Thematic strategies have been one of the fastest-growing investment segments of recent years1, both for the broader industry as well as for Qontigo, manager of STOXX and DAX indices.

Thematic funds represent 2.7% of all assets under management in equity funds globally, up from 0.8% ten years ago.2 Qontigo’s STOXX® Thematics family, meanwhile, now counts over two dozen indices targeting structural and forward-looking themes disrupting our modern societies (Figure 1).

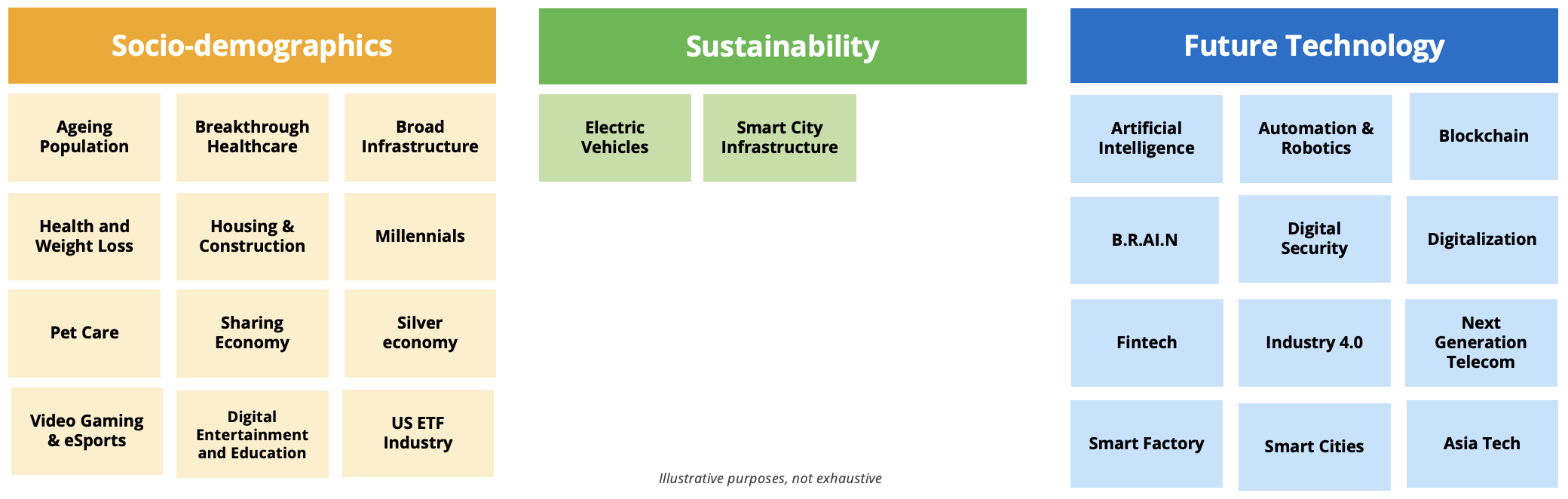

Figure 1: Qontigo’s STOXX thematic indices

The themes have been carefully chosen considering their scope and durability, and to avoid fads. Each one represents a cross-industry concept and can be categorized within three ‘megatrends’: socio-demographics, sustainability and technological progress. They include breakthrough healthcare, automation and robotics, digitalization, and smart city infrastructure, to name a few themes.

The indices seek to identify the beneficiaries of such megatrends using a revenue-based or artificial-intelligence selection process. They can be used as underlyings for ETFs, mutual funds, structured products and exchange-traded derivatives. Eight of the STOXX thematic indices underlie respective iShares ETFs from BlackRock, with total assets of USD 8.9 billion.3

Flows continue despite market pullback

The market volatility and macroeconomic disruptions of 2022 have raised a challenge to the more growth-style, tech-focused thematic portfolios as interest rates rise. By nature, thematic portfolios also carry a higher risk than do broader strategies and can therefore be more volatile in times of market stress. But volatility can work both ways, which means that many of the themes are likely to outperform the market in the eventual recovery. Also, the adjusted equal weighting of constituents in many thematic ETFs ensures that the portfolios are often more diversified than corresponding sector or market indices.

Still, the recent market turmoil has not fully dented investor interest. Through April, ETFs that invest in themes received net inflows of USD 38.6 billion in 2022.4 The STOXX Global 1800 Index fell 13.2% in the same period.

Importantly, the segment continues to break new ground with innovative solutions that respond to investors’ specific needs. On June 20, Eurex, a leading derivatives exchange, listed its first futures tracking thematic strategies, providing investors a new way to gain, manage and hedge portfolio exposures with the advantages of a liquid and centrally cleared market. The new contracts track the STOXX® Global Breakthrough Healthcare, STOXX® Global Digitalisation and STOXX® Global Digital Security indices.

Also this year, we expanded the joint offering with BlackRock with the launch of the STOXX® Global Digital Entertainment and Education Index, which underlies an iShares UCITS ETF (Euronext Amsterdam ticker: PLAY) since June 30. The index aims to track those stocks that stand to benefit from two accelerating trends of our times, as the public changes the way it consumes media and accesses learning.

Meanwhile, the availability of ever more sophisticated data sources will continue to generate new possibilities in the thematics space, regardless of the market backdrop. The index category has shown some of the most ingenious combinations of data inputs, selection methodologies and — increasingly important for investors — sustainability criteria.

No longer cutting it

This year’s market volatility also offers a chance to reappraise the benefits of thematic investment. Specifically, it is important to remember that a thematic approach is for the long term. Moreover, investing along themes appears to be more fitting for our era of technological advances and macro shocks than is implementing the traditional sector-focused approach.

Trends that have gained precedence this year, including investments in renewable energy sources, protection against cyber-attacks, and a scarcity of semiconductors due to disruptions in the global supply chain, are best targeted with a thematic-based approach than with traditional sector portfolios.

A sector-based allocation no longer cuts it in the current environment. What we need is something that is more targeted and that really captures and hones in on trends. A winning theme can generate alpha from its sector allocation, as I wrote in a white paper5 published in March.

Breadth of options

As Rob Powell, Head of Thematic & Sector Product Strategy at BlackRock, explained at the recent Qontigo Investment Intelligence Summit, while investors have sold the more growth-style themes, such as technological breakthrough, they have added to funds tracking themes such as climate change. In Rob’s words, the industry has shown itself to be more resilient than some people would have imagined.

A different investment profile

Thematic investing is daring — it relies on a predictive assessment of future growth as opposed to past reports. It provides diversification from the traditional sector- and country-based portfolio, and extends its duration and time horizon by investing in trends that outpace the annual, or even quarterly, earnings calendar that dominates equity markets. As such, thematic funds are typically less dependent on the cyclicality of the global economy.

Multi-year (or -decade) trends such as urbanization in developing nations, the digitalization of entertainment and education, or the automation of factories will not falter due to temporary market snags.

In the short term, economic swings will alter investors’ risk appetite. If markets regain some stability in coming weeks and share prices start reflecting again more fundamental drivers, thematic indices should recover their standing. Meanwhile, these testing times of financial and economic volatility should be used to reappraise the advantages of the investment strategy.

* Christoph Schon is Senior Principal at Qontigo’s Applied Research

1 Over the two years through 2021, assets invested in thematic funds worldwide nearly tripled to USD 806 billion, according to Morningstar.

2 Source: Morningstar.

3 Data as of May 13, 2022.

4 Data from ETFGI, covering all funds worldwide.

5 Schon, C., ‘Thematic investing in the current climate – A more focused approach to sustainable and future-proof investing,’ Qontigo, March 2022.