SDAX®, the benchmark for small-capitalization German stocks, was launched on June 21, 1999. With an average annual return of nearly 10% since inception,[1] the index has tracked the country’s lesser-known corporate stories on their growth journey.

SDAX includes the 70 companies that come after DAX® and MDAX® — respectively the indices for blue-chip and mid-sized German companies. Selection into SDAX follows minimum quality requirements and is based on free-float market capitalization.

In December 2023 Amundi launched the Amundi SDAX UCITS ETF, which tracks the SDAX and is listed in Frankfurt. The index is also a popular underlying for listed investment certificates.

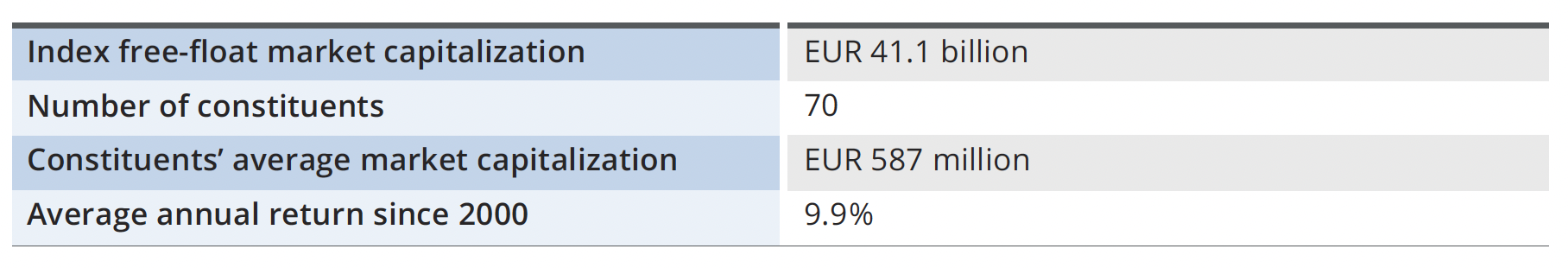

Figure 1: SDAX in numbers

Performance

In the past ten years, SDAX has beaten the blue-chip DAX by a total 17 percentage points. The edge over the MDAX index has been significantly larger: 45 points over the entire period.

Despite the recent gains, SDAX is still 12% below its record high reached in November 2021.

Figure 2: Index performance

While SDAX has shown slightly higher volatility than DAX in recent years, this was not always the case historically. Between 2008 and 2017, the small-caps index had consistently lower annualized volatility — meaning it didn’t fluctuate as much as the blue-chip index.

“Small stocks attract a strong investor following, and to many of them an index-based approach is the easiest and most efficient way to target this segment,” said Serkan Batir, Global Head for Product Development and Benchmarks at STOXX. “We are celebrating 25 years of exciting small-cap stories with SDAX.”

Index composition

The primary criteria for inclusion into SDAX are:

- An existing listing on the Regulated Market of the Frankfurt Stock Exchange (FSE) and continuous trading on Xetra®

- Minimum free float of 10%

- Minimum trading liquidity

- Legal or operating headquarters in Germany

- Timely publication of an audited annual financial report, half-yearly financial reports and quarterly statements

- Adherence to specific German Corporate Governance Codex requirements.

Figure 3 shows the index’s largest components as of June 24, 2024. Hypoport, which provides technology services to the credit, real estate and insurance industries, holds the biggest weight.

Figure 3: Top 10 index components

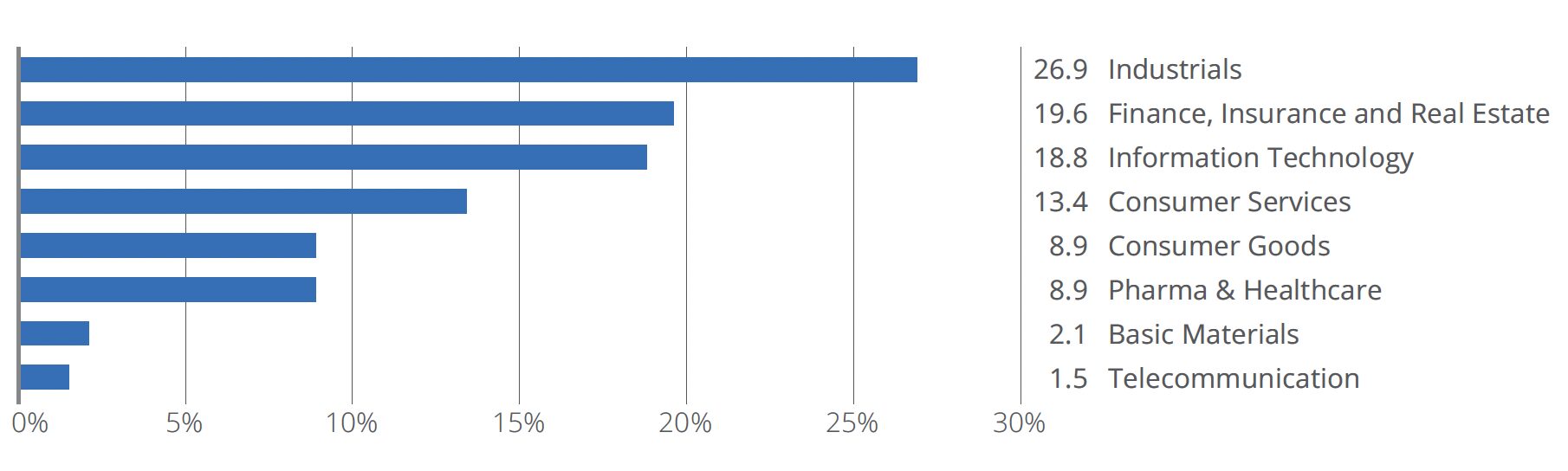

Figure 4 displays the index’s Supersectors distribution. Industrial Goods & Services and Information Technology are two of the most important ones, as it happens with the larger DAX. This implies that the core, global-leading prowess of Germany’s corporate sector in those two industries is equally present in both the large and small companies segments. Further, the rest of the Supersector weightings show a highly diversified index.

Figure 4: Supersector weightings

Capping alternatives

The weighting of index constituents is capped at 15%. A version of SDAX that limits the weight of stocks to 10% was introduced in March of this year.

Methodology updates

In September 2018, STOXX changed the composition of DAX indices for German small-, mid-sized companies and technology shares to better reflect the size and sector representation of those markets and bring rules in line with international standards. The sector segregation that restricted technology shares from entering MDAX and SDAX was lifted. As a result, SDAX was expanded to 70 from 50.

As part of a bigger overhaul announced in 2020, all components in SDAX and other DAX Selection Indices are required to timely publish their financial statements and have an internal independent audit committee in place. The selection criterion of trading turnover was replaced by a minimum liquidity requirement, with market capitalization remaining the key metric as is customary internationally.

As of March 2024, SDAX dividends are reinvested in the whole index portfolio rather than in the distributing stock as it happened earlier.

The index is reviewed twice a year but goes through a quarterly so-called Fast Exit/Fast Entry review to account for significant changes in companies’ market capitalization.

The size factor

To many investors, small-caps are the holy grail of stock-picking. Often young companies in the early stages of expansion, with low analyst coverage and broadly yet untapped by large institutional funds, small stocks can offer the potential of above-average growth. For the past 25 years, SDAX has enabled transparent and rules-based exposure to this segment in one of the world’s leading industrialized economies.

[1] Total return in euros, the most followed version of the index.