After more than two years of work, the Taskforce on Nature-related Financial Disclosures (TNFD) has issued its framework of recommendations for companies and financial firms to identify, assess, manage and disclose nature-related issues. The framework has been devised to become a metrics standard and provides guidance on nature-related assessment and disclosure.

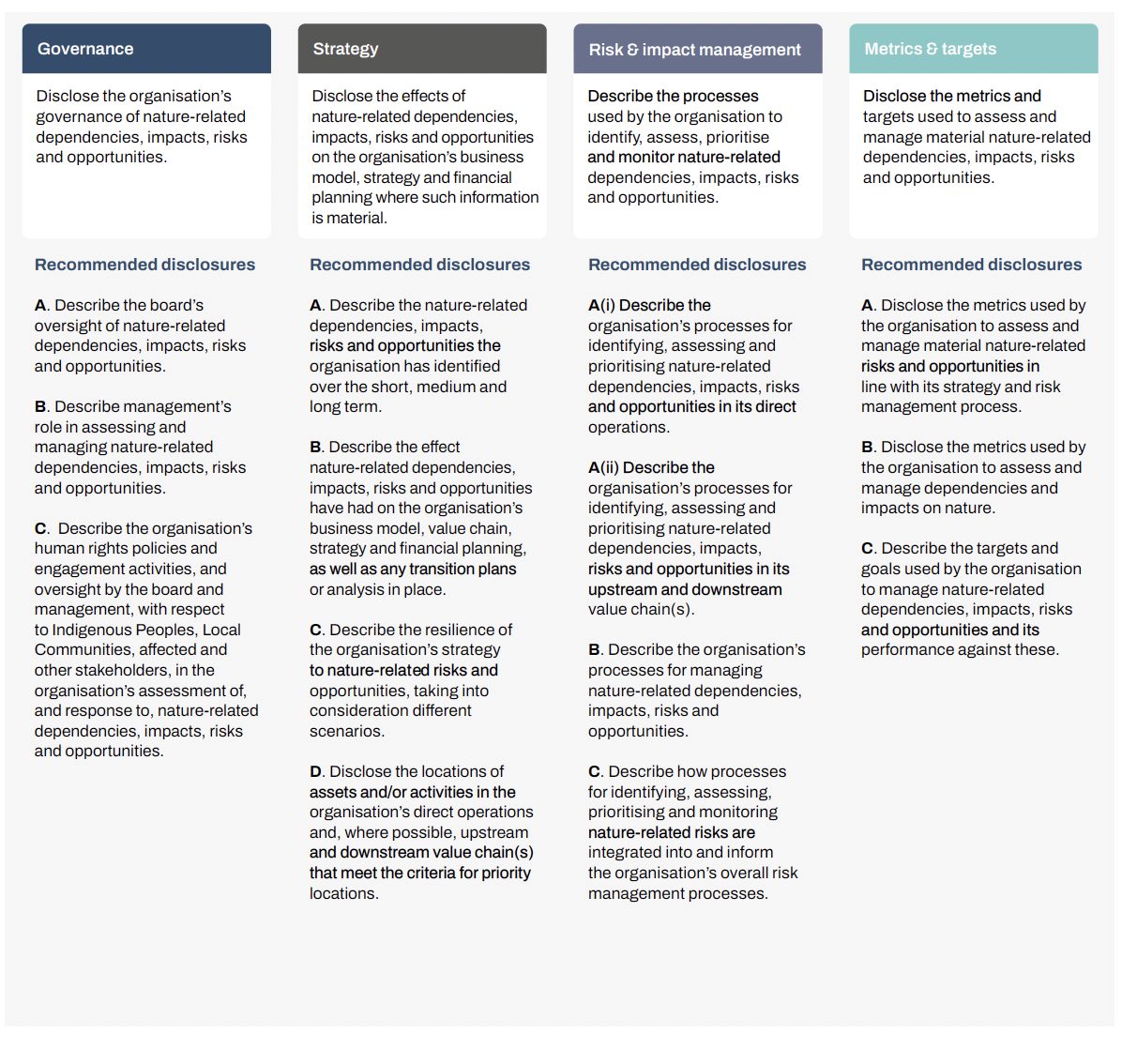

The TNFD recommendations set a road map to guide companies in integrating nature into their governance, strategy, risk and impact management, and metrics and targets. Under four pillars, there are 14 recommended disclosures (Figure 1) covering nature-related topics that echo those in the Task Force on Climate-related Financial Disclosures (TCFD).

Experts are aiming to replicate the momentum and market experience in climate action created by the TCFD. The TNFD framework comes nearly one year after the signing of the Kunming-Montreal Global Biodiversity Framework (GBF), an accord many expect could do for biodiversity what the Paris Agreement did for climate: channel targeted investment flows. In following clear, comparable and consistent information by companies, investors can better allocate capital to nature-focused strategies, and address nature-related risks of the physical, transition, systemic and regulatory types.

What is the TNFD?

