(The article below was first published on ETF Stream.)

STOXX currently offers clients a range of five indices directly targeting the Artificial Intelligence theme. The newest additions — STOXX® Global AI Infrastructure and STOXX® Global AI Adopters and Applications — were the result of a collaboration with BlackRock, which led to the launch of two ETFs tracking the thematic indices.

We caught up with Ladi Williams, Head of Thematics and Strategy Index Product Management at STOXX, to ask him how the index provider approaches the conception and construction of indices covering such a vast and complex theme.

Ladi, what is AI as an investable idea, and how has STOXX approached it with its indices?

“AI is a hugely transformative technology, one with potentially unprecedented economic opportunities for investors. The AI sector is experiencing rapid growth, fueled by advances in computing power, data availability and machine learning breakthroughs. Given how vast the theme is, it is imperative to define and categorize the various subthemes within AI in order to come up with a strategy that can best capture the theme through an investment product.

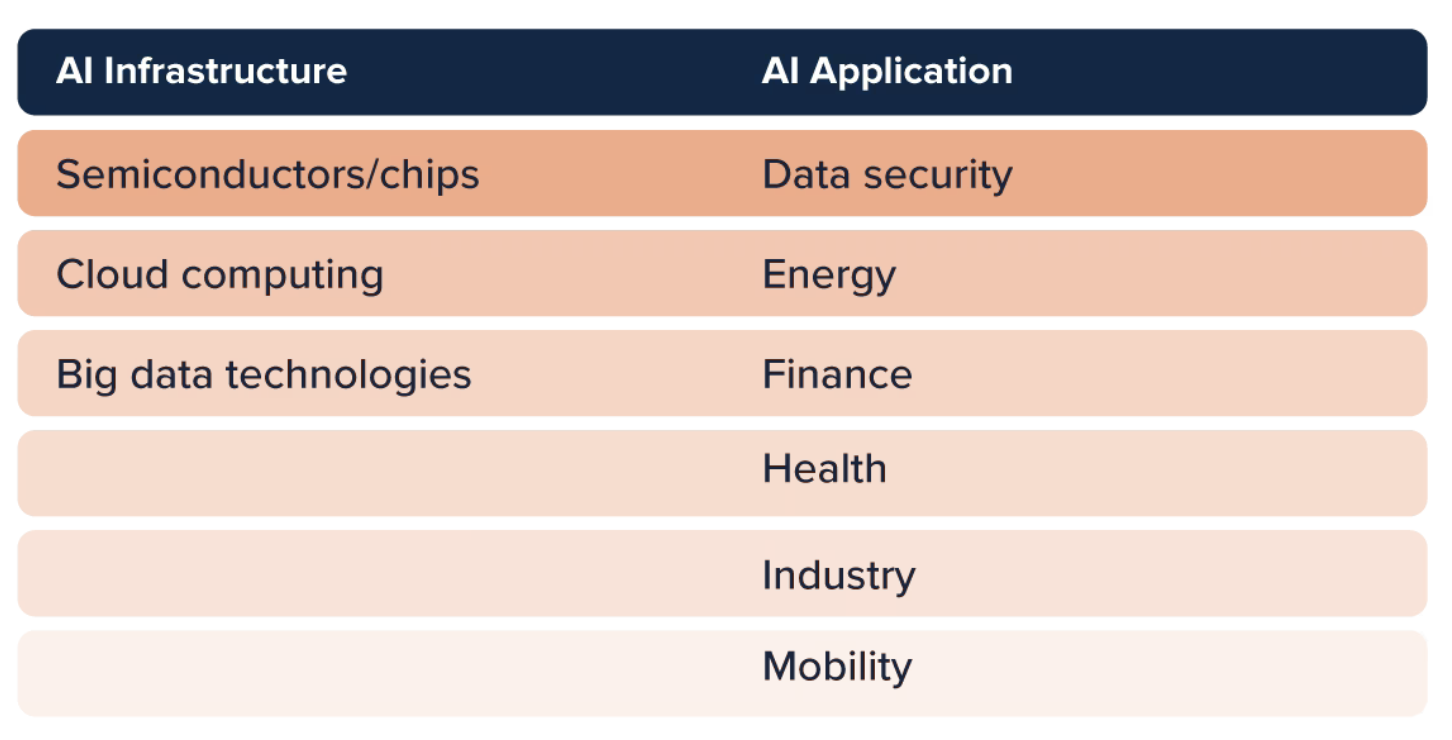

At STOXX we divide the AI theme into two categories: AI infrastructure, which consists of the fundamental building blocks, or the ‘picks and shovels,’ enabling the technology; and AI Applications, which represents its main application areas.[1]

Figure 1: STOXX AI theme categories

Equipped with this definition of a theme, we can adopt a systematic methodology that allows us to consistently select companies in the identified business lines.

The STOXX AI suite currently consists of five indices and is used to capture the different aspects and development stages of the targeted theme. We do so through the STOXX Thematics Framework, which is based on the life cycle of a theme and provides valuable insights into the evolution and potential of investment themes.”

Can you walk us through the STOXX Thematic Framework?

