The sharp market downturn in the past four weeks has also shaken equity options prices, which have shifted briskly from deep calm to unprecedented panic.

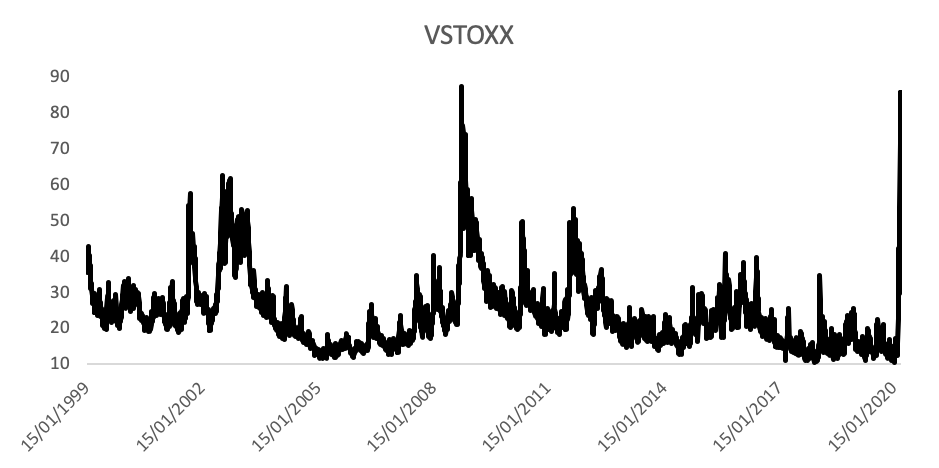

The EURO STOXX 50® Volatility Index, or VSTOXX®, climbed to 85.6 on Mar. 16 this year, its highest level since 1999 except only for one day in October 2008 during the depths of the global financial crisis (Chart 1). The index tracks real-time options prices for the EURO STOXX 50® Index, thus reflecting market expectations of future – or implied – volatility in Eurozone stocks. Mar. 12, 2020 marked the steepest daily jump for the volatility index on record amid concern about the economic disruption caused by the novel coronavirus.

Chart 1 – The fear gauge

As markets fall or rise, prices for options tend to move in opposite direction mostly because investors buy portfolio protection. On Mar. 12, 2020 the EURO STOXX 50 Index logged its widest daily loss on record: -12.4%. The blue-hip benchmark has tumbled 36.6% since Feb. 19 this year on a gross-return basis.

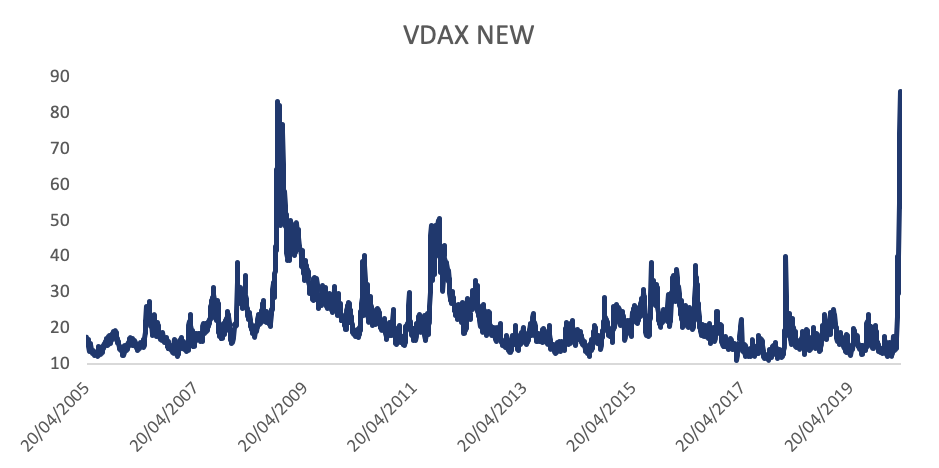

German options are pricing an even more volatile market than in 2008. The VDAX-NEW® Index, which tracks the price of options on Germany’s benchmark DAX® Index, touched on Mar. 16 its highest level ever (Chart 2).