The Taskforce, a government-supported global initiative, was launched in June 2021 with the objective to provide a framework that can help companies and stakeholders address environmental risks and opportunities.[1]

“Nature is no longer a corporate social responsibility issue, but a core and strategic risk management issue alongside climate change. Corporate and investor stewardship of, and investment in, nature is a transformational opportunity for companies who innovate and financial institutions who finance the solutions needed at scale. The TNFD recommendations help organisations meet this challenge.”

TNFD – Executive summary of recommendations, Sept. 18, 2023.

Figure 1: TNFD’s recommended disclosures

Importantly, the framework also supports financial institutions in portfolio construction and investment product development. It follows a broad “AR3T” action sequence (Avoid, Reduce, Restore, Regenerate, Transform) that prioritizes companies that avoid or minimize negative impacts on nature over the pursuit of restoration efforts or reconstructive measures.

TNFD’s “AR3T” recommended action sequence

- Avoid: Prevent negative impacts from happening in the first place; eliminate them entirely

- Reduce: Minimize negative impacts that cannot be fully eliminated

- Restore: Initiate or accelerate the recovery of an ecosystem with respect to its health, integrity and sustainability

- Regenerate: Take actions within existing nature uses, such as agricultural practices, to increase the health, integrity, function and productivity of an ecosystem

- Transformative Action: Consider ways in which organizations can contribute to needed systemic change inside and outside their value chains.

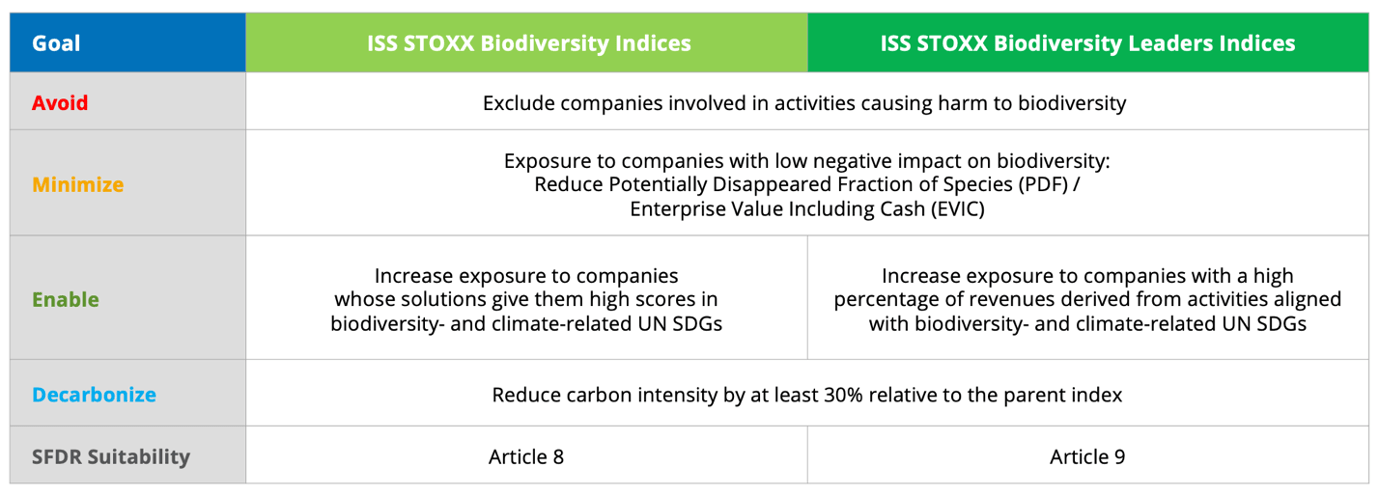

This sequence is correlated to a high degree with the four-step index construction process at the core of the ISS STOXX® Biodiversity indices framework, introduced in April 2023 (Figure 2). The indices allow investors to take a comprehensive approach to biodiversity challenges, and integrate sophisticated data from ISS that assess companies’ nature-related footprint.

Figure 2: ISS STOXX Biodiversity Indices four-step framework

Source: STOXX [2]

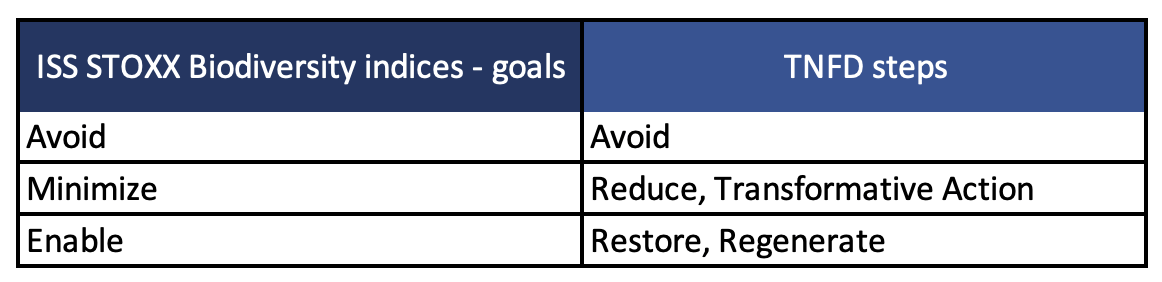

Both STOXX and TNFD frameworks contemplate similar steps addressing the different degrees and types of biodiversity action (Figure 3).