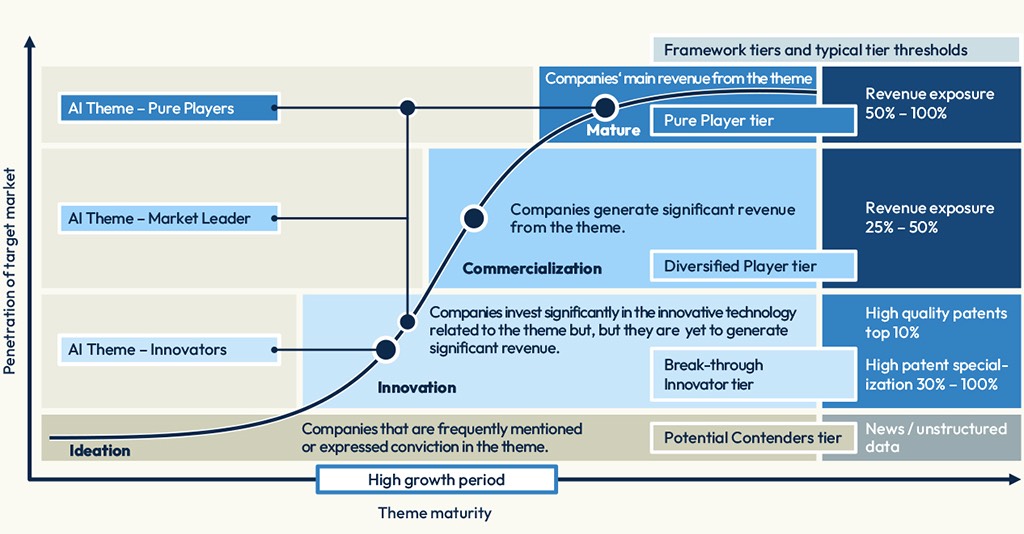

“The lifecycle framework identifies investable themes based on their conceptual and business evolution. The framework recognizes there are four stages in the development of a thematic concept: ideation, innovation, commercialization and maturity. As the cycle evolves, the level of conviction in a theme grows and the thematic exposure is better measured as more observable data points emerge.

Figure 2: AI theme evolution through the STOXX Thematic Framework lens

At its core, thematic investing uses indicators to identify companies that, at each stage of the evolution cycle, are most likely to be the main beneficiaries of a given theme. In the innovation phase, forward-looking indicators such as patents signal innovation activities, and early movers can be identified. As we progress along the curve, products and services begin to emerge and revenue exposure becomes measurable. The dual revenue/patent approach allows the indices to spot innovators and market leaders in different fields.

All themes pass through different stages of evolution, in line with their maturity as a market segment. Comprehensive themes such as AI encompass a number of segments at different stages of maturity. This offers an opportunity for capturing two different aspects of a particular theme: the specific segments within a theme and companies at different stages of their journey. Once the theme and subthemes for AI have been defined, overlaying the STOXX Thematic Framework leads to the creation of the STOXX AI index suite.”

How do you select stocks at each specific stage of the thematic life cycle?

“The chronological nature of themes offers a tiered view of all their subthemes. The STOXX AI indices target the key companies at different stages of the AI theme, through three main tier groups: innovators, market leaders and pure players.

STOXX uses a modular approach to incorporating different tiers in the construction of a single thematic index to capture companies or subthemes that are positioned at different stages along the innovation curve. This strikes a flexible balance between purity of exposure and higher-growth opportunities.”

Can you provide more information about the different AI indices you have developed?

“We devised the STOXX AI Thematic suite as a flexible and diversified set with which investors can harness the entire AI value chain. So specifically, we have the following five AI indices:

The STOXX® Global Artificial Intelligence, represents the more mature portion of the theme, comprised of companies that are positively exposed to AI from a revenue perspective.

Then we have the STOXX® World AC AI Market Leaders, which focuses on companies with significant market share exposure to the AI industry through direct revenue exposure and that have characteristics typically associated with peer-group leadership.

The STOXX® Global AI Infrastructure tracks companies that play a central role in the development and evolution of the building-block components for AI, such as semiconductors, cloud computing and big data technologies. The index uses a mix of companies’ revenue and patent data.

The STOXX® Global Artificial Intelligence Innovators identifies players with key patents in the development and evolution of AI building-block components and applications.

And finally, the STOXX® Global AI Adopters and Applications focuses on those segments representing the broader market adoption of AI. This index also uses a mix of companies’ revenue and patent data.”

Finally, how do you see the theme of AI evolving in the market this year, following the strong price performance of 2024?

“What I can say is that every time STOXX takes on a theme, there is deep research and due diligence involved, generally in partnership with a client, to assess the strength, potential upside and longevity of the investment thesis. Thematic investing is about taking a multi-year, and often multi-cycle, view on risk and return in the portfolio. And that is where we see AI at the moment, with many segments and subthemes at that innovation stage of the life cycle that we discussed earlier.”

[1] According to the BlackRock Investment Institute, annual investment into AI data centers and chips could surpass USD 700 billion by 2030 (Source: BlackRock Investment Institute, “Investment perspectives,” November 2024). UBS expects revenues from the AI applications and models segment — including AI software assistants, AI advertising, AI cloud and models, and others — to grow from USD 2.2 billion in 2022 to USD 225 billion in 2027 – a compound annual growth of 152%. (Source: UBS, “TechGPT: Raising AI revenue forecast by 40%”).