launch of first ETF in Europe tracking EURO STOXX 50 Equal Weight index

STOXX Ltd. today announced its expanding collaboration with Invesco, with Invesco’s launch of the Invesco EURO STOXX 50 Equal Weight UCITS ETF, its first ETF in Europe tracking the EURO STOXX 50 Equal Weight index that provides equivalent Blue-chip representation of supersector leaders in the Eurozone.