Chart 2 – DAX options

Volatility in decline amid bull market

The volatility spike came right on the heels of deep calm in equity markets. Volatility, both implied by options prices and realized in share prices, has subsided since the financial crisis. On Jan. 17 this year, the VSTOXX fell to 10.7, its second-lowest reading since data begins. As such, the speed at which sentiment deteriorated between Feb. 19 — when the EURO STOXX 50 traded at a record high1— and Mar. 16 is unprecedented in the volatility index’s history.

Mean reversions

If the recent move represents a systemic increase in volatility not seen in over a decade, it could also offer a trading opportunity — provided history and the VSTOXX’s usual pattern are any guide.

According to Qontigo’s Index Product Management team, the most important property of volatility is that it is mean-reverting,2 meaning it has a tendency to revert back close to an average value over the medium to long term.

Investors also need to be cognizant of the asymmetry between volatility’s up and down swings, according to Anand Venkataraman, Head of Index Product Management at Qontigo.

“Upward movements in volatility are typically short, intense, and usually not foreseeable, making it extremely difficult to employ a strategy that tracks a trend of rising volatility,” Venkataraman wrote in a report last year. “In contrast, jumps in volatility are typically followed by a period of falling volatility towards its medium- to long-term average levels.”

Investing in volatility

From this it follows that strategies that go short volatility after sudden spikes may prove rewarding. However, timing such a strategy may prove difficult.

One way to target such a strategy is through Eurex-listed futures and options on the VSTOXX Index, which offer an accurate and cost-effective way to take a directional view on European volatility. Trading in the derivatives has grown steadily to record volumes in recent years as more investors turn to the VSTOXX as a gauge of political and market risk in Europe.

Vol-of-vol, volatility strategy indices

Beyond the VSTOXX index, investors can resort to other means to track volatility. The EURO STOXX 50® Volatility of Volatility Index (V-VSTOXX), for example, measures the implied volatility of options on VSTOXX futures, hence reflecting expectations regarding the volatility of volatility.

Elsewhere, Qontigo’s volatility strategy indices include the EURO STOXX 50® Investable Volatility Index, which measures forward implied volatility in the Eurozone equity market, the VSTOXX® Short-Term Futures and VSTOXX® Mid-Term Futures Indices, VSTOXX® Short-Term Futures Investable Index and VSTOXX® Short-Term Futures Inverse Investable Index.

Option-writing strategies

Qontigo also offers indices tracking popular option-writing strategies. These include the EURO STOXX 50® BuyWrite Indices and the DAXplus® Covered Call Index, which recreate the strategy of holding a long position in an underlying while selling a call option on it. The EURO STOXX 50® PutWrite Index replicates a collateralized strategy of writing put options on the EURO STOXX 50 Index on a monthly basis.

Option-write strategies produce extra income and lower volatility compared with traditional equity long-only positions, and typically tend to outperform during market downturns. The higher the market’s implied volatility, the larger the income generated by the strategies. However, the performance of such strategies is influenced by market volatility and by the underlying asset’s returns and hence is not a plain investment strategy for volatility.

Finally, the EURO iSTOXX® 50 Collar Index is a strategy that combines two types of options. A collar is constructed by owning shares of a security while simultaneously buying puts and selling calls on it. The collar strategy attempts to limit the risk or volatility by capping both the upside and downside of the position.

Venkataraman does warn that, in any case, a constant directional view on volatility may not be deemed a profitable strategy in the long run due to the lack of direct returns from volatility and its mean-reversion property.

Opportunity to manage volatility

The current jump in volatility is exceptional, as historic data shows. While price moves of this sort can create market distortions, they also present opportunities for investors to manage a portfolio’s risk and returns more efficiently.

1 Record high when measured in gross returns in euros. Highest level since 2008 on a price level.

2 Venkataraman, A., ‘Volatility – An Investable Asset Class,’ STOXX, January 2019.