Trading in STOXX® Europe 600 ESG-X Index (FSEG) futures, the world’s most popular sustainability-focused derivatives, has topped 1 million contracts this year, as more traders and investors turn to the products to manage responsible portfolios.

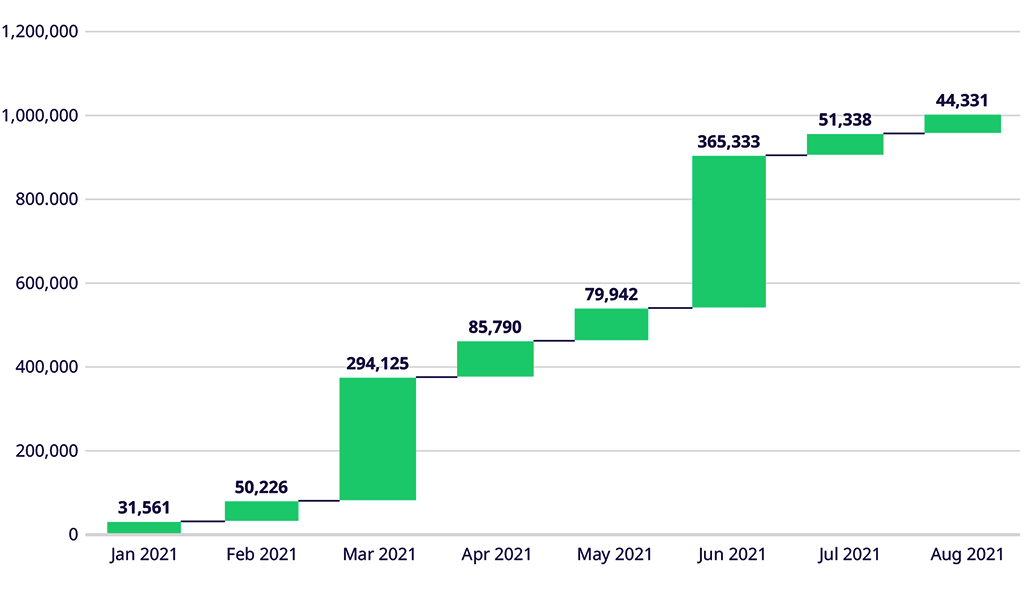

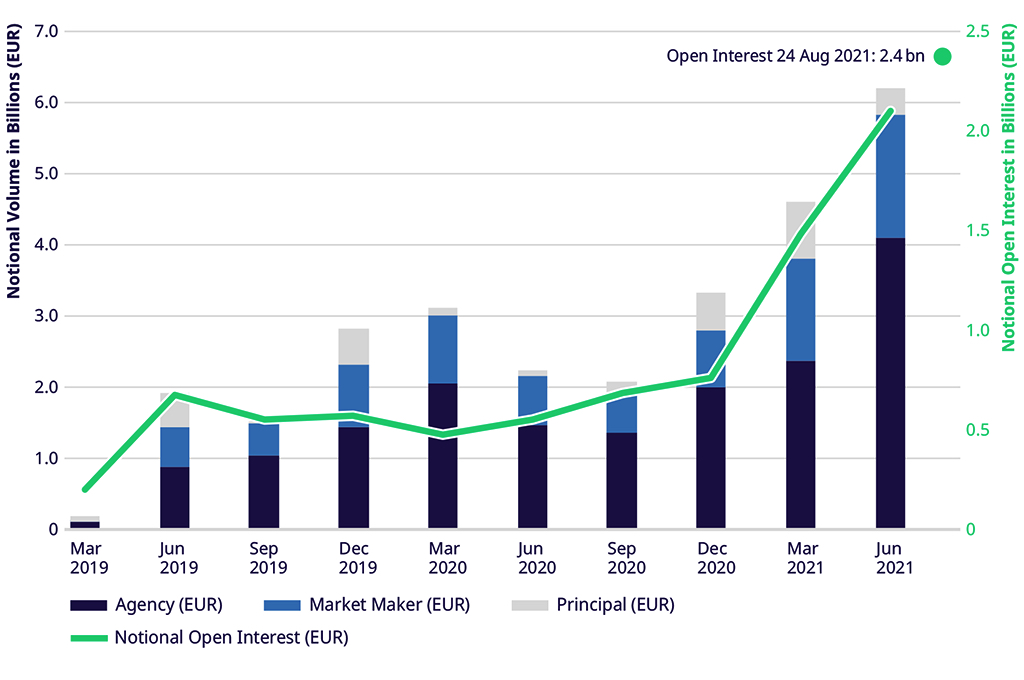

A total of 1,002,646 futures contracts exchanged hands in 2021 as of Aug. 24, a record annual high for any ESG instrument traded on Eurex and a 56% jump from the same period last year. The value of traded volume in the futures has reached EUR 16.5 billion euros this year. Open interest in the products stood at EUR2.5 billion this week, up from EUR 641 million a year earlier.

“Interest and assets continue to increase in the listed ESG derivatives market, which provides a much-needed sustainable choice to investors,” said Hamish Seegopaul, Head of R&D, ESG and Quantitative Indices at Qontigo. “This is both testimony to the relentless adoption of sustainable investing and to the innovation and convenience of the investment products.”

The STOXX Europe 600 ESG-X Index futures were listed in February 2019, while options started trading in October that year. The futures attracted immediate investor interest as an efficient way to replicate the underlying equity market and a cost-effective solution to comply with responsible principles. A total of 263,114 options on the index have traded so far in 2021, with open interest currently standing at EUR 962 million.

Surge in demand

The Europe 600 ESG-X futures are part of a broader ESG segment at Eurex that has seen interest swell in the past year. The exchange reported last month that open interest in the segment stood at EUR 3.5 billion at the end of June, made up almost entirely by STOXX-underlied instruments, while the value of total traded volume in the second quarter exceeded EUR 22 billion. The ESG derivatives space has beaten records in daily and monthly traded contracts this year, Eurex said.

Figure 1 – Number of traded STOXX Europe 600 ESG-X Index futures

Figure 2 – STOXX Europe 600 ESG-X Index futures: notional traded volume and notional open interest

Benefits of ESG derivatives

ESG derivatives give investors the ability to hedge, manage portfolio positions and materially lower trading costs with instruments that are fully compliant with their sustainability principles. STOXX and Eurex have been at the world’s forefront in the rollout of the derivatives, coinciding with the rapid growth of ESG mandates in Europe.

Global coverage in ESG exclusions

STOXX’s ESG-X family is composed of versions of established STOXX benchmarks that apply exclusionary screens based on the responsible policies of large asset owners. The indices exclude companies in breach of Sustainability’s Global Standards Screening, as well as those involved with controversial weapons, thermal coal and tobacco.

Listed derivatives on the ESG-X family also include futures on the STOXX® USA 500 ESG-X Index, which were at the time of listing the first derivatives in Europe tracking ESG exclusions on US stocks and the first worldwide to include a screening for thermal-coal mining and coal-fired power plants.

ESG integration

Since November 2020, two Qontigo second-generation ESG indices — the EURO STOXX 50® ESG Index and DAX® 50 ESG Index1 — also underlie futures and options on Eurex. Both apply exclusionary screens for activities that are undesirable from a responsible-investing perspective, and additionally integrate sustainability parameters into stock selection.

Other available ESG derivatives include futures on the STOXX® Europe Climate Impact Ex Global Compact Controversial Weapons & Tobacco Index, EURO STOXX 50® Low Carbon Index, and futures and options on the STOXX® Europe ESG Leaders Select 30 Index.

1 Contracts track the index in its EUR price return version.