Qontigo has introduced the STOXX® Global Metaverse, a thematic index that follows a unique patents-based stock selection methodology and that will underlie an iShares ETF from BlackRock.

The strategy selects companies developing technologies related to the deployment and adoption of the Metaverse, including interactive virtual platforms, wearables, immersive applications, computer processing capabilities and digital twin. The new index expands Qontigo’s suite of solutions targeting the upside of a digital future.

“The STOXX Global Metaverse index complements our suite of Qontigo thematic strategies focusing on transformative technologies in a world which is digitalizing at a rapid speed,” said Axel Lomholt, Chief Product Officer, Indices and Benchmarks at Qontigo. “We are applying an innovative patents-based methodology that enables us to identify the pioneering companies developing the Metaverse.”

The Metaverse is expected to become a trillion-dollar revenue paradigm, as more companies and consumers grow their presence in the virtual world, impacting industries such as e-Commerce, online education, manufacturing and advertising. The Metaverse has been defined as ‘the next evolution of the internet and social networks’1 and described as ‘the biggest new growth opportunity for several industries in the coming decade.’2 Consulting firm McKinsey has estimated the Metaverse may generate up to 5 trillion dollars in economic value by 2030.2

New partnership with EconSight

The STOXX Global Metaverse index uses EconSight’s3 patents database. The specialist analytics provider employs a sophisticated patent classification system and indicators that help identify companies with intellectual property in cutting-edge technologies associated with the Metaverse.

