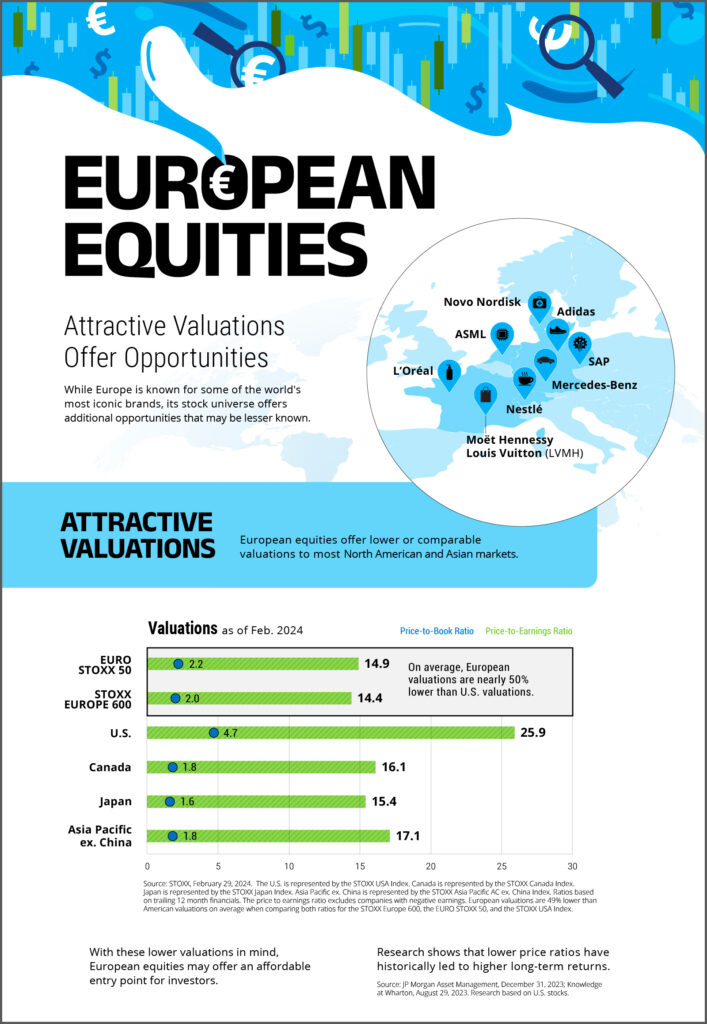

The EURO STOXX 50 tracks the Eurozone’s supersector leaders, resulting in a diversified and liquid portfolio. The index’s weighting is based on free-float market capitalization, with a maximum weight of 10 percent per constituent.

The blue-chip benchmark underlies more than 25 billion euros in ETF assets, while futures and options on the index are the most actively traded equity index derivatives on Eurex.1 More than 160,000 structured products are linked to the EURO STOXX 50.2

Details

Symbol

SX5E

Calculation

Realtime

Dissemination Period

09:00-18:00 CET

ISIN

EU0009658145

Bloomberg

SX5E Index

Last Value

5,970.47

-19.39 (-0.32%)

As of CET

Week to Week Change

1.33%

52 Week Change

13.27%

Year to Date Change

2.05%

Daily Low

5970.47

Daily High

6028.9

52 Week Low

4622.14 — 9 Apr 2025

52 Week High

6041.14 — 15 Jan 2026

Top 10 Components

| ASML HLDG | NL |

| SIEMENS | DE |

| SAP | DE |

| BCO SANTANDER | ES |

| ALLIANZ | DE |

| SCHNEIDER ELECTRIC | FR |

| TOTALENERGIES | FR |

| LVMH MOET HENNESSY | FR |

| BCO BILBAO VIZCAYA ARGENTARIA | ES |

| SIEMENS ENERGY | DE |

Zoom

Low

High

Featured indices

1 Data as of December 2023.

2 Source: Structured Retail Products.