The European Securities and Markets Authority (ESMA) in May released its final guidelines on fund names, which will strictly govern whether the financial products can be labeled with certain sustainability-related terms.[1]

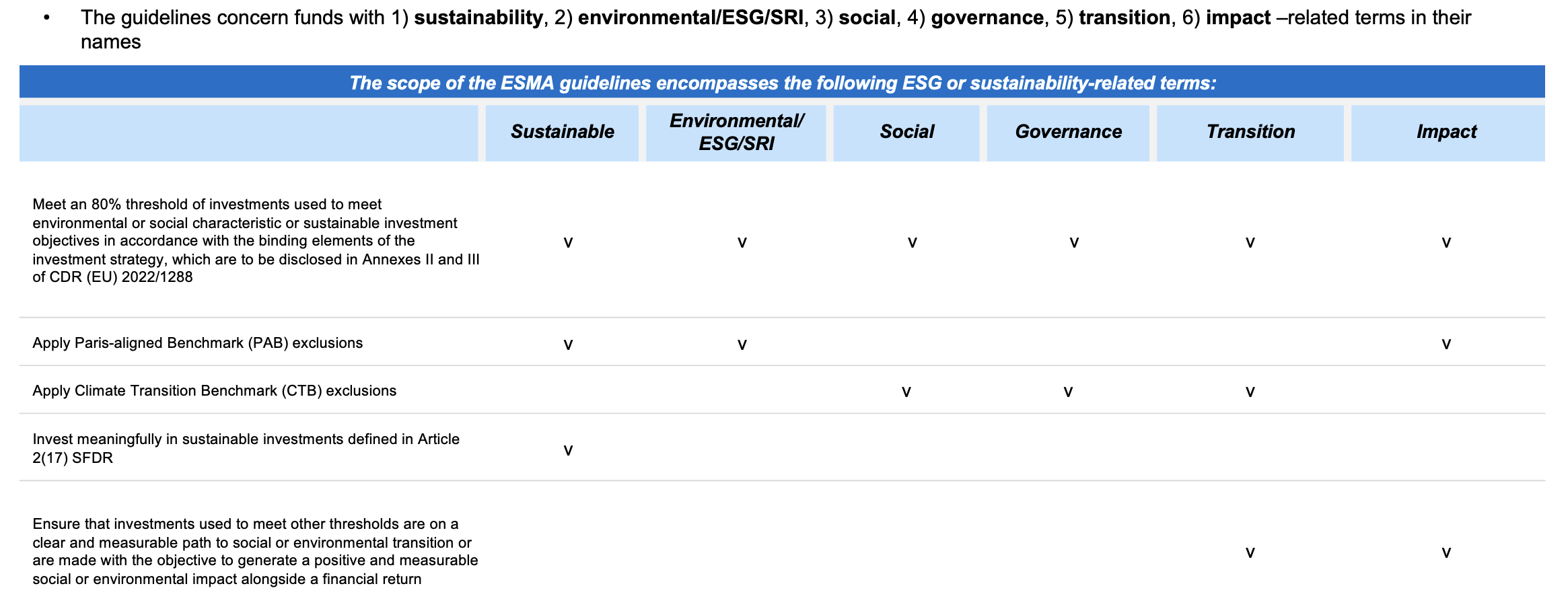

The new naming rules — designed to mitigate the risk of greenwashing — concern the use of specific words such as ‘ESG,’ ‘sustainable,’ ‘SRI’ or ‘impact.’ ESMA has provided detailed requirements for funds that want to use those terms, a summary of which appears in Figure 1. For a deeper analysis of the new regulation, see our report from June.

Figure 1: ESMA naming guidelines

These guidelines tie the implicit promise in a fund’s name to a minimum investment in the stated objective. One of their more contentious aspects is the ‘minimum safeguards’ provision, which bans investments in industries excluded from Paris-aligned Benchmarks (PABs). In essence, this means no funds branded as ‘ESG’ or ‘sustainable’ can invest in oil and gas companies, a notable challenge as many of those funds still do. In turn, this means that impacted funds will need to either meet ESMA’s portfolio requirements or change the fund names to comply with the guidelines.

STOXX indices

In view of the strict criteria prescribed in ESMA’s guidelines, we have assessed their potential impact on STOXX’s ESG & Sustainability indices. This blog aims to highlight which indices are already aligned with ESMA’s guidelines. While the guidelines apply to funds, they are also likely to impact the indices that many of those funds track, particularly when a manager changes the strategy of a fund and therefore requires an updated underlying index methodology.

All solutions within STOXX’s extensive ESG & Sustainability index classification can be customized to align with the ESMA naming rules. The following four index families already do so.

- SRI Indices

The STOXX® SRI (Socially Responsible Investing) indices apply a set of involvement, carbon emission intensity and compliance screens, and additionally track the best ESG performers in each industry group within a selection of STOXX benchmarks.

From a starting universe such as the STOXX® Europe 600, the 10% highest-emitting stocks are excluded, as are companies that violate global norms and product involvement screens. These filters currently include involvement in controversies, tobacco, alcohol, adult entertainment, gambling, controversial weapons, small arms, military contracting, thermal coal, oil and gas, and nuclear power.

The remaining securities are ranked in descending order of their ESG scores within each of the 11 ICB Industry groups. The STOXX SRI Indices select the top-ranking securities in each industry until reaching a third of the number of securities in the starting universe (200 in the case of the STOXX® Europe 600 SRI index), thus exceeding ESMA’s requirement to exclude at least 20% of the starting universe using sustainability-related restrictions.

