COVID-19 was crucial because it highlighted how interconnected we are with other species and how unsustainable development increases the risk of pandemics.[1]

In a 2021 blog, we discussed why investors should care about biodiversity, its relationship with climate change, the related regulatory landscape, and challenges with data. We are in the midst of a nature crisis. Our future is critically dependent on our planet’s lives, ecosystems and temperature.

2022 milestones

The recent Living Planet Report 2022[2] from the WWF highlights the gravity of biodiversity destruction: the WWF’s Living Planet Index shows an average 69% decline in monitored wildlife populations around the world between 1970 and 2018.

In July 2022, the UN General Assembly passed a resolution recognizing access to a clean, healthy and sustainable environment as a human right. Although not legally binding, the UN calls upon states, international organizations, businesses and other stakeholders to “scale up efforts” to protect this right.

As we go to publication, world leaders are gathering at the 15th conference of the UN Convention on Biological Diversity (COP15) in Montreal, Canada, to find an agreement with the right level of ambition and measurability in the goals and targets to halt biodiversity loss by the end of this decade.

Thanks to novel measurement tools that open up new possibilities, investors are beginning to understand the corporate risks associated with biodiversity destruction and the inseparable link to climate change. Some money managers have launched funds that consider corporate impacts on biodiversity.

The biodiversity loss and the ecological footprint

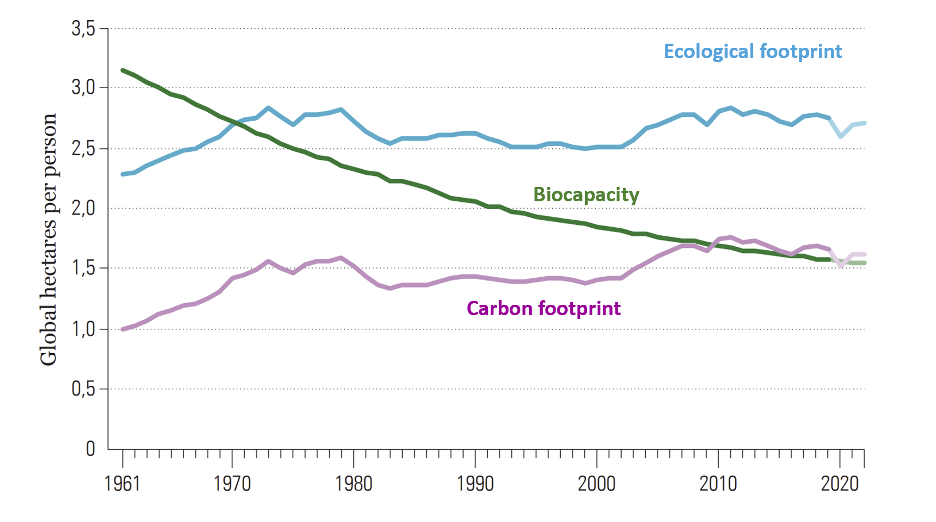

Our planet’s biocapacity is the ability of its ecosystems to regenerate[3], providing people with biological resources and absorbing the waste they produce. The ecological footprint, the demand put on biocapacity, exceeds Earth’s biocapacity by at least 75%, the equivalent to living off 1.75 Earths[4]. This overshoot erodes the planet’s health and, with it, humanity’s prospects.

Figure 1 – Global ecological footprint and biocapacity

Biodiversity loss has a negative impact on economic activity as well. The World Economic Forum has estimated that more than half of the world’s gross domestic product is moderately or highly dependent on the ecosystem.[6]

The link to climate change

The recent assessment reports from the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES)[7], and the Intergovernmental Panel on Climate Change (IPCC)[8], unambiguously document the link between climate change and the degradation of biodiversity.

Over the last 50 years, the human population has doubled, reaching 8 billion people in November. The world economy has grown nearly fourfold and global trade has grown tenfold. All this has dramatically increased demand for energy and materials. Economic incentives have generally favored expanding activity, often with environmental harm, rather than conservation or restoration.

