In 2026, STOXX is celebrating the 15th anniversary of its Thematic indices suite, which has grown to more than 70 indices targeting the beneficiaries of transformative forces shaping societies and the global economy.

These disruptive “megatrends” offer historic opportunities for investors, both in terms of return potential and as a way to diversify from macroeconomic factors and cycles that often drive traditional market-cap-weighted benchmarks.

| See more: STOXX Thematic indices overview |

Examining the track record

Nearly EUR 62 billion flowed into thematic-focused ETFs worldwide in 2025 — more than eleven times the amount recorded a year earlier.[1] ETFs tracking STOXX Thematic indices ended the year at more than EUR 13 billion in assets, following net investments of EUR 1.6 billion.

But how have these strategies performed in recent years? A returns analysis of STOXX Thematic indices indicates that they have delivered robust long-term outperformance and often exhibit strong short-term momentum. The magnitude of outperformance of “winning” strategies tends to exceed the degree of underperformance among laggards. One clear conclusion emerges: selecting the right theme is crucial — and even among broad thematic categories, some have been more popular with investors than others.

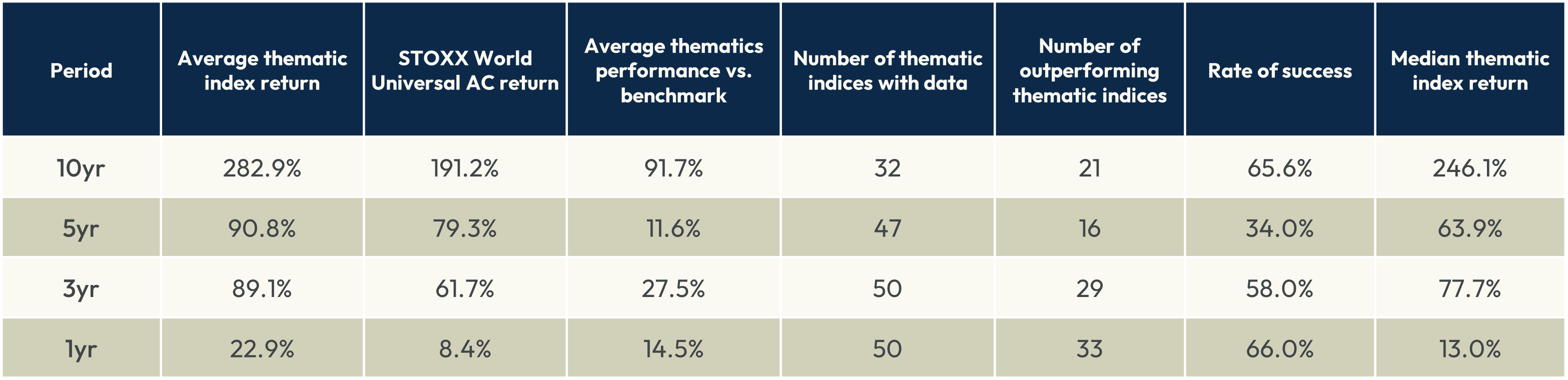

Figure 1 shows the average performance of a selection of 50 STOXX Thematic indices over different periods in the ten years through December 31, 2025.[2] In the past one and three years, for example, Thematic strategies returned an average of 15 and 28 percentage points more, respectively, than the STOXX® AC World Universal benchmark. On a five-year period, the average Thematics return was 11.6 points higher. The outperformance widens to almost 92 points when considering 10 years — equivalent to a 6.8 percentage points annualized outperformance over the decade.

Figure 1: Relative performance

When assessing the rate of success — the share of indices that outperformed the benchmark over each period — the data suggest that selecting the right indices contributed disproportionately to overall results. In other words, the exceptionally strong performance of a number of top strategies helped lift the average.

Over the past three years, for example, just over half of Thematic strategies outperformed the STOXX World AC Universal benchmark. However, returns from the Defense, Quantum Computing, Artificial Intelligence, Gold and Silver themes were strong enough to propel the overall performance of Thematic indices well above the benchmark’s gains. On average, the top half of the STOXX Thematics suite returned 137% over the three years, while the bottom half yielded 23%. The STOXX World AC Universal benchmark gained 61.7% over the period.[3]

This skew toward the “winners” is further confirmed when examining median, rather than average, returns for the Thematics suite. On this basis, the outperformance of Thematic strategies is narrower over one, three and ten years, while they underperform over five years: 55, -15, 16 and 4.6 percentage points for the 10-, 5-, 3- and 1-year periods, respectively.

