The calculation behind VSTOXX® (EURO STOXX 50® Volatility index), the flagship gauge for European volatility, is being adjusted to strengthen the index’s trading ecosystem.

All indices in the VSTOXX family have a settlement level that is calculated on the 30th calendar day preceding the expiry of VSTOXX options on Eurex.[1] A settlement level is calculated as the arithmetic average of all index ticks over a time window of 30 minutes — i.e. progressively enlarging the observation period. Following a market consultation, STOXX will extend that interval from 30 to 60 minutes, starting at 11 a.m. CET (from 11:30 a.m. currently) and ending at 12:00 p.m. The change will come into effect on September 16, 2024.

As Zubin Ramdarshan, Head of Equity & Index Product Design at Eurex, explained in a recent interview, increasing the so-called time-weighted average price (TWAP) window will help VSTOXX market makers take on bigger positional risk into the expiry, fostering liquidity and making volatility ideas executable for end customers.

Implied volatility

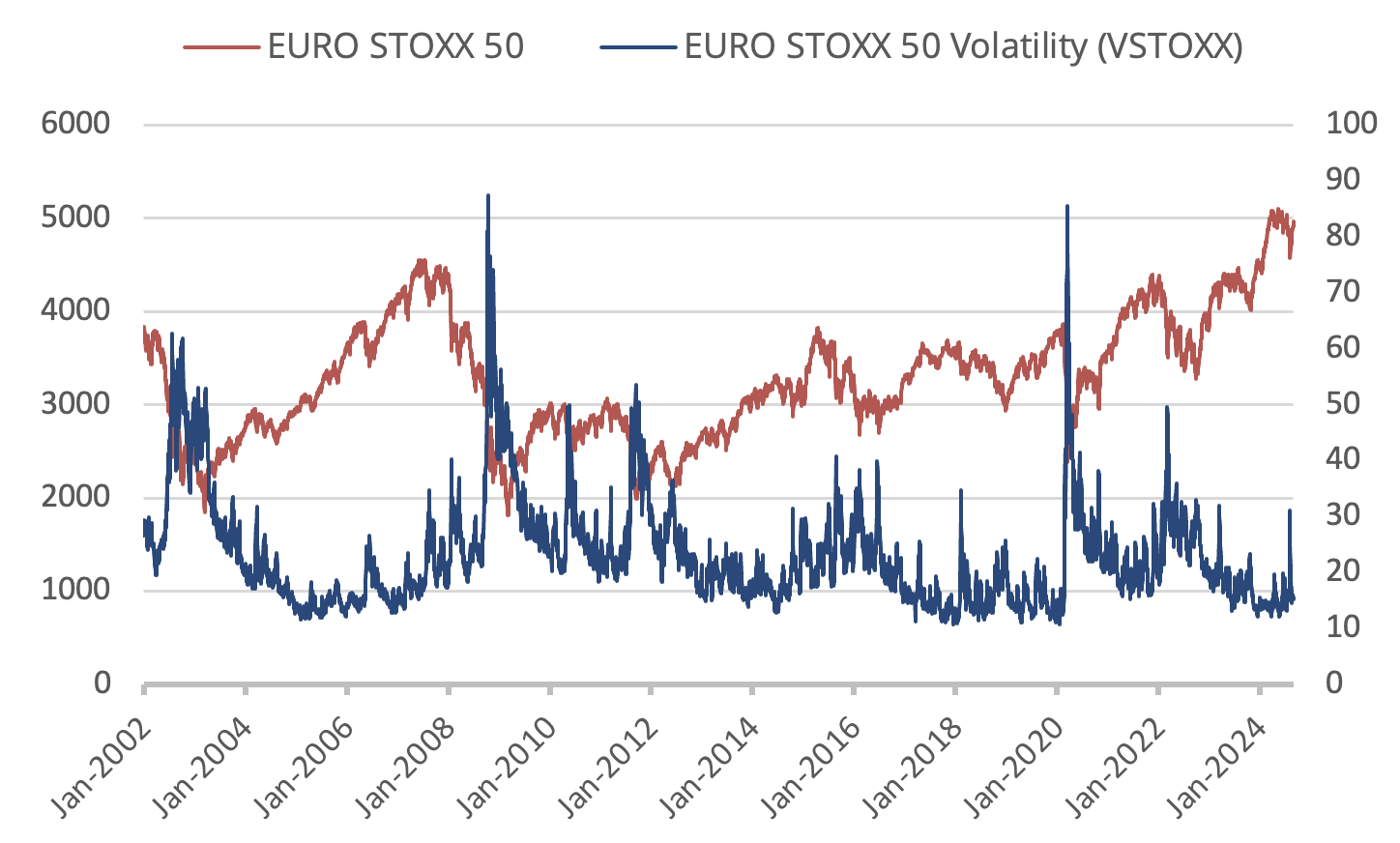

VSTOXX indices track real-time options prices for the EURO STOXX 50® benchmark, thus reflecting market expectations of future volatility – also known as implied volatility – in Eurozone stocks. As markets fall or rise, prices for options tend to move in opposite direction. This responds to investors and traders buying or selling protection (puts) against increasing future moves, prompting changes in implied volatility.

Although the main index VSTOXX 30 days is the most popular – and is usually referred to as “the VSTOXX” – eleven other main indices are calculated, covering fixed maturities up to 360 days in increments of 30 days.

Figure 1: VSTOXX comparison to EURO STOXX 50

“The VSTOXX is the undisputable benchmark for European volatility and increasingly an instrument used by investors to manage and hedge portfolios, and implement directional strategies,” said Ramdarshan at Eurex. “By enhancing the liquidity around VSTOXX futures and options, we are essentially facilitating those trades and maximizing the possibilities that volatility trading can bring.”

As volatility spiked in August, market participants turned to VSTOXX derivatives as a way to protect portfolios, among other strategies. On August 5 this year, a total of 212,111 futures[2] traded on Eurex, the fourth-busiest day since the products were listed in 2009. The EURO STOXX 50 fell 6.2% in the three sessions through August 5 amid concern that the US economy may slow down faster than previously expected.

For more on the VSTOXX methodology, please click here.

[1] The VSTOXX indices are based on market prices of Eurex’s EURO STOXX 50 index options. The VSTOXX does not measure implied volatilities of at-the-money options, but the implied variance across all options of a given time to expiry.

[2] Futures on the VSTOXX show the expectation of where the 30-day implied volatility will be at the futures’ expiration date.