This has caused a sharp increase in greenhouse gas emissions, habitat conversion, degradation from land-use change combined with pollution, and the introduction of invasive species. The consequences are known today: the mean global temperature and the frequency of extreme weather events have increased, as have the number of species threatened with extinction.

Land-use change is currently the biggest threat to nature. However, if we are unable to limit warming to 1.5°C below pre-industrial levels, climate change is likely to become the dominant cause of biodiversity loss in coming decades. Unlike changes to climate, which could be reversible even if it may take thousands of years, species extinctions and the eradication of ecosystems are permanent.

The importance of COP15

Biodiversity loss is ranked as one of the biggest threats facing humanity and around a million species are threatened with extinction[9]: we urgently need a plan that unites the world in dealing with this existential challenge.

Such is the urgency as COP15 gathers. It will be important to find a consensus at the summit on the 30×30 target (an objective to protect 30% of land and sea by 2030) and preserve the rights of indigenous peoples. Currently, about 17% of the world’s land is protected and just 8% of the global ocean is under some sort of conservation scheme[10].

The ultimate goal is to slow down biodiversity loss, halt it by 2030 and achieve full recovery by 2050. While awareness of the challenge is greater than ever, the international community failed to achieve the Aichi Biodiversity Targets agreed in Japan in 2010 to slow the loss of the natural world[11].

Regulatory action is accelerating

Meanwhile, regulators are putting the focus on companies’ biodiversity-related behavior.

In 2021, the Taskforce on Nature-related Financial Disclosures (TNFD) was established to integrate nature in financial and business decisions. TNFD will deliver in 2023 a framework for organizations to report and act on evolving nature-related risks and opportunities. The ultimate goal is to orient global financial flows toward nature-positive outcomes.

Europe is taking a strong lead in seeking environmental data with the EU Taxonomy for sustainable activities, which will determine what business activities contribute towards — or hamper — six environmental objectives.[12] Disclosure requirements for biodiversity objectives will apply from January 1, 2023.

In France the new Article 29 of the French law on Energy and Climate sets detailed requirements on disclosures across both biodiversity and climate. From 2022, financial institutions are required to publish information on the portion of their assets complying with the environmental criteria set out in the EU Taxonomy.

Biodiversity considerations in indices

It is becoming increasingly clear[13] to investors that mismanagement of biodiversity entails risks for companies. These include:

- Physical risk: loss of raw materials, disruption of operating environment.

- Litigation risk: increasing legislation, e.g., EU action plan for sustainable finance.

- Transition risk: change in market preferences, civil society campaigns.

With the recent regulatory developments, better understanding of biodiversity risks and enhanced data availability, we are ready to address how investors can practically integrate biodiversity considerations within fund approaches. There are solutions emerging in the market from various angles: risk management, new revenue generation and managing real-world impact.

The best starting point is to identify the specific objective behind such investments. Investors should ask themselves whether they are looking for companies that:

- are minimizing their negative impact on biodiversity; or

- are providing products and services that contribute to biodiversity solutions; or

- are managing any material biodiversity risks effectively.

Based on the specific objective, investors can then identify the right datasets and index design options. Data providers such as ISS ESG, Sustainalytics, Clarity AI and SDI AOP have developed comprehensive revenue datasets mapped to specific activities, or to the United Nations’ Sustainable Development Goals (SDGs), of which biodiversity is a key part.

Secondly, biodiversity risks are captured as metrics in several broad ESG datasets. These are useful to capture the level of materiality of ESG risks for specific companies based on their sectors, geographies and jurisdictions, as well as how well a company is managing them.

Lastly, we now see new and existing data providers producing biodiversity metrics to help investors measure the impact of their investment portfolios on biodiversity in alignment with scientific and economic frameworks.

The two most widely used metrics are the Mean Species Abundance (MSA) and the Potentially Disappearing Fraction of Species (PDF).

Qontigo’s data partner ISS ESG has recently released a dataset providing company-level PDF assessments, which measure the potential loss of species in a given area over a specific period of time.