- Paris-aligned Benchmarks (PABs) and Climate Transition Benchmarks (CTBs)

The PABs and CTBs are based on liquid securities from a selection of STOXX benchmarks and their methodologies follow the requirements outlined by the European Commission’s Regulation (EU) 2020/1818.

Those requirements are designed such that the resulting PAB and CTB portfolios’ greenhouse gas (GHG) emissions are aligned with the global warming target of the Paris Climate Agreement. The STOXX CTBs aim for a 40% GHG intensity reduction from the starting universe, and the STOXX PABs target a 60% reduction.

Companies identified as failing global norms, or that are involved in controversies, tobacco production and controversial weapons, are not eligible for selection. PABs also exclude businesses that derive revenue from coal, oil, natural gas, or from power generated from those materials. Because CTBs carry ‘transition’ in their name, they can invest in oil and gas companies, according to ESMA.

Furthermore, STOXX removes from both PABs and CTBs companies that, based on the ISS ESG SDG methodology, have significant obstruction in the following UN Sustainable Development Goals (SDGs): SDG 12 Responsible Consumption and Production, SDG 13 Climate Action, SDG 14 Life Below Water and SDG 15 Life On Land.

Additionally, PAB and CTB indices are designed to meet a year-on-year 7% decarbonization target. Scope 1-3 emissions are considered across all sectors from the first date of index construction.

The weighing process follows an optimization process to meet the minimum requirements in the EU regulation.

As a result, over 20% of the parent indices is currently screened out to make up the STOXX PAB and CTB indices.

- Biodiversity Focus SRI indices

The ISS STOXX Biodiversity Focus SRI indices are derived from the ISS STOXX Biodiversity indices, a suite that integrates nature-related risks and opportunities through a comprehensive approach.

The indices use the ISS STOXX biodiversity framework and integrate additional composition requirements and extra filters to comply with heightened objectives and policies. The ISS STOXX biodiversity framework is composed of four steps working together to allocate capital to companies that minimize their biodiversity footprint. The indices exclude companies involved in activities causing harm to biodiversity, select those with a less negative impact on ecosystems compared to peers, and those supporting relevant SDGs. Finally, they also reduce the portfolio’s carbon emissions.

To explore the ISS STOXX biodiversity framework, see a dedicated blog here.

Specific to the ISS STOXX Biodiversity Focus SRI indices are filters to screen out companies involved in adult entertainment, alcohol, gambling, fossil fuels and nuclear power, as well as those with the lowest ISS ESG corporate ratings (D-, D and D+). The ISS STOXX Biodiversity Focus SRI indices also have caps on ICB Industries and single stocks, and a stricter carbon reduction objective than the standard ISS STOXX Biodiversity indices.[2]

The ISS STOXX Biodiversity Focus SRI indices exclude more than 20% of the initial universe and apply all PAB screens, addressing ESMA’s requirements under its fund naming guidelines.[3]

Adapting while keeping a philosophy

Antonio Celeste, Head of Sustainability Index Product Management at STOXX, argues that sustainable investing calls for nimble solutions that can adapt to regulators’ and investors’ shifting expectations. As such, index providers must continue to work with partners to design indices that meet fund managers’ needs and help them comply with new rules and regulation, he says.

“The evolving ESG regulatory landscape in Europe poses a challenge because it requires modifying products to meet new regulatory requirements while maintaining the investment philosophy that was defined with or by our clients,” says Antonio. “Having a deep understanding of ESG data and its implications in index construction has become paramount.”

STOXX has launched a market consultation to gather input from relevant stakeholders and interested third parties on whether the methodologies of the rest of STOXX and DAX ESG & Sustainability indices should be modified along ESMA’s guidelines.

“We strongly believe that clear rules to define investment strategies ultimately benefit investors, reduce greenwashing risk and foster market confidence,” he adds.

Antonio noted that the four STOXX index families discussed earlier exceed the requirements in the ESMA guidelines.[4]

Energy stocks in focus

A key takeaway from the ESMA guidelines is the ascendancy of oil and gas stocks exclusions, says Antonio. In banning those stocks from funds carrying ‘sustainable,’ ‘environmental,’ ‘ESG’ and ‘SRI’ in their names, the agency is expanding an exclusion that has been contentious since the onset of sustainable investing, to the vast majority of the ESG and Sustainability market.

The creation of two types of European Climate benchmarks in the past decade – PABs and CTBs – responded to a conflicting positioning among European responsible investors on whether energy stocks should be allowed in responsible portfolios or not.

A patchwork of rules

The ESMA guidelines will start applying three months after their publication in all EU official languages, and managers of existing funds will get an additional six months for compliance.

Complying with regulation in Europe can be a challenging task for fund managers, who must often also observe country-level labeling regimes. At the same time, the EU’s Sustainable Finance Disclosures Regulation (SFDR), which has become a de-facto fund labeling framework since implementation in March 2021, is currently undergoing a comprehensive assessment that may lead to a fundamental revamp.

A patchwork sustainable finance environment in Europe limits the ability of investors to make informed investment decisions. In the current environment, the risk is that investment firms concerned about obsolescence may put planned ESG funds on hold, waiting for more regulatory stability.

Offering flexibility and customization potential in indexing can help investors overcome such hurdles.

[1] The guidelines apply to UCITS management companies and alternative investment funds.

[2] While the ISS STOXX Biodiversity indices aim for a 30% reduction in carbon emissions relative to the starting universe, the objective has been raised to a 50% cut in the case of the ISS STOXX Biodiversity Focus SRI indices.

[3] The ISS STOXX® Europe 600 Biodiversity Focus SRI index, for example, consists of 275 companies, while 325 have been screened out from its benchmark universe.

[4] For a closer look at the indices’ methodologies, please see the index guide here.