Performance by category

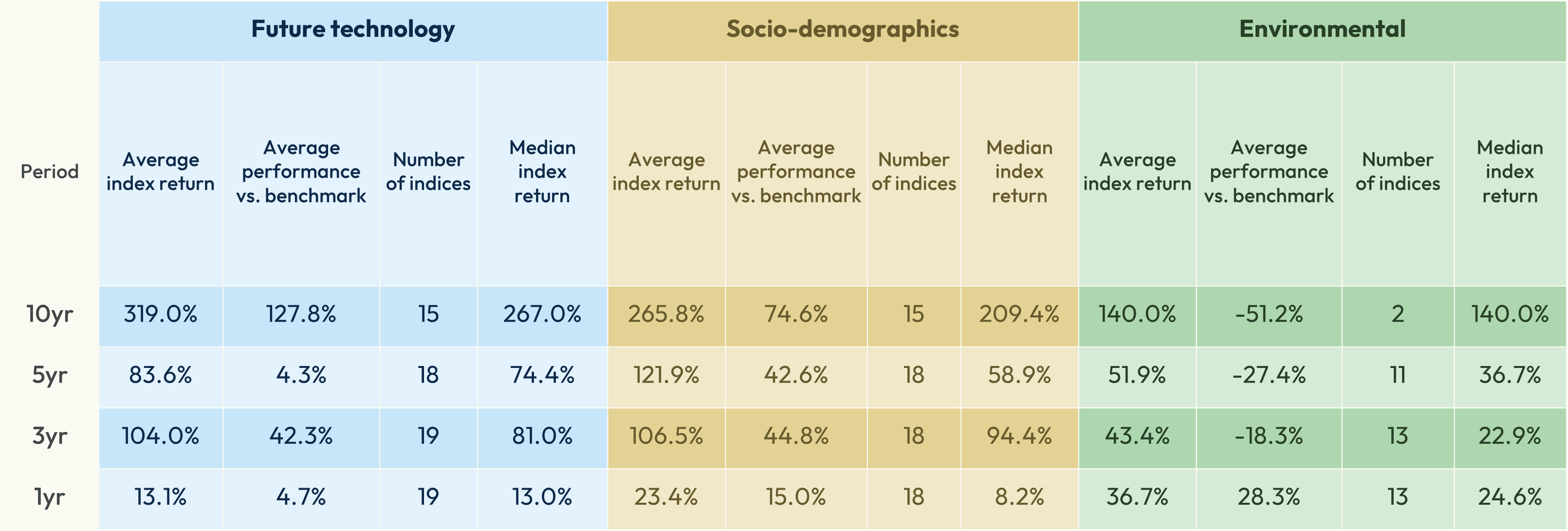

When looking at the three broad categories in the STOXX Thematics suite — Future technology, Socio-demographics and Environmental — returns over the four periods show strong performance for the first two. Indices tracking environmental-related themes, however, underperformed in the long term but rebounded strongly on a relative basis in 2025.

