After rising in tandem with other investment styles for most of 2019, value stocks — those trading at below-average valuations — have since May slipped back to the bottom, adding to their multi-year lagging record.

Investors are favoring, instead, more risk-averse company factors such as low volatility and strong balance sheets.1

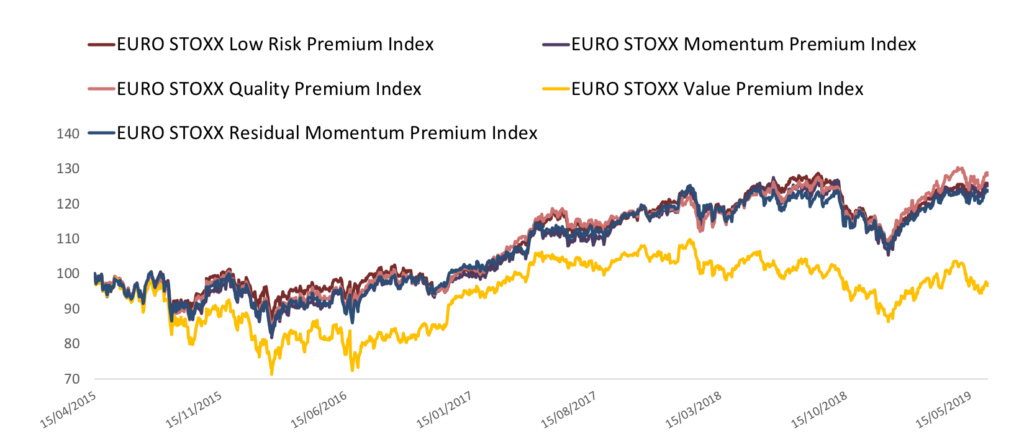

Chart 1 compares the performance of the EURO STOXX® Single Premium Indices for value, quality, momentum and low risk. The last three, together with residual momentum, are the best-performing factors among eight EURO STOXX Multi Premia® and Single Premium Indices in the past one, two and three years.

Chart 1

Record low trading for value

The EURO STOXX® Value Premium Index has fallen 6.2% since the start of May, the worst performance among the STOXX premia indices. Since rallying to a record high in April 2015, the Value Premium Index has fallen 3.3%, compared with an average advance of 26.3% for the other three factors in Chart 1. The EURO STOXX Value Premium Index is trading at a record low relative to the low risk, quality and momentum indices since data begins in 2004.

For a review of the EURO STOXX Single Premium and Multi Premia Indices’ methodology, please click here.

Macro headwinds

Two possible explanations exist for the underperformance of value shares. Firstly, the group tends to do better in the initial stages of a market upside, when investors regain confidence in an economic acceleration. Concerns that the US economy may have peaked in the current cycle, coupled with trade tensions, may have weighed on optimism.

Secondly, sector make-up has played against the value universe. The EURO STOXX Value Premium Index is overweight the three worst-performing industries since the start of May: basic resources, banks and carmakers. The three sectors have suffered from, respectively, fears of a global economic slowdown, expectations of lower interest rates and the threat of new tariffs on European exports.

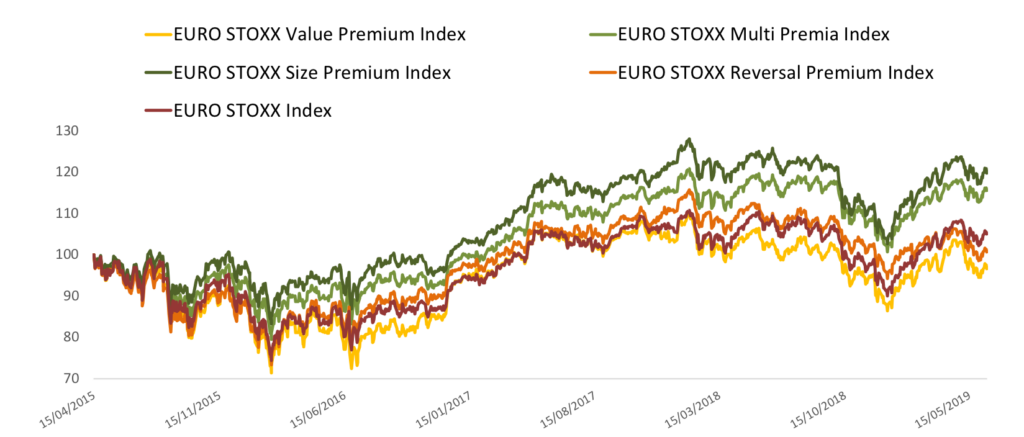

Chart 2 shows the performance of the EURO STOXX Value Premium Index against the remaining three styles in the premia set — reversal premium, size and multi-premia — as well as the benchmark EURO STOXX® Index. Again, the value measure is the worst performer during the period.

Chart 2

To be sure, value investing is a strategy with a long tradition that has paid off in past decades. Even more recent history may give value investors some optimism. Last time the EURO STOXX Value Premium Index underperformed the benchmark EURO STOXX Index by this much in a similar time frame, back in July 2016, markets went on to rally in the ensuing ten months. The value gauge took the lead during that recovery, outperforming the benchmark by 7.6 percentage points.2

Featured indices

EURO STOXX® Multi Premia® and Single Premium Indices

1 Bloomberg, ‘Stock Investors Are Getting Smarter as the Threats Stack Up,’ Jun. 17, 2019.

2 Net returns in euros, Jul. 7, 2016 – May 11, 2017.