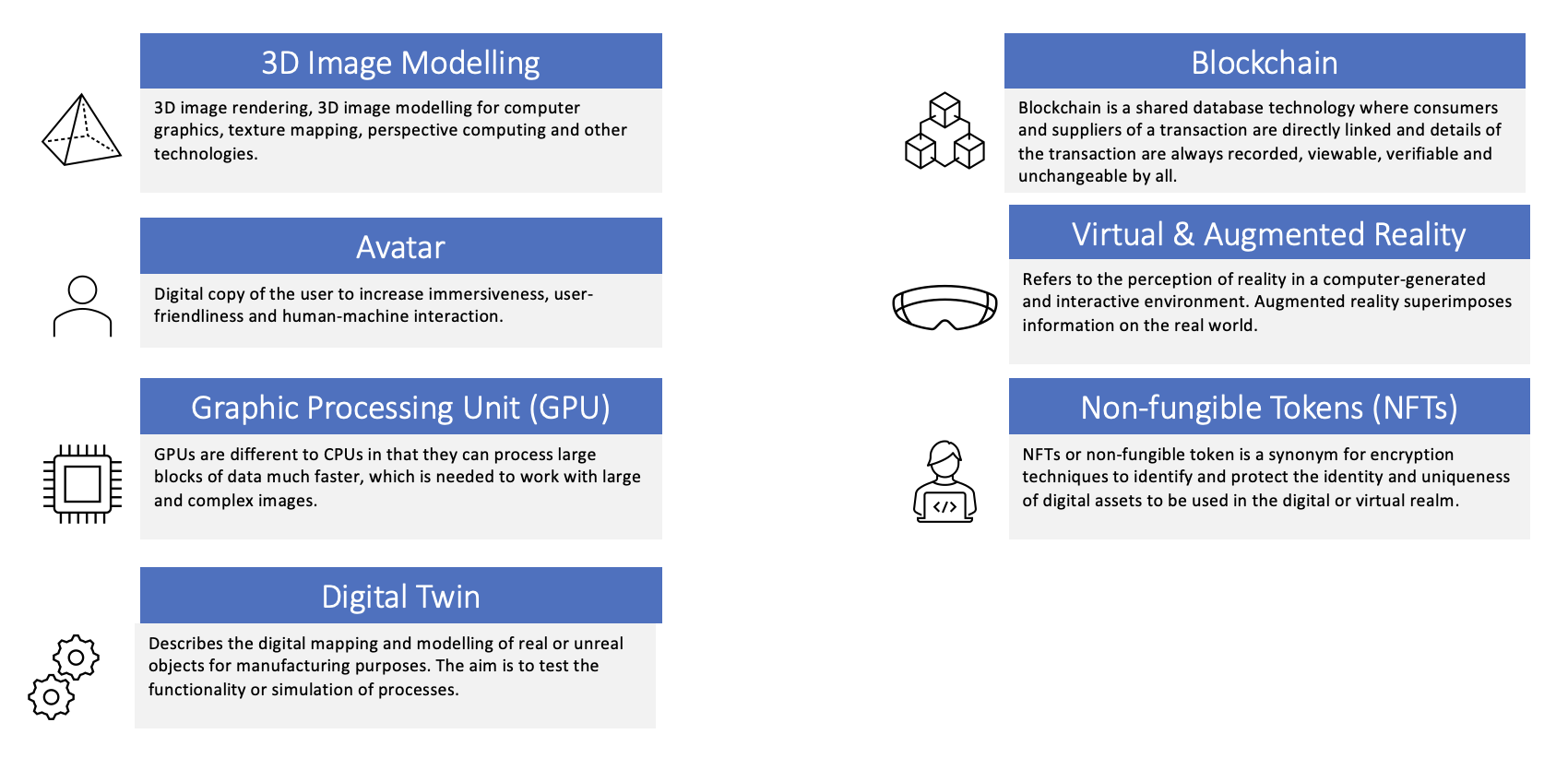

Specifically, the methodology focuses on seven technologies that have been identified as essential for the functioning and adoption of the Metaverse:

Figure 1 – Technologies in focus

In this way, investors are directly capturing the core of the targeted theme, but they are also indirectly harnessing the upside of broader themes such as digital infrastructure and online platforms.

High quality and specialization

The selection methodology combines two criteria: the number of high-quality patents (defined by a patent’s citation frequency and market coverage it has been applied for) and a company’s patents specialization (or the number of a company’s Metaverse-related patents divided by its entire patent portfolio). This dual selection process ensures a good balance of established players (e.g., Samsung, Microsoft, Sony) and emerging innovators (e.g., Coinbase, Roblox, Vuzix).

“The Metaverse is at the early stages of its lifecycle,” said Christoph Schon, Senior Principal, Qontigo Applied Research. “Therefore, patents are a vital, forward-looking indicator to determine which companies are likely to have a dominant position in this space once demand takes off in coming years. This is not a thematic strategy that can rely on backward-looking revenue streams to select key players as is the case with other, more mature themes.”

ESG exclusions

The index also takes ESG considerations into account: companies that are non-compliant with Sustainalytics’ Global Standards Screening (GSS) or are involved in controversial weapons activities are excluded. Additional exclusion filters screen out companies for product involvement in weapons, energy and tobacco.