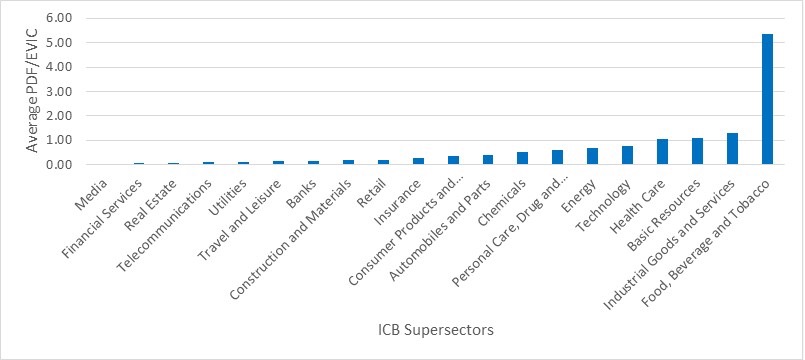

We decided to explore how companies perform on biodiversity using ISS ESG’s PDF indicator. Figure 2 shows aggregated PDF/EVIC[14] values across sectors (higher PDF values indicate a higher level of impact on biodiversity).

Figure 2 – Negative impact on biodiversity by Supersector

As the chart shows, there are significant disparities in the biodiversity impact of Supersectors. The most at-risk industry (highest PDF/EVIC values) is Food, Beverage and Tobacco. Industrial Goods and Services, Basic Resources and Health Care follow.

The path ahead

The recognition of biodiversity as a material risk and regulatory pressures are greatly bolstering investor interest in the topic. Investors are now able to translate this interest into real fund approaches thanks to innovation and enhancements in datasets that can support the integration of various biodiversity-linked objectives in investment decision-making.

There is strong hope that COP15 could be nature’s ‘Paris Agreement.’ Just as in the case of climate action, the role of investors will be crucial. We expect a significant increase in the number and size of funds invested in biodiversity-sensitive strategies.

Biodiversity is a key topic of development for Qontigo given our strong focus on building collaborative solutions for sustainable investments, best-of-breed data and partnerships, and robust regulatory monitoring.

* Antonio Celeste is Director for Sustainability Product Management at Qontigo, and Saumya Mehrotra is Associate Principal, Sustainability Product Management.

[1] See Jeff Tollefson, ‘Why deforestation and extinctions make pandemics more likely,’ Nature, Aug. 7, 2020.

[2] Living Planet Report 2022, WWF.

[3] Wackernagel, M., Hanscom, L., Jayasinghe, P., Lin, D., Murthy, A., Neill, E. & Raven, P. (2021). ‘The importance of resource security for poverty eradication,’ Nature Sustainability, 4(8), 731–738.

[4] York University, Ecological Footprint Initiative & Global Footprint Network (2022). National Footprint and Biocapacity Accounts, 2022 edition. Produced for the Footprint Data Foundation and distributed by Global Footprint Network.

[5] Carbon footprint measures carbon emissions from fossil fuel burning and cement production. These emissions are converted into forest areas needed to sequester the emissions not absorbed by oceans.

[6] ‘Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy,’ World Economic Forum, January 2020.

[7] IPBES (2019), ‘Global assessment report on biodiversity and ecosystem services of the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (Version 1)’.

[8] IPCC (2021), ‘Climate Change 2021: The Physical Science Basis,’ Summary for Policymakers (p. 32). IPCC (2022), ‘Climate Change 2022: Impacts, Adaptation and Vulnerability,’ Summary for Policymakers. IPCC (2022), ‘Climate Change 2022: Mitigation of Climate Change,’ Summary for Policymakers.

[9] IPBES, media release issued May 6, 2019.

[10] UNEP, Protected Planet Report 2020.

[11] Global Biodiversity Outlook 5, Convention on Biological Diversity.

[12] The EU Taxonomy regulation establishes six environmental objectives: climate change mitigation, climate change adaptation, sustainable use and protection of water and marine resources, transition to a circular economy, pollution prevention and control, and protection and restoration of biodiversity and ecosystems.

[13] Qontigo is a signatory to the Principles for Responsible Investment (PRI).

[14] Enterprise Value Including Cash (EVIC) is the sum of the market capitalization of all issued equity plus total debt, minorities’ interests and cash holdings.