Figure 3: Correspondence between the STOXX and TNFD action sequences

Source: STOXX [3]

While the STOXX Biodiversity framework sets a defined target to reduce a portfolio’s carbon emission, the TNFD recommendations clearly identify greenhouse gas emissions as a cause of indirect negative impact on biodiversity, making it imperative to reduce them in the fight for nature.

For a detailed explanation of the ISS STOXX Biodiversity framework, please see our article: “New ISS STOXX indices use comprehensive framework to help investors address biodiversity challenges.”

Looking ahead

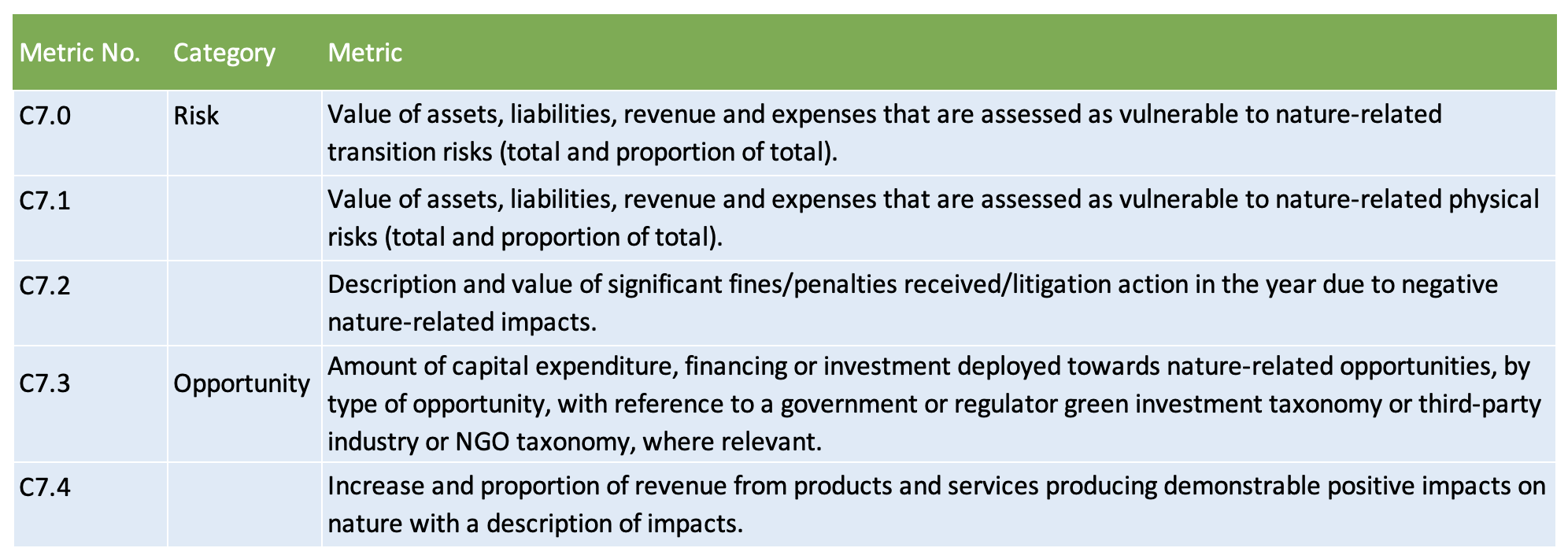

The TNFD recommendations also include a set of core global disclosure metrics that provide an overview of a company’s position in the context of biodiversity (Figure 4).

Figure 4: TNFD core global disclosure metrics for nature-related risks and opportunities

The ISS STOXX Biodiversity indices already address those metrics where available. Examples are the exclusion of companies that fail to pass norms-based and ESG controversies filters (C7.2), and the integration of the UN Sustainable Development Goals (SDGs) (C7.4).

The ISS STOXX biodiversity framework can be expanded, deepened and enhanced if and when information on companies’ assets, liabilities, revenue and expenses that are vulnerable to nature-related risks (C7.0 and C7.1), as well as on the amount of capital and investment deployed towards nature-related opportunities (C7.3) becomes available.

It is to be hoped that, through the new requirements of the CSRD (Corporate Sustainability Reporting Directive) and through stewardship actions, we will obtain more disclosure from companies.

* Antonio Celeste is Director for Sustainability Product Management at STOXX.

[1] The TNFD is composed of executives from businesses, financial institutions and market intermediaries from across 180 countries with asset management responsibilities over USD 20 trillion (source: TNFD).

[2] The Potentially Disappeared Fraction of species (PDF) is a metric used to quantify the impact of corporates on biodiversity. PDF represents the potential decline in species richness in an area over a period due to unfavourable conditions associated with environmental pressures. 100% PDF means full destruction of biodiversity in a given area, 0% means total preservation from human activities.

[3] The PDF considers a company’s set of environmental pressures on species and habitats, its entire value chain and geographical location, hence it addresses the Transformative Action step as well.