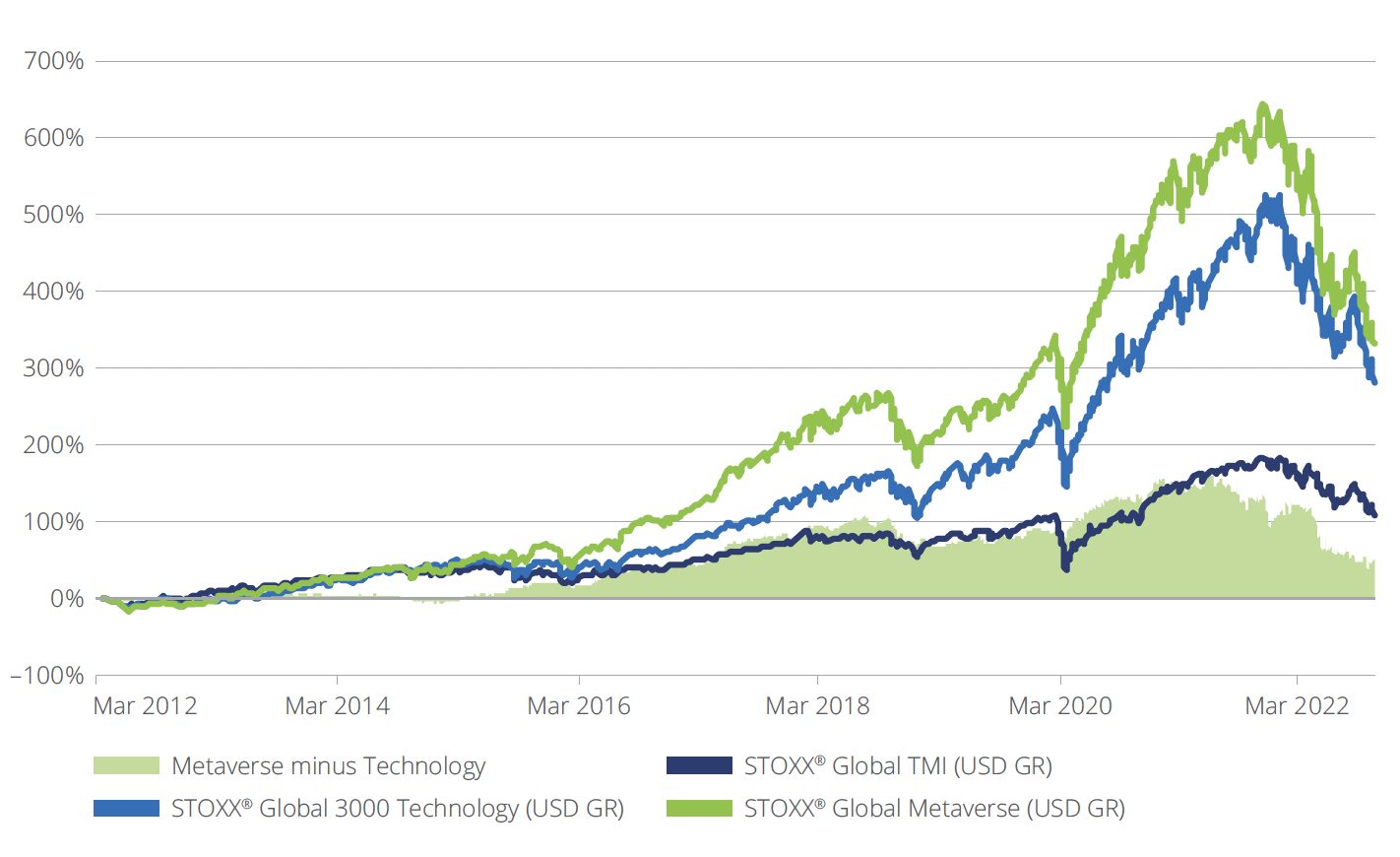

In the past ten years, the STOXX Global Metaverse has significantly outperformed the STOXX® Global TMI benchmark (Figure 2). It has also shown an edge over a traditional sector-based technology index.

Figure 2 – STOXX Global Metaverse performance

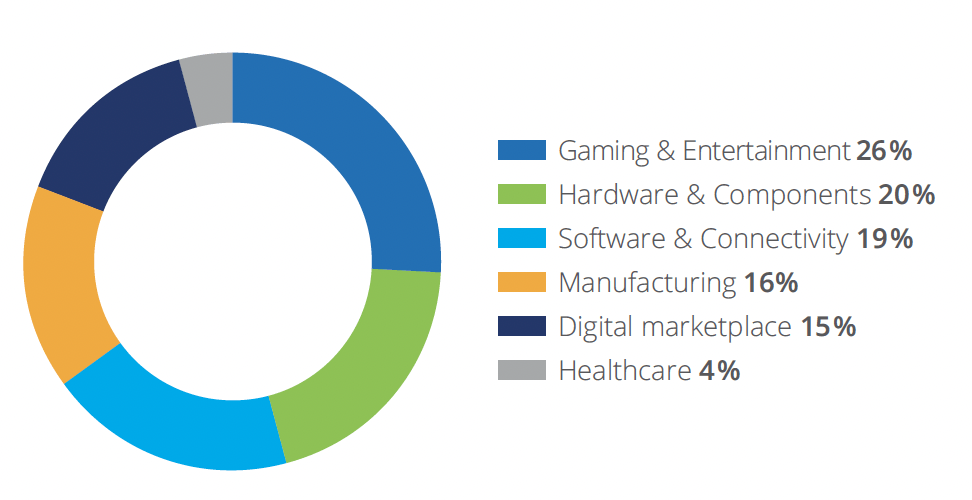

While some people may quickly relate the Metaverse to gaming companies, the space offers increasingly diverse exposure to other business sectors, as more industries step into the virtual universe and introduce related services (Figure 3).

Figure 3 – Index exposure, based on companies’ existing business lines

Growing collaboration

With this latest launch, BlackRock and Qontigo are expanding their partnership in thematic solutions. The collaboration dates to 2016 and has resulted in the issue of eight iShares ETFs, including funds tracking the STOXX® Global Automation & Robotics, STOXX® Global Breakthrough Healthcare and STOXX® Global Digitalisation.

The Metaverse promises to unveil a new world with infinite possibilities — one that could, in coming years, significantly change the way we live, socialize and transact business. The theme has the ingredients that are a must for thematic indices: disruptive technologies and a long-term growth focus. With the STOXX Global Metaverse, Qontigo is adding a new building block for investors to target the digital future through rules-based, systematic and transparent thematic strategies.

1 Bloomberg Intelligence, ‘Metaverse may be $800 billion market, next tech platform,’ Dec. 1, 2021.

2 McKinsey & Co., ‘Value creation in the metaverse,’ June 2022.

3 EconSight is a Swiss consulting company that specializes in measuring technological progress.