Figure 2: Thematic categories’ returns

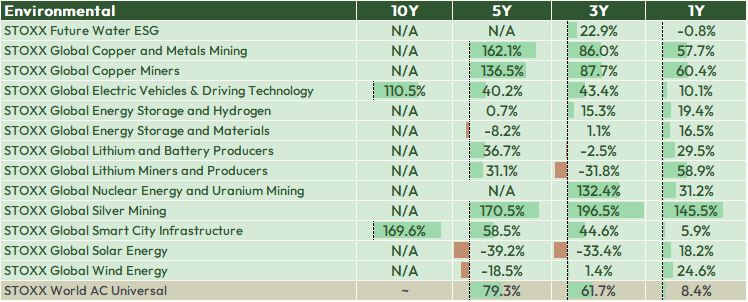

Individual performance

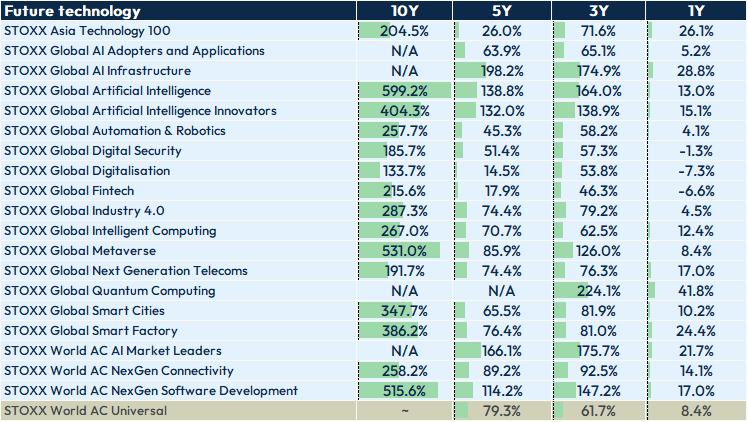

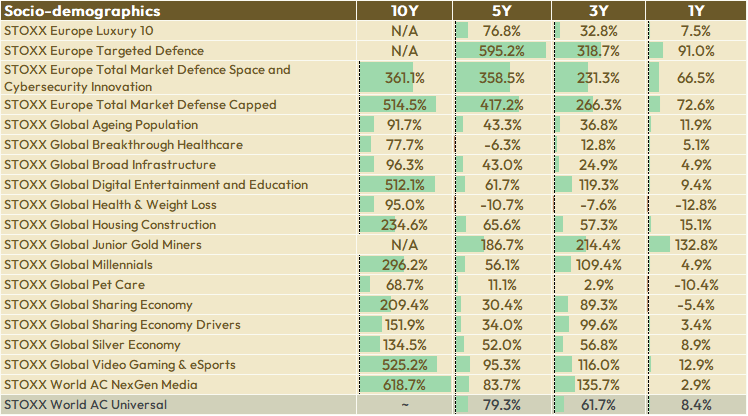

Figure 3 shows the performance over the four different periods considered, for all STOXX Thematic indices with 10-year data history.

Figure 3: Index returns by category

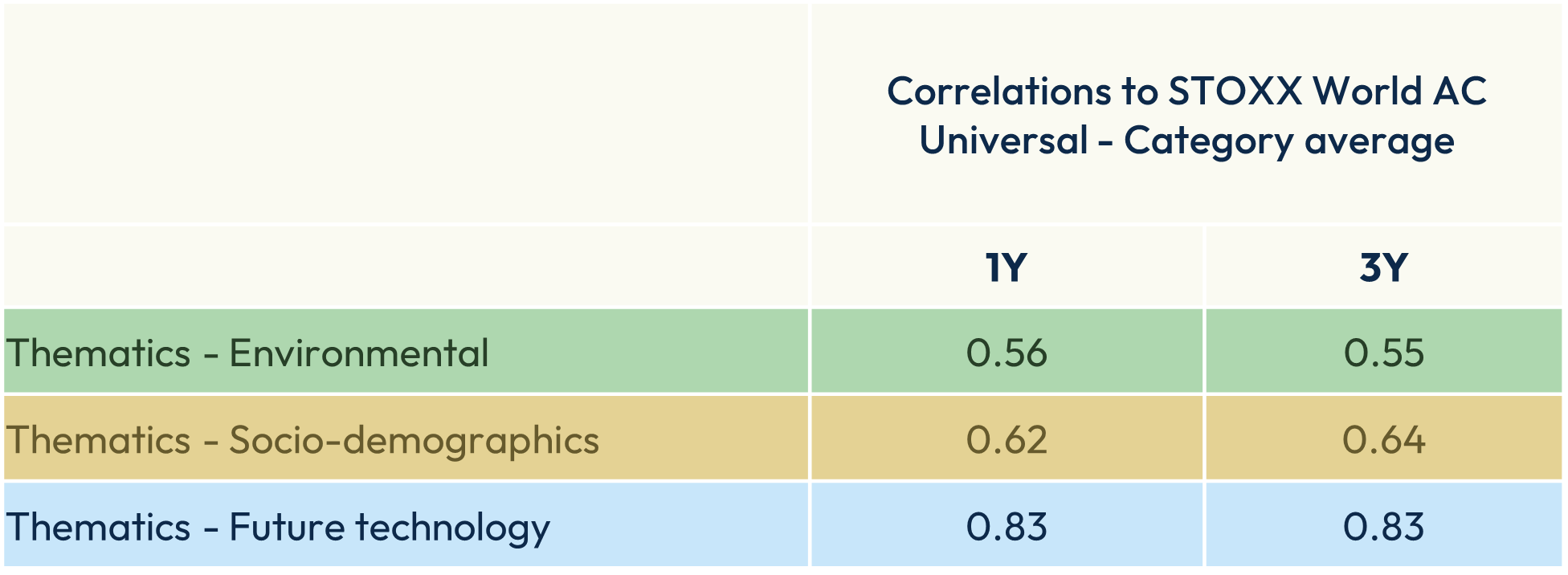

Correlations

Beyond returns, correlation with broader benchmarks is a key consideration for many investors. The STOXX Thematic indices exhibit a wide range of co-movements — reflecting their idiosyncratic characteristics. In the year ending December 31, 2025, correlations with the STOXX World AC Universal benchmark ranged from 0.06 for the STOXX® Europe Targeted Defence index to 0.96 for the STOXX® Global Artificial Intelligence Innovators index. A correlation of 1 means two assets move in lockstep, while a reading near zero suggests little to no relationship. A correlation of -1 implies the assets tend to move in opposite directions.

Figure 4: Thematic categories – correlation

The higher correlation observed in the Future Technology category may be explained by the growing influence of Technology stocks on global equity markets. The Technology Supersector accounts for 32% of the STOXX World AC Universal benchmark — almost three times the weight of the second-most important group, Industrial Goods and Services (11%).

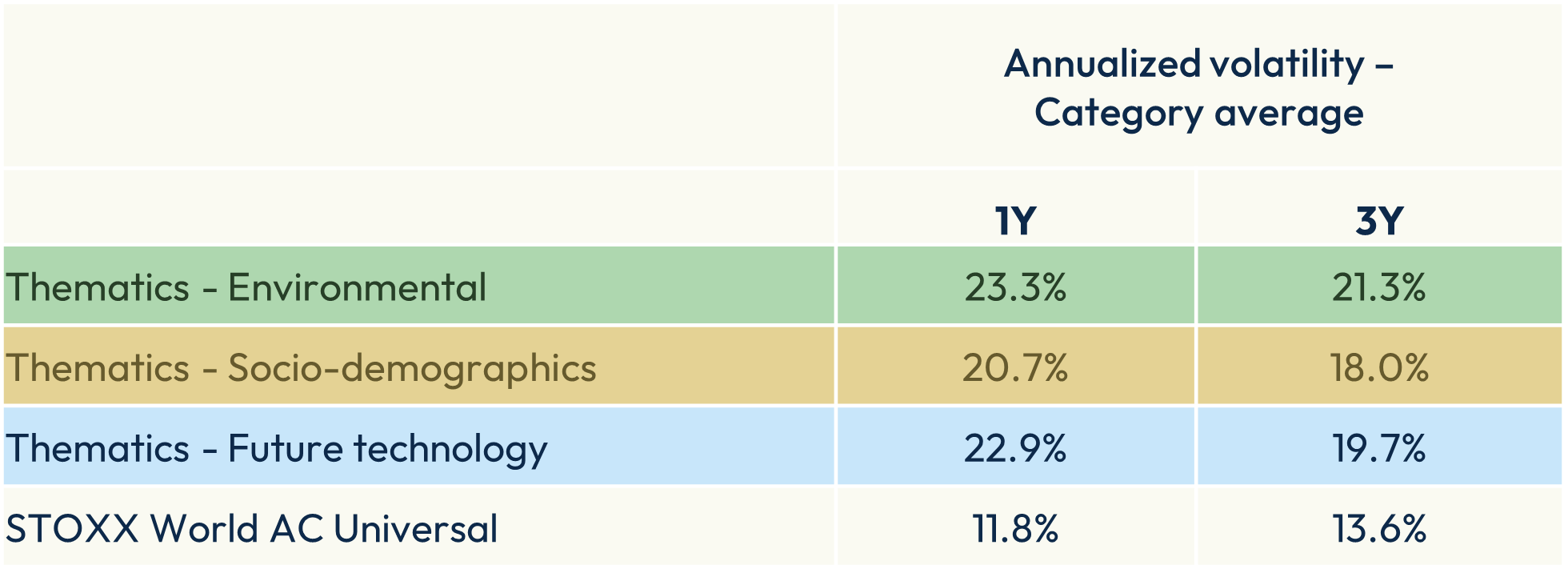

Volatility

Because thematic investing targets specific growth drivers, it typically carries a higher risk profile than broad-market benchmarks. While some thematic portfolios achieve diversification across multiple sectors, others concentrate on similar types of stocks, which can lead to sharper swings. Figure 5 shows the average annualized volatility across the three STOXX Thematic categories.

Figure 5: Thematic categories – volatility

On average, the Environmental category presents the highest annualized volatility in the past one and three years. This was led by indices tracking companies involved in climate transition or critical metals, including the STOXX® Global Lithium Miners and Producers, and STOXX® Global Silver Mining.

New themes ahead

The performance of Thematic indices in recent years shows that these strategies have done exactly what they are intended to do: offer the potential for above-market returns over the long term and provide a source of diversification away from the traditional economic cycles that dominate equity markets.

While 2025 marked a record year for thematic investing in terms of assets under management, interest promises to continue at pace, supported by new themes, ongoing technological advancements and societal change. This momentum is shaping opportunities not only for investors, but for the world at large.

More info:

How to capture investment themes at different stages of their lifecycle

Thematic indices: Capturing trends from AI to defense to transition metals

[1] Source: STOXX. Data through December 2025.

[2] Only a subset of STOXX Thematic indices was used in this analysis to ensure consistency and avoid overlapping index versions.

[3] The STOXX World AC Universal index is not the natural benchmark for all Thematic strategies. It is used in this article only for comparison reasons.