Assets managed under responsible mandates worldwide grew 15% between the end of 2017 and the end of 2019, outpacing the growth of the broader market, according to the Global Sustainable Investment Alliance (GSIA).

Investments in environmental, social and governance (ESG) strategies leaped to USD35.3 trillion from USD30.7 trillion during the review period, the GSIA said in its fifth biennial Global Sustainable Investment Review published on Jul. 19. That outpaced the 7.2% expansion rate in total assets under professional management during the period.

US-based ESG assets jumped 42% in the two years, more than compensating for a decline in European assets that resulted from a change in ESG definitions. Sustainable investing made up of 35.9% of total assets under management globally, up from 33.4% in end-2017 and 27.9% in end-2015, the GSIA said.

Multiple drivers

Sustainable investing has become the norm for many of the world’s largest asset owners and asset managers, and regulators are stepping in to draw rules that can add transparency and momentum to the process. Meanwhile, retail investors are also steadily adopting responsible strategies. A survey from the Index Industry Association (IIA) published last week showed that driving the trend is client demand, a desire for increased and diversified returns, concerns regarding ESG factors (climate, corporate governance, etc.), as well as reputational or regulatory risk.

“ESG is rapidly re-shaping all corners of the investment landscape and this has only intensified since the GSIA study period concluded at the start of 2020,” said Rodolphe Bocquet, Global Head of Sustainable Investment at Qontigo. “Underneath the top-line growth in assets, important dynamics and developments are unfolding. The industry’s perception of, and approach to, sustainability is evolving, with the focus placed on measurement, best practices, standardization and real-world impact.”

The GSIA groups the regional and country membership-based sustainable investment organizations, so its findings and statistics are as complete and official as it can get. The STOXX® Global 1800 Index rose 17.4% in the two-year period considered by the GSIA study, while the STOXX® Global 1800 ESG-X Index climbed 18.1%.1

Europe tightens definitions

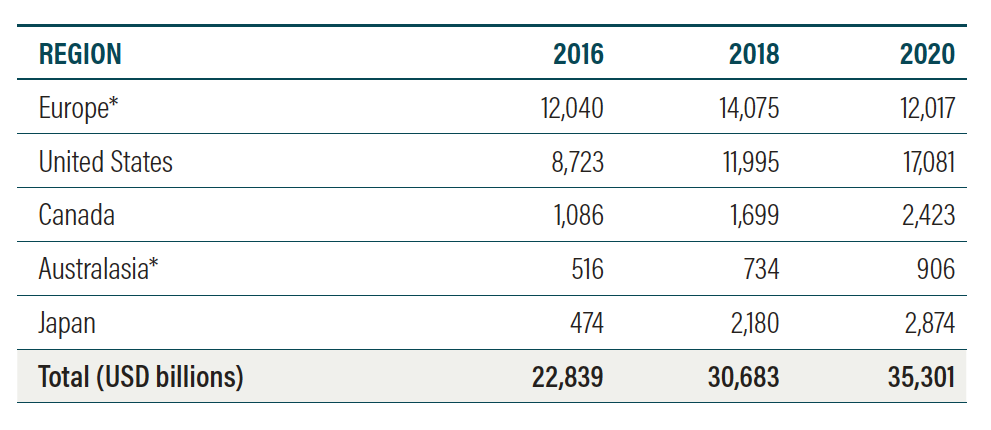

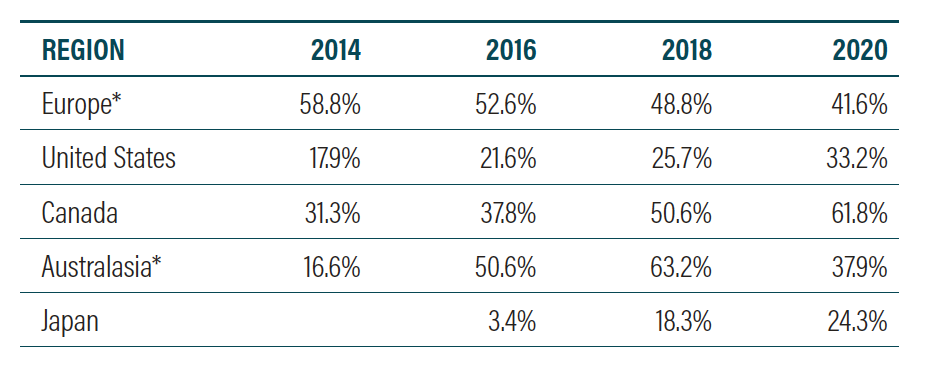

ESG’s market share of professionally managed assets grew in the two-year period in all regions except Europe (Figure 1). The cause was a tightening of sustainable investing definitions from which European data is drawn, reflecting new laws as part of the European Sustainable Finance Action Plan, the GSIA said.

“In Europe, this was driven in large part by a strong legislative push that now explicitly sets out sustainability standards for sustainable finance products,” the GSIA said in an executive summary to the report. Speaking during a webinar, Simon O’Connor, Chair of the GSIA, explained that the reduction reflected a broader increase in requirements and standards of what constitutes an ESG investment in Europe.

Figure 1 – Snapshot of global sustainable investing assets

Regional picture

As a result, sustainable investing now accounts for 42% of all managed assets in Europe, down from 49% at the end of 2017 (Figure 2). The proportion of assets committed responsibly in the US, where definitions didn’t change, increased to 33% of the total from 26%.

In Australia and New Zealand, industry-driven changes in the definitions of ESG assets also affected the value of capital invested, the GSIA explained.

Figure 2 – Proportion of sustainable investing assets relative to total managed assets

Europe now accounts for 34% of global sustainable assets, down from 46% in 2017, the report showed. The US has jumped to the top rank, representing a 48% share, up from 39% two years earlier.

Sustainable investing through passive vehicles

Qontigo’s STOXX index unit has advanced sustainable investing since 2001 and now counts a comprehensive suite of sustainable index solutions targeting a range of ESG, low carbon and climate impact strategies. This includes, for example, the EURO STOXX 50® ESG, the DAX® 50 ESG and DAX® ESG Target indices, the STOXX® ESG-X indices and the STOXX Climate Benchmark Indices.

US investors seeking a responsible and sustainable index-based approach to domestic portfolios also have several alternatives to reflect distinct levels of ESG penetration. A recent Qontigo whitepaper analyzes three ESG alternatives to the STOXX® USA 500 benchmark: the STOXX® USA 500 ESG Broad Market, STOXX® USA 500 ESG Target and STOXX® USA 500 ESG Target TE.

Popularity of sustainable investing strategies

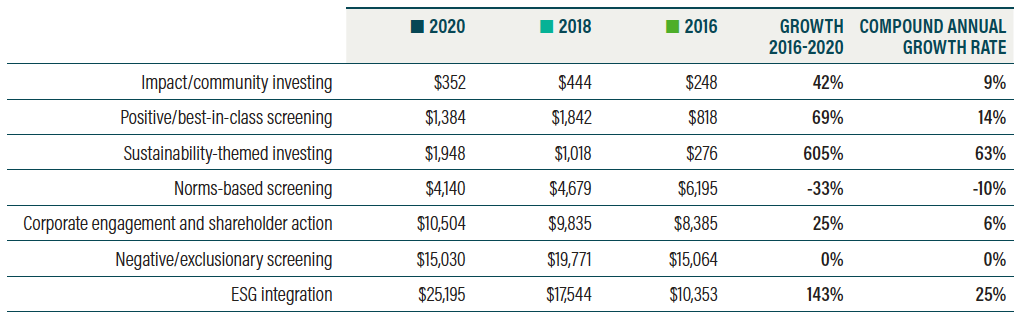

ESG integration — the systematic and explicit inclusion of ESG factors into financial analysis — took over from negative or exclusionary screening as the most popular strategy among the seven GSIA-defined categories within sustainable investment. Around USD25.2 trillion were managed in ESG integration strategies at the end of 2019, up from USD17.5 trillion two years earlier, the GSIA report said.

Sustainability-themed investing, and corporate engagement and shareholder action were the only two other strategies to increase in value. This was a change from the previous two years, when all strategies but one — norms-based screening — grew. 2

Figure 3 – Global growth of sustainable investing strategies

However, the GSIA warned that any picture of total assets invested by strategy should only be taken as a guidance rather than a full representation of holistic trends, as the analysis is impacted by changing definitions by region and by multiple combinations of the strategies.

Overall, the 300 European and US investors consulted as part of the IIA ESG survey published last week expect ESG assets to grow to 44% of their portfolios over the next five years, from 27% in twelve months’ time.

1 Net returns in dollars.

2 The following are GSIA definitions: Sustainability themed/thematic investing is the investment in themes or assets specifically contributing to sustainable solutions such as sustainable agriculture, green buildings, lower-carbon-tilted portfolio, gender equity and diversity. Corporate engagement & shareholder action employs shareholder power to influence corporate behaviour, including direct corporate engagement, the filing of shareholder proposals, and proxy voting that is guided by ESG guidelines. Norms-based screening is the screening of investments against minimum standards of business or issuer practice based on international norms.