Valour Inc. has licensed the STOXX® Digital Asset Blue Chip X index to use as underlying for an exchange-traded product (ETP) listed on the Frankfurt Stock Exchange (FSE).

The index, which marked STOXX’s entry into the digital assets space, has been developed in partnership with crypto-financial services provider Bitcoin Suisse. It aims to track a diversified and high-quality basket of assets, utilizing crypto-native metrics to select those that serve as a reflection of the crypto universe today.

Changing backdrop

More institutions are turning to digital assets for strategic objectives such as portfolio diversification, and as an enhanced ecosystem and clearer regulation make market fundamentals more attractive to a larger breed of investors. After a bout of market volatility in 2022, asset prices recovered in 2023, and the crypto market is now valued at USD 2.5 trillion[1].

“Investors are clearly allocating significantly more to alternative asset classes to diversify their portfolios,” said Axel Lomholt, General Manager at STOXX. “That’s why we are moving into an investment segment that’s increasingly gaining a foothold in portfolios. With Bitcoin Suisse, we do this with an established partner and with an index methodology designed to meet the robustness needs of today’s investors.”

Selection process

Assets in the STOXX Digital Asset Blue Chip X are derived from the Bitcoin Suisse Index Reference Classification List (xRCL) and must be eligible for the FSE’s Xetra venue. Only assets in the following five sectors from the Bitcoin Suisse Global Crypto Taxonomy (GCT) are currently available for selection: Cryptocurrencies, General Purpose Smart Contract Platforms, Decentralized Finance (DeFi), Utility and Culture.[2] Selection is based on a multi-step procedure that seeks to identify the strongest and most representative assets in each eligible sector.

A blue-chip focus means the new index does not just select the largest crypto assets by market capitalization, as is customary with other indices, but instead considers crypto-native metrics including the scope of adoption, the size of the developer community, the fees paid by users and the age of the protocol. This, together with robust exchange-based pricing, ensures the investable tokens present quality standards that are acceptable to a larger pool of investors.

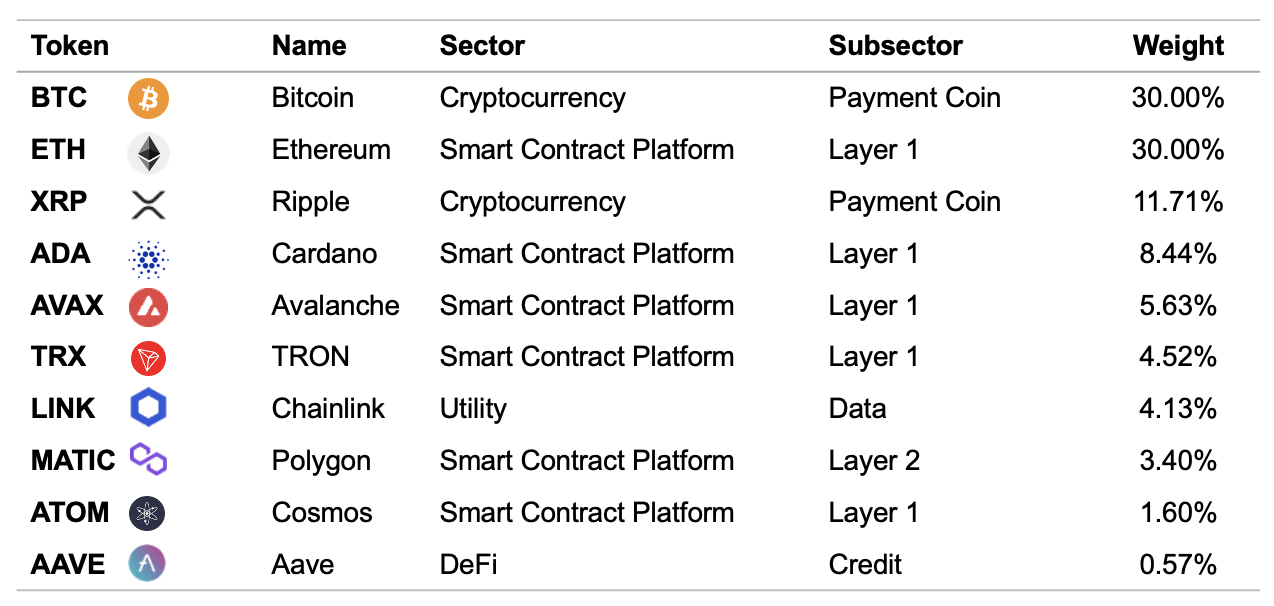

A market capitalization weighting scheme with a cap of 30% limits exposure to dominant tokens — such as Bitcoin and Ethereum currently — while keeping the strategy representative of the underlying market. Weights are capped at 30% in each quarterly review, meaning any asset that exceeds that threshold will be cut back in the following rebalance.

For more details on the index and its constitution, visit a blog from December.

Figure 1: Index holdings

[1] https://coinmarketcap.com/

[2] The Cryptocurrency sector contains blockchains with the primary purpose of being a form of cryptographically secured digital money. The General Purpose Smart Contract Platform sector contains blockchains that offer functionality ‘beyond money’, usually in the form of decentralized applications consisting of smart contracts that utilize the native coin of the blockchain. The DeFi sector contains smart-contract-based protocols that may operate on their own or another blockchain and are powered by a native token. The Utility sector contains blockchains and protocols that enable access to, or represent, a resource. The resource does not have to be digital. The Culture sector contains blockchains or protocols that represent cultural works of art – as opposed to utility. A sixth sector in the taxonomy, Tokenized Assets, is currently not covered in the index methodology. This sector contains blockchains and protocols to manage tokenized versions of asset classes or instruments